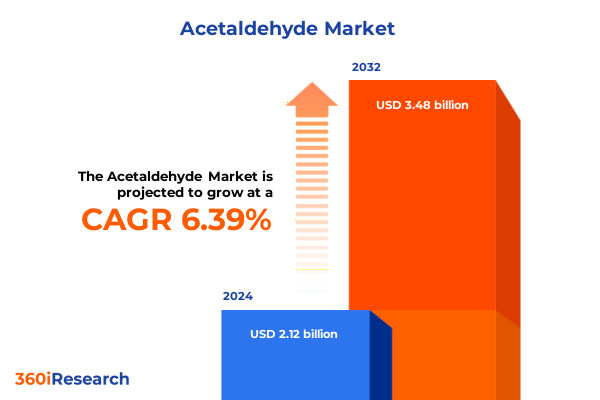

The Acetaldehyde Market size was estimated at USD 2.24 billion in 2025 and expected to reach USD 2.38 billion in 2026, at a CAGR of 6.47% to reach USD 3.48 billion by 2032.

Unveiling Acetaldehyde’s Cornerstone Role in Modern Industry Amid Intensifying Safety, Sustainability Imperatives, and Global Supply Chain Resilience

Acetaldehyde is a simple yet pivotal organic compound that features prominently in modern chemical manufacturing and value chains. Its unique properties as a colorless liquid or gas, combined with its low boiling point near ambient temperature, enable seamless integration into downstream processes. As one of the most important aldehydes produced at industrial scale, acetaldehyde serves as a linchpin for synthesizing a broad range of chemicals from acetic acid to vinyl acetate monomer. This ubiquity in industrial applications underscores its strategic importance to diverse sectors.

The primary route for acetaldehyde production is the catalytic oxidation of ethylene, commonly referred to as the Wacker process, in which palladium(II) chloride and copper(II) chloride catalysts facilitate the conversion of ethylene and oxygen into acetaldehyde under controlled temperature and pressure. A secondary method involves the partial oxidation or dehydrogenation of ethanol over silver or copper-based catalysts at elevated temperatures, offering flexibility when feedstock availability favors bio-ethanol sources. Both processes have been refined over decades to achieve high selectivity and cost-efficiency, though each presents distinct environmental and operational considerations.

Acetaldehyde’s versatility is reflected in its widespread utilization across product lines, including solvents, plasticizer intermediates, and key reagents for pharmaceutical and fragrance synthesis. Its reactivity with bases and alcohols makes it an ideal precursor for acetal derivatives and polymer chemistry. However, its physical and chemical properties also demand rigorous safety and regulatory oversight. Classified as a potential occupational carcinogen, acetaldehyde is subject to strict exposure limits and labeling requirements under OSHA and GHS frameworks to mitigate inhalation and contact risks. This regulatory environment continues to shape production protocols and end-use applications, reinforcing the need for continuous monitoring of health, safety, and environmental standards.

Navigating the Evolution of Acetaldehyde Production Through Green Innovation, Digitalization, and Rigorous Regulatory Transitions

The acetaldehyde industry is undergoing a profound transformation as sustainability imperatives accelerate the shift toward greener feedstocks and processes. Recent advances in catalytic dehydrogenation of bio-ethanol demonstrate the potential for renewable ethanol to serve as a viable acetaldehyde precursor under milder conditions using supported rare-metal catalysts, reducing greenhouse gas emissions and reliance on fossil-derived ethylene. This alignment with green chemistry principles, driven by EPA and state-level incentives for eco-friendly process design, is reshaping investment priorities and R&D roadmaps across major producers.

Parallel to the bio-feedstock evolution, digital transformation is redefining how acetaldehyde plants operate and optimize yields. Integration of IoT sensors, digital twins, and AI-powered analytics enables real-time monitoring of reaction conditions, predictive maintenance, and enhanced quality control. For example, leading chemical manufacturers have reported substantial efficiency gains and reduced downtime after deploying Industry 4.0 platforms for asset management and process control. These digital strategies not only improve safety margins but also support more agile responses to demand fluctuations and supply chain disruptions.

