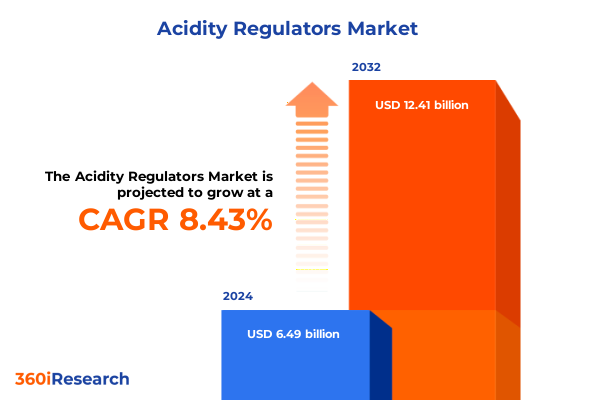

The Acidity Regulators Market size was estimated at USD 7.01 billion in 2025 and expected to reach USD 7.58 billion in 2026, at a CAGR of 8.48% to reach USD 12.41 billion by 2032.

Setting the Stage for Acidity Regulators Market Growth with Unprecedented Clean Label Demands and Enhanced Food Safety Protocols

Acidity regulators, encompassing a spectrum of organic acids and alkaline compounds, serve as indispensable components in food and beverage, personal care, and pharmaceutical formulations, ensuring optimal pH balance, flavor stability, and microbial safety. Their ability to fine-tune acidity profiles supports texture modification, shelf-life extension, and preservation of sensory attributes, making them integral to modern product development across multiple industries.

In 2025, the regulatory landscape has intensified its focus on food additives, with key initiatives aimed at bolstering consumer safety and transparency. In April, the FDA announced a phase-out of certain synthetic dyes and outlined plans to strengthen oversight of Generally Recognized as Safe (GRAS) self-certifications, signaling a shift toward heightened scrutiny of all additive ingredients.

Concurrently, consumer demand for clean label products has surged, driven by growing health awareness and a preference for recognizable ingredients. Market analysis indicates that naturally derived acidity regulators, such as citric acid from citrus fruits and lactic acid from fermentation processes, are replacing synthetic alternatives as brands strive to meet clean label and organic standards.

Meanwhile, technological advancements in production processes are enabling the development of multi-functional regulators that deliver improved stability during processing and storage at lower usage levels, thereby enhancing operational efficiency and environmental sustainability.

Embracing a New Era of Innovation in Acidity Regulation Fueled by Sustainability and Cutting-Edge Technological Advancements

The acidity regulators market is experiencing a paradigm shift as sustainability and clean label credentials have become core drivers of innovation. Natural and organic alternatives are at the forefront, with manufacturers exploring plant-derived and fermentation-based production methods to align with consumer and regulatory preferences.

Producers are leveraging biotechnology to develop acidity regulators from waste-to-value feedstocks, such as agricultural by-products, reducing reliance on petroleum derivatives and minimizing environmental impact. This transition is fueled by global sustainability initiatives and consumer demand for eco-friendly products.

Simultaneously, customized formulation capabilities have expanded through digital tools and AI-driven platforms, enabling rapid prototyping of acidity profiles tailored to specific sensory and functional requirements. These capabilities accelerate product development cycles and optimize acid usage, enhancing cost efficiency and product consistency.

Another transformative shift is the diversification of sourcing strategies. Companies are adopting nearshoring approaches and establishing regional fermentation facilities to mitigate supply chain disruptions and tariff-related uncertainties, thereby ensuring uninterrupted access to critical acidity regulators.

Analyzing the Ripple Effects of Recent United States Tariff Measures on the Acidity Regulators Supply Chain and Cost Structures

The cumulative impact of recent United States tariff measures has reverberated across the acidity regulators supply chain, driving cost increases and compelling strategic realignment. In early 2025, the USTR enacted reciprocal tariffs, in some cases reaching up to 145% on chemical imports from China, including lactic acid, acetic acid, and other key acidity regulators.

Food and beverage manufacturers reliant on China-sourced ascorbic, citric, and malic acids reported input cost hikes of approximately 20–30%, creating pricing pressures that are especially acute in tight-margin segments such as sauces, ready meals, and beverages.

Specialty chemical producers have voiced concerns over the sudden escalation of feedstock expenses and freight charges, with industry associations warning of deep uncertainty given the complex, global nature of additive supply chains.

As a result, many organizations are recalibrating their supplier portfolios, prioritizing domestic and regional sources and exploring alternative feedstocks to mitigate tariff-induced volatility. This reconfiguration is reshaping global trade routes and accelerating investments in local production capacities, underscoring the critical need for agile sourcing strategies.

Deciphering Core Segmentation Insights Revealing Application-Driven, Type-Specific, Form-Based, and Distribution-Focused Market Dynamics

The market’s application segmentation reveals that Food and Beverages remain the dominant end-user, with acidity regulators extensively deployed in bakery confectionery, dairy, meat products, and a broad array of beverage categories, including alcoholic, carbonated, fruit juices, and non-carbonated drinks. This diversity underscores the necessity for regulators to deliver precise pH control across varied processing conditions.

When viewed through the lens of type segmentation, citric acid commands prominence due to its non-toxic nature and recognition as a natural ingredient, particularly in clean label formulations. Lactic and malic acids have gained traction in dairy alternatives and fruit-based applications, while phosphoric acid continues to serve as a cornerstone for carbonated beverages. Sodium bicarbonate maintains its relevance in bakery and snack applications, offering leavening and buffering functionality.

Form segmentation highlights the importance of dosage accuracy and process compatibility. Granular forms facilitate uniform dispersibility in dry mix systems, liquid formats enable rapid integration in continuous beverage processes, and powder variants provide versatility for both dry and wet formulations, balancing solubility and storage stability.

Distribution channel segmentation shows that traditional distributor sales channels remain vital for industrial customers seeking bulk supply and technical support, while direct sales relationships are strengthening to facilitate customized solutions. Emerging online sales platforms are supporting niche producers with expedited procurement, reflecting shifts toward greater agility in supply chain engagement.

This comprehensive research report categorizes the Acidity Regulators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- Distribution Channel

Uncovering Regional Market Drivers Shaping Demand for Acidity Regulators Across Americas, Europe Middle East & Africa, and Asia-Pacific

In the Americas, the acidity regulators market has been energized by surging consumer demand for clean label and organic products. The Organic Trade Association reported that U.S. sales of certified organic goods reached $71.6 billion in 2024, growing at more than twice the rate of the overall market and underscoring widespread adoption of naturally derived acidity regulators across food and beverage categories.

Within Europe, Middle East & Africa, regulatory frameworks shaped by initiatives like the EU’s Farm to Fork strategy are steering formulators toward sustainable and transparent ingredient sourcing. By reducing reliance on synthetic additives and fostering circular bio-based production models, these policies are prompting increased adoption of naturally derived acidity regulators to meet evolving compliance and consumer expectations.

Asia-Pacific stands as the largest regional consumer of acidity regulators, driven by rapid growth in processed food and beverage industries in China, India, and Southeast Asia. IMARC Group’s analysis confirms the region’s leading share in global acidulant consumption, underpinned by high-volume citric acid production and expanding domestic demand for malic and lactic acids in beverage and convenience food applications.

This comprehensive research report examines key regions that drive the evolution of the Acidity Regulators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Acidity Regulator Manufacturers Spotlighting Strategic Initiatives and Competitive Differentiators in the Global Marketplace

Leading industry players have strategically invested to meet the evolving demands for acidity regulators. Corbion and Jungbunzlauer have expanded fermentation capacity in Europe, focusing on high-purity citric and lactic acids to support clean label initiatives and reduce carbon footprint.

Global ingredient suppliers such as ADM and Tate & Lyle have forged partnerships to enhance regional supply resiliency. ADM’s $200 million investment in Singapore and Tate & Lyle’s collaboration with Thai feedstock producers exemplify efforts to diversify production base and secure consistent access to natural acidulants.

Cargill and COFCO Biochemical have directed capital toward facility expansions in China and India, specifically targeting malic and fumaric acid production, in response to growing beverage and processed food demand. Their process optimization efforts aim to deliver consistent quality and supply reliability for downstream customers.

Simultaneously, agile regional producers and niche specialty firms are leveraging localized distribution networks and customization capabilities to cater to small-to-medium enterprises seeking differentiated acidity control solutions, enriching the competitive landscape with application-specific offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acidity Regulators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- AvansChem Speciality Chemicals

- Bartek Ingredients Inc.

- BASF SE

- Brenntag AG

- Cargill, Incorporated

- CD Formulation

- Chemelco International B.V.

- Corbion NV

- FBC Industries Inc.

- Fosfa A.S.

- Fuso Chemical Co. Ltd.

- Hawkins Watts Limited

- Hebei Pengfa Chemical Co., Ltd.

- Isegen South AfriCA (Pty) Ltd.

- Jones Hamilton Co.

- Jungbunzlauer Suisse AG

- Molecular Depot LLC

- Parry Enterprises India Limited

- Polynt S.p.A.

- Seachem Laboratories, Inc.

- Tate & Lyle PLC

- Teknova, Inc.

- Thirumalai Chemicals Limited

- Univar Solutions Inc.

Actionable Playbook for Industry Leaders to Optimize Acidity Regulator Strategies and Strengthen Market Resilience Amidst Disruption

To navigate the current market environment, industry leaders should diversify their sourcing strategies by establishing multi-regional supply agreements that mitigate tariff-driven cost spikes and capacity constraints. Such agreements ensure uninterrupted access to critical acidity regulators.

Investing in next-generation fermentation and bioprocessing technologies is crucial for scaling sustainable production of naturally derived acids, reducing dependency on petrochemical feedstocks, and aligning with tightening regulatory frameworks that favor organic and clean label ingredients.

Proactive collaboration with regulatory bodies can enable companies to shape additive policy development, expedite voluntary compliance programs, and position themselves as responsible innovators, thereby enhancing brand credibility and minimizing reformulation risks.

Leveraging digital formulation platforms and AI-driven analytics will optimize acidulant usage, accelerate new product development cycles, and deliver tailored sensory and stability profiles, translating into improved cost efficiency and faster time-to-market.

Building resilient distribution ecosystems that integrate traditional channels, direct sales partnerships, and agile e-commerce solutions will empower organizations to respond swiftly to shifting customer preferences and scale customized acidity regulator offerings effectively.

Methodological Framework Underpinning Rigorous Primary and Secondary Research Delivering High-Quality Insights on Acidity Regulators

This study employs a hybrid research methodology, integrating comprehensive secondary research with deep primary engagement across the value chain to ensure robust and actionable insights.

Secondary research encompassed the review of regulatory publications, corporate disclosures, trade association reports, and peer-reviewed literature, providing foundational context and validating emerging trends.

Primary research involved structured interviews with formulation scientists, supply chain executives, academic experts, and key opinion leaders, delivering qualitative depth and first-hand perspectives on segmentation drivers and strategic priorities.

Quantitative data underwent rigorous triangulation through cross-comparison with sales tracking databases, government tariff schedules, and customs data, ensuring accuracy and reliability of the findings.

The research process adhered to best practices in transparency, reproducibility, and ethical data handling, enabling stakeholders to confidently leverage these insights in strategic planning and investment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acidity Regulators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acidity Regulators Market, by Type

- Acidity Regulators Market, by Form

- Acidity Regulators Market, by Application

- Acidity Regulators Market, by Distribution Channel

- Acidity Regulators Market, by Region

- Acidity Regulators Market, by Group

- Acidity Regulators Market, by Country

- United States Acidity Regulators Market

- China Acidity Regulators Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Illuminate the Future Trajectory of the Acidity Regulators Market and Strategic Considerations

The acidity regulators market is being reshaped by converging forces of regulatory scrutiny, consumer preferences, and geopolitical influences, creating both challenges and opportunities for industry participants.

Clean label and natural ingredient imperatives are catalyzing a shift toward fermentation-derived and plant-based acidulants, supported by technological advancements that enhance production efficiency and environmental sustainability.

Tariff pressures and supply chain realignments are compelling organizations to diversify sourcing and invest in regional production hubs, reinforcing the need for operational agility and strategic foresight.

Segmentation analysis underscores the diverse applications, types, forms, and distribution channels that define growth potential, while regional insights highlight the importance of tailored approaches to meet local demands and regulatory requirements.

Moving forward, the ability to integrate sustainability, regulatory compliance, and digital innovation into core strategies will be critical for capturing value and sustaining long-term growth in the acidity regulators market.

Unlock Your Competitive Advantage by Partnering with Ketan Rohom to Secure Comprehensive Market Intelligence on Acidity Regulators

For organizations seeking to deepen their understanding of these market dynamics and to gain a competitive edge, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide access to the full comprehensive market research report on acidity regulators, delivering strategic advisory services tailored to your business objectives and ensuring you are equipped with actionable intelligence to steer growth.

- How big is the Acidity Regulators Market?

- What is the Acidity Regulators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?