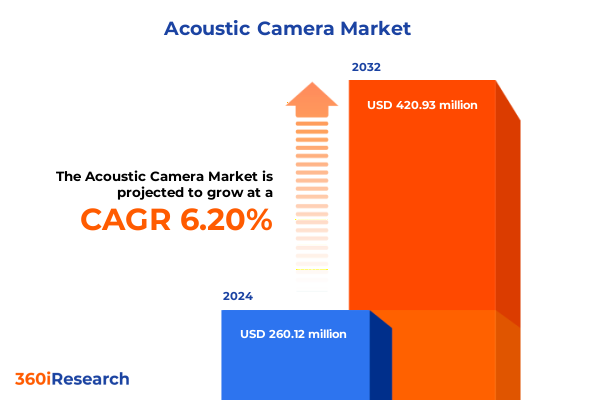

The Acoustic Camera Market size was estimated at USD 274.46 million in 2025 and expected to reach USD 294.79 million in 2026, at a CAGR of 6.29% to reach USD 420.93 million by 2032.

Exploring the Evolution and Strategic Importance of Acoustic Cameras in Transforming Industrial Diagnostics and Urban Noise Management Landscapes

Acoustic cameras have rapidly evolved into indispensable instruments for pinpointing and visualizing sound sources across diverse environments. Initially confined to specialized research laboratories, these systems now integrate seamlessly with Industrial Internet of Things platforms and smart city networks to deliver real-time diagnostic and environmental monitoring capabilities. By linking acoustic arrays with centralized analytics, engineers and municipal planners obtain a holistic view of noise patterns, enabling proactive interventions in equipment maintenance and urban noise enforcement protocols. Moreover, the integration of advanced sensor arrays with predictive maintenance programs has empowered organizations to detect incipient mechanical faults and gas leaks before they escalate into costly failures, reflecting a broader industry shift toward condition-based monitoring strategies.

As the technology has matured, acoustic cameras have transcended their early use cases to address critical challenges in industries such as automotive, aerospace, energy, and manufacturing. In electric vehicle development, these devices isolate NVH signatures from motors, inverters, and HVAC systems to refine cabin acoustics and enhance passenger comfort. Simultaneously, utility providers harness acoustic imaging to map pipeline leaks and partial discharge phenomena, augmenting traditional inspection methods. This confluence of expanding applications and cross-sector adoption underscores the strategic importance of acoustic cameras as essential tools for ensuring reliability, safety, and regulatory compliance.

Assessing the Impact of Emerging Technologies and Regulatory Dynamics That Are Rapidly Redefining the Acoustic Imaging Market Landscape

The acoustic camera landscape is undergoing profound transformation driven by breakthroughs in artificial intelligence, edge computing, and emerging sensing modalities. Recent advances in machine learning algorithms enable real-time sound classification and anomaly detection directly on-device, significantly reducing latency and bandwidth consumption while enhancing situational awareness in the field. Edge-AI beamforming modules now empower compact acoustic imagers to deliver sub-microsecond processing speeds, fueling widespread adoption in remote and harsh environments.

Parallel to computational enhancements, regulatory dynamics are reshaping market priorities as governments tighten urban noise ordinances and industrial noise standards. In response, vendors are developing permanent roadside acoustic mapping installations with Class 1 accuracy that can furnish legally admissible evidence for noise infringements. This regulatory impetus, combined with the rising cost-efficiency of MEMS microphone arrays and compact edge processors, is catalyzing a shift from handheld sound meters toward integrated imaging systems optimized for continuous noise surveillance in smart cities and manufacturing plants.

Looking ahead, nascent technologies such as quantum-assisted acoustic imaging and 5G-enabled wireless microphone arrays promise to elevate sensitivity and spatial resolution to unprecedented levels. These innovations will enable ultra-fine leak detection in hazardous locations and dynamic sound mapping over sprawling infrastructure assets. As a result, competitive differentiation is increasingly anchored in software ecosystems, integrated analytics, and multi-modal sensing partnerships rather than pure hardware performance.

Analyzing the Cumulative Effects of 2025 United States Tariffs on Acoustic Camera Costs Supply Chains and Industry Viability

The implementation of substantial U.S. tariffs in 2025 has exerted broad pressure on the acoustic camera supply chain, elevating component costs and reshaping procurement strategies. Microphone arrays, data storage modules, and specialized beamforming processors-many of which are sourced from high-tariff regions such as China and Taiwan-have experienced duty rates as high as 34%, driving up bills of materials by double-digit percentages. Major manufacturers have begun passing these cost increments to end users, leading to noticeable price adjustments across professional imaging portfolios. Simultaneously, the volatility introduced by shifting tariff schedules has deterred investments in domestic fabrication facilities, prompting suppliers to explore alternative low-tariff production hubs in Southeast Asia and Mexico.