Regulatory dynamics are also catalyzing change. The EU’s Carbon Border Adjustment Mechanism has initiated a transitional phase (2023–2025) for reporting embedded emissions in carbon-intensive imports, signaling potential extension to chemical precursors beyond its initial scope, which could impose carbon costs on acetaldehyde imports in the coming years. Companies are proactively preparing for definitive CBAM rules in 2026 by improving emissions accounting and exploring low-carbon production pathways. This regulatory foresight, combined with evolving trade policies, is forging a new competitive landscape that rewards technological agility and environmental stewardship.

Examining the Widespread Consequences of Recent U.S. Trade Tariffs on the Chemical Industry’s Cost Structures and Supply Chains

In 2025, the United States reinforced existing Section 301 tariffs on Chinese imports, including numerous organic chemicals, maintaining duty rates of up to 25 percent on a broad array of List 3 products and imposing an additional 20 percent tariff under IEEPA effective March 4, 2025. These measures have reverberated through chemical supply chains, intensifying input cost pressures and prompting many distributors to raise downstream prices accordingly. As a result, raw material expenses for widely used solvents and intermediates have increased by an estimated 30 to 40 percent, shrinking margins for formula-based applications and specialty producers alike.

Beyond price impacts, tariffs have compelled firms to reexamine sourcing strategies and invest in alternative supply lines. Importers facing constraints on Chinese feedstocks have sought new partnerships in Southeast Asia and the Middle East, while domestic producers have accelerated capacity expansions to capitalize on protected home markets. However, these shifts have introduced logistical inefficiencies, extended lead times, and elevated freight dynamics, with downstream users in paints, coatings, and pesticides feeling the strain of higher dutiable values.

Trade groups have responded with a mix of advocacy and tactical adjustments. Associations such as the NACD have highlighted the broader economic costs, estimating potential distributor job losses and urging authorities to refine exclusion processes to alleviate burdens on critical chemicals distributors. Meanwhile, operational teams are deploying tariff classification reviews, bonded movements, and tariff engineering to navigate compliance and manage financial liabilities. For acetaldehyde stakeholders, these tariff developments underscore the need for proactive risk mitigation and agile procurement strategies in a landscape where trade policy continues to reshape competitive dynamics.

Deciphering Critical Market Segmentation Dynamics Shaping Acetaldehyde Demand Patterns Across Applications, Industries, Grades, Processes, and Forms

A nuanced understanding of acetaldehyde market segmentation reveals divergent demand drivers across multiple dimensions. From an application perspective, acetaldehyde’s versatility is apparent in its role as a precursor for acetic acid, the backbone for vinyl acetate, and a foundational element in fragrance synthesis, where it contributes to key aroma compounds. The pharmaceutical sector leverages high-purity grades of acetaldehyde for active pharmaceutical ingredient production, while plasticizers and solvents depend on technical-grade material to balance performance with cost. Niche applications such as pyridine synthesis further demonstrate its strategic importance in heterocyclic building block manufacture.

Analyzing end-use industries offers additional insight. In chemical manufacturing, commodity operations favor large-volume, cost-efficient grades, whereas specialty chemical producers demand tighter specifications and robust consistency for customized formulations. The cosmetics and personal care industry prioritizes reagent and high-purity grades for fragrance and flavor technologies, while food and beverage applications adhere to USP standards for safety compliance. Paints and coatings providers rely on solvent-grade acetaldehyde to optimize drying times and film properties, and pharmaceutical manufacturing requires exacting purity and traceability to meet regulatory standards.

Grading distinctions also shape market opportunities. High-purity acetaldehyde bifurcates into analytical and electronic subgrades, with the latter serving critical roles in semiconductor wafer cleaning and electronic component manufacturing. Reagent grades underpin laboratory and pilot-scale research, technical grades facilitate general industrial uses, and USP grades ensure suitability for ingestible or parenteral products.

Production processes introduce another layer of differentiation. Catalytic oxidation via the Wacker process dominates due to its high throughput and well-established infrastructure, while dehydrogenation of ethanol provides a sustainable alternative when bio-ethanol feedstocks are accessible. Partial oxidation of ethylene remains a flexible option for producers seeking to integrate with existing ethylene oxide facilities.

Finally, form factors bifurcate into liquid and vapor gas presentations. Liquid acetaldehyde accounts for the majority of trade volumes, benefiting from ease of handling and storage, whereas vapor gas applications cater to gas-phase reactions and specialized delivery systems, often associated with onsite generation and closed-loop recycling configurations.

This comprehensive research report categorizes the Acetaldehyde market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Production Process

- Grade

- Form

- End Use Industry

- Distribution Channel

Unveiling Regional Trends Influencing Acetaldehyde Utilization and Production Efficiencies Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in the Americas reflect a diverse landscape of production capacity, regulatory environments, and end-use demand. The United States remains the largest single-country market, driven by strong pharmaceutical, coatings, and specialty chemical sectors. EPA and TSCA reforms have heightened scrutiny of chemical emissions and fostered investment in greener production methods. At the same time, domestic tariff protections have incentivized onshore capacity expansions, even as importers navigate ongoing Section 301 exclusions and reclassification initiatives to secure supply continuity.

In Europe, the combination of REACH regulations, the evolving Carbon Border Adjustment Mechanism, and aggressive sustainability targets is shaping procurement and manufacturing strategies. European producers are integrating bio-based feedstocks and low-emission technologies to align with carbon pricing mechanisms, while importers of non-EU acetaldehyde prepare for potential definitive CBAM entry in 2026. These requirements, together with stringent health and safety standards, are driving convergence on best practices in emissions reporting and process transparency.

The Asia-Pacific region remains the fastest-growing arena for acetaldehyde production and consumption. China and India continue to roll out new ethylene oxidation units, supported by government incentives under industrial modernization programs. Celanese’s Nanjing facility and Eastman’s collaborations illustrate the strategic importance of local partnerships and integrated logistics networks. At the same time, Southeast Asian hubs are emerging as competitive alternatives, leveraging lower feedstock costs and favorable trade agreements to supply regional demand.

This comprehensive research report examines key regions that drive the evolution of the Acetaldehyde market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating the Strategic Positions and Competitive Strengths of Leading Global Players Driving the Acetaldehyde Industry Landscape

The acetaldehyde market exhibits a high degree of consolidation among a handful of global leaders distinguished by their technological capabilities and integrated supply chains. Celanese Corporation, as the world’s largest acetic acid producer, leverages backward integration into ethylene oxidation to maintain cost leadership and reliability in supply. Eastman Chemical Company offers a robust portfolio in specialty grades, focusing on high-purity segments for food, beverage, and pharma applications, supported by its extensive R&D footprint and quality certification programs.

Sumitomo Chemical Co. Ltd. combines global reach with downstream chain integration, ensuring feedstock security and leveraging synergies across its petrochemical and specialty divisions. Sekab exemplifies the bio-based pathway with its commitment to lignocellulosic ethanol production for green acetaldehyde manufacturing. Merck KGaA and Honeywell International deliver niche solutions in pharmaceutical intermediates and performance segments, respectively, relying on stringent process controls and regulatory compliance. Other notable entities such as Jubilant Life Sciences, Laxmi Organic Industries, and Wacker Chemie AG contribute significant capacity and localized market expertise, creating a dynamic interplay of global scale and regional specialization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acetaldehyde market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ashok Alco - chem Limited

- Celanese Corporation

- Eastman Chemical Company

- Gelest, Inc.

- GFS Chemicals, Inc.

- Godavari Biorifineries Limited

- Jubilant Life Sciences Limited

- Laxmi Organic Industries Ltd.

- LCY Chemical Corp.

- Lonza Group Ltd.

- Merck KGaA

- Naran Lala Pvt. Ltd.

- Nikunj Chemicals

- Penta Fine Ingredients, Inc.

- Sekab

- Sumitomo Chemical Co., Ltd.

- Thermo Fisher Scientific Inc.

- Vigon International, LLC

- Vizag Chemical International

- Wacker Chemie AG

Proactive Strategies for Industry Leaders to Capitalize on Acetaldehyde Market Shifts While Ensuring Resilience and Sustainable Growth Practices

Industry leaders should prioritize investment in renewable feedstock routes and modular production technologies to mitigate both carbon exposure and tariff risk. Aligning with green chemistry principles, companies can accelerate pilot programs for ethanol-derived acetaldehyde, reducing dependency on imported ethylene and positioning for future carbon border adjustments. Concurrently, engaging in tariff classification reviews and pursuing Section 301 exclusion requests can shield critical feedstock streams from disruptive duties, preserving margin integrity amid fluctuating trade policies.

Digital integration should extend beyond pilot deployments to enterprise-wide adoption of Industry 4.0 capabilities. Leveraging AI for predictive maintenance and process optimization can reduce unplanned downtime and enhance throughput. Implementing digital twins offers a pathway to rapid scenario analysis, enabling organizations to adapt to market volatility and regulatory shifts with greater agility.

Collaboration with regulatory bodies and active participation in CBAM advisory forums will ensure preparedness for evolving carbon border mechanisms. Early adoption of emissions reporting frameworks and strategic use of de minimis exemptions can secure a competitive advantage in EMEA markets. Emphasizing high-purity and specialty segments will further diversify revenue streams, capitalizing on premium pricing for analytical and electronic grade acetaldehyde in advanced manufacturing sectors.

Implementing a Robust Mixed Methodology Framework to Ensure Validated Insights and High-Integrity Findings in Acetaldehyde Research

This analysis integrates a mixed-methodology framework combining extensive secondary research, primary interviews, and data triangulation to ensure comprehensive and validated insights. Secondary research encompassed peer-reviewed journals, regulatory documents, and reputable industry publications to establish foundational market context and identify emerging trends. Primary research involved structured interviews with key stakeholders, including process engineers, regulatory experts, and procurement leaders, to capture nuanced perspectives on operational challenges and strategic priorities.

Quantitative data were cross-referenced with trade statistics and official tariff documentation, while qualitative findings were corroborated through expert panels and advisory board workshops. This iterative approach allowed for real-time validation of critical assumptions and scenario modeling, enhancing the robustness of market segmentation and regional analyses. Rigorous data governance protocols and quality checks were applied throughout, ensuring that conclusions are supported by credible evidence and aligned with current industry standards.

By synthesizing multiple data streams and stakeholder viewpoints, this methodology provides a high-integrity foundation for strategic decision-making and yields actionable intelligence on acetaldehyde market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acetaldehyde market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acetaldehyde Market, by Production Process

- Acetaldehyde Market, by Grade

- Acetaldehyde Market, by Form

- Acetaldehyde Market, by End Use Industry

- Acetaldehyde Market, by Distribution Channel

- Acetaldehyde Market, by Region

- Acetaldehyde Market, by Group

- Acetaldehyde Market, by Country

- United States Acetaldehyde Market

- China Acetaldehyde Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Study Takeaways on Acetaldehyde Industry Evolution to Inform Decision-Making and Guide Future Strategic Positioning

This study highlights the critical nexus between evolving production technologies, regulatory landscapes, and global trade policies in shaping the acetaldehyde industry. The transition toward bio-based and low-carbon pathways presents both opportunities for differentiation and challenges in feedstock accessibility. Digital transformation emerges as a key enabler for process efficiency and supply chain resilience, while trade tariffs and carbon border mechanisms underscore the importance of proactive policy engagement.

Regional insights reveal that North America’s protected markets and regulatory initiatives incentivize domestic capacity growth, whereas Europe’s focus on carbon accounting demands advanced sustainability planning. Asia-Pacific, propelled by government incentives and integrated value chains, continues to expand production but must balance growth with environmental stewardship. Across these regions, major players are adapting portfolios to capture high-purity and specialty segments, mitigating risks associated with commodity price volatility.

Ultimately, acetaldehyde stakeholders who adopt agile operational models, invest in green technologies, and engage strategically with evolving trade and carbon regimes will be best positioned to navigate market uncertainties. This collective insight underscores the imperative for continued innovation, collaboration, and data-driven decision-making to secure long-term competitiveness in a dynamic global landscape.

Engage with Associate Director Ketan Rohom to Acquire the Comprehensive Acetaldehyde Market Research Report and Unlock Strategic Business Insights

To secure your competitive edge and gain a deeper understanding of acetaldehyde’s evolving market dynamics, reach out to Associate Director Ketan Rohom for a personalized consultation and to obtain the comprehensive market research report tailored to your strategic needs.

This detailed report delivers actionable insights across emerging production technologies, regulatory shifts, supply chain optimization, and growth opportunities within critical segments and regions. Ketan Rohom will guide you through the report’s key findings, outline the most relevant data for your organization, and demonstrate how these insights can directly inform your decision-making process.

Position your company to capitalize on upcoming industry transformations by leveraging this in-depth research and our expert analysis. Contact Ketan Rohom today to schedule a briefing and explore how the report can drive your initiatives in process innovation, tariff mitigation, sustainability, and market expansion.

- How big is the Acetaldehyde Market?

- What is the Acetaldehyde Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?