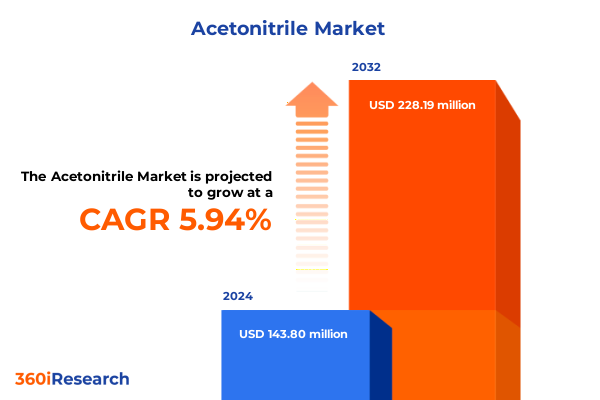

The Acetonitrile Market size was estimated at USD 151.94 million in 2025 and expected to reach USD 165.10 million in 2026, at a CAGR of 5.98% to reach USD 228.18 million by 2032.

Unveiling the Strategic Importance of Acetonitrile in Modern Industrial Processes and Analytical Applications Across Key Sectors

Acetonitrile, a colorless and volatile organic compound, has emerged as a cornerstone solvent in diverse industrial and analytical processes due to its exceptional polarity, low viscosity, and broad compatibility with organic and aqueous systems. Its critical role as a polar aprotic solvent underpins high-performance liquid chromatography (HPLC), where it ensures precise separation and detection of complex molecules. In pharmaceutical laboratories, this solvent facilitates both synthetic reactions for active pharmaceutical ingredients and rigorous quality control protocols required for regulatory compliance. Moreover, acetonitrile’s application extends into agrochemical formulation, where it supports purification and crystallization steps that define product efficacy and safety. Across electronics and battery manufacturing, its dielectric properties make it an ideal component in electrolyte formulations for lithium-ion batteries, addressing the growing demand for energy storage in electric vehicles and grid-scale applications. These multifaceted uses underscore the compound’s strategic importance in driving innovation and operational excellence151 words

Examining the Pivotal Technological Advancements and Sustainability Initiatives Globally Reshaping the Acetonitrile Market Landscape

The acetonitrile market is undergoing profound transformation, propelled by sustainability initiatives, supply chain diversification, and technological breakthroughs. Leading producers are embracing green chemistry protocols that integrate closed-loop solvent recovery systems, significantly reducing volatile organic compound emissions and enhancing environmental compliance. Concurrently, advancements in catalyst design are optimizing ammonia-based production routes, offering dedicated capacity that mitigates dependence on co-product volumes from acrylonitrile manufacture and stabilizes supply amid fluctuating propylene demand. For instance, more than half of global acetonitrile is co-produced during acrylonitrile synthesis, creating vulnerability to upstream feedstock disruptions176 words

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Acetonitrile Supply Chains and Cost Structures

In 2025, the United States introduced a series of tariffs on chemical imports that have materially altered the economics of acetonitrile procurement and distribution. A baseline 10% levy on imports from most countries and elevated reciprocal tariffs of 20% on the European Union and 54% on China have amplified landed costs for solvent imports. Specialty chemical stakeholders caution that these measures could exacerbate input price inflation, with distributors projecting up to $1.25 billion in additional annual costs151 words

Revealing Critical Market Segmentation Insights Driven by Product, Production Methods, Applications, and Distribution Channels in Acetonitrile Sector

A nuanced understanding of acetonitrile’s market dynamics requires examining its segmentation across multiple dimensions that influence demand, pricing, and supply resilience. On the basis of product classification, the market bifurcates between derivative-grade materials utilized for chemical intermediates and high-purity solvent grades tailored for analytical and pharmaceutical applications. Production method segmentation distinguishes co-production derived from acrylonitrile hydrocarbon processes, which supplies the majority of global volume, from dedicated ammonia-based synthesis routes that offer supply security and purity control. From an application perspective, acetonitrile’s footprint spans agrochemicals, where it aids in pesticide and herbicide purification; analytical laboratories, where it underlies the performance of HPLC systems; general chemical manufacturing; electronics and semiconductor cleaning operations; and pharmaceutical API synthesis and quality assurance. Finally, distribution channels reveal the strategic balance between direct sales arrangements with large end users seeking custom supply agreements, and the extensive reach provided by distributors and wholesalers serving diverse small- and medium-scale customers. This multi-dimensional segmentation underscores the complexity of market drivers and the importance of tailored strategies for each segment191 words

This comprehensive research report categorizes the Acetonitrile market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Production Method

- Application

- Distribution Channel

Exploring Distinct Regional Dynamics and Growth Patterns for Acetonitrile Demand across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in the acetonitrile market reflect the interplay of manufacturing capacity, end-use demand, and trade policies across the Americas, EMEA, and Asia-Pacific zones. In the Americas, abundant shale gas feedstock has fostered competitive domestic acetonitrile production, enabling local producers to benefit from stable feedstock costs and proximity to major pharmaceutical, agrochemical, and energy storage hubs. Export opportunities remain significant, although recent U.S. tariffs have introduced pressure on price competitiveness. Across Europe, Middle East & Africa, strong pharmaceutical and specialty chemical sectors in Western Europe drive demand for high-purity solvent grades, while emerging markets in the Gulf region and North Africa are investing in petrochemical infrastructure that may increase local output capacity. These areas also emphasize regulatory compliance and environmental stewardship, encouraging green production technologies. In the Asia-Pacific region, rapid industrialization, expanding pharmaceutical R&D centers, and the burgeoning electronics and electric vehicle manufacturing sectors underpin the fastest growth trajectory globally. This region accounts for approximately 40% of global consumption, buoyed by large-scale co-production facilities in China and India alongside capacity expansions in Southeast Asia that aim to serve both domestic markets and export lanes60 words

This comprehensive research report examines key regions that drive the evolution of the Acetonitrile market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Initiatives and Competitive Positioning of Leading Acetonitrile Producers in a Dynamic Global Market

The competitive landscape of acetonitrile is defined by integrated petrochemical producers and specialty chemical firms that differentiate on scale, product purity, and innovation in sustainable processes. Industry participants such as INEOS, Formosa Plastics, Asahi Kasei, Avantor, and Tedia have pursued diversification through investments in specialized production routes, including ammonia-based facilities that guarantee high-purity solvent grades. Concurrently, these companies are collaborating with technology partners to deploy closed-loop recovery systems, reducing waste and improving cost efficiency. Additionally, leading firms have established global distribution networks that blend direct supply agreements for strategic customers with extensive coverage through distributors and wholesalers. This dual approach enables them to service high-value end users in the pharmaceutical and electronics sectors while retaining flexibility to meet smaller customers’ needs without compromising service levels. As market demand evolves, these companies are also exploring partnerships to develop bio-based acetonitrile, leveraging renewable feedstocks to align with stringent environmental regulations and corporate sustainability goals194 words

This comprehensive research report delivers an in-depth overview of the principal market players in the Acetonitrile market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AnQore B.V.

- Arihant Chemicals

- Asahi Kasei Corporation

- Ataman Acar Kimya A.S.

- Azelis Group

- Biosolve Chimie

- Filo Chemical, Inc.

- Gayatri Industries

- GFS Chemicals, Inc.

- Greenfield Global Inc.

- Honeywell International Inc.

- Imperial Chemical Corporation

- Ineos AG

- Manas Petro Chem

- Merck KGaA

- Mitsubishi Chemical Corporation

- Nova Molecular Technologies, Inc.

- Otto Chemie Pvt. Ltd.

- RCI Labscan Company Limited

- Robinson Brothers Limited

- Spectrum Chemical Mfg. Corp.

- Taekwang Industrial Co., Ltd.

- Tedia

- Thermo Fisher Scientific Inc.

- VWR International, LLC

Implementing Strategic Measures for Strengthening Resilience and Capitalizing on Growth Opportunities within the Acetonitrile Industry

To navigate the evolving acetonitrile landscape, industry leaders should adopt a multipronged strategy. First, investing in ammonia-based production facilities and advanced catalytic processes will diversify supply sources and mitigate the risks associated with propylene co-production volatility. Second, implementing closed-loop solvent recovery and bio-based production initiatives can drive sustainability, reduce operating costs, and align with tightening environmental regulations. Third, stakeholders should proactively engage with policymakers and industry associations to advocate for tariff exemptions or harmonized trade frameworks that preserve access to critical feedstocks and alleviate pricing pressures on imported materials. Fourth, forging strategic alliances with end-use sectors-particularly pharmaceutical and battery manufacturers-can secure long-term supply agreements and co-development of application-specific solvent grades. Finally, optimizing distribution models by balancing direct sales for large-scale customers with enhanced distributor partnerships will expand market reach without diluting service quality. By executing these coordinated actions, companies will strengthen resilience, safeguard margins, and capture emerging growth opportunities in a market characterized by technological acceleration and regulatory complexity174 words

Detailing Rigorous Research Methodology Combining Primary Engagements and Secondary Analysis to Achieve Accurate Acetonitrile Market Insights

Our research methodology combines rigorous primary and secondary data collection, ensuring depth and accuracy in capturing the nuances of the acetonitrile market. Primary research encompassed in-depth interviews with industry experts across production, distribution, and end-use segments, including senior executives at leading solvent manufacturers, procurement heads within pharmaceutical and electronics firms, and policy advisors from trade associations. These engagements provided first-hand insights into operational challenges, strategic priorities, and emerging application trends.

Secondary research involved a comprehensive review of industry publications, trade association reports, regulatory filings, and peer-reviewed scientific literature. Data triangulation was employed to validate historical trends, benchmark competitor strategies, and assess the economic impact of trade policies. Quantitative analyses leveraged proprietary databases and import-export statistics to map supply chain flows and regional consumption patterns.

Finally, our analytic framework integrates scenario planning to model the effects of tariff shifts, capacity expansions, and sustainability initiatives. We conducted sensitivity analyses on feedstock price fluctuations to simulate supply security under different market conditions. This blended approach delivers robust, actionable insights that underpin strategic decision-making for stakeholders across the acetonitrile value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acetonitrile market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acetonitrile Market, by Product

- Acetonitrile Market, by Production Method

- Acetonitrile Market, by Application

- Acetonitrile Market, by Distribution Channel

- Acetonitrile Market, by Region

- Acetonitrile Market, by Group

- Acetonitrile Market, by Country

- United States Acetonitrile Market

- China Acetonitrile Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Synthesis of Acetonitrile Market Trends, Challenges, and Strategic Imperatives Guiding Decision-Makers towards Effective Execution

In summary, the acetonitrile market stands at a pivotal juncture, poised between accelerating demand from pharmaceuticals, agrochemicals, electronics, and energy storage applications and the challenges of evolving trade policies and sustainability imperatives. Technological innovations in production methods and solvent recovery are reshaping supply dynamics, while strategic segmentation across product grades, application verticals, and distribution channels informs targeted growth strategies. Regional disparities in feedstock access, regulatory frameworks, and end-use development underscore the value of tailored market approaches.

As leading producers refine their competitive positioning through green chemistry investments and diversified supply networks, collaboration with policymakers and end-user sectors will be critical to mitigate the impact of import tariffs and secure resilient, cost-effective access to acetonitrile. This report provides a comprehensive roadmap for navigating these complexities, equipping decision-makers with the insights required to optimize investment, enhance operational efficiency, and capitalize on emerging opportunities in a dynamic global market.

Engage with Ketan Rohom to Secure In-Depth Acetonitrile Market Analysis and Unlock Strategic Insights Driving Your Business Forward

We invite you to take the next step towards gaining a competitive edge in the acetonitrile market by securing our comprehensive research report. Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, whose expertise will guide you through tailored insights, data-driven analyses, and strategic recommendations. In a landscape defined by rapid technological advancements, evolving regulatory environments, and dynamic trade policies, this report delivers the clarity needed to navigate challenges and capitalize on emerging opportunities.

By engaging with Ketan Rohom, you gain access to personalized support and detailed briefings that align with your organization’s objectives. Whether you seek an in-depth understanding of tariff impacts, segmentation nuances, regional dynamics, or sustainability innovations, this report equips you with the critical intelligence to inform strategic decisions. Reach out today to explore customized licensing options, enterprise access, and value-add services designed to accelerate your market positioning.

Don’t let uncertainty slow your strategic momentum. Contact Ketan Rohom now to unlock exclusive insights, schedule a consultation, and acquire the definitive acetonitrile market research that will empower your team to lead with confidence.

- How big is the Acetonitrile Market?

- What is the Acetonitrile Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?