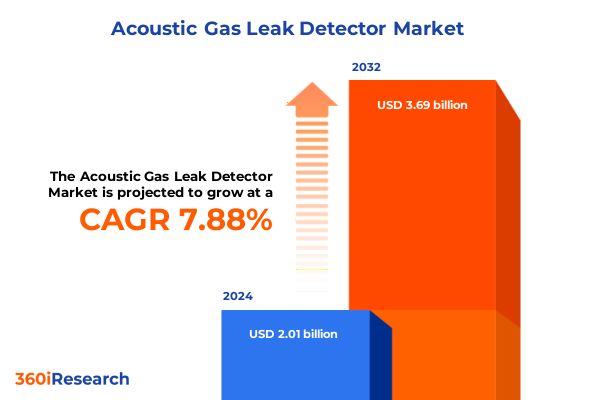

The Acoustic Gas Leak Detector Market size was estimated at USD 2.16 billion in 2025 and expected to reach USD 2.34 billion in 2026, at a CAGR of 7.96% to reach USD 3.69 billion by 2032.

Acoustic Gas Leak Detection Technology: Unveiling the Latest Advances, Market Dynamics, and Strategic Imperatives for Decision-Makers

The escalating focus on safety, environmental compliance, and operational efficiency has propelled acoustic gas leak detection into the forefront of industrial and commercial asset management. As regulatory agencies tighten methane and volatile organic compound emission limits, companies across sectors must adopt advanced detection solutions that ensure both worker safety and environmental stewardship. Acoustic gas leak detectors, which rely on sound wave analysis to pinpoint leaks without direct contact, offer a noninvasive and highly sensitive alternative to traditional sensor arrays. Moreover, the integration of real-time data analytics and networked monitoring platforms is shifting detection strategies from reactive maintenance to proactive asset integrity management.

Against this backdrop, the present executive summary aims to distill critical learnings from the acoustic gas leak detection landscape. It outlines the forces driving technological innovation, examines the ripple effects of tariff policy adjustments on supply chains, and uncovers segmentation and regional market dynamics. By weaving in key competitive insights and action-oriented recommendations, this document is designed to inform leaders in manufacturing, oil and gas, power generation, and water management. Through a structured narrative, decision-makers will gain clarity on how diverse application requirements, deployment preferences, and distribution channels converge to shape market evolution. Ultimately, this introduction sets the stage for a deep dive into the trends that will define the future of acoustic gas leak detection.

Navigating Disruptive Technological Advancements and Regulatory Dynamics Reshaping the Acoustic Gas Leak Detection Market Landscape

In recent years, acoustic gas leak detection has undergone a profound metamorphosis driven by the convergence of digital transformation, regulatory evolution, and sustainability mandates. Traditional acoustic sensors, once limited by analog processing and manual inspection workflows, now integrate advanced edge computing to filter ambient noise and enhance detection accuracy. Cloud-based platforms and Internet of Things connectivity have enabled remote monitoring, predictive maintenance algorithms, and comprehensive asset health dashboards. This shift from standalone devices to networked ecosystems allows stakeholders to anticipate failures before they escalate into costly or hazardous incidents.

Regulatory frameworks have also adjusted in response to heightened global awareness around greenhouse gas emissions. Stricter methane reporting requirements and more frequent inspection mandates influence capital allocation toward automated, continuous monitoring solutions. Concurrently, corporate environmental, social, and governance (ESG) goals are incentivizing investment in technologies that minimize fugitive emissions and support transparent performance metrics. Across industries, these transformative pressures are catalyzing partnerships between detector manufacturers, analytics providers, and system integrators. As a result, the acoustic gas leak detection landscape is rapidly maturing into a cohesive ecosystem where data interoperability, cybersecurity safeguards, and user-centric interfaces are imperative for sustained growth and compliance.

Assessing the Compounded Effects of 2025 United States Tariff Adjustments on Supply Chains, Component Costs, and Market Accessibility

The landscape of acoustic gas leak detection has been materially reshaped by the United States’ sequential imposition and refinement of tariff policies in 2025. Building on Section 301 tariffs introduced in 2018 and subsequent reciprocal duties aimed at addressing technology transfer and unfair trade practices, the U.S. Trade Representative announced in early 2025 a three-month extension of certain product exclusions covering a range of industrial machinery and electronic components imported from China. While these exclusions provided temporary relief for suppliers of gas detection equipment, they did not universally apply to the specialized ultrasonic transducers and signal processing units that underpin acoustic leak detectors, resulting in a marked escalation in sourcing costs.

The absence of permanent exemptions for sensor-specific components has compelled many original equipment manufacturers to reevaluate their supply chain strategies. Some have accelerated nearshoring efforts, qualifying alternative suppliers in Europe and Japan to mitigate exposure to fluctuating duty rates. Others have leveraged requests for product-specific exclusions through a new USTR exclusion process, though the rolling nature of approvals introduces timing uncertainties for procurement and project execution. These policy headwinds are compounded by broader inflationary pressures across raw materials, labor, and logistics, translating into higher price tags for end users and compressed margins for technology providers. Consequently, tariff volatility remains a critical factor for stakeholders seeking to balance cost management with uninterrupted access to cutting-edge detection capabilities.