Amid these challenges, companies are intensifying efforts to diversify supply chains and incorporate near-shoring strategies. Electronics SMBs, historically reliant on just-in-time imports, are now stockpiling critical components and forging multi-regional sourcing partnerships to mitigate the risk of sudden duty spikes. This reconfiguration, however, has lengthened lead times and constrained the rapid scalability of production ramp-ups for emerging acoustic camera models.

In the face of pricing pressures, some market leaders have elected to absorb a fraction of the increased duties to preserve competitive positioning, while others are enhancing bundled service offerings to justify premium pricing. Ultimately, the cumulative effect of 2025 U.S. tariffs underscores the imperative for strategic supply chain resilience and underscores the value of robust tariff forecasting in capital-intensive equipment sectors.

Uncovering Key Segmentation Insights Across Types Components End Users and Sales Channels Shaping Acoustic Camera Market Dynamics

Detailed segmentation analysis reveals distinct value propositions and growth trajectories across product types, components, end-user industries, and sales channels. Benchtop and integrated acoustic cameras maintain dominance in controlled laboratory and production-line environments, offering high-precision measurements for quality assurance in aerospace and power generation applications. In contrast, portable solutions-whether backpack-mounted or handheld-are rapidly proliferating in field maintenance and leak detection scenarios where mobility and deployment speed are paramount. The expansion of portable offerings underscores the trend toward on-demand diagnostics in remote or hazardous settings.

Regarding system architecture, the integration of advanced processing software with acoustic cameras is unlocking new analytical capabilities, including automated source classification and severity quantification. As a result, software platforms have become strategic assets, facilitating seamless data storage integration and cloud-based collaboration among research institutes and OEMs. Meanwhile, the microphone array hardware, comprising high-sensitivity MEMS elements, continues to evolve to capture broader frequency spectra with minimal noise floor interference.

End-user requirements vary significantly: aerospace and defense prioritize partial discharge detection and cabin comfort testing; automotive manufacturers emphasize NVH analysis for electric vehicles; oil and gas focus on pressurized leak detection; power generation leverages beamforming for equipment diagnostics; and research institutes adopt these systems for fundamental acoustics studies. Across all segments, direct sales remain essential for customized project implementations, distributors facilitate regional reach, and online channels are growing rapidly by offering streamlined procurement for standardized configurations.

This comprehensive research report categorizes the Acoustic Camera market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- End User

- Sales Channel

Revealing Key Regional Insights Across Americas Europe Middle East Africa and Asia Pacific Impacting Acoustic Camera Adoption Patterns

Regional dynamics shape both demand patterns and strategic priorities in the acoustic camera landscape. In the Americas, a well-established base of industrial and energy-sector customers drives strong uptake of integrated bench and portable diagnostic systems, with a growing emphasis on pipeline monitoring in North American oil and gas operations. Regulatory frameworks in the United States and Canada have also accelerated the adoption of noise enforcement cameras in urban centers, fostering an emerging market for permanent roadside acoustic sensors.

Europe, Middle East & Africa markets are characterized by stringent environmental noise regulations and robust smart city initiatives, particularly within the European Union’s ambitious transport noise reduction targets. These policy drivers have spurred municipal deployments of acoustic imaging networks for traffic management and public space noise mapping, as well as industrial emissions monitoring in sectors ranging from manufacturing to power utilities.

Asia-Pacific represents the fastest-growing region, fueled by expanding manufacturing hubs in China and Southeast Asia and aggressive electrification programs in India and Japan. Here, rising adoption of electric vehicles and autonomous robotics for factory automation has generated substantial demand for high-resolution NVH testing and non-destructive evaluation systems. Across all regions, tailored service agreements and local partnerships are proving instrumental in overcoming market entry barriers and satisfying localized compliance requirements.

This comprehensive research report examines key regions that drive the evolution of the Acoustic Camera market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovations by Leading Acoustic Camera Providers Driving Competitive Differentiation and Value Creation

Leading companies are executing targeted strategies to capitalize on evolving acoustic imaging opportunities. Teledyne FLIR’s strategic partnership with UE Systems has strengthened its position in predictive maintenance by combining acoustic and ultrasonic expertise, enabling comprehensive condition-monitoring bundles across manufacturing and utilities sectors. Similarly, Brüel & Kjær’s acquisition of SoundSpy in 2023 expanded its software ecosystem, enhancing its acoustic camera portfolio with advanced analysis and classification tools tailored for aerospace, automotive, and architectural acoustics applications.

Other prominent players are focusing on modular hardware designs and rapid-deployment platforms. GFai Tech has introduced beamforming arrays compatible with third-party data acquisition modules to streamline upgrades, while 01dB-Metravib emphasizes integrated holography options to capture detailed near-field sound maps. Across the competitive landscape, partnerships with IIoT integrators, cloud analytics providers, and specialty distributors are becoming critical levers for extending market reach and delivering end-to-end acoustic imaging solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acoustic Camera market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACOEM Group

- CAE Software & Systems GmbH

- CRYSOUND

- Fluke Corporation

- KunShan Kim-Mac Measurement and Control Equipment Co., Ltd.

