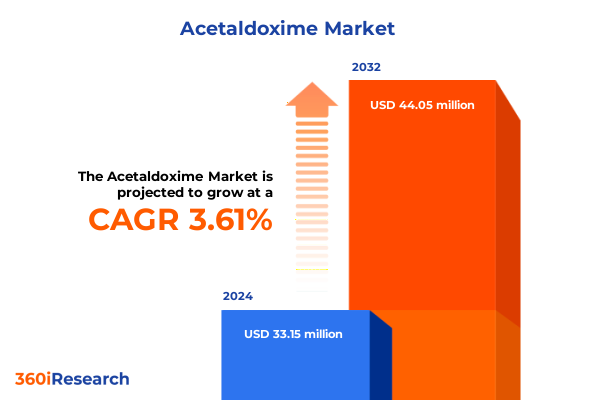

The Acetaldoxime Market size was estimated at USD 34.33 million in 2025 and expected to reach USD 40.41 million in 2026, at a CAGR of 3.62% to reach USD 44.05 million by 2032.

Exploring Acetaldoxime’s Pivotal Role as a Versatile Chemical Intermediate Unlocking Innovations in Crop Protection, Pharmaceuticals, Corrosion Control, and Resin Curing

Acetaldoxime has emerged as a critical building block within the specialty chemicals arena, recognized for its multifaceted applications across the agrochemical, pharmaceutical, and industrial sectors. As a key intermediate in the synthesis of selective herbicides, it underpins the formulation of high-efficiency fungicides, herbicides, and pesticides that are essential to modern crop protection strategies in response to rising global food demand. Beyond agriculture, acetaldoxime’s role has expanded into pharmaceutical manufacturing, where its reactivity facilitates the production of active pharmaceutical ingredients and complex small molecule compounds, supporting a surge in R&D aimed at more targeted therapeutics.

Simultaneously, the compound’s integration into corrosion inhibitor formulations has addressed critical infrastructure challenges by enhancing metal surface protection and extending equipment service life in harsh environments. In parallel, resin curing applications have leveraged its chemical properties to improve polymer network formation, boosting performance characteristics in coatings and adhesives. Underpinning these developments is a growing sustainability imperative, driving innovation in greener synthesis routes and biodegradable formulations that meet stringent regulatory standards while preserving operational efficiency. As these diverse end-use industries converge in their demand for high-purity, performance-driven intermediates, acetaldoxime stands at the intersection of technological advancement and environmental stewardship.

Uncovering the Green Chemistry Revolution and Digital Traceability Breakthroughs That Are Redefining Acetaldoxime Production, Sustainability, and Supply Chain Resilience

The acetaldoxime landscape is being reshaped by a dual wave of sustainability mandates and digital supply chain transformations. Chemical formulators are increasingly aligning with green chemistry principles, seeking low-impact, biodegradable intermediates that reduce solvent usage and minimize hazardous byproducts. This shift has catalyzed the adoption of bio-catalyzed synthesis methods and solvent-free reaction pathways, lowering the environmental footprint of acetaldoxime production while driving operational cost savings. Concurrently, advanced analytics and blockchain-backed traceability solutions have introduced unprecedented transparency into procurement and quality control, streamlining compliance and accelerating time-to-market for specialty intermediates.

In tandem with these technological strides, the rise of biobased feedstocks is challenging traditional petrochemical routes by offering renewable alternatives that resonate with corporate ESG targets. Regulatory agencies have responded by strengthening requirements for lifecycle assessments and risk profiling, influencing raw material sourcing decisions and product registration processes. At the same time, cross-industry demand-from agrochemicals to pharmaceuticals-has intensified the need for tailored high-purity grades and functionalized acetaldoxime variants. As stakeholders embrace collaborative R&D partnerships and invest in modular, flexible production platforms, they position themselves to capture emerging opportunities in a market where innovation and regulatory agility are paramount.

Navigating the Ripple Effects of New 2025 US Tariff Measures on Acetaldoxime Imports That Are Reshaping Sourcing Strategies and Cost Structures

In 2025, the introduction of new tariff measures by the United States government has reverberated through the acetaldoxime value chain, prompting stakeholders to reassess sourcing and cost structures. Increased duties on imported feedstocks and finished intermediates have elevated landed costs, compelling formulators to explore nearshoring options and strategic backward integration to stabilize supply. Domestic producers have responded by expediting capacity expansions and optimizing process efficiencies to address emerging shortfalls and mitigate currency exposure.

The higher price basis for external procurement has also driven more dynamic contracting practices. Buyers and suppliers are forging flexible agreements that balance long-term volume commitments with spot contracts, fostering resilience against further policy shifts. In response to uneven tariff impacts across regions, some export-oriented manufacturers are leveraging duty-exempt zones and free trade agreements to preserve competitiveness in international markets. These strategic adaptations underscore the importance of agile supply chain management, proactive regulatory intelligence, and collaborative partnerships in navigating the evolving trade policy environment within the acetaldoxime sector.