Critical Insights into Market Segmentation by Application, Technology, End User, Deployment, and Distribution Channel Influencing Growth Drivers

A granular examination of market segmentation reveals differentiated value propositions and adoption patterns across multiple dimensions. Based on application, demand emanates from chemical processing facilities that require rapid leak localization to avoid costly shutdowns, while manufacturing end users-from automotive assembly lines to food and beverage plants and pharmaceutical production suites-prioritize noninvasive monitoring that integrates seamlessly into highly regulated cleanroom environments. In oil and gas, upstream exploration platforms, midstream pipelines, and downstream refineries depend on acoustic systems for leak detection in remote corridors and high-pressure manifolds, whereas power generation sites leverage these solutions for both gas turbine inlet systems and auxiliary pipelines. Drinking water and wastewater operators in the water and wastewater segment adopt acoustic detectors to protect public health by identifying hazardous gas accumulations before they reach treatment areas.

When viewed through the lens of technology, infrared and laser-based detectors offer optical pinpointing of specific gas signatures, complementing photoacoustic devices that translate pressure waveforms into high-fidelity spectral data. Ultrasonic sensors remain favored for their resilience in noisy industrial settings. End users in commercial and residential environments gravitate toward compact, plug-and-play units optimized for human safety corridors, while industrial operators deploy integrated solutions across SCADA networks. Fixed installations provide continuous perimeter surveillance, whereas portable detectors facilitate spot-check inspections, enabling maintenance teams to verify leak remediation on demand. Finally, distribution strategies vary from direct sales engagements and channel partnerships with distributors and resellers to digital storefronts that streamline procurement through online platforms. This multi-dimensional segmentation underscores the need for adaptive go-to-market models that align product capabilities with the nuanced demands of each customer archetype.

This comprehensive research report categorizes the Acoustic Gas Leak Detector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Technology

- End User

- Deployment

- Distribution Channel

Regional Market Dynamics Uncovered Across Americas, Europe Middle East & Africa, and Asia Pacific Highlighting Growth Patterns and Challenges

Regional dynamics further illuminate the contours of opportunity and challenge within the acoustic gas leak detection arena. In the Americas, stringent federal and state-level emission regulations dovetail with large-scale infrastructure renewal programs, prompting utilities, midstream operators, and municipal authorities to upgrade legacy systems. North American manufacturers are particularly attuned to compliance deadlines that require continuous monitoring, with Latin American markets gradually following suit as investment flows into resource extraction and industrial modernization.

Across Europe, Middle East & Africa, a heterogeneous regulatory environment presents both hurdles and incentives. The European Union’s Fit for 55 package, with its comprehensive methane and VOC monitoring requirements, is catalyzing demand for advanced acoustic solutions, while the Middle East’s oil and gas giants drive adoption through capital-intensive petrochemical expansions. In parts of Africa, nascent regulatory frameworks and budgetary constraints challenge deployment, yet international development programs and public-private partnerships are catalyzing pilot projects in refineries and municipal water systems.

In Asia-Pacific, rapid industrialization and maritime port expansions are key growth vectors. China’s emphasis on domestic sensor innovation is accelerating the introduction of photoacoustic and laser-based systems, while India’s infrastructure revitalization plans prioritize leak detection for both urban gas networks and large-scale manufacturing corridors. Meanwhile, Australia’s stringent mining safety protocols and expanding LNG facilities underscore the critical role of acoustic detectors in remote and hazardous environments. These divergent regional trajectories demand customized market entry tactics that address local policy landscapes, procurement preferences, and service infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Acoustic Gas Leak Detector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Spotlighting Key Industry Players Driving Innovation, Strategic Collaborations, and Market Penetration

The competitive terrain in acoustic gas leak detection is defined by a blend of incumbents and agile innovators that are advancing the frontier of sensing technologies and data analytics. Multi-industrial conglomerates have fortified their portfolios through strategic acquisitions and research collaborations, with established brands offering end-to-end solutions that integrate hardware, software platforms, and managed services. Meanwhile, lean specialist firms have carved niches by introducing portable detectors equipped with machine learning algorithms that automatically differentiate between genuine leaks and background noise, delivering rapid field diagnostics.

Partnerships between detection hardware manufacturers and cloud-based analytics providers have become increasingly common, as organizations seek scalable architectures that convert acoustic signature data into actionable insights. At the same time, regional providers, particularly in Asia-Pacific and the Middle East, are expanding their footprints through local manufacturing and service networks to comply with domestic content requirements. Across the board, companies are investing in cybersecurity measures to safeguard leak data and ensure operational continuity, while channel diversification strategies-from direct commercial contracts to tiered distributor relationships-enable broader market reach. As the sector matures, the ability to offer subscription-based detection-as-a-service models and embed leak-detection capabilities within broader safety and environmental compliance frameworks will distinguish market leaders from the rest.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acoustic Gas Leak Detector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Drägerwerk AG & Co. KGaA

- Emerson Electric Co.

