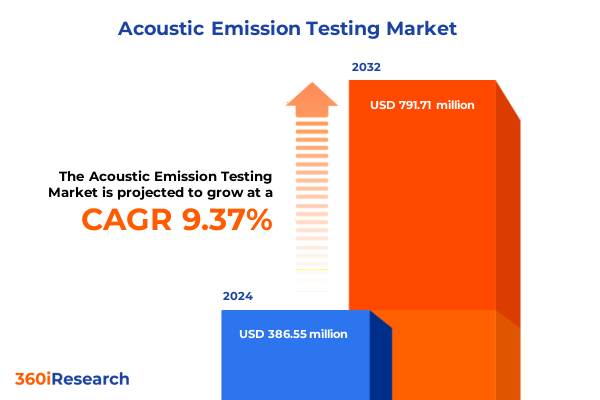

The Acoustic Emission Testing Market size was estimated at USD 407.18 million in 2025 and expected to reach USD 430.83 million in 2026, at a CAGR of 6.06% to reach USD 614.96 million by 2032.

Pioneering Advances in Acoustic Emission Testing Set the Stage for Unprecedented Reliability, Enhanced Fault Detection, and Operational Efficiency Across Industries Worldwide

Acoustic emission testing has emerged as a pivotal nondestructive evaluation approach, offering unparalleled capabilities to detect and characterize structural and material defects in real time. This technique leverages transient elastic waves generated by the rapid release of energy within materials under stress, enabling maintenance teams, engineers, and quality assurance professionals to pinpoint crack initiation, corrosion, and fatigue before catastrophic failures occur. As global industries confront aging infrastructure and increasingly stringent safety mandates, acoustic emission testing is asserting its role as an indispensable diagnostic tool.

Recent innovations in sensor technology and data analysis have further broadened the scope and accuracy of acoustic emission testing. Improved piezoelectric sensors deliver higher sensitivity across a broader frequency spectrum, while advances in fiber optic sensing offer immunity to electromagnetic interference, facilitating deployment in harsh or high-voltage environments. Meanwhile, the integration of sophisticated signal processing algorithms enables real time differentiation between relevant defect signatures and background noise. Consequently, industries ranging from aerospace to energy are embracing acoustic emission testing as a proactive measure to enhance reliability, extend asset lifecycles, and reduce unplanned downtime.

The Landscape of Acoustic Emission Testing Undergoes Transformative Shifts Driven by Technological Breakthroughs, Integration of Smart Solutions, and Evolving Regulatory Frameworks

The acoustic emission testing landscape is undergoing a transformative shift marked by the convergence of digitalization, Internet of Things (IoT) connectivity, and artificial intelligence (AI). Traditional standalone analyzers and wired data acquisition systems are evolving into modular, networked platforms capable of continuous remote monitoring. These smart systems enable condition-based maintenance strategies, replacing scheduled inspections with adaptive, data-driven interventions that optimize resources and minimize risk.

This evolution is further accentuated by the rise of cloud-based data management software, which facilitates centralized storage and advanced analytics across distributed operations. Engineering teams can now leverage real time dashboards and predictive modeling to forecast material behavior and prioritize critical assets for inspection. Regulatory frameworks are also adapting; agencies are increasingly recognizing acoustic emission testing as a standardized approach for compliance and risk management. As a result, early adopters who implement integrated, waveform-based techniques are achieving higher operational confidence, reduced inspection costs, and improved safety margins.

Mounting Impact of United States Tariffs in 2025 on Acoustic Emission Testing Ecosystem Redefines Supply Chains, Cost Structures, and Market Accessibility for Stakeholders

In 2025, the imposition of selective tariffs by the United States government has reshaped the operational and cost dynamics of the acoustic emission testing ecosystem. Key hardware inputs, including piezoelectric sensors and specialized analyzers, face elevated import duties, leading to increased equipment procurement costs for end users. This scenario has prompted equipment manufacturers to reassess global supply chains, with some exploring alternate sourcing from tariff-exempt regions or investing in domestic production capabilities to mitigate financial exposure.

Until recently, the impact of trade policy shifts was diffuse, but the latest tariff amendments have accelerated consolidation within the supply base. Smaller sensor suppliers without diversified manufacturing footprints are encountering margin pressure, catalyzing strategic partnerships and mergers with larger, integrated OEMs. In parallel, service providers are renegotiating long-term contracts to accommodate cost escalation, often embedding tariff-adjustment clauses. While these adjustments introduce short-term cost inflation, they also incentivize innovation in modular hardware design and wireless data acquisition to reduce dependency on high-tariff components.