Delving into Application, End Use Industry, Form, Purity, and Distribution Channel Segmentation to Illuminate Critical Demand Patterns and Strategic Opportunities

Acetaldoxime’s market dynamics are deeply informed by five primary segmentation dimensions that reveal nuanced demand patterns and inform targeted value creation strategies. Application-driven insights highlight the dominance of agrochemical intermediates, where the compound supports fungicide, herbicide, and pesticide formulations critical to yield optimization. Simultaneously, pharmaceutical intermediates stand out for their role in the efficient synthesis of active pharmaceutical ingredients, peptides, proteins, and small molecule pharmaceuticals, indicating high-value growth potential.

End use industries diversify the demand profile, extending beyond traditional agrochemicals to encompass coatings and adhesives, construction materials, and pharmaceutical manufacturing environments. In these contexts, acetaldoxime’s form preference diverges, with liquid grades facilitating seamless integration in continuous processes while solid variants offer handling advantages and storage stability. Purity levels create further distinction: industrial grade products strike a balance between cost efficiency and acceptable impurity thresholds, whereas laboratory grade materials meet rigorous specifications for advanced research and specialized applications.�

Distribution channel analysis underscores the strategic trade-offs between direct sales partnerships, which enable volume commitments and long-term collaboration, and online sales platforms, which deliver rapid order fulfillment and broad geographic coverage. Understanding these segmentation layers empowers producers and distributors to tailor product development, marketing focus, and service offerings with precision, driving competitive differentiation in each target segment.

This comprehensive research report categorizes the Acetaldoxime market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Purity

- Application

- End Use Industry

- Distribution Channel

Examining Distinct Drivers Shaping Acetaldoxime Demand and Production across the Americas, Europe Middle East & Africa, and Asia-Pacific Regions

Regional dynamics in the acetaldoxime market reflect the interplay of agricultural modernization, regulatory frameworks, and industrial development across three major geographies. In the Americas, the United States stands as both a significant consumer and producer, driven by robust agrochemical R&D investments, stringent regulatory compliance requirements, and growing demand for advanced polymer curing agents in coatings and adhesives. Canada’s focus on sustainable agriculture has further bolstered interest in low-toxicity herbicide intermediates, reinforcing North America’s leadership in high-purity chemical manufacturing.

Within Europe, Middle East, and Africa, stringent environmental regulations and ambitious green transition policies have accelerated the adoption of acetaldoxime synthesized via bio-catalyzed and solvent-free techniques. The European Union’s emphasis on lifecycle assessments and chemical safety standards has spurred innovation in low-emission production routes, while Middle Eastern investments in specialty chemicals diversification are enhancing local capacity. In Africa, the expansion of commercial farming operations has increased demand for herbicide precursors that balance efficacy with environmental stewardship.

Asia-Pacific remains the fastest-growing regional market, propelled by expanding agricultural acreage, burgeoning pharmaceutical manufacturing hubs, and increased infrastructure spending. China and India, in particular, have ramped up acetaldoxime production capacities to serve domestic and export markets. Southeast Asian nations are also integrating advanced agrochemicals to improve crop yields, while Japan and South Korea continue to focus on high-purity grades for pharmaceutical and electronics applications.

This comprehensive research report examines key regions that drive the evolution of the Acetaldoxime market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Capacity Expansions, Acquisitions, Eco-Friendly Production Innovations, and Supply Chain Partnerships by Leading Acetaldoxime Manufacturers

Leading global producers are deploying a diverse set of strategic initiatives to fortify their positions in the acetaldoxime landscape. In India, Aarti Industries announced a substantial expansion of its acetaldoxime production facility in October 2023, aiming to enhance downstream supply for both pharmaceutical and agrochemical intermediates, while leveraging scale efficiencies to strengthen its export competitiveness. Meanwhile, Arkema S.A. completed a key acquisition in September 2023 that augments its specialty chemicals portfolio and secures access to novel acetaldoxime derivatives, signaling a commitment to broaden its application footprint.

Solvay has distinguished itself through investment in greener process technology, unveiling an eco-friendly acetaldoxime production methodology that significantly reduces carbon emissions and operational costs, thereby setting a new industry benchmark for environmental performance. Simultaneously, BASF has forged strategic partnerships to reinforce its domestic and global supply chains, collaborating with regional chemical manufacturers to ensure consistent delivery of high-purity intermediates under evolving trade policies. These varied approaches-from capacity expansion to M&A, green process innovation, and collaborative ventures-illustrate the dynamic competitive landscape and the multifaceted routes through which leading firms are driving growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acetaldoxime market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABCR GmbH & Co. KG

- Arkema S.A.

- Avantor, Inc.

- BASF SE

- Eastman Chemical Company

- Evonik Industries AG

- GODAVARI BIOREFINERIES LTD

- Jiangshan Taige Chemical

- Jiangsu ECOWAY Science & Technology

- Jubilant Ingrevia Limited

- Merck KGaA

- Mitsui Chemicals, Inc.

