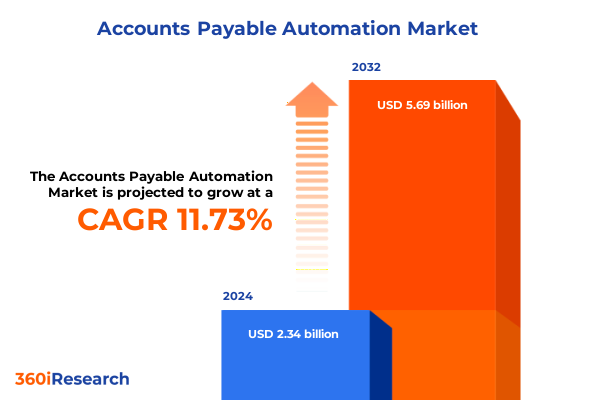

The Accounts Payable Automation Market size was estimated at USD 2.60 billion in 2025 and expected to reach USD 2.89 billion in 2026, at a CAGR of 11.84% to reach USD 5.69 billion by 2032.

Reimagining Financial Efficiency through Next-Generation Accounts Payable Automation Strategies That Propel Operational Excellence

Organizations are under increasing pressure to optimize financial operations, reduce manual errors, and accelerate invoice processing cycles. In many enterprises, accounts payable functions still rely on fragmented workflows, paper-based approvals, and siloed data repositories. These persistent inefficiencies can lead to late payments, strained supplier relationships, and exposure to compliance risks. Simultaneously, evolving business demands and the digital economy compel companies to adopt more agile, data-driven approaches. As finance teams look to reallocate resources towards strategic initiatives, the imperative to modernize accounts payable processes has never been more pronounced.

Advancements in software, cloud infrastructure, and intelligent automation now enable a seamless end-to-end accounts payable journey. By integrating invoice capture, approval orchestration, payment execution, and analytics, organizations can establish a unified platform that drives visibility, control, and collaboration across internal and external stakeholders. Moreover, these solutions can be tailored to align with existing enterprise resource planning systems, ensuring minimal disruption while maximizing adoption.

This executive summary presents a comprehensive analysis of transformative shifts within the landscape, examines the cumulative effects of U.S. trade tariffs on cost structures, delineates key market segmentation and regional dynamics, evaluates competitive positioning among leading providers, and offers actionable recommendations. Additionally, the report outlines the rigorous research methodology underpinning these insights and concludes with a forward-looking perspective, culminating in an invitation to engage further.

Harnessing Digital Transformation and Intelligent Automation to Revolutionize Accounts Payable Processes in a Rapidly Evolving Business Environment

Market dynamics are being reshaped by rapid digital transformation, as organizations increasingly embrace cloud-native architectures and intelligent automation. Robotic process automation bots now tackle high-volume invoice processing tasks that were once the domain of manual data entry clerks. Artificial intelligence and machine learning algorithms constantly refine accuracy through pattern recognition, anomaly detection, and predictive analytics. These innovations not only streamline routine workflows but also free up finance professionals to focus on strategic vendor management and risk mitigation.

Additionally, emerging technologies such as blockchain and distributed ledger systems are beginning to enhance invoice traceability and fraud deterrence, while application programming interfaces enable seamless integrations with external supplier networks. Low-code development environments further democratize solution customization, empowering business users to tailor workflows without complex IT interventions. As these trends converge, the accounts payable function is evolving from a transactional back-office operation into a dynamic, insights-driven hub that delivers real-time financial intelligence.

Assessing the Cumulative Consequences of United States Trade Tariffs on Accounts Payable Automation Cost Structures and Provider Ecosystems

Since the imposition of broad Section 301 tariffs and selective industry-specific levies, enterprises have grappled with rising costs for hardware components, embedded systems, and outsourced implementation services. The cumulative burden of these duties has translated into higher acquisition expenses for scanners, servers, and network equipment that support automation platforms. Service providers, in turn, have had to adjust their pricing models to account for increased labor and logistics costs tied to multinational supply chain disruptions.

In response, leading solution vendors have diversified procurement strategies by nearshoring hardware production and partnering with regional integrators to minimize cross-border duties. Simultaneously, clients are renegotiating vendor contracts, adopting flexible subscription-based pricing, and accelerating the shift toward fully cloud-hosted deployments to reduce reliance on physical infrastructure. These maneuvers illustrate how finance leaders can mitigate tariff impact through strategic sourcing, agile contracting, and cloud-enabled elasticity.

