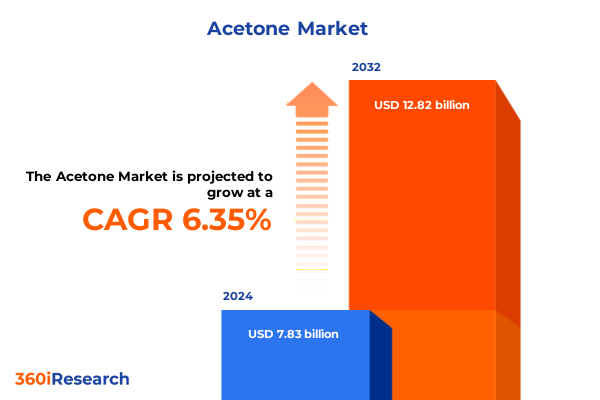

The Acetone Market size was estimated at USD 8.31 billion in 2025 and expected to reach USD 8.83 billion in 2026, at a CAGR of 6.38% to reach USD 12.82 billion by 2032.

Acetone Industry Unveiled Through Market Dynamics, Application Growth, and Emerging Strategic Imperatives Driving Future Developments

Acetone, recognized as one of the simplest and most versatile ketones, stands at the core of numerous industrial and consumer applications. In 2022, the global acetone market value surpassed six billion U.S. dollars, with annual production volumes exceeding seven million tonnes through predominantly petrochemical processes. This high-volume production underscores acetone’s role not only as an essential organic solvent but also as a primary feedstock for the synthesis of methyl methacrylate and bisphenol A, precursors to widely used plastics and resins. Approximately one third of acetone produced globally serves as a solvent in paints, coatings, adhesives, and electronic cleaning agents, while a quarter of output undergoes conversion to acetone cyanohydrin for downstream chemical intermediates.

Against this backdrop, acetone’s high volatility, water miscibility, and low toxicity have driven its adoption in cosmetics for nail polish removers, in pharmaceuticals for excipient formulation, and in laboratories as a polar, aprotic solvent. Rapidly evolving end users-from automotive adhesives to semiconductor manufacturing-demand stringent purity standards, leading to refined grades such as specialty and technical acetone that cater to niche and bulk requirements, respectively. Furthermore, acetone’s VOC-exempt status in the United States has bolstered its preference among formulators aiming to meet regulatory thresholds for volatile organic compounds, reinforcing its dominant solvent position across various industries.

Looking forward, acetone’s market trajectory is shaped by a confluence of factors: tightening environmental regulations, heightened demand for sustainable feedstocks, and emerging substitute technologies. As manufacturers balance economic and ecological priorities, acetone’s inherent versatility and established supply chains are expected to sustain its market prominence while unlocking new pathways for innovation and growth.

Navigating Transformative Technological, Regulatory, and Sustainability Shifts Redefining Acetone Production and Market Accessibility

The acetone landscape is undergoing transformative shifts as producers and end users adapt to new sustainability imperatives and regulatory frameworks. Notably, breakthroughs in biotechnological synthesis have paved the way for carbon-negative production routes. For instance, engineered strains of Clostridium autoethanogenum now enable gas fermentation processes that convert waste gases into acetone and isopropanol at industrial pilot scales, achieving up to three grams per liter per hour productivity with life cycle analyses confirming a negative carbon footprint. Concurrently, academic advances have demonstrated one-pot biosynthesis methods using microbial consortia to recycle waste poly(hydroxybutyrate) into high-purity acetone, illustrating the potential for circular economy integration within the bioplastics sector.

In parallel, pressure from governments and consumers alike has accelerated investment in bio-based feedstocks. Markets are seeing a surge in fermentation-based acetone where renewable biomass such as sugarcane, corn, and lignocellulosic residues are fermented to yield ≥99 percent pure solvent, reducing carbon emissions by nearly half compared to propene-derived processes. These shifts are accompanied by strategic alliances between chemical manufacturers and agricultural suppliers aimed at securing traceable feedstock streams and de-risking supply chains, signaling a departure from fossil feedstock dependency.

Moreover, regulatory landscapes are converging on sustainability metrics as carbon pricing, VOC restrictions, and incentives for renewable chemicals intensify. The European Union’s Green Deal and the United States’ Inflation Reduction Act have introduced tax credits and grants that favor bio-derived acetone production and advanced recycling initiatives. Together, these technological, policy, and market developments are redefining production paradigms and fostering a more resilient, environmentally aligned acetone ecosystem.

Assessing the Combined Effects of New U.S. Anti-Dumping Duties and Tariff Structures on Acetone Supply Chains and Pricing Dynamics

In 2025, the United States reinforced its protective measures on imported acetone through the continuation of definitive antidumping and countervailing duty orders, imposing significant margins on key exporting nations. The Department of Commerce determined dumping margins of 28.10 percent for Belgium, 47.86 percent for the Republic of Korea, 131.75 percent for Singapore, 414.92 percent for South Africa, and 171.81 percent for Spain following expedited sunset reviews. These duties, layered upon existing base tariffs on chemical imports, have materially increased landed cost structures for downstream users relying on lower-cost offshore acetone.

Consequently, the cumulative impact on supply chains has been twofold. First, domestic processors of adhesives, coatings, and pharmaceuticals have faced margin compression or passed incremental costs onto end customers, which in some cases prompted temporary production slowdowns and inventories drawdown strategies. Second, the elevated import duties have spurred strategic reorientation among U.S. buyers toward domestic acetone sources, driving up utilization rates at local facilities while exposing capacity constraints in specialty grade segments. Domestic producers have capitalized on this environment by negotiating offtake agreements and investing in incremental upgrades to expand technical grade output.

Furthermore, tariff-induced distortions triggered global trade realignments as export volumes from duty-affected nations declined sharply, creating openings for alternative suppliers in Asia-Pacific and the Americas. This realignment has underscored the importance of supply chain diversification and tariff planning as central elements of procurement strategies. As U.S. tariffs remain in force through 2025, industry participants are expected to navigate a landscape where cost competitiveness must be balanced against supply security and compliance.

Deriving Actionable Insights from Grade, Form, Raw Material Source, and Application Segmentations Shaping Acetone Market Evolution

The acetone market demonstrates distinct characteristics when examined through multiple segmentation lenses, each offering actionable insights. Analysis by grade reveals contrasting demand cycles for specialty grade acetone, valued for its ultra-high purity in electronics and pharmaceutical syntheses, versus technical grade acetone, which fulfills bulk solvent applications in paints and adhesives. This bifurcation underscores the need for tailored production protocols and quality control systems to meet varying purity thresholds without compromising unit economics.

When considering form, liquid acetone predominates, delivered either as diluted aqueous solutions for safe handling or as concentrated solvent-based solutions for maximum solvency power. While liquid delivery ensures seamless integration into continuous manufacturing operations, solid acetone formulations have found niche uptake in specialty adhesive systems where controlled release profiles and stability are paramount, prompting selective investment in solid-state processing capabilities.

Examining raw material sources, the dichotomy between petrochemical and biomass-derived routes shapes both cost and sustainability narratives. Crude oil and natural gas propylene cracking remain the backbone of petrochemical acetone, driven by established economies of scale, whereas biomass routes leveraging corn and wood feedstocks navigate evolving logistic chains and incentive frameworks. Feedstock strategy alignment has consequently emerged as a core competency for producers seeking to optimize carbon intensity metrics and hedge against fossil price volatility.

Finally, application segmentation highlights dynamic growth pockets that inform capital allocation. Automotive adhesives, construction adhesives, and packaging adhesives represent distinct end-use landscapes with varying volume and margin profiles, just as makeup removers and nail care products define personal care requirements. Electronics segments split between printed circuit board cleaning and semiconductor manufacturing demand ultra-low impurity grades. Coating end uses range from architectural to marine, each with specialized solvent compatibility and regulatory constraints. Pharmaceutical applications bifurcate into active ingredient synthesis and broader compound formulation roles. Rubber processing, whether natural or synthetic, rounds out the spectrum with tailored solvent interactions. Insights from these segmentations guide producers and end users in prioritizing capacity expansions, R&D efforts, and go-to-market strategies.

This comprehensive research report categorizes the Acetone market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Form

- Raw Material Sources

- Applications

- Distribution Channel

Analyzing Regional Performance Trends and Trade Nuances Across the Americas, Europe Middle East Africa, and Asia-Pacific Acetone Markets

In the Americas, acetone demand continues to reflect the region’s robust packaging, automotive, and pharmaceutical sectors, with North American producers ramping up technical-grade capacity to capitalize on reshoring initiatives. Despite intermittent feedstock cost pressures linked to U.S. Gulf Coast propylene pricing, domestic refiners have maintained high operating rates, buoyed by long-term supply contracts and logistical advantages along key waterways. Meanwhile, Latin American markets are seeing gradual uptake of sustainable acetone blends, driven by local incentives and cross-border investments from multinational players.

Across Europe, Middle East, and Africa, oversupply conditions have persisted amid high energy costs and stringent environmental regulations. European producers are rationalizing volumes and investing selectively in high-efficiency facilities, as illustrated by capacity adjustments at Antwerp and Gladbeck sites. Policy shifts under the European Green Deal have intensified the push for lower-emission operations, yet tariff uncertainties in global trade continue to influence utilization rates, particularly for phenol-coupled acetone capacities in Western Europe.

In Asia-Pacific, rapid industrialization and expanding consumer markets underpin strong growth trajectories in China, India, and Southeast Asia. Investments in new petrochemical complexes and renewable feedstock projects have elevated regional self-sufficiency, while regulatory frameworks in China and South Korea increasingly favor bio-based chemical production. Notably, large-scale biobased acetone facilities in South Korea, leveraging corn and wood residues, have positioned the region as a leader in sustainable solvent manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Acetone market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Acetone Producers and Innovators Driving Competitive Advances, Strategic Partnerships, and Market Leadership Dynamics

Major industry players are actively shaping the acetone landscape through volume leadership, innovation pipelines, and strategic realignments. Celanese Corporation, a global leader in acetic acid, produces significant volumes of acetone as a by-product across its three largest acetic acid plants in Texas, Singapore, and Nanjing, China, leveraging integrated operations to optimize feedstock utilization and distribution channels. Royal Dutch Shell has signaled an eventual exit from most chemicals by the decade’s end, yet continues to serve key European and Asia-Pacific markets, supplying acetone primarily as a phenol process by-product and investing selectively in circular chemistry collaborations to future-proof its portfolio.

Eastman Chemical Company’s recent expansion initiatives have aimed to align specialty acetone output with evolving end-use demands in sustainable plastics recycling and advanced materials, although the unexpected withdrawal of Department of Energy funding for its Texas-based PET depolymerization project highlighted the volatility of government support. INEOS Phenol, the world’s largest phenol and acetone producer, is strategically rationalizing its European footprint by pausing operations in Germany and focusing on modernizing the Antwerp facility, balancing cost pressures from energy and CO₂ policies against long-term demand forecasts.

On the innovation front, LG Chem and Mitsui Chemicals are distinguished in the biobased acetone segment. LG Chem holds approximately 34 percent of the global biobased acetone market due to early biomass technology investments, while Mitsui Chemicals controls roughly 26 percent through R&D-driven differentiation and specialty formulations optimized for pharmaceutical and personal care applications. These industry leaders collectively underscore the dual themes of scale and sustainability influencing competitive positioning in the global acetone sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acetone market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALTIVIA Petrochemicals, LLC

- BASF SE

- Borealis AG

- CEPSA Química, S.A.

- Chang Chun Group

- China National Petroleum Corporation

- DuPont de Nemours, Inc.

- Formosa Chemicals and Fibre Corporation

- Hindustan Organic Chemicals Limited

- Honeywell International Inc.

- INEOS Phenol GmbH

- Kumho P&B Chemicals., Inc.

- LG Chem Ltd.

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- Mitsui Chemicals Inc.

- Prasol Chemicals Ltd

- PTT Phenol Company Limited

- Reliance Chemicals Pvt Ltd

- Royal Dutch Shell Group

- SANKYO CHEMICAL CO.,LTD.

- Solvay SA

- Sunnyside Corporation

- Thermo Fischer Scientific Inc.

- Versalis S.p.A.

Implementing Strategic Recommendations to Strengthen Resilience, Drive Growth, and Capitalize on Emerging Opportunities in the Acetone Ecosystem

Industry leaders should first prioritize supply chain diversification to mitigate the risks posed by tariff fluctuations and regional capacity constraints. By securing multi-source procurement agreements-including both domestic suppliers and alternative international partners-companies can reduce vulnerability to antidumping duties and ensure continuity during market disruptions.

Second, investing in sustainable production pathways will yield long-term cost and reputational benefits. Expanding bio-based acetone capacity, whether through strategic joint ventures with agricultural feedstock suppliers or by adopting emerging gas fermentation technologies, allows participants to capture government incentives and meet rising customer demand for low-carbon solvents.

Third, refining product portfolios to align with high-margin specialty segments such as electronic-grade and pharmaceutical-grade acetone can enhance profitability. Tailored quality management systems and targeted R&D collaborations will support rapid commercialization of ultra-high-purity grades while optimizing manufacturing processes for scale.

Moreover, integrating digital analytics into procurement and logistics workflows will empower dynamic pricing strategies and inventory optimization. Real-time visibility into feedstock availability and demand signals enables agile adjustments to production schedules, minimizing carrying costs and capitalizing on spot market opportunities.

Finally, forging collaborative partnerships across the value chain-including end-user alliances and research consortia-will accelerate innovation and facilitate the development of next-generation acetone applications. Such ecosystem engagement ensures alignment between market needs and technological capabilities, fostering sustainable growth and competitive differentiation.

Employing Rigorous Mixed-Method Research Techniques to Deliver Comprehensive and Reliable Insights into Acetone Market Dynamics

This analysis draws upon a rigorous mixed-method research framework combining primary and secondary data sources. Quantitative data were collected from regulatory filings, government publications, and peer-reviewed literature to ensure accuracy in tariff rates, production capacities, and trade flows. Qualitative insights were garnered through expert interviews with industry executives, policy analysts, and technical specialists to validate emerging trends and strategic priorities.

Secondary research included review of scientific journals and technical conferences reporting on biobased and carbon-neutral acetone production processes. Regulatory and tariff analyses leveraged U.S. Federal Register notices and International Trade Commission determinations to quantify antidumping duties and assess their implications on cost structures.

Data triangulation and consistency checks were performed across multiple datasets to reconcile discrepancies and uphold methodological robustness. Insights were further corroborated through scenario modeling to stress test supply chain configurations under varying tariff and feedstock cost assumptions. This blended approach ensured the delivery of comprehensive, reliable, and actionable insights tailored to strategic decision-making within the acetone value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acetone market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acetone Market, by Grade

- Acetone Market, by Form

- Acetone Market, by Raw Material Sources

- Acetone Market, by Applications

- Acetone Market, by Distribution Channel

- Acetone Market, by Region

- Acetone Market, by Group

- Acetone Market, by Country

- United States Acetone Market

- China Acetone Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding Remarks Emphasizing Strategic Imperatives, Market Opportunities, and the Path Forward for the Global Acetone Industry

The global acetone industry is at a pivotal nexus where traditional petrochemical advantages intersect with transformative sustainability imperatives and regulatory dynamics. While robust demand remains anchored in core end uses such as solvents and chemical intermediates, emerging segments grounded in bio-based and circular production methods offer new growth frontiers.

Regional diversifications and antidumping measures have recalibrated supply chains, emphasizing the strategic importance of integrated domestic capacities alongside proactive tariff management. Major players are responding through capacity realignments, technological investments, and strategic partnerships that collectively reinforce competitive positioning.

Looking ahead, the balance between cost optimization and environmental stewardship will define market leadership. Companies that successfully navigate feedstock transitions, invest in specialty grade capabilities, and embrace digital agility will be best positioned to capture evolving market opportunities. As the industry advances into a more sustainable era, collaborative innovation and data-driven strategies will underpin resilient growth.

Contact Ketan Rohom to Unlock In-Depth Acetone Market Intelligence, Custom Insights, and Strategic Guidance Tailored to Your Business Needs

To explore a tailored deep dive into this market, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure a comprehensive report and gain exclusive access to detailed qualitative and quantitative insights. Leverage this opportunity to partner with an expert who can customize analyses to your specific strategic goals and operational needs. Connect today to empower your decision-making with a definitive acetone market intelligence package designed for sustainable growth and competitive advantage.

- How big is the Acetone Market?

- What is the Acetone Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?