- Radison Labs Private Limited

- Shandong Jiuchen New Materials

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

Implementing Green Chemistry, Digital Traceability, Strategic Partnerships, and Agile Capacity Planning to Strengthen Acetaldoxime Market Position

To navigate the evolving acetaldoxime environment, industry leaders must prioritize a set of targeted actions. First, investing in green chemistry capabilities-such as bio-catalysis and solvent elimination-will ensure regulatory compliance and enhance brand differentiation in environmentally conscious markets. Parallel efforts should focus on digitalizing quality control and traceability systems to reduce supply chain risk and accelerate product registration cycles. Engaging in strategic partnerships with raw material suppliers and end-use formulators can mitigate tariff impacts, stabilize pricing structures, and secure preferential supply arrangements in key regions.

Simultaneously, firms should bolster domestic production capacities or nearshore facilities to hedge against geopolitical uncertainties and import duties, while exploring duty-exempt trade frameworks to preserve export competitiveness. Product portfolios can be optimized by segmenting offerings according to application-specific requirements-balancing industrial grade cost advantages against premium laboratory grade margins. Finally, enhancing customer engagement through direct sales collaborations and online distribution channels will facilitate responsive service delivery and extended market reach, solidifying long-term relationships and unlocking new segments.

Outlining Rigorous Primary Interviews, Secondary Data Analysis, and Multi-Step Validation Processes That Ensure High-Integrity Insights into Acetaldoxime Market Trends

This analysis integrates both qualitative and quantitative research methods to ensure comprehensive and accurate market insights. Primary research included detailed interviews with plant managers, R&D scientists, procurement directors, and regulatory specialists across leading acetaldoxime-producing companies. These discussions provided firsthand perspectives on emerging production technologies, supply chain adaptations, and application-specific performance requirements. Secondary research comprised a thorough review of industry publications, patent databases, regulatory filings, and academic studies, enabling cross-verification of production innovations and end-use trends.

Data triangulation was performed through iterative validation with industry experts to reconcile discrepancies between sources and refine key themes. Rigorous analytical frameworks-such as PESTLE and Porter’s Five Forces-were employed to contextualize macroeconomic drivers, competitive dynamics, and technological shifts. The research scope prioritized recent developments up to mid-2025, ensuring relevance to current regulatory environments and trade policies. Collectively, this methodology provides a robust foundation for actionable conclusions and strategic recommendations tailored to stakeholders across the acetaldoxime value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acetaldoxime market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acetaldoxime Market, by Form

- Acetaldoxime Market, by Purity

- Acetaldoxime Market, by Application

- Acetaldoxime Market, by End Use Industry

- Acetaldoxime Market, by Distribution Channel

- Acetaldoxime Market, by Region

- Acetaldoxime Market, by Group

- Acetaldoxime Market, by Country

- United States Acetaldoxime Market

- China Acetaldoxime Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Market Drivers, Segment Differentiation, Competitive Dynamics, and Strategic Imperatives to Guide Stakeholders in Achieving Sustainable Growth

Acetaldoxime’s evolving market landscape is defined by converging drivers: surging demand across agrochemical and pharmaceutical applications, intensifying sustainability mandates, and shifting trade policies that recalibrate supply chains. Key segmentation insights underscore the importance of tailoring product forms, purity grades, and distribution strategies to meet diverse customer needs. Regional outlooks highlight the strategic imperative of balancing domestic capacity growth in North America and Asia-Pacific with regulatory innovation in Europe, Middle East, and Africa.

Competitive dynamics reveal that capacity expansions, M&A activity, and eco-efficient process innovations are central to securing market leadership. Going forward, actionable recommendations emphasize green chemistry investments, digital supply chain enhancements, and proactive engagement with tariff mitigation measures. By leveraging robust primary and secondary research methodologies, stakeholders can navigate the complex interplay of technological advancement, regulatory evolution, and market segmentation. These insights equip decision-makers with the clarity to pursue targeted growth strategies, optimize supply chain resilience, and capture emerging opportunities in the specialty chemicals landscape.

Unlock Strategic Insights and Tailored Acetaldoxime Market Intelligence by Connecting with Associate Director of Sales & Marketing Ketan Rohom

To secure a definitive advantage in the acetaldoxime market, engage directly with Associate Director of Sales & Marketing Ketan Rohom to obtain the full market research report. His expertise will guide you through a tailored overview of the report’s methodology, key findings across applications, regions, and competitive dynamics, as well as strategic recommendations developed specifically for your organization’s needs. By connecting with Ketan Rohom, you will gain immediate access to actionable data and insights that support informed decision making on supply chain optimization, product development priorities, and investment strategies. Reach out today to explore customized research packages, subscription options, and consulting services designed to accelerate growth and resilience in a rapidly evolving specialty chemicals landscape.

- How big is the Acetaldoxime Market?

- What is the Acetaldoxime Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?