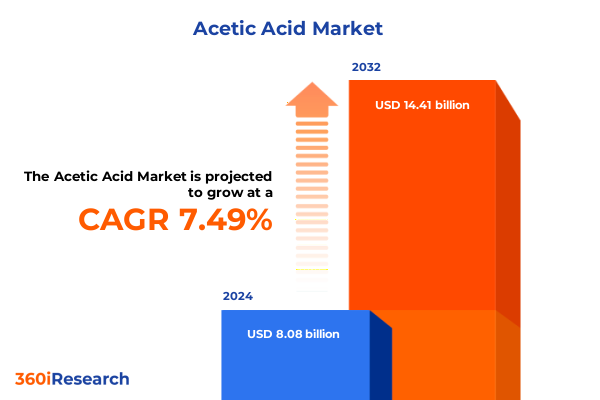

The Acetic Acid Market size was estimated at USD 8.68 billion in 2025 and expected to reach USD 9.34 billion in 2026, at a CAGR of 7.50% to reach USD 14.41 billion by 2032.

Unveiling the Dynamics Shaping the Global Acetic Acid Market and Its Crucial Role in Modern Industrial and Consumer Applications

Unveiling the unparalleled significance of acetic acid requires an appreciation for its status as a cornerstone of modern chemistry. Recognized as a vital feedstock, acetic acid underpins the production of vinyl acetate monomer, a fundamental component in adhesives, paints, and coatings. Concurrently, it plays a pivotal role in synthesizing polyethylene terephthalate (PET), which dominates global packaging applications. Beyond polymers, acetic acid’s versatility extends into the food industry, where it serves as the principal component of culinary vinegar, and into pharmaceuticals, where it facilitates active pharmaceutical ingredient (API) manufacture. Its ubiquity across end-use sectors underscores its strategic importance in both industrial and consumer markets, shaping cost structures, innovation pipelines, and regulatory dialogues worldwide.

This executive summary distills critical insights into the evolving acetic acid landscape, charting key transformative shifts and the implications of U.S. tariff measures enacted in 2025. It presents a nuanced segmentation analysis that illuminates grade distinctions, diverse production pathways, product forms, distribution channels, and end-user patterns. Complementing these framing elements, regional deep dives reveal geographic demand drivers, while company profiles shed light on strategic initiatives that are redefining market leadership. Concluding with actionable recommendations, a transparent research methodology, and a persuasive call to action, this overview equips decision-makers with the clarity needed to navigate complexities and capitalize on emerging opportunities.

Navigating Transformative Forces Driving Sustainable Innovations and Resilient Supply Chain Evolution in the Acetic Acid Industry

At the heart of today’s market transformation lies an intensified focus on sustainability, with industry stakeholders rapidly adopting bio-based production routes to reduce carbon footprints. Renewable feedstocks such as ethylene derived from bioethanol and advanced fermentation methods are emerging as credible alternatives to conventional petrochemical oxidation processes. Simultaneously, digitalization initiatives-spanning predictive maintenance in manufacturing plants to blockchain-enabled traceability-are enhancing operational resilience and transparency across the value chain. These technological infusions are set against a backdrop of circular economy principles, where by-product utilization and solvent recovery are gaining traction to minimize waste and enhance resource efficiency.

Moreover, shifts in downstream demand patterns are catalyzing product innovation. The surge in stringent environmental regulations has spurred research into low-volatile organic compound (VOC) formulations, while the pharmaceutical and personal care sectors are driving the development of ultra-pure grades. In parallel, strategic partnerships between chemical producers and academic institutions are accelerating research into catalytic improvements and novel process intensification techniques. As a result, the market landscape is being reshaped by collaborative R&D that marries scientific rigor with commercial pragmatism. Together, these transformative forces are redefining competitive benchmarks and laying the groundwork for the next generation of acetic acid applications.

Assessing the Comprehensive Effects of 2025 United States Tariff Measures on Trade Dynamics and Competitive Landscape of Acetic Acid

The United States’ 2025 tariff measures have introduced a new dimension of complexity to the global acetic acid market. Levies on key import origins have elevated landed costs for foreign producers, prompting domestic buyers to reassess sourcing strategies. In response, some downstream manufacturers have pivoted toward local supply to mitigate tariff-induced price volatility, bolstering domestic acetic acid producers’ negotiating power. Conversely, producers in tariff-affected regions have intensified efforts to secure alternative markets, often redirecting volumes toward Asia-Pacific hubs where demand growth remains robust.

These shifts have rippled through the supply chain, influencing inventory management and contractual benchmarks. Spot-market transactions have taken on greater prominence as buyers seek flexibility amid uncertain duty landscapes. In parallel, forward contracts with destination clauses tied to tariff adjustments are becoming standard practice, reflecting a collective desire to share and hedge risk. While these adjustments help stabilize trade flows, they also heighten pressure on margin structures and necessitate more sophisticated tariff-pass-through mechanisms. Ultimately, the cumulative impact of 2025 U.S. tariffs underscores a broader imperative: industry participants must deftly navigate evolving trade policies to maintain both cost competitiveness and supply continuity.

Delving into Crucial Grade, Production Method, Form, Distribution Channel, and End-User Patterns Driving Value in the Acetic Acid Market

A granular view of market segmentation reveals distinct performance drivers across multiple dimensions. Within grade categorization, food-grade acetic acid continues to command attention for its stringent purity requirements and direct consumer-facing applications, whereas industrial grade retains dominance in large-scale polymer synthesis and solvent manufacturing. Pharmaceutical grade, characterized by exacting regulatory specifications, is experiencing incremental uptake from life sciences innovators seeking advanced intermediates. Shifting to production processes, traditional methods such as acetaldehyde oxidation and methanol carbonylation still undergird the bulk of capacity, yet emerging pathways like bio-based ethylene oxidation and fermentation processes are converging toward mainstream viability as decarbonization mandates intensify.

Form factors also influence logistics and end-user decisions. Liquid acetic acid remains ubiquitous due to cost-efficient handling and established distribution networks, while solid acetic acid finds niche adoption in formulations where ease of storage and granular dosing offer advantages. Distribution channel dynamics are similarly multifaceted: offline channels sustain core volumes through established industrial distributors and retail chemists, even as online procurement platforms gain traction for specialty and small-batch requirements. Finally, on the end-user front, the food and beverage segment continues to anchor demand, with cosmetics and personal care applications exhibiting robust growth as consumers seek naturally derived preservatives. Academic and research institutions, though smaller in volume, drive innovation, while chemical and pharmaceutical industries underline the market’s strategic importance.

This comprehensive research report categorizes the Acetic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Production Process

- Form

- Distribution Channel

- End-User

Unraveling Regional Demand Nuances across the Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Growth Drivers in Acetic Acid

In the Americas, robust downstream industries and supportive policy frameworks underpin steady demand for acetic acid across North and South America. The United States leads with advancements in shale-derived ethylene supply chains, facilitating competitive petrochemical oxidation capacities, whereas Brazil’s bioderived ethanol production presents fertile ground for bio-based process expansion. Regulatory initiatives focused on reducing greenhouse gas emissions further incentivize investments in sustainable production technologies throughout the region.

Turning to Europe, the Middle East, and Africa, stringent environmental regulations in the European Union have spurred retrofitting of existing plants for lower carbon footprints, alongside incentives for green chemistry applications. The Middle East is leveraging its energy exports to finance integrated chemical complexes, while North African hubs benefit from proximity to both European and sub-Saharan markets. Across these territories, rising demand for pharmaceutical-grade acetic acid is notable, as local healthcare sectors expand and regional manufacturing capabilities strengthen.

The Asia-Pacific region remains the fastest evolving market, propelled by capacity expansions in China and India and burgeoning end-use segments in Southeast Asia. China’s large-scale methanol carbonylation sites continue to influence global supply balances, even as the nation accelerates its transition to bio-based feedstocks. Meanwhile, India’s petrochemical investments and ASEAN countries’ focus on specialty chemicals are forging new growth corridors. Together, these regional dynamics underscore the importance of localized strategies and tailored infrastructure investments.

This comprehensive research report examines key regions that drive the evolution of the Acetic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Strategic Initiatives and Competitive Positioning of Leading Global Players Shaping the Future of the Acetic Acid Industry

Leading players are leveraging a blend of capacity expansions, joint ventures, and technological collaborations to solidify market position. Global chemical giants are investing in advanced catalyst technologies and modular plants aimed at boosting throughput while curbing emissions. Strategic partnerships between established producers and biotechnology firms are accelerating the commercialization of bio-derived acetic acid, signaling a clear shift toward greener production footprints.

Moreover, companies are deploying digital twins and advanced analytics to optimize plant performance, reduce unplanned downtime, and balance feedstock variability. This digital integration is complemented by broader supply chain visibility initiatives, which enable more agile responses to shifting demand patterns and tariff developments. Concurrently, select participants are diversifying into specialty segments, offering high-purity grades and custom formulations to pharmaceutical and electronics manufacturers. Taken together, these strategic moves illustrate a competitive landscape increasingly defined by technological leadership, sustainability credentials, and a willingness to explore cross-sector alliances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acetic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anant Pharmaceuticals Pvt. Ltd.

- BASF SE

- BP p.l.c.

- Celanese Corporation

- Daicel Corporation

- Eastman Chemical Company

- EuroChem Group

- Formosa Plastics Corporation

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- Hawkins, Inc.

- Hebei Pengfa Chemical Co., Ltd.

- INEOS Group AG

- Jiangsu Sopo (Group) Co., Ltd.

- Jubilant Ingrevia Limited

- Junsei Chemical Co.,Ltd.

- KANTO CHEMICAL CO.,INC.

- Kingboard Holdings Limited

- Kishida Chemical Co.,Ltd.

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- Saudi Basic Industries Corporation

- SEKAB Biofuels & Chemicals AB

- Shandong Hualu-Hengsheng Chemical Co., Ltd.

- Yancheng City Chunzhu Aroma Co.,Ltd.

- Zhengzhou Batong Industrial Co., Ltd

Empowering Industry Leaders with Strategic Roadmaps to Leverage Innovation, Sustainability, and Resilient Supply Chains in the Acetic Acid Sector

Industry leaders should prioritize investment in alternative feedstock research and accelerate pilot deployments of bio-based production technologies. By doing so, they can preempt tightening environmental regulations and establish early mover advantages in low-carbon acetic acid. Simultaneously, organizations are advised to implement digital supply chain platforms that integrate real-time data across sourcing, production, and distribution functions, thereby enhancing responsiveness to tariff fluctuations and demand variability.

Enhancing collaboration with end-users through co-innovation frameworks can unlock new applications and foster long-term off-take agreements that de-risk capital investments. Furthermore, diversifying geographic footprint-both through strategic alliances and greenfield sites-can mitigate regional policy risks and capture emerging demand in underpenetrated markets. Lastly, fostering transparent sustainability reporting and obtaining third-party certifications will reinforce brand equity and satisfy increasingly stringent ESG criteria, positioning companies to thrive as stakeholders place greater emphasis on environmental and social governance.

Outlining Comprehensive Research Methodologies Embracing Rigorous Data Collection, Expert Engagement, and Triangulation for Acetic Acid Market Analysis

This analysis synthesizes insights gathered through a rigorous multi-tiered research approach. Primary research entailed in-depth interviews with C-suite executives, plant managers, and R&D specialists across major producing regions, ensuring perspectives from both upstream and downstream stakeholders. Simultaneously, secondary research drew upon peer-reviewed journals, patent registries, government publications, and industry association reports to contextualize quantitative data and benchmark best practices.

To ensure robustness, findings underwent triangulation through cross-validation of interview inputs, public disclosures, and third-party technical assessments. Qualitative insights were augmented by process simulation studies and environmental impact analyses to address both operational viability and sustainability performance. Finally, regional market realities were mapped using supply chain flow models and policy review matrices, ensuring that each recommendation aligns with localized regulatory frameworks and infrastructural constraints.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acetic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acetic Acid Market, by Grade

- Acetic Acid Market, by Production Process

- Acetic Acid Market, by Form

- Acetic Acid Market, by Distribution Channel

- Acetic Acid Market, by End-User

- Acetic Acid Market, by Region

- Acetic Acid Market, by Group

- Acetic Acid Market, by Country

- United States Acetic Acid Market

- China Acetic Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Insights from Market Dynamics, Tariff Impacts, and Strategic Segments to Illuminate the Outlook for Acetic Acid Stakeholders

The acetic acid market stands at an inflection point where traditional petrochemical pathways intersect with evolving sustainability imperatives. While established oxidation processes remain foundational, the momentum behind bio-based and green chemistry alternatives is unmistakable. Concurrently, geopolitical factors and trade policies-most notably U.S. tariffs-are reshaping sourcing decisions and supply chain architectures. Navigating this multifaceted environment requires a granular understanding of grade specifications, production technologies, product forms, distribution channels, and end-user dynamics, all of which influence strategic positioning.

Regional variances further underscore the necessity for adaptive strategies: from capacity upgrades in the Americas to environmental retrofits in Europe, alongside rapid expansions and policy incentives in Asia-Pacific. Leading companies are already demonstrating the value of integrated digital platforms, cross-sector partnerships, and focused sustainability roadmaps. As stakeholders chart future directions, they must balance agility and innovation with prudent risk management, ensuring that investments are aligned with both regulatory trends and shifting consumer expectations. In sum, the path forward demands a holistic approach that synthesizes technological prowess, market intelligence, and strategic foresight.

Engage with Ketan Rohom to Secure Your Exclusive Acetic Acid Market Report for Informed Decision-Making and Strategic Advantage in Competitive Landscapes

To explore comprehensive insights and secure a competitive edge, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to obtain your exclusive acetic acid market report. Engaging with Ketan opens dialogue on tailored data solutions that align with your strategic priorities. His expertise will guide you through the report’s nuanced findings, ensuring you leverage the most relevant intelligence for informed decision-making. Connect today to transform uncertainty into opportunity and accelerate growth within the dynamic acetic acid landscape.

- How big is the Acetic Acid Market?

- What is the Acetic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?