Unlocking Segment-Specific Opportunities by Leveraging Insights from Component, Process, Deployment, Application, and Industry Vertical Analyses

The market’s component dimension splits into professional services-encompassing consulting and implementation-and core solutions, which include invoice automation and invoice management platforms. Organizations embarking on process improvement often pair advisory engagements with robust technology adoption to ensure seamless deployment and user alignment, blending strategic planning with hands-on integration services.

Within the process axis, priorities range from invoice approval workflows that dynamically route exceptions to invoice capture technologies that leverage optical character recognition and cognitive learning, and ultimately extend into payment execution modules that integrate with banking rails and diverse payment instruments. Each stage requires tailored controls, data validations, and audit trails to satisfy both corporate policy mandates and regulatory compliance requirements.

Deployment options further refine buyer decisions, with cloud-based models offering public, private, or hybrid cloud configurations, thereby accommodating varying security postures and scalability demands. On-premise solutions retain appeal for organizations with stringent data residency needs, whether through in-house data storage or third-party managed services under strict service-level agreements. Deployment choice often hinges on existing IT governance frameworks, risk tolerance, and total cost of ownership considerations.

Application-based segmentation covers compliance management features-such as audit preparedness and fraud detection-expense management capabilities that span travel-and-expense and vendor-managed expenditures, as well as invoice processing modules designed for both electronic and paper-based invoice streams. Finance teams can select specialized applications or integrated suites, depending on the relative emphasis on risk mitigation, employee reimbursement optimization, or high-throughput invoice handling.

Finally, industry vertical focus spans critical sectors, including banking, financial services, and insurance; consumer goods and retail; education; energy and utilities; government; healthcare; information technology and telecommunications; manufacturing; and transportation and logistics. Each vertical brings distinct billing complexities, regulatory landscapes, and supplier ecosystems, necessitating tailored workflows, specialized analytics, and targeted implementation best practices.

This comprehensive research report categorizes the Accounts Payable Automation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Process

- Deployment Type

- Application

- Industry Vertical

Comparing Regional Dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific to Guide Strategic Accounts Payable Automation Adoption

In the Americas, enterprises have been quick to pioneer cloud-based automation, driven by a competitive landscape that rewards operational agility and cost containment. Strong regulatory frameworks, such as the Sarbanes-Oxley Act, underpin a demand for robust control mechanisms and audit readiness features, while vendor consolidation has spurred a rise in strategic partnerships and merger activity among leading providers.

Europe, the Middle East, and Africa present a mosaic of compliance and data privacy standards, most notably the General Data Protection Regulation and region-specific financial reporting directives. These regulations necessitate configurable data governance modules and nuanced localization capabilities. As a result, many organizations in EMEA opt for private or hybrid cloud environments that reconcile centralized process efficiency with stringent local sovereignty requirements.

Across Asia-Pacific, rapid digitalization initiatives by governments and enterprises alike have accelerated the adoption of mobile-enabled invoice capture and real-time payment processing. Emerging economies in Southeast Asia and India are leapfrogging legacy infrastructures, while established markets in Japan and Australia prioritize advanced analytics, artificial intelligence-driven exception management, and integration with broader procure-to-pay ecosystems. The diverse maturity levels in APAC underscore the importance of flexible, multilingual platforms that can scale in tandem with regional growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Accounts Payable Automation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Landscapes and Strategic Moves of Leading Accounts Payable Automation Providers to Identify Differentiators

The competitive landscape is characterized by a mix of global platform providers, specialized niche players, and consulting firms that bundle technology solutions with managed services. Established enterprises differentiate through deep ERP integration capabilities, multi-country deployment expertise, and broad partner ecosystems. Mid-market challengers, on the other hand, often compete on ease of use, rapid implementation cycles, and subscription-based pricing models that lower the barrier to entry.

Strategic alliances between software vendors and financial institutions are reshaping value propositions, with some providers offering embedded payment facilitation and dynamic discounting programs to optimize working capital. Innovation hubs within leading organizations are exploring chatbots for supplier inquiries and advanced predictive analytics to forecast cash flow impacts. Competition is increasingly driven by user experience design, API extensibility, and the ability to incorporate emerging technologies without disrupting existing operational rhythms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Accounts Payable Automation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AvidXchange Inc.

- Basware Corporation

- BILL Operations, LLC.

- Bottomline Technologies Inc

- Comarch SA

- Corcentric, LLC

- Corpay Inc.

- Coupa Software Inc

- Fidelity National Information Services, Inc.

- Iron Mountain, Inc.

- KashFlow Software Ltd,

- Microsoft Corporation

- MineralTree, Inc.

- Nexstep Infotech Pvt. Ltd

- Norming Software International Ltd.

- Oracle Corporation

- Procurify Technologies Inc.

- Quadient

- Qvalia AB

- Razorpay

- Sage Group PLC

- SAP SE

- Tipalti Inc.

- Zycus Inc.

Developing Actionable Strategies that Empower Industry Leaders to Maximize Value and Drive Transformation in Accounts Payable Automation Operations

Finance leaders should begin by mapping current invoice processing workflows to identify manual touchpoints and exception rates, and then prioritize low-code automation pilots that demonstrate rapid value capture. By selecting platforms with modular architectures, organizations can incrementally introduce AI-driven document classification, anomaly detection, and self-learning approval routing, reducing risk while scaling capabilities.

Effective change management is essential; this involves assembling cross-functional governance teams, communicating clear process benchmarks, and establishing training programs that align end users with the new digital workflows. Embedding real-time dashboards and performance scorecards ensures accountability and highlights areas for continuous improvement. To further enhance supplier relationships, integrating early-payment discounting options and supplier portals can accelerate cycle times and foster collaboration.

Finally, executives should negotiate flexible contracting terms that accommodate tariff fluctuations and cloud consumption variability. Partnering with providers that offer outcome-based pricing, regional support structures, and robust service-level commitments will secure long-term resilience and adaptability in the face of evolving market conditions.

Ensuring Rigorous Research Integrity through Mixed-Method Approaches and Robust Data Validation in Market Analysis Design

The analysis underpinning this report is based on a comprehensive mixed-method research design. Secondary research included a review of industry publications, regulatory filings, financial statements, vendor collateral, and white papers to establish a macro-level understanding of technological advancements, market dynamics, and regulatory influences. This desk research provided a foundation for identifying key themes and framing relevant hypotheses.

Primary research involved in-depth interviews with executive stakeholders, including finance VPs, procurement directors, and IT architects, to capture firsthand perspectives on deployment challenges, vendor selection criteria, and future roadmap priorities. A structured survey of end users augmented these insights, quantifying satisfaction levels, adoption barriers, and feature preferences. Qualitative data were triangulated with quantitative metrics through rigorous data validation techniques, including consistency checks, outlier analysis, and peer review sessions. This methodological rigor ensures that the conclusions and recommendations resonate with both strategic decision-makers and operational practitioners.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Accounts Payable Automation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Accounts Payable Automation Market, by Components

- Accounts Payable Automation Market, by Process

- Accounts Payable Automation Market, by Deployment Type

- Accounts Payable Automation Market, by Application

- Accounts Payable Automation Market, by Industry Vertical

- Accounts Payable Automation Market, by Region

- Accounts Payable Automation Market, by Group

- Accounts Payable Automation Market, by Country

- United States Accounts Payable Automation Market

- China Accounts Payable Automation Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Converging Insights and Forward-Looking Perspectives to Illuminate the Future Trajectory of Automated Accounts Payable Practices

The evolution of accounts payable automation from basic digitization toward an integrated, intelligent finance hub underscores its strategic importance in modern enterprises. By embracing cloud-native platforms, AI-infused workflows, and flexible deployment models, finance teams can transcend traditional back-office constraints and deliver real-time insights that drive corporate performance.

Moving forward, organizations that prioritize data governance, supplier collaboration, and continuous process optimization will be best positioned to harness the full potential of automation. As the competitive landscape intensifies, the ability to adapt rapidly to regulatory changes, tariff impacts, and emerging technology trends will determine which companies achieve sustained efficiency gains and measurable ROI.

Driving Engagement with Tailored Insights and Personalized Support Opportunities through Direct Consultation with Associate Director of Sales & Marketing

To explore detailed insights, actionable strategies, and customized recommendations, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can guide you through the report’s findings, organize a personalized briefing session, and outline how these analyses can be tailored to your organization’s unique needs. By connecting with Ketan, you will gain direct access to expert perspectives, supporting data, and a roadmap for implementation that aligns with your strategic objectives. Secure your copy of the comprehensive market research report today and empower your team to harness the full potential of accounts payable automation.

- How big is the Accounts Payable Automation Market?

- What is the Accounts Payable Automation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?