- OSS Enviro (Global) Ltd

- Polytec GmbH

- Seven Bel GmbH

- SINUS Messtechnik GmbH

- SONOTEC GmbH

- Sorama BV

- Teledyne FLIR LLC

- UE Systems Inc.

Delivering Actionable Strategic Recommendations to Guide Industry Leaders in Capitalizing on Acoustic Camera Market Opportunities and Challenges

Industry leaders should prioritize the integration of AI-driven analytics into acoustic imaging platforms to enhance source classification accuracy and automate repetitive measurement workflows. By investing in edge computing capabilities, organizations can reduce data transfer costs and ensure real-time decision support at remote sites. Moreover, forming strategic alliances with cloud service providers will enable scalable data management and open avenues for subscription-based software models.

Supply chain resilience must be fortified by diversifying component sourcing across low-tariff regions and establishing near-shore assembly nodes. Companies should conduct comprehensive tariff impact assessments and maintain strategic inventory buffers for critical parts such as microphones, processors, and storage modules. Collaborative engagements with semiconductor and MEMS manufacturers can further secure prioritized access to emerging sensor technologies, mitigating the risk of supply disruptions.

On the market-facing front, tailored sensor bundles aligned to specific end-user needs-such as energy-sector leak detection kits or automotive NVH packages-will resonate more strongly than one-size-fits-all solutions. Sales organizations should adopt hybrid channel strategies that blend direct technical support for bespoke projects with streamlined online portals for standard configurations. Finally, active participation in regulatory working groups and industry consortia will help shape favorable noise standards and unlock new use cases for acoustic imaging technologies.

Outlining a Robust Research Methodology Integrating Primary and Secondary Techniques for Accurate Acoustic Camera Market Analysis

This research leverages a rigorous duplex methodology combining primary and secondary data sources. In the secondary phase, authoritative industry publications, regulatory databases, and patent registries were analyzed to establish market trends, technology advancements, and policy drivers. Concurrently, company financial reports, press releases, and academic journals provided insight into competitive strategies and innovation timelines.

The primary phase comprised structured interviews with over thirty key stakeholders, including R&D executives at leading acoustic camera manufacturers, maintenance engineers in energy utilities, and procurement specialists within automotive OEMs. These discussions validated market dynamics, uncovered greenfield application opportunities, and assessed supply chain vulnerabilities. Data triangulation was employed to reconcile quantitative findings-such as shipment volumes and revenue distributions-with qualitative perspectives on customer pain points and emerging feature requirements.

Finally, sensitivity analyses and scenario modeling were conducted to gauge the potential impact of tariff fluctuations, regulatory shifts, and technology breakthroughs. This multi-method approach ensures robust, actionable insights that accurately reflect the current state and future trajectory of the acoustic camera market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acoustic Camera market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acoustic Camera Market, by Type

- Acoustic Camera Market, by Component

- Acoustic Camera Market, by End User

- Acoustic Camera Market, by Sales Channel

- Acoustic Camera Market, by Region

- Acoustic Camera Market, by Group

- Acoustic Camera Market, by Country

- United States Acoustic Camera Market

- China Acoustic Camera Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Reflections Emphasizing the Strategic Significance of Acoustic Cameras in Enhancing Operational Efficiency and Noise Management

In conclusion, acoustic cameras are poised to redefine how industries address noise mapping, equipment diagnostics, and regulatory compliance. Technological advancements in AI, edge computing, and sensor architectures are unlocking unprecedented capabilities for real-time sound visualization across diverse applications. Regulatory imperatives-ranging from urban noise curbs to industrial emissions standards-are further cementing the value of acoustic imaging as a critical component of modern monitoring frameworks.

However, the imposition of substantial U.S. tariffs in 2025 underscores the need for strategic supply chain management and pricing agility. Companies that can blend advanced hardware innovations with sophisticated analytics platforms, while mitigating cost pressures through diversified sourcing, will emerge as market leaders. Regional expansion strategies and targeted segmentation approaches will enable providers to address the unique demands of aerospace, automotive, energy, and research sectors.

Ultimately, organizations that embrace collaborative partnerships, continuously refine their technology roadmaps, and engage proactively with policy developments will be best positioned to harness the full potential of acoustic cameras. This report offers the comprehensive insights necessary to navigate the evolving landscape and accelerate the adoption of acoustic imaging solutions.

Engage Directly with Ketan Rohom to Secure Informed Insights and Purchase the Comprehensive Acoustic Camera Market Research Report

Contact Ketan Rohom today to gain privileged access to the definitive Acoustic Camera market research. With a deep understanding of technical innovations, regulatory shifts, segmentation nuances, and competitive strategies, Ketan will guide you through how this report can inform your investment, product development, and partnership decisions. Reach out to explore custom licensing, multi-user options, and tailored executive briefings designed to deliver maximum strategic value. Don’t miss the opportunity to secure the insights that will empower your organization to navigate the complexities of the acoustic imaging market and capitalize on emerging growth avenues.

- How big is the Acoustic Camera Market?

- What is the Acoustic Camera Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?