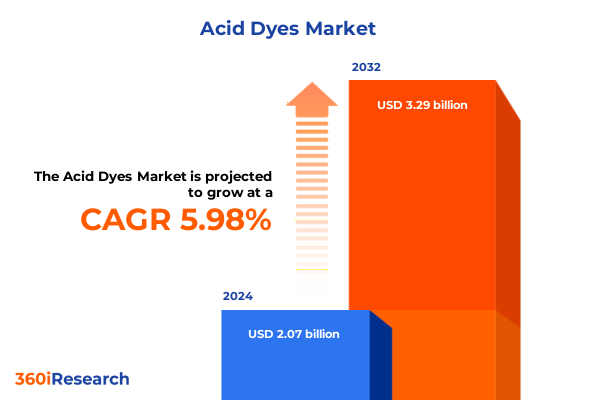

The Acid Dyes Market size was estimated at USD 2.19 billion in 2025 and expected to reach USD 2.32 billion in 2026, at a CAGR of 5.98% to reach USD 3.29 billion by 2032.

Laying the Foundation of Acid Dyes Market Analysis by Examining Its Evolutionary Roots and Ongoing Relevance Across Diverse Industrial Applications

An acid dye is an anionic organic compound that binds to fibers in an acidic bath, leveraging ionic interactions between the dye’s acidic groups and protonated amino sites on protein-based and synthetic fibers. These dyes typically feature sulfonic or carboxylic acid moieties, which facilitate rapid uptake and good lightfastness on substrates like wool, silk, and nylon when applied at low pH. Although overall wash fastness can be limited, the strong electrical attraction and specific dye-fiber chemistry deliver vibrant coloration that meets the demands of specialized applications.

Originally developed for textile applications, acid dyes have expanded beyond apparel to serve diverse sectors including leather tanning, paper coloration, and biomedical staining. In medical microscopy, certain acid dyes enable the visualization of cellular organelles, while in the food and cosmetics industries, select acid dyes approved as color additives deliver visually appealing products. Within industrial dyeing processes, acid dyes offer the precision and intensity required for technical textiles, protective fabrics, and high-visibility materials demanded by automotive and aerospace end users.

Decoding the Transformative Forces Reshaping Acid Dye Industry Practices Amidst Technological Innovation, Sustainability Pressures, and Digitalization

The acid dyes landscape is undergoing a profound transformation driven by stringent environmental regulations and escalating consumer advocacy for sustainable manufacturing. Regulatory frameworks such as Europe’s REACH and global bluesign standards have compelled manufacturers to reduce hazardous effluent, invest in advanced wastewater treatment, and develop biodegradable formulations that comply with evolving legislation. As a result, chemical producers are pivoting from traditional petrochemical feedstocks toward renewable and bio-based alternatives, reflecting a green imperative that reshapes supply chains and R&D priorities across the industry.

Concurrently, the integration of digital technologies and Industry 4.0 principles is revolutionizing acid dye production and application. Automated color-matching platforms, AI-driven dye bath analytics, and IoT-enabled process monitoring enhance precision, reduce waste, and optimize resource usage. Nanotechnology advancements are further augmenting dye performance by improving molecular dispersion and fastness, while specialized metal complex and levelling dye chemistries are unlocking new technical textile and high-performance coating opportunities. These digital and scientific innovations are converging to redefine competitive advantage in the acid dyes market.

Assessing the Ramifications of Newly Implemented 2025 United States Tariffs on Acid Dye Trade Flows, Supply Chains, and Competitive Industry Strategies

As of January 1, 2025, U.S. Section 301 tariffs continue to impose an additional 25% levy on acid dyes and related chemical intermediates imported from the People’s Republic of China under List 3 of the Harmonized Tariff Schedule. This sustained tariff regime originated in 2018 and has prompted importers to reassess supply chains, driving sourcing diversification toward India, Turkey, and smaller domestic producers. The elevated cost base has pressured profit margins for textile and leather dyers, catalyzing efforts to optimize inventory management and negotiate tariff exclusions where feasible.

Beyond immediate cost implications, the U.S. tariff structure has accelerated strategic restructuring across the acid dyes value chain. Downstream converters are exploring nearshore partnerships to mitigate supply risk, while R&D teams are prioritizing alternative chemistries less dependent on Chinese raw materials. These adjustments, while complex, have spurred investments in localized production capabilities and stronger collaboration with specialty distributors. In the longer term, the tariff-driven emphasis on resilience is likely to foster more robust, geographically diversified supply networks capable of withstanding future trade policy volatility.

Unveiling Key Segmentation Perspectives Illuminating End-Use, Dye Type, Form, and Distribution Channels Influencing Acid Dye Market Pathways

The acid dyes market is distinctly structured by end-use categories that shape demand patterns and application technologies. In leather tanning, formulations must deliver strong fixation under acidic pH while maintaining color consistency on uneven surfaces. The paper sector demands acid dyes with rapid uptake and minimal bleed-through to ensure sharp printing and vibrant shades. Within textiles, the division between nylon, silk, and wool substrates creates nuanced performance requirements: nylon applications often favor metal complex dyes for fastness, silk commands high brilliance from low molecular weight leveling dyes, and wool benefits from milling dyes offering exceptional wash durability.

Dye type segmentation further refines market dynamics, with metal complex dyes dominating high-performance segments and pre-metallised variants-particularly aluminum and chrome complexes-serving apparel and technical fabrics that require enhanced color strength and durability. The choice between liquid and powder forms influences manufacturing flexibility, storage logistics, and process control; liquid acid dyes facilitate precise dosing in automated systems, while powders offer extended shelf life and simplified transport. Distribution channels range from direct-sales agreements for large industrial consumers to specialized chemical distributors providing value-added technical support, alongside growing e-commerce platforms enabling smaller end users to access niche dye chemistries with rapid fulfillment.

This comprehensive research report categorizes the Acid Dyes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Dye Type

- Form

- End Use

- Distribution Channel

Mapping Essential Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Uncover Acid Dye Market Trajectories and Drivers

The Americas region, led by the United States, accounts for the majority share of acid dye consumption in 2024, driven by its extensive textiles, leather processing, and specialty printing industries. U.S. manufacturers prioritize dyes that comply with EPA effluent guidelines and state-level wastewater standards, prompting increased demand for low-impact formulations. Supply chain decentralization trends are evident as converters in Mexico and Brazil source directly from global producers to mitigate tariff exposure, while end users in Canada emphasize niche applications such as food packaging inks and biomedical stains that require FDA-approved colorants.

In Europe, stringent environmental regulations under REACH and the European Green Deal propel the adoption of eco-friendly acid dyes, with Germany, France, and the U.K. emerging as innovation hubs for bio-based and closed-loop dyeing technologies. Regional emphasis on sustainable fashion and luxury textiles sustains demand for high-quality acid dyes with robust fastness and minimal toxic residues. Meanwhile, the Europe, Middle East & Africa territory sees expanding interest in acid dyes for automotive interiors and industrial coatings, supported by regional trade agreements that facilitate cross-border supply networks. The Asia-Pacific landscape is characterized by rapid production growth in China, India, Japan, and South Korea, where scale manufacturing capabilities meet soaring local demand for apparel and leather goods. However, regulatory tightening around wastewater discharge in China and India underscores the need for investments in effluent treatment and sustainable dyeing processes across the region.

This comprehensive research report examines key regions that drive the evolution of the Acid Dyes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Acid Dye Manufacturers and Innovators Driving Market Progress Through Strategic Investments, R&D Advancements, and Collaborative Partnerships

Leading chemical companies have cemented their positions in the acid dyes sector through robust portfolios, global production footprints, and extensive application support networks. Major manufacturers such as Atul Ltd., BASF SE, Clariant International, DyStar, and Huntsman International are recognized for their comprehensive acid dye offerings ranging from leveling and milling dyes to specialized metal complex variants. These global players combine multi-site manufacturing with technical service centers to deliver customized solutions for textiles, leather, and paper converters worldwide, fostering deep customer partnerships and rapid market responsiveness.

Innovation-driven mid-sized and regional companies also play a pivotal role by focusing on niche chemistries and sustainability initiatives. Dikai Chemical, Hubei Chuyuan, and Zhejiang Jihua Group have intensified R&D investments to develop eco-friendly and bio-based formulations, collaborating with technology providers to integrate digital process controls and closed-loop wastewater treatments. Strategic alliances, capacity expansions, and targeted acquisitions underpin competitiveness, enabling these firms to address emerging industry regulations and rapidly evolving performance requirements in high-growth end-use segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acid Dyes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archroma Operations LLC

- BASF SE

- CHT Group

- Clariant AG

- DIC Corporation

- DyStar Holding GmbH

- Hangzhou Emperor Chemical Co., Ltd.