Unveiling Core Segmentations Reveals Multifaceted Components, Applications, End Users, Installation Modes, and Technique Variations Shaping the Acoustic Emission Testing Market

A nuanced view of the acoustic emission testing landscape emerges when examined through multiple segmentation lenses. Component segmentation reveals distinct trajectories for hardware, services, and software. Within hardware, the analyzer segment bifurcates into modular and standalone configurations, while data acquisition systems evolve along wired and wireless architectures. Sensor technologies also diverge, with fiber optic variants gaining traction in high-voltage settings and piezoelectric models maintaining dominance in conventional applications. The services spectrum spans consulting for condition assessment and failure analysis, maintenance & support delivered through corrective and preventive frameworks, and training & certification delivered in both classroom and online environments. Software solutions further fragment into analysis software-offering post processing and real time analysis-data management platforms that operate on cloud based or on premises deployments, and simulation software encompassing finite element and physical modeling functionalities.

Application segmentation underscores broad end-use diversity. Aerospace & defense and automotive sectors demand stringent validation, manufacturing leverages acoustic emission for quality assurance, oil & gas relies on continuous monitoring for pipeline integrity, and power generation facilities integrate testing into asset management. End user categories span large industrial operators in aerospace, automotive, energy & power, manufacturing, oil & gas & petrochemical, and research institutions pioneering new sensor and algorithmic developments. Installation type influences adoption patterns: permanent systems deliver around-the-clock surveillance for critical assets, while portable units support ad hoc inspections and field diagnostics. Finally, technique segmentation differentiates parameter-based approaches, which analyze event counts and amplitude metrics, from waveform-based methods that interpret full signal profiles to diagnose complex failure modes.

This comprehensive research report categorizes the Acoustic Emission Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Testing Type

- Type

- Component

- Installation Type

- Technique

- End User

Diverse Regional Dynamics Highlight Varying Adoption Rates, Innovative Collaborations, and Infrastructure Maturity Across Americas, Europe Middle East Africa, and Asia Pacific Regions

The acoustic emission testing market exhibits pronounced regional heterogeneity driven by regulatory environments, infrastructural maturity, and industrial end-user demand. In the Americas, strong investments in aging oil & gas pipelines and the proactive maintenance policies of North American utilities have catalyzed the early adoption of wireless data acquisition systems and cloud-native analytics. Meanwhile, Europe, Middle East & Africa is characterized by stringent safety regulations in aerospace & defense and robust collaboration between research institutions and OEMs, fostering innovation in fiber optic sensing and AI-powered failure analysis platforms. Across the Asia-Pacific landscape, rapid industrial expansion, particularly within manufacturing and power generation sectors, has fueled demand for modular analyzers and cost-effective portable test suites. Localized manufacturing in key countries is also driving down equipment costs, democratizing access to acoustic emission testing capabilities.

Emerging economies in the region are increasingly partnering with global technology providers to build skilled workforces through training & certification programs delivered both in person and online. These cross-regional dynamics are redefining competitive benchmarks and offering new opportunities for vendors to tailor solutions that address specific regulatory and operational challenges.

This comprehensive research report examines key regions that drive the evolution of the Acoustic Emission Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Innovation Trajectories of Leading Companies Illuminate Competitive Landscapes and Collaborative Opportunities in Acoustic Emission Testing Domain

Leading players in the acoustic emission testing domain are strategically positioning themselves through targeted R&D investments, intellectual property expansion, and collaborative alliances. Several multinational hardware manufacturers are focusing on next-generation modular analyzers that integrate edge computing capabilities, enabling real time defect classification at the sensor node. Concurrently, software developers are enhancing data management platforms with AI-driven predictive analytics, facilitating normative behavior modeling across heterogeneous asset fleets.

Service providers are differentiating their portfolios by bundling consulting, maintenance & support, and training offerings into comprehensive lifecycle solutions. In parallel, a number of companies have established joint ventures with research institutions to co-develop novel fiber optic sensors and advanced waveform-based techniques. These alliances accelerate time to market for breakthrough technologies. As competitive intensity rises, strategic collaborations between hardware OEMs, software vendors, and end-users are emerging as a critical success factor, enabling integrated value propositions that address evolving customer requirements and regulatory mandates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acoustic Emission Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- MISTRAS Group, Inc.

- TÜV Rheinland AG

- Parker Hannifin Corporation

- TÜV SÜD

- Siemens AG

- Acuren

- SGS SA

- Vallen Systeme GmbH

- Eddyfi Technologies by Previan Technologies, Inc.

- Acoustic Emission Technologies, Inc.

- Applus+ Group

- Arudra Engineers Pvt. Ltd

- Beijing Softland Times Scientific & Technology Co., Ltd.

- General Electric Company

- Kistler Group

- KRN Services, Inc.

- Matcor Technology & Services Pte Ltd

- QingCheng AE Institute(Guangzhou) Co.,Ltd

- Score Group plc

- Sonatest Ltd.

- TCR Advanced Engineering Private Limited

- Wabtec Corporation

Actionable Recommendations Empower Industry Leaders to Capitalize on Emerging Trends, Mitigate Tariff Impacts, and Drive Sustainable Growth Through Strategic Investments and Partnerships

Industry leaders looking to harness the full potential of acoustic emission testing should prioritize the integration of wireless data acquisition with cloud-based analytics platforms to achieve seamless condition monitoring. By investing in modular hardware architectures and edge processing, organizations can deploy scalable networks of sensors that reduce latency and improve data fidelity. Moreover, forging partnerships with specialized service providers can enable streamlined maintenance & support frameworks, ensuring rapid response to emerging defect signals.

To mitigate the financial impact of US tariffs, procurement teams should consider dual-sourcing key components and exploring domestic manufacturing alliances. Implementing tariff-adjustment clauses in service contracts and leveraging simulation software for virtual testing can also offset cost increases. Training & certification programs, both in classroom and online formats, should be expanded to cultivate in-house expertise, empowering engineers to interpret complex acoustic signatures and apply parameter-based and waveform-based techniques effectively. Ultimately, a holistic approach-combining technological innovation, strategic sourcing, and workforce development-will drive sustainable growth and competitive differentiation.

Robust Research Methodology Integrates Comprehensive Data Collection, Expert Validation, and Advanced Analytical Techniques to Ensure Rigorous Insights into Acoustic Emission Testing Trends

This research employs a multi-phase methodology to deliver rigorous and reliable insights. Primary data collection involved interviews with industry experts across hardware manufacturing, software development, and service provision, ensuring a balanced perspective on market dynamics. Secondary research encompassed a comprehensive review of regulatory documents, patent filings, academic publications, and financial reports to validate technology trends and tariff impacts.

Quantitative analysis was underpinned by advanced statistical modeling, synthesizing segmentation variables and regional performance metrics. Expert validation workshops were conducted to refine assumptions and interpret complex acoustic emission phenomena. Additionally, scenario planning techniques were applied to assess potential supply chain disruptions stemming from evolving trade policies. By triangulating data from these diverse sources, the methodology delivers a robust foundation for forecasting adoption trajectories and strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acoustic Emission Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acoustic Emission Testing Market, by Testing Type

- Acoustic Emission Testing Market, by Type

- Acoustic Emission Testing Market, by Component

- Acoustic Emission Testing Market, by Installation Type

- Acoustic Emission Testing Market, by Technique

- Acoustic Emission Testing Market, by End User

- Acoustic Emission Testing Market, by Region

- Acoustic Emission Testing Market, by Group

- Acoustic Emission Testing Market, by Country

- United States Acoustic Emission Testing Market

- China Acoustic Emission Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Summarizing Fundamental Insights of Acoustic Emission Testing Market Landscape Illuminates Key Drivers, Restraints, and Strategic Pathways for Future Industry Evolution

In summary, acoustic emission testing is transitioning from a niche inspection tool to a cornerstone technology for proactive asset management across industries. The convergence of smart hardware, cloud analytics, and AI-driven interpretation is elevating the precision and timeliness of defect detection. At the same time, shifting trade policies in 2025 are prompting supply chain realignments and stimulating innovation in modular and domestic manufacturing capabilities.

Key segmentation insights underscore the importance of tailoring solutions across component, application, end-user, installation type, and technique dimensions. Regionally, the Americas, EMEA, and Asia-Pacific each present unique opportunities shaped by regulatory frameworks, infrastructure demands, and local partnerships. Competitive dynamics are intensifying as leading companies invest in integrated offerings and collaborate with research institutions. By adhering to rigorous research methodologies, organizations can navigate this evolving landscape with confidence, leveraging acoustic emission testing to enhance safety, reliability, and operational efficiency.

Engage with Ketan Rohom to Unlock Comprehensive Acoustic Emission Testing Market Research Report Tailored to Inform Strategic Decisions and Advance Organizational Objectives

To obtain the full Acoustic Emission Testing market research report, prospective buyers are invited to connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging with Ketan ensures personalized guidance to navigate the detailed findings, customized analyses, and strategic recommendations contained in the comprehensive report. Through this dialogue, decision makers can clarify specific data needs, explore bespoke research add-ons, and align the insights with their organizational objectives.

By partnering with Ketan Rohom, organizations gain access to expert support on licensing options, report delivery timelines, and extended consulting services designed to help translate research insights into actionable strategies. Whether you are evaluating component innovations, assessing regional market dynamics, or seeking to understand the ripple effects of US tariffs, Ketan’s expertise will ensure that you receive the precise intelligence required to make confident, data-driven decisions. Reach out today to secure your copy and harness the power of cutting-edge market intelligence to drive growth, optimize investments, and maintain a competitive edge in the evolving Acoustic Emission Testing landscape.

- How big is the Acoustic Emission Testing Market?

- What is the Acoustic Emission Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?