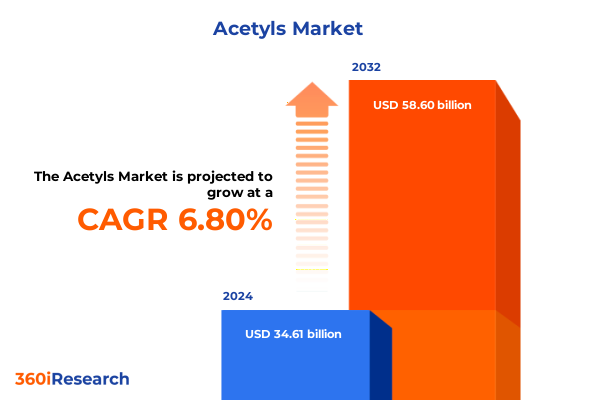

The Acetyls Market size was estimated at USD 36.87 billion in 2025 and expected to reach USD 39.28 billion in 2026, at a CAGR of 6.84% to reach USD 58.60 billion by 2032.

Exploring the Fundamental Role and Evolving Importance of Acetyl Compounds Across Diverse Industrial Value Chains Globally

The acetyls domain has long served as an indispensable cornerstone across chemical manufacturing and downstream industries, offering versatile functionalities that span solvent extraction, polymer synthesis, and pharmaceutical formulation. As reactive intermediates, acetyl compounds facilitate critical reactions, enabling the transformation of raw materials into coatings, adhesives, and high-purity excipients. Beyond their traditional roles, evolving production processes and heightened emphasis on environmental stewardship have propelled acetyls to the forefront of industrial innovation, reinforcing their strategic importance to manufacturers and end users alike.

Against this backdrop, stakeholders are increasingly scrutinizing the interplay between feedstock availability, process efficiency, and regulatory compliance to maintain a competitive edge. Advances in catalytic technologies and process intensification have begun to reshape conventional production paradigms, driving cost reductions and minimizing waste. Simultaneously, greater emphasis on sustainability metrics has underscored the need for greener feedstocks and energy-efficient operations, creating new pathways for differentiation and value creation.

This introduction lays the foundation for a deeper exploration of market dynamics, strategic shifts, and regional nuances, setting the stage for stakeholders to navigate the complexities of the acetyls landscape with informed confidence.

Unveiling the Key Technological Breakthroughs and Market Dynamics Reshaping the Global Acetyls Ecosystem in Recent Years Landscape

In recent years, the acetyls ecosystem has undergone a profound metamorphosis driven by breakthroughs in process technology and shifts in end-use demand. The advent of advanced catalytic systems has significantly enhanced reaction selectivity, enabling producers to reduce energy consumption and improve product yields. Simultaneously, digitalization initiatives, including real-time process monitoring and data analytics, have empowered operators to optimize plant performance, anticipate maintenance needs, and mitigate operational risks.

Concurrently, evolving consumer preferences and regulatory pressures have recalibrated demand patterns, with downstream sectors such as coatings and pharmaceuticals placing a premium on solvent purity and traceability. This has spurred the adoption of closed-loop manufacturing and solvent recovery solutions, further elevating sustainability credentials. Suppliers are now forging collaborative partnerships with research institutions to pioneer bio-based acetyl feedstocks, underscoring the industry’s commitment to circularity and decarbonization.

Together, these interconnected dynamics are reshaping the competitive landscape, compelling incumbents and new entrants alike to adopt agile strategies that leverage technological innovation and environmental stewardship. The result is a transformative shift that promises to redefine cost structures, value propositions, and growth trajectories in the global acetyls market.

Analyzing the Comprehensive Effects of United States Tariff Measures Implemented in 2025 on the Acetyls Supply Chain and Cost Structures

The imposition of targeted tariff measures by the United States in early 2025 has exerted significant influence on the acetyls supply chain, prompting a recalibration of sourcing strategies and cost assessments. These duties, aimed at leveling the playing field for domestic producers, have altered the margin calculus for import-dependent stakeholders, who must now weigh the financial impact of levies against the reliability of overseas supply. As a consequence, procurement teams are diversifying supplier portfolios, seeking resilient alliances that balance price competitiveness with logistical agility.

Moreover, the heightened import costs have reverberated across downstream applications, compelling manufacturers in coatings, adhesives, and printing inks to explore alternative formulations or adjust pricing models. In some cases, strategic alliances with North American producers have been formalized to secure preferential access and stabilize supply commitments. This paradigm has spurred investments in localized warehousing and blending facilities, aimed at buffering tariff volatility and expediting lead times.

While the tariff landscape presents near-term challenges for stakeholders reliant on acetyl chloride and vinyl acetate monomer imports, it also creates opportunities for domestic capacity expansions and strategic backward integration. By realigning capital deployment to support regional production hubs, industry leaders can mitigate duty impacts and reinforce supply continuity for critical acetyl compounds.

Revealing Intrinsic Demand Patterns Through In-Depth Product, Application and Purity Grade Segmentation in the Global Acetyls Marketplace

A granular examination of the acetyls market through the lens of product, application, and purity grade segmentation reveals nuanced demand drivers and competitive pressures. When viewed by product type, acetic anhydride stands out for its dominance in cellulose acetate and aspirin synthesis, while acetyl chloride is prized for chlorination processes that yield specialized intermediates. Butyl acetate and ethyl acetate continue to underpin solvent applications in coatings and inks, where fast evaporation rates and low toxicity are paramount. Methyl acetate’s role as a low-boiling solvent and vinyl acetate monomer’s essential contribution to polymerization further illustrate the product-driven heterogeneity within the sector.

From an application perspective, adhesives and sealants benefit from acetyls’ adhesive bonding strength, with construction, packaging, and woodworking adhesives each presenting unique formulation requirements. In coatings, decorative and industrial segments demand solvents that balance performance with regulatory compliance, driving incremental innovation in solvent recovery. Pharmaceutical applications split between drug formulation and excipients underscore the criticality of high-purity acetyl grades, catalyzing investment in specialized purification assets. The textile industry’s bifurcation into natural and synthetic fibers likewise creates differentiated solvent specifications to accommodate fiber affinity and dye solubility.

Purity grade segmentation further highlights strategic differentiation, as food-grade acetyl derivatives satisfy stringent safety mandates for flavor and fragrance extraction, industrial-grade variants meet broad solvent needs, and pharmaceutical-grade compounds address the most rigorous pharmacopoeial standards. This layered segmentation demonstrates how targeted product and purity combinations unlock tailored solutions across end-use verticals.

This comprehensive research report categorizes the Acetyls market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Application

Highlighting Distinct Regional Trends and Growth Drivers Shaping Demand for Acetyl Compounds Across the Americas Europe Middle East & Africa and Asia-Pacific

Regional analysis uncovers distinct growth trajectories and demand levers across major geographic markets. In the Americas, established manufacturing centers leverage integrated petrochemical complexes that ensure feedstock security and cost-efficient production, underpinning robust consumption in coatings and polymer intermediates. Stakeholders in North America are also advancing carbon reduction schemes and solvent reclamation programs to meet evolving environmental regulations and corporate sustainability targets.

The Europe, Middle East & Africa region presents a mosaic of market dynamics, with Western Europe’s stringent regulatory environment driving premium demand for high-purity acetyls in pharmaceutical and specialty applications, while the Middle East’s expanding petrochemical investments create incremental capacity for industrial-grade solvents. Across the African subcontinent, nascent manufacturing hubs are increasingly exploring acetyls for agrochemical formulations, reflecting an emergent value chain movement toward localized chemical processing.

In Asia-Pacific, rapid urbanization and infrastructure development fuel expansive growth in construction adhesives, decorative coatings, and printing inks. Strategic partnerships between regional producers and multinational chemical companies are facilitating technology transfer and capacity expansions, particularly in China and India. This synergy accelerates product diversification and cost optimization, positioning the Asia-Pacific region as a pivotal engine of acetyls market growth.

This comprehensive research report examines key regions that drive the evolution of the Acetyls market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Initiatives and Competitive Positioning of Leading Organizations Driving Innovation in the Acetyls Sector on a Global Scale

Leading organizations within the acetyls arena are executing strategic initiatives to solidify their market positions and drive innovation. Established chemical conglomerates continue to optimize sprawling asset portfolios, integrating advanced separation technologies and energy recovery systems to enhance profitability while adhering to strict environmental mandates. These players are also expanding their global footprints through targeted acquisitions and joint ventures, enabling them to capture emerging demand in high-growth regions and achieve end-to-end supply chain resilience.

Mid-tier specialty chemical firms are carving out niches by focusing on high-purity and bio-based acetyl derivatives, actively collaborating with academic institutions to develop proprietary catalysts and fermentation-based processes. By investing in digital transformation and modular plant designs, these innovators are reducing time to market and offering ultra-purified products tailored to pharmaceuticals and food applications. At the same time, agile startups are leveraging lean R&D approaches and strategic partnerships to pilot sustainable feedstock alternatives, including biomass-derived acetyls that align with circular economy principles.

Collectively, these diverse competitive strategies underscore a dynamic ecosystem where scale advantages, technological differentiation, and sustainability credentials interplay to define leadership and value creation in the global acetyls sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acetyls market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Celanese Corporation

- China National Petroleum Corporation

- Daicel Corporation

- Dow Chemical Company

- Eastman Chemical Company

- HELM AG

- INEOS Group

- Jiangsu Sopo Group

- Jubilant Ingrevia Limited

- Kingboard Holdings

- LOTTE Chemical Corporation

- LyondellBasell Industries N.V.

- Saudi International Petrochemical Company

- Showa Denko K.K.

- Wacker Chemie AG

Actionable Strategic Recommendations to Optimize Operational Efficiency and Competitive Advantage for Industry Leaders in the Acetyls Domain

To thrive amid intensifying competition and regulatory complexity, industry leaders must adopt a multifaceted strategic playbook focused on operational excellence, innovation acceleration, and market diversification. First, investing in state-of-the-art catalytic and separation processes will not only drive down energy consumption but also enable finer control over product purity, directly addressing the requirements of sophisticated end-use segments. Parallel efforts to implement advanced process analytics can yield predictive maintenance insights and minimize unplanned downtime, safeguarding profitability.

Next, embracing circularity through solvent recovery and bio-based feedstock adoption can differentiate offerings while mitigating exposure to raw material volatility. Collaborating with upstream and downstream partners to establish closed-loop supply chains fosters trust and transparency, positioning organizations as preferred suppliers in sustainability-conscious markets. Furthermore, expanding into underdeveloped geographic areas through strategic alliances or greenfield investments can unlock new revenue pools, especially where demand for adhesives, coatings, and pharmaceuticals is on the rise.

Finally, leaders should cultivate agile innovation frameworks, leveraging cross-functional teams and open innovation platforms to accelerate product development cycles. By aligning R&D roadmaps with customer pain points and regulatory trajectories, companies can swiftly bring next-generation acetyl solutions to market, cementing long-term competitive advantage.

Outlining the Rigorous Multistage Research Methodology Employed to Ensure Accuracy Reliability and Depth in Acetyls Market Analysis

The research underpinning this analysis follows a rigorous, multistage methodology designed to ensure comprehensiveness, accuracy, and depth. Primary data was gathered through in-depth interviews with industry stakeholders, including producers, distributors, and end users across key geographies. These insights were triangulated with secondary information obtained from reputable industry journals, patent filings, and regulatory publications to validate market trends and technological advancements.

Quantitative assessments were conducted to map the interplay between production capacities, feedstock movements, and consumption patterns, applying scenario analysis to reflect potential supply chain disruptions and policy shifts. Qualitative evaluations examined competitive positioning, strategic initiatives, and innovation pipelines of leading companies, supported by case studies and proprietary benchmarking databases. Additionally, the methodology incorporated sensitivity analyses to gauge the resilience of market drivers under varying economic and regulatory conditions.

Throughout the research process, stringent quality controls were applied, including peer reviews and data validation checks, to uphold the integrity of findings. This structured approach ensures that the resulting insights provide a robust foundation for strategic decision-making in the acetyls market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acetyls market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acetyls Market, by Product Type

- Acetyls Market, by Purity Grade

- Acetyls Market, by Application

- Acetyls Market, by Region

- Acetyls Market, by Group

- Acetyls Market, by Country

- United States Acetyls Market

- China Acetyls Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Imperatives to Provide a Definitive Perspective on Future Opportunities in the Acetyls Ecosystem

This comprehensive evaluation synthesizes the critical forces shaping the acetyls industry, from technological breakthroughs and shifting trade policies to nuanced segmentation dynamics and regional growth patterns. The convergence of advanced catalytic techniques and digitalization initiatives heralds a new era of efficiency and product quality, while the 2025 tariff landscape underscores the importance of agile supply chain strategies and localized capacity expansions. Segmentation analysis reveals how tailored product types, applications, and purity grades unlock differentiated value across end-use sectors, and regional insights highlight distinct market drivers that vary from mature chemical hubs to emerging industrial centers.

For stakeholders, the imperative is clear: embracing innovation, sustainability, and strategic partnerships will be essential to navigating a landscape defined by rapid change. By aligning operational upgrades with circularity goals and expanding footprints in growth corridors, companies can capture the upside of evolving demand. Moreover, continuous monitoring of policy developments and proactive tariff mitigation will be vital to safeguarding margins and ensuring uninterrupted supply.

Ultimately, this analysis offers a definitive perspective on where the acetyls market stands today and illuminates the pathways for future opportunity. Equipped with these findings, decision-makers can chart a course toward resilient, profitable growth in an increasingly complex global environment.

Connect with Associate Director Ketan Rohom to Access the Comprehensive Acetyls Market Research Report and Unlock Actionable Insights to Propel Growth

Engaging with Ketan Rohom opens a direct line to the in-depth insights and strategic intelligence necessary to outpace competitors and capitalize on emerging opportunities within the acetyls sector. Through personalized consultation, prospective clients can unlock tailored perspectives on product innovation, supply chain optimization, and market expansion tactics. This dialogue not only grants access to the comprehensive market research report but also equips decision-makers with pragmatic action plans aligned to their unique organizational objectives. By leveraging this collaboration, stakeholders gain the clarity and confidence to navigate regulatory landscapes, anticipate supply-and-demand shifts, and drive sustainable growth across global operations.

Don’t miss the chance to transform market intelligence into competitive advantage. Partnering with Ketan Rohom empowers you to harness data-driven strategies and thought leadership that accelerate performance and capture value. Reach out today to schedule a consultation and secure your copy of the definitive acetyls market research report, setting the stage for informed decisions and lasting success in an evolving industrial landscape.

- How big is the Acetyls Market?

- What is the Acetyls Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?