- Hangzhou Jihua Polymer Material Co., Ltd.

- Hangzhou Ritan Chemical Co.,Ltd.

- Huntsman Corporation

- LANXESS AG

- Solvay SA

- Sumitomo Chemical Company, Limited

Formulating Actionable Strategic Recommendations to Empower Industry Leaders in Navigating Acid Dye Market Challenges and Seizing Emerging Growth Opportunities

Industry leaders should prioritize supply chain resilience by diversifying raw material sourcing beyond traditional geographies, establishing strategic alliances with regional toll manufacturers, and proactively pursuing tariff exclusion requests to mitigate ongoing trade-policy risks. Embracing sustainable process innovations-such as low-water digital dyeing, closed-loop effluent treatment, and bio-based dye chemistries-will not only address regulatory compliance but also resonate with consumer demands for eco-friendly products. Investments in advanced analytics and AI-driven process optimization can further reduce resource consumption, enhance color consistency, and lower operational costs.

To capitalize on growth opportunities, companies must strengthen collaboration across the value chain, engaging with fiber producers, fashion brands, and end consumers to co-develop high-performance, sustainable acid dyes. Expanding service offerings through digital platforms and e-commerce channels will unlock new revenue streams among small and medium-sized converters. Finally, sustained R&D efforts in specialty formulations-targeting high-value applications such as medical textiles, performance coatings, and precision imaging-will differentiate portfolios and secure long-term competitive advantage in a dynamically evolving market.

Outlining Rigorous Research Methodology Employed to Gather, Validate, and Analyze Data Underpinning Comprehensive Acid Dye Market Insight Development

This research integrates both primary and secondary methodologies to ensure comprehensive market coverage and robust insights. Primary data was collected through structured interviews with industry executives, technical experts, and key end users representing textile, leather, and paper sectors. These discussions provided nuanced perspectives on emerging application requirements, sustainability priorities, and supply chain strategies.

Secondary research involved extensive review of public filings, regulatory publications, scientific journals, and trade association reports. Information from customs databases and tariff schedules was analyzed to assess trade policy impacts, while technical datasheets and patents were examined to map technological advancements. Qualitative insights were corroborated through triangulation, ensuring the accuracy and consistency of the findings underpinning this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acid Dyes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acid Dyes Market, by Dye Type

- Acid Dyes Market, by Form

- Acid Dyes Market, by End Use

- Acid Dyes Market, by Distribution Channel

- Acid Dyes Market, by Region

- Acid Dyes Market, by Group

- Acid Dyes Market, by Country

- United States Acid Dyes Market

- China Acid Dyes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Core Insights and Takeaways to Illuminate the Future Outlook and Strategic Imperatives Within the Evolving Acid Dye Industry Ecosystem

The acid dyes market is at a strategic inflection point, driven by converging forces of environmental regulation, digital transformation, and evolving global trade policies. Sustainability imperatives are reshaping formulation chemistries and production processes, while Industry 4.0 technologies deliver unprecedented control and efficiency in dye applications. U.S. tariffs have catalyzed supply chain diversification, prompting stakeholders to invest in regional manufacturing capabilities and tariff mitigation strategies.

Segmentation nuances-from end-use categories to form factors and distribution channels-highlight the importance of tailored solutions that align with specific performance and logistics requirements. Regional dynamics in the Americas, EMEA, and Asia-Pacific underscore the need for geographically attuned strategies, particularly as regulatory landscapes tighten and consumer expectations evolve. By leveraging advanced R&D, strategic partnerships, and data-driven decision-making, companies can navigate market complexities, unlock new value pools, and sustain competitive advantage in the dynamic acid dyes landscape.

Driving Informed Decisions with Our Comprehensive Acid Dye Market Report: Contact Ketan Rohom for Tailored Insights and Exclusive Access Today

For tailored strategic guidance and exclusive access to our comprehensive Acid Dyes Market Research Report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. A conversation with Ketan will provide you with customized insights, deeper competitive intelligence, and the opportunity to explore how our rigorous analysis can support your organization’s growth objectives. Contact Ketan to secure your copy of the report and unlock the actionable data you need to make informed decisions in this rapidly evolving market.

- How big is the Acid Dyes Market?

- What is the Acid Dyes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?