- Fluke Corporation

- General Electric Company

- Hermann Sewerin GmbH.

- Honeywell International Inc.

- Industrial Scientific Corporation

- INFICON Holding AG.

- MSA Safety Incorporated

- Sensit Technologies, Inc.

- Siemens AG

- SPX Flow, Inc.

- Teledyne FLIR LLC

- Xylem Inc.

Strategic Recommendations for Industry Leaders to Enhance Competitive Positioning, Optimize Operations, and Capitalize on Emerging Opportunities

Industry leaders must adopt a multi-pronged strategic approach to secure competitive advantage in the evolving acoustic gas leak detection market. Prioritizing research and development investments toward hybrid detection technologies that combine ultrasonic and photoacoustic methodologies will yield differentiated solutions capable of addressing complex leak scenarios. At the same time, cultivating supply chain resilience by diversifying component sources and advocating for stable tariff regimes through engagement with trade policymakers can mitigate cost volatility and ensure project timelines remain on track.

Scaling service capabilities via digital platforms is another imperative. By developing cloud-native analytics that leverage artificial intelligence to predict leak probability and generate maintenance alerts, providers can shift from transactional sales of hardware to recurring revenue streams. Building strategic alliances with system integrators and cloud service providers will facilitate seamless interoperability, while tailored training programs for end users will reinforce customer loyalty and drive long-term adoption. Moreover, offering flexible purchasing options-ranging from direct equipment sales to consumption-based models and financing leases-can expand market access across diverse end-user segments. Through these actionable steps, companies will be better positioned to capitalize on regulatory tailwinds, technological advances, and the rising imperative for environmental stewardship.

Robust Multi-Method Research Framework Employed to Generate Comprehensive and Reliable Acoustic Gas Leak Detection Market Insights

This research leverages a robust multi-method framework to deliver comprehensive insights into the acoustic gas leak detection market. The primary phase involved an extensive review of regulatory filings, patent databases, and technical white papers to map the evolution of detection technologies and identify key innovation trends. Industry association reports and government documents provided historical context and clarified compliance requirements across major jurisdictions.

Complementing secondary sources, primary research comprised in-depth interviews with senior executives from detector manufacturers, system integrators, and end-user organizations spanning chemical, oil and gas, power generation, and water utilities. Structured surveys captured quantitative data on deployment preferences, procurement cycles, and technology adoption drivers. An expert panel convened to validate preliminary findings, offering critical perspectives on tariff impacts, regional market nuances, and emerging applications.

Data triangulation techniques were applied to reconcile insights from multiple sources and ensure the reliability of conclusions. Quality assurance protocols, including peer reviews and cross-functional stakeholder validation, were integral to maintaining methodological rigor. By combining qualitative narratives with quantitative benchmarks, this study delivers an actionable intelligence suite that articulates both the current landscape and future trajectory of acoustic gas leak detection.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acoustic Gas Leak Detector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acoustic Gas Leak Detector Market, by Application

- Acoustic Gas Leak Detector Market, by Technology

- Acoustic Gas Leak Detector Market, by End User

- Acoustic Gas Leak Detector Market, by Deployment

- Acoustic Gas Leak Detector Market, by Distribution Channel

- Acoustic Gas Leak Detector Market, by Region

- Acoustic Gas Leak Detector Market, by Group

- Acoustic Gas Leak Detector Market, by Country

- United States Acoustic Gas Leak Detector Market

- China Acoustic Gas Leak Detector Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Evolution of Acoustic Gas Leak Detection Technologies and Strategic Imperatives for Stakeholder Success

As acoustic gas leak detection continues its trajectory from niche safety solution to cornerstone of environmental compliance and operational efficiency, stakeholders must stay attuned to the interplay of technology, policy, and market forces. The past year has underscored the importance of agility in responding to tariff uncertainties, while advanced sensing modalities and digital analytics have proven instrumental in transforming reactive maintenance into predictive integrity management.

Segmentation insights reveal that no single application or technology domain will dominate; rather, success will hinge on developing modular systems that can adapt across chemical processing, manufacturing, energy, and water treatment contexts. Regional dynamics further emphasize the need for nuanced market entry strategies that account for diverse regulatory regimes and infrastructure readiness levels. In this evolving ecosystem, the ability to forge collaborative partnerships-between hardware innovators, software providers, and regulatory bodies-will be a key differentiator.

Looking ahead, the convergence of acoustic detection with broader asset management platforms and the expansion of consumption-based service models signal a new era of integrated safety solutions. By aligning product development, supply chain strategies, and customer engagement around this interconnected vision, organizations can capitalize on the momentum driving the acoustic gas leak detection market and secure long-term value for all stakeholders.

Drive Your Organization Forward with Exclusive Acoustic Gas Leak Detection Market Intelligence Tailored by Sales & Marketing Expert

Unlock unparalleled insights into the acