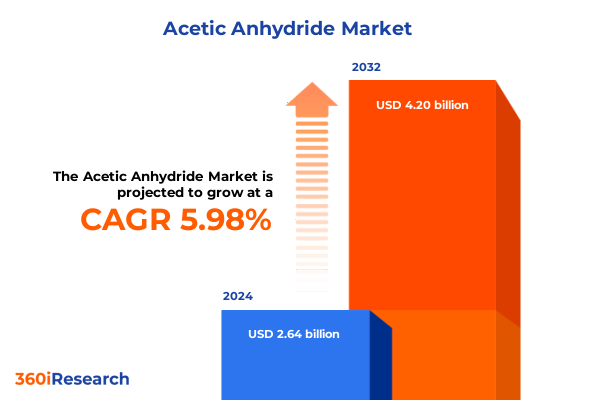

The Acetic Anhydride Market size was estimated at USD 2.79 billion in 2025 and expected to reach USD 2.96 billion in 2026, at a CAGR of 5.98% to reach USD 4.20 billion by 2032.

Unveiling the Strategic Significance of Acetic Anhydride Across Diverse Industries Amidst Evolving Global Chemical Demand Dynamics

Acetic anhydride occupies a pivotal role as an acetylating agent in a spectrum of industrial processes, serving as a cornerstone of chemical synthesis for cellulose derivatives, pharmaceuticals, and specialty materials. Its unique reactivity underpins the production of cellulose acetate fibers used in textiles and films, while also facilitating the acetylation steps essential for salicylic acid synthesis in analgesic manufacture. Beyond its traditional applications, the growing demand for bio-based intermediates and specialty polymers has propelled acetic anhydride into new frontiers of research, catalyzing innovations across sustainable chemistry and circular economy initiatives. As global manufacturers navigate rising environmental expectations and tighter regulatory landscapes, acetic anhydride’s versatility reinforces its strategic importance within complex production networks.

Moreover, shifts in trade policies and raw material availability have magnified the need for agile procurement strategies and diversified supply chains. With major producers spanning North America, Europe, and Asia, the market’s structure is highly interdependent, making end users increasingly attentive to geopolitical developments and logistics disruptions. Whether deployed in cellulose acetate for photographic film, in polymer modifiers for high-performance coatings, or in acetylation reactions for active pharmaceutical ingredients, acetic anhydride remains integral to industrial value chains. Consequently, keeping abreast of technological advances, sustainability mandates, and trade policy shifts is critical for stakeholders looking to maintain competitive advantage and operational resilience.

This executive summary offers a comprehensive overview of the key drivers, market transformations, and strategic imperatives shaping the acetic anhydride landscape. By distilling the most salient developments-from tariff adjustments to emerging segmentation insights-this analysis equips decision makers with the context and foresight needed to navigate the rapidly evolving global chemical sector.

Examining the Transformational Shifts Redefining the Acetic Anhydride Market Through Regulatory, Technological and Geopolitical Disruptions

The acetic anhydride market is being recalibrated by an array of regulatory, geopolitical, and technological forces that are reshaping its trajectory. Trade policy adjustments-including reciprocal tariffs applied to imports from key regions-have heightened scrutiny of sourcing strategies, compelling buyers to evaluate supplier diversification and nearshoring options to mitigate trade-related risks. Concurrently, heightened environmental regulations and evolving sustainability standards are encouraging producers to invest in low-emission processes and renewable feedstocks, driven by government incentives such as the Department of Energy’s Utilization Procurement Grants program targeting low-carbon chemical intermediates.

Technological innovation is another transformative pillar, as companies accelerate the adoption of advanced process controls, continuous flow reactors, and digital platforms for supply chain visibility. These advancements support optimization of reaction conditions, reduction of energy consumption, and improved batch traceability. Furthermore, green chemistry initiatives-from bio-based acetic acid routes to enzyme-catalyzed acetylation-are gaining traction, promising to lower carbon footprints and align production with circular economy objectives.

Parallel to regulatory and technological shifts, the market is witnessing a consolidation trend among global producers, driven by strategic M&A and capacity expansions in regions with favorable feedstock availability. These moves not only enhance scale economies but also facilitate integrated offerings across acetic acid, anhydride, and derivative streams. Taken together, these disruptive currents are recasting competitive dynamics, driving the need for agile strategies that balance cost efficiency, environmental compliance, and innovation leadership.

Assessing the Multifaceted Cumulative Impact of 2025 United States Tariff Measures on Acetic Anhydride Import Flows From Key Trading Partners

In 2025, the United States implemented a layered tariff framework on acetic anhydride imports, which now combines a base duty, country-specific surcharges, and retaliatory reciprocal tariffs. Under Harmonized Tariff Schedule code 2915.24.00.00, a general duty of 3.5% applies to most origins, while a special duty exemption exists for select trading partners including Australia and Korea. Imports originating from China incur an additional 25% duty imposed under Section 301, resulting in a cumulative duty burden of 28.5% at the U.S. border.

Moreover, reciprocal tariffs instituted under Executive Order modifications effective April 9 introduced an extra 20% levy on shipments from European Union countries and a 24% surcharge on Japanese imports, lifting duty exposure for those regions to 23.5% and 27.5% respectively. These measures have prompted market participants to re-evaluate global supply chains, as cost differentials across source regions have widened significantly. Consequently, regional suppliers and integrated producers with domestic capacity are gaining enhanced competitiveness, while end users reliant on imported volumes face urgent pressure to adjust procurement and pricing strategies.

The cumulative impact of the layered tariffs extends beyond landed costs to influence downstream contract negotiations, inventory planning, and capital expenditure decisions for domestic production. With duty-driven cost variances exceeding 20% between favored and penalized origins, stakeholders are increasingly weighing near-term stockpiling against long-term supply agreements to mitigate volatility. These dynamics underscore the imperative for continuous monitoring of trade policy evolutions and proactive alignment of sourcing frameworks to safeguard operational continuity and margin stability.

Deriving Actionable Segmentation Insights Based on Application, Purity Grade, Manufacturing Process, Distribution Channel and Packaging Preferences

Deep segmentation analysis reveals differentiated demand patterns and pricing dynamics that are critical for effective market engagement. When disaggregated by application, the cellulose acetate segment continues to anchor overall acetic anhydride consumption, driven by sustained demand for textile printing solutions and high-clarity film manufacturing. The insecticides and pesticides application stream demonstrates nuanced demand within fungicide formulations, herbicide intermediates, and insecticide chemistries, each exhibiting distinct seasonality and regulatory trajectories. In pharmaceuticals, the acetylation requirements for paracetamol synthesis and the derivatization processes leading to salicylic acid bypass have shaped bespoke procurement specifications and purity requirements. Plasticizer production further segments into non-phthalate plasticizers-led by DIDP and DINP derivatives-and phthalate plasticizers such as DBP and DEHP, with non-phthalate alternatives gaining momentum due to tightening regulatory scrutiny. Meanwhile, the textile printing segment leverages specialized grades of acetic anhydride to achieve precise acetylation control for vibrant, wash-fast prints.

Purity grade insights illuminate a bifurcation between electronic grade and industrial grade demand. Within the electronic category, display grade requirements prioritize ultra-low metal impurities for liquid crystal applications, while semiconductor grade demands ultrahigh purity for wafer cleaning and etching chemistries. Reagent grade continues to serve general laboratory and small-scale manufacturing needs, maintaining stable volume requirements with predictable price differentials. Examining manufacturing processes, catalytic carbonylation leads in global capacity, the ketene process remains favored for flexible plant configurations, and oxidative carbonylation is emerging in specialty applications due to lower environmental impact.

Distribution channel and packaging preferences further delineate market behavior. Direct sales agreements underpin large volumetric contracts with major end users, whereas distributors provide agility in smaller batch deliveries. E-commerce platforms are beginning to facilitate smaller lot sizes for research applications and niche producers. Packaging insights demonstrate bulk containers dominating cost-sensitive industrial supply chains, drums retaining relevance for mid-tier volumes, and iso tanks being preferred for high-volume logistical efficiency across intercontinental supply routes.

This comprehensive research report categorizes the Acetic Anhydride market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Purity Grade

- Manufacturing Process

- Packaging Type

- Application

- Distribution Channel

Illuminating Regional Variations in Acetic Anhydride Demand and Supply Characteristics Across the Americas, EMEA and Asia-Pacific Markets

Regional demand patterns for acetic anhydride are shaped by distinctive industrial infrastructures, regulatory frameworks, and feedstock proximities. In the Americas, the United States benefits from integrated petrochemical hubs with abundant natural gas feedstocks, supporting competitively priced domestic acetic anhydride output that undercuts many import origins. Mexico’s growing pharmaceutical and agrochemical sectors are increasingly sourcing from North American producers, while select Latin American markets continue to rely on imports due to limited local manufacturing scale.

Within Europe, Middle East, and Africa, Western Europe maintains a mature consumption base driven by well-established chemical and pharmaceutical clusters, although new environmental mandates are pressuring producers to innovate greener acetylation routes. Central and Eastern European countries leverage cost advantages for derivative production but remain net importers of acetic anhydride. In the Middle East, low-cost energy inputs have enabled nascent capacity expansions, positioning regional producers to serve adjacent markets in North Africa and South Asia.

Asia-Pacific stands as the largest regional consumer, with China leading global demand through its expansive chemical intermediates sector and textile industries. India is emerging rapidly as a key growth engine, supported by government incentives to expand pharmaceutical and agrochemical output. Meanwhile, Southeast Asian nations are investing in downstream acetylation capacities, targeting export opportunities and local supply resilience. Geographical proximity to feedstock sources, alongside evolving regulatory priorities and trade agreements, continues to drive differentiated regional strategies for both global producers and local buyers.

This comprehensive research report examines key regions that drive the evolution of the Acetic Anhydride market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Acetic Anhydride Industry Players and Their Strategic Moves Shaping Production Capacities, Sustainability and Market Leadership

Market leadership in acetic anhydride production is increasingly driven by scale, feedstock integration, and strategic investments in sustainability. According to a July 2025 ranking, Junsei Chemical Co., Ltd. leads global search interest with a 27.1% click share, reflecting strong digital engagement and supplier visibility, followed by Jubilant Ingrevia Limited and GJ Chemical as notable contenders in Asia-based manufacturing. Eastman Chemical Company and Celanese Corporation secure significant market positions through their integrated acetic acid and anhydride platforms, bolstered by large-scale facilities and innovation partnerships targeting bio-based product lines.

Celanese’s investments in low-carbon chemistry, including its role as the sole DOE-approved Utilization Procurement Grants vendor for sustainable acetic acid, exemplify how strategic R&D can confer competitive differentiation. Eastman’s emphasis on specialty additives and advanced materials further underscores the shift toward higher-value, lower-volume intermediates that align with sustainable manufacturing mandates. Meanwhile, key acquisitions-such as INEOS’s acquisition of the Eastman Texas City Site-have reinforced capacity footprints and feedstock synergies, enabling more resilient production networks and modular expansion capabilities in high-growth regions.

Emerging players in India, Europe, and the Middle East are leveraging favorable energy costs and policy incentives to establish competitive acetic anhydride sites, challenging legacy producers and diversifying global supply sources. Ultimately, industry leadership is being defined not only by production scale but also by agility in responding to environmental regulations, digital transformation, and customer-centric value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acetic Anhydride market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Wanwei Group Co., Ltd

- Ataman Kimya A.S.

- Atom Scientific Limited

- Avantor, Inc.

- BASF SE

- Biosolve Chimie

- Carl Roth GmbH + Co. KG

- Celanese Corporation

- Central Drug House (P) Ltd.

- Cole-Parmer Instrument Company, LLC by Antylia Scientific

- Daicel Corporation

- Eastman Chemical Company

- Euriso-top by Cambridge Isotope Laboratories, Inc.

- Finar Ltd. by Actylis

- GFS Chemicals, Inc.

- Honeywell International Inc.

- Ineos AG

- Jiangsu Danhua Group Co.,Ltd.

- Jubilant Ingrevia Limited

- Merck KGaA

- MP Biomedicals, LLC by Valiant Co. Ltd

- RLG Group

- Robinson Brothers Limited

- SimSon Pharma Limited

- Spectrum Chemical Mfg. Corp.

- Taj Pharmaceuticals Limited by TAJ PHARMA GROUP

- Tedia

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co., Ltd.

- Vizag Chemical International

Formulating Actionable Recommendations for Industry Stakeholders to Navigate Supply Chain Risks, Regulatory Changes and Emerging Sustainability Imperatives

Industry leaders seeking to thrive amid the evolving acetic anhydride landscape should prioritize strategic sourcing diversification by establishing reciprocal supply agreements across North American, European, and Asia-Pacific hubs to buffer against escalating trade tensions and tariff volatility. Building flexible procurement frameworks that incorporate both long-term volume contracts and agile spot-buy arrangements will help maintain cost predictability while enabling rapid response to market disruptions.

Given the intensifying focus on sustainability, firms must accelerate investments in low-carbon acetylation technologies, including bio-based feedstocks and continuous flow processes, to mitigate regulatory risk and meet customer ESG criteria. Collaborative partnerships with technology providers and research institutions can unlock efficiency gains, reduce energy intensity, and support circular economy objectives, thereby enhancing brand reputation and unlocking premium pricing structures.

Digital integration across the value chain-leveraging advanced analytics for demand forecasting, blockchain for supply chain transparency, and IoT-enabled process monitoring-can drive operational excellence and compliance with evolving quality standards. Moreover, refining segmentation strategies by aligning product portfolios to specific end-use requirements-such as semiconductor grade purity or non-phthalate plasticizer intermediates-will enable companies to capture higher-margin niches and deepen customer relationships.

Finally, proactive engagement with policymakers and industry consortia will empower stakeholders to shape trade policy outcomes, secure tariff exemptions, and advocate for harmonized environmental regulations. This multi-pronged approach will fortify resilience, foster innovation, and position organizations to capitalize on emerging opportunities within the dynamic acetic anhydride market.

Detailing the Robust Research Methodology Employed to Ensure Rigorous Data Collection, Triangulation and Validation Within the Acetic Anhydride Study

This study employs a rigorous research methodology that integrates comprehensive secondary data analysis, primary interviews, and multi-tier validation to ensure accuracy and relevance. Secondary research sources include official government publications such as the Harmonized Tariff Schedule, peer-reviewed journals, industry association white papers, and corporate sustainability reports. These sources provide foundational insights into trade policy developments, regulatory frameworks, and technological advancements.

Primary research comprised in-depth interviews with leading chemical producers, key end users across pharmaceuticals and agrochemicals, and trade policy experts, yielding qualitative perspectives on market dynamics, supply chain challenges, and investment priorities. Input from supply chain logistics specialists and engineering consultants further enriched the understanding of operational constraints and technological feasibility.

Data triangulation techniques were applied by cross-referencing multiple independent sources to resolve inconsistencies and validate assumptions relating to tariff impacts, production capacities, and segment-specific demand drivers. Quantitative data points were corroborated with industry databases and proprietary shipment records, while qualitative findings were subjected to expert review panels to enhance robustness.

The resulting analysis captures both quantitative and qualitative dimensions of the acetic anhydride market, underpinned by transparent documentation of data sources, research limitations, and analytical frameworks. This methodological rigor ensures that conclusions and recommendations are grounded in comprehensive, timely, and credible evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acetic Anhydride market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acetic Anhydride Market, by Purity Grade

- Acetic Anhydride Market, by Manufacturing Process

- Acetic Anhydride Market, by Packaging Type

- Acetic Anhydride Market, by Application

- Acetic Anhydride Market, by Distribution Channel

- Acetic Anhydride Market, by Region

- Acetic Anhydride Market, by Group

- Acetic Anhydride Market, by Country

- United States Acetic Anhydride Market

- China Acetic Anhydride Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Reflections on Acetic Anhydride Market Trends Highlighting Strategic Imperatives and Future Outlook for Industry Decision Makers

The acetic anhydride market stands at a critical juncture where trade policies, technological advances, and sustainability imperatives converge to redefine competitive landscapes. Layered tariff regimes have altered cost structures and sourcing strategies, elevating the importance of regional production hubs and strategic supplier partnerships. Technological progress in green chemistry and digital supply chain tools offers pathways to decouple growth from environmental impact while fostering operational resilience.

Segmentation analysis underscores that granular understanding of application-specific requirements-from the high-purity demands of semiconductor cleaning chemistries to the regulatory nuances of non-phthalate plasticizer intermediates-is essential for capturing premium market opportunities. Regional insights reveal divergent dynamics: Americas benefits from abundant feedstocks, EMEA navigates stringent environmental mandates, and Asia-Pacific drives volume growth through robust chemical and pharmaceutical expansion.

Leading producers are differentiating through integrated asset portfolios, sustainability credentials, and strategic M&A, yet emerging players are rapidly gaining traction by capitalizing on cost advantages and policy support. To maintain competitive advantage, stakeholders must adopt agile procurement frameworks, invest in decarbonization technologies, and embrace digital supply chain innovations.

In sum, the evolving acetic anhydride ecosystem demands proactive adaptation to regulatory shifts, technological disruptions, and shifting end-use patterns. Armed with these insights, industry decision makers can chart strategies that balance cost, compliance, and growth, ensuring long-term market leadership and resilience.

Secure Your In-Depth Acetic Anhydride Market Intelligence by Connecting with Ketan Rohom to Access the Comprehensive Research Report Today

Don’t miss out on the opportunity to leverage unparalleled insights into the acetic anhydride market’s evolving dynamics and competitive landscape. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discover how this comprehensive research report can empower your strategic decisions, optimize supply chain resilience, and unlock growth opportunities. Secure your access today and position your organization at the forefront of market innovation and regulatory preparedness.

- How big is the Acetic Anhydride Market?

- What is the Acetic Anhydride Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?