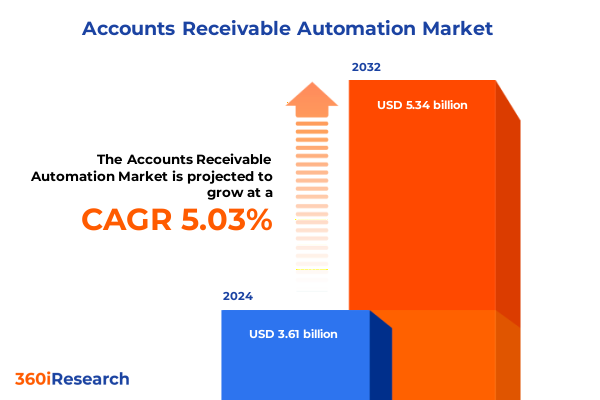

The Accounts Receivable Automation Market size was estimated at USD 3.75 billion in 2025 and expected to reach USD 3.90 billion in 2026, at a CAGR of 5.20% to reach USD 5.34 billion by 2032.

Unveiling the Strategic Imperative and Evolutionary Drivers Shaping Accounts Receivable Automation for Enhanced Cash Flow Performance

Accounts receivable automation has emerged as a cornerstone of modern financial operations, where persistent reliance on manual processes has long hampered liquidity, accuracy, and stakeholder alignment. Traditional approaches to invoice management, payment matching, and credit assessments often involve spreadsheet-driven workflows, error-prone reconciliations, and resource-intensive dispute resolution. This environment not only burdens finance teams with administrative overhead but also obscures real-time visibility into receivables performance and risk exposures.

In response to mounting pressures for enhanced operational agility, risk mitigation, and optimized cash flow, enterprises are accelerating the adoption of intelligent automation solutions tailored for accounts receivable. By harnessing advanced technologies such as artificial intelligence, machine learning, and robotic process automation, organizations can transcend conventional processing bottlenecks, achieve greater accuracy in payment matching and credit assessments, and proactively manage exceptions. Integration with enterprise resource planning and customer relationship management platforms further amplifies the ability to generate predictive insights and foster cross-functional collaboration between finance, sales, and customer service teams.

Subsequent sections explore the cumulative impact of United States tariff policy changes in 2025 on technology deployments, dissect market segmentation across applications, payment methods, deployment models, organization sizes, and industry verticals, and illuminate regional trends across the Americas, EMEA, and Asia-Pacific. Additionally, leading provider strategies and actionable playbooks will equip leaders to harness automation for improved working capital performance.

This executive summary distills key transformations reshaping the accounts receivable automation landscape and provides strategic insights across segmentation, regional dynamics, and competitive positioning.

Mapping the Technological Convergence and Organizational Shifts Propelling Accounts Receivable Automation into a New Era of Operational Agility

The accounts receivable automation ecosystem is experiencing a profound transformation, fuelled by a convergence of emerging technologies and evolving operational paradigms. Over the past two years, artificial intelligence and machine learning have migrated from pilot projects to core components in invoice data extraction, predictive cash forecasting, and anomaly detection. Meanwhile, robotic process automation drives the orchestration of routine tasks, such as payment reminders and reconciliations, liberating finance professionals to focus on exception management and strategic analysis.

Cloud adoption has accelerated significantly, as organizations recognize the benefits of scalable, subscription-based models over capital-intensive on-premises deployments. The shift to cloud-native architectures empowers finance teams with real-time dashboards, mobile accessibility, and seamless updates, fostering agility in the face of fluctuating market demands. API-driven integration between AR platforms, enterprise resource planning solutions, and customer relationship management systems ensures end-to-end process synchronization, reducing manual interventions and data discrepancies.

Beyond pure technology, the rise of real-time payment rails and digital payment solutions, including direct bank transfers, virtual cards, and mobile wallets, is reshaping collection dynamics. Self-service portals and interactive dispute resolution workflows offer customers transparency and autonomy, accelerating resolution cycles and strengthening relationships. Concurrently, agile operating models encourage cross-functional collaboration among finance, sales, and customer success teams to tailor collection strategies to specific customer profiles.

Regulatory developments around data privacy, fair collection practices, and financial reporting further underscore the importance of compliance-driven design. As treasury and finance functions embrace digital transformation, the future of accounts receivable automation will be defined by platforms that combine advanced analytics, extensible integration layers, and adaptive workflow engines to deliver continuous performance improvement and heightened resilience.

Assessing the Cumulative Impact of United States 2025 Tariff Policies on Accounts Receivable Automation Strategies and Infrastructure

In January 2025, the Office of the United States Trade Representative finalized expanded Section 301 tariffs on critical technology components imported from China, increasing rates on semiconductors to 50 percent and raising duties on solar cells, steel, and aluminum products to 50 and 25 percent, respectively. These measures amplify the cost base for vendors providing on-premises infrastructure fundamental to accounts receivable automation deployments, especially within data centers relying on imported servers, networking hardware, and storage arrays.

Concurrently, Section 232 investigations targeting semiconductor imports have signalled potential new tariffs of up to 25 percent on raw chips and assembled modules, reinforcing uncertainty across the hardware supply chain and compelling companies to reassess capital expenditures on localized manufacturing capabilities. Rapid reciprocal tariffs enacted in April 2025, which escalated duties on goods from China-origin to 125 percent before being partially rolled back in May, further pressured IT procurement budgets, discouraging large refresh cycles in favor of life-cycle extension and hybrid infrastructure models.

Industry reports indicate that HPE has responded with up to 20 percent price increases on ProLiant servers, and Cisco has announced anticipated hikes of 5–10 percent on Catalyst networking equipment, directly inflating the total cost of ownership for on-premises AR automation implementations. As a result, many finance teams are pivoting toward cloud-based software-as-a-service solutions, which decouple workflow automation from capital-intensive hardware investments and offer predictable, subscription-based expense structures.

The compounding effect of tariff policy volatility has spurred vendors and financial decision-makers to deepen vendor diversification strategies, seeking hardware suppliers from tariff-exempt jurisdictions or augmenting existing fleets with domestically produced equipment. These strategic adjustments are reshaping procurement roadmaps and vendor partnerships, underscoring the importance of encompassing tariff scenarios in the business case analyses for future accounts receivable automation investments.

Exploring Five Critical Dimensions of Segmentation That Drive Tailored Accounts Receivable Automation Strategies Across Diverse Business Needs

When evaluating the accounts receivable automation landscape, it is essential to consider the five core dimensions of segmentation that shape vendor offerings and client requirements. In the realm of application functionality, solutions range from sophisticated cash application modules-with automated allocation engines that leverage optical character recognition and machine learning to reconcile remittances in real time-to manual allocation interfaces for exceptional cases. Collections management offerings similarly span proactive communication workflows, including multichannel reminders, through to promise-to-pay tracking systems that enforce agreed schedules and enhance collection efficiencies. Credit management suites deliver both initial credit assessments utilizing predictive scoring models and ongoing credit monitoring dashboards that flag emerging risks. Dispute management capabilities encompass identification engines that auto-classify exceptions and resolution workflows designed to streamline correspondence and documentation, while invoice management platforms cover end-to-end processes from invoice creation and digital delivery to comprehensive tracking of payment status.

The versatility of modern AR automation platforms extends beyond functional modules. Payment method support now includes traditional cash and check processing-where legacy workflows persist for certain customer segments-as well as electronic payment rails, which dominate high-volume, low-value transactions and drive straight-through processing rates to new heights. Deployment models offer flexibility between cloud-hosted architectures that provide rapid scalability and on-premises implementations favored by organizations requiring stringent data sovereignty controls. Organizational scale factors are also critical: large enterprises often demand global rollouts that integrate with complex ERP landscapes, while small and medium businesses seek cost-effective, modular subscriptions that can accelerate digital adoption without heavy upfront capital requirements. Lastly, industry vertical considerations influence solution prioritization, with financial services firms focusing on risk mitigation and regulatory compliance, healthcare providers emphasizing patient billing integration and privacy safeguards, IT and telecommunications companies leveraging real-time billing reconciliation, manufacturing enterprises linking receivables to supply chain finance, and retail and e-commerce operators prioritizing customer self-service and rapid payment fulfillment. This holistic segmentation framework ensures that stakeholders can align technology investments with their unique operational and strategic imperatives.

This comprehensive research report categorizes the Accounts Receivable Automation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Payment Method

- Application

- Deployment Model

- Industry Vertical

Revealing Regional Dynamics That Shape Demand, Adoption Patterns, and Operational Nuances for Accounts Receivable Automation in Americas, EMEA and Asia-Pacific Markets

The Americas region remains a powerhouse for accounts receivable automation adoption, driven by a mature technological ecosystem, widespread digitization mandates, and a strong emphasis on cash flow optimization. In North America, the confluence of advanced regulatory environments, sophisticated treasury practices, and a concentration of global software vendors fosters rapid uptake of cloud-based AR platforms with embedded analytics and AI-driven decision support. Latin American organizations are increasingly replacing manual, paper-based receivables processes with subscription-based automation tools, spurred by the need to manage foreign exchange exposures and bolster liquidity in volatile macroeconomic climates.

In Europe, the Middle East, and Africa (EMEA), heterogeneous regulatory frameworks and varied economic maturity levels create a multifaceted landscape for AR automation. Leading European markets prioritize integration with established ERP systems and compliance with data privacy regulations, prompting vendors to localize offerings and secure certifications under GDPR and regional financial directives. Meanwhile, Middle Eastern and African economies demonstrate growing interest in hosted AR solutions to support rapidly expanding commercial sectors, with an emphasis on improving financial transparency and reducing days sales outstanding in industries such as energy, infrastructure, and telecommunications.

The Asia-Pacific region exhibits dynamic growth trajectories, propelled by digital transformation initiatives, government incentives for technological adoption, and rising demand for real-time payment infrastructure. In advanced markets like Japan and Australia, enterprises are adopting AI-powered AR suites that integrate seamlessly with electronic invoicing mandates and digital banking networks. Emerging markets in Southeast Asia and India are witnessing accelerated migration from legacy systems to cloud-native platforms, facilitated by innovative fintech partnerships and a vibrant start-up ecosystem that underscores the strategic importance of receivables automation for scaling businesses and optimizing working capital across fragmented banking landscapes.

This comprehensive research report examines key regions that drive the evolution of the Accounts Receivable Automation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Emerging Players Driving Accounts Receivable Automation Through Strategic Partnerships, Product Innovations, and Industry Collaborations

The competitive landscape of accounts receivable automation is characterized by a blend of established enterprise software providers and agile specialized vendors, each driving innovation through targeted capabilities and strategic alliances. HighRadius has solidified its position by integrating process mining techniques with predictive analytics, enabling finance teams to visualize end-to-end receivables workflows and pinpoint improvement opportunities. Bill.com, known for its user-friendly interface and seamless integration with small business accounting platforms, continues to expand its footprint among small and medium enterprises by introducing collaborative features that streamline vendor payments and automate approval workflows.

On the enterprise front, Oracle NetSuite leverages its preexisting ERP ecosystem to deliver a unified financial management suite, embedding AI-driven cash application and dynamic discounting functionalities within core modules. Kyriba has differentiated itself through a treasury-centric approach to receivables, linking cash visibility and liquidity forecasting with automated collections orchestration. Infor and SAP maintain a steady presence by extending their broader ERP capabilities, while FIS and other financial services technology firms carve out niches in payment orchestration and fraud detection.

Emerging players like YayPay and VersaPay are disrupting traditional models by emphasizing customer-centric features, such as interactive portals and self-service negotiation tools that reduce disputes and enhance payer experiences. Partnerships and acquisitions remain a key growth driver, with major cloud infrastructure providers collaborating with AR specialists to embed automation within broader digital finance transformations. This combination of large-scale ERP integration, fintech innovation, and supplier ecosystem partnerships propels the market forward, shaping a diverse vendor landscape that caters to the strategic needs of both global enterprises and nimble midmarket organizations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Accounts Receivable Automation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apideck

- BILL Operations, LLC.

- BlackLine

- Chargebee, Inc.

- Corcentric, Inc.

- HighRadius Corporation

- Invoiced, Inc.

- Newgen Software Technologies Limited

- Oracle Corporation

- Pagero AB

- Sage Group plc

- SAP SE

- Tesorio

Delivering Practical Guidance to Industry Leaders for Accelerating Accounts Receivable Automation Adoption and Maximizing Cash Flow Efficiency

To capitalize on the transformative potential of accounts receivable automation, industry leaders should prioritize strategic investments in artificial intelligence and machine learning capabilities. By embedding predictive analytics into credit assessments and cash forecasting, finance teams can proactively identify high-risk accounts, optimize collection strategies, and reduce days sales outstanding. It is crucial to select platforms that offer extensible AI modules, enabling continuous model refinement as transaction volumes and customer behaviors evolve.

Equally important is the alignment of technology roadmaps with enterprise resource planning and customer relationship management systems. A phased, integration-first approach reduces implementation risks, ensures data integrity across disparate systems, and accelerates time-to-value. Leaders should convene cross-functional working groups-including finance, IT, and sales stakeholders-to define clear process ownership, governance frameworks, and success metrics for receivables automation initiatives.

Embracing flexible deployment architectures that blend cloud-based subscription models with on-premises controls provides a balanced pathway for organizations navigating regulatory constraints and cost optimization imperatives. Hybrid infrastructures allow for elasticity during peak transaction periods and localized data residency where required, unlocking operational resilience without sacrificing scalability.

Finally, establishing a continuous improvement culture through ongoing performance monitoring, change management, and stakeholder training ensures sustainable adoption. Key performance indicators should extend beyond traditional metrics to include automated exception resolution rates, straight-through processing percentages, and customer satisfaction scores. By weaving these metrics into regular executive reviews, organizations can pivot strategies in real time, refine automation rules, and maintain leadership in receivables performance.

Detailing the Rigorous Multi-Phase Research Methodology That Underpins Robust Accounts Receivable Automation Market Insights and Ensures Analytical Integrity

The research methodology underpinning this executive summary combines rigorous multi-phase approaches to deliver comprehensive insights and uphold analytical integrity. The process commenced with an extensive desk research phase, wherein industry publications, government policy announcements, and vendor disclosures were systematically reviewed to map emerging technologies, market drivers, and tariff developments affecting accounts receivable automation.

Complementing secondary research, a series of primary interviews were conducted with senior finance executives, technology architects, and AR solution providers. These conversations provided first-hand perspectives on implementation challenges, adoption strategies, and evolving use cases across diverse organization sizes and industry verticals. Interview protocols were designed to elicit both quantitative benchmarks, such as process cycle times, and qualitative assessments of technology maturity and vendor responsiveness.

Subsequent data triangulation involved cross-validating findings against proprietary transaction datasets and publicly available financial reports. This step ensured consistency in thematic insights and revealed nuanced correlations between tariff policy shifts and vendor pricing strategies. Throughout the analysis, an iterative validation process was applied, engaging subject-matter experts to refine assumptions, rectify discrepancies, and enhance the robustness of segmentation frameworks.

Finally, all methodologies and sources underwent independent peer review to verify accuracy and relevance. This rigorous approach ensures that the executive summary reflects the latest market dynamics, delivers actionable guidance, and meets the highest standards of research excellence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Accounts Receivable Automation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Accounts Receivable Automation Market, by Payment Method

- Accounts Receivable Automation Market, by Application

- Accounts Receivable Automation Market, by Deployment Model

- Accounts Receivable Automation Market, by Industry Vertical

- Accounts Receivable Automation Market, by Region

- Accounts Receivable Automation Market, by Group

- Accounts Receivable Automation Market, by Country

- United States Accounts Receivable Automation Market

- China Accounts Receivable Automation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Core Insights and Strategic Takeaways to Conclude the Executive Summary on Accounts Receivable Automation Market Dynamics and Future Trajectories

The acceleration of accounts receivable automation represents a strategic imperative for organizations seeking to strengthen financial resilience and optimize working capital. As manual processes give way to intelligent, integrated platforms, finance teams realize tangible benefits in cash visibility, exception management, and decision support. Navigating the compound effects of tariff-induced cost pressures and shifting deployment paradigms underscores the importance of flexible, cloud-native architectures.

A deep segmentation lens-spanning applications, payment methods, deployment models, organization sizes, and industry verticals-enables tailored solution selection that aligns with specific operational needs. Regional insights from the Americas, EMEA, and Asia-Pacific further emphasize the critical role of localization, compliance, and vendor ecosystems in driving adoption.

Leading vendors continue to innovate through AI-driven capabilities, collaborative self-service portals, and strategic partnerships that embed automation within broader digital finance transformations. By following the actionable recommendations outlined-prioritizing predictive analytics, integration, hybrid deployment flexibility, and performance measurement-industry leaders are well positioned to sustain competitive advantage.

Looking ahead, the fusion of real-time payment rails, advanced analytics, and extensible platform architectures will define the next wave of accounts receivable innovation, propelling finance organizations toward greater agility, accuracy, and stakeholder value.

Engage with Ketan Rohom to Secure Comprehensive Accounts Receivable Automation Insights and Purchase the Ultimate Market Research Report for Strategic Decision-Making

To explore the full breadth of market analysis, segmentation insights, and strategic recommendations presented in this executive summary, engage with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in accounts receivable automation will guide you through tailored use cases and deployment scenarios that resonate with your organizational priorities.

Connect with Ketan to secure immediate access to the comprehensive market research report, equipping your team with the actionable intelligence needed to drive informed technology investments and achieve sustained improvements in cash flow performance.

- How big is the Accounts Receivable Automation Market?

- What is the Accounts Receivable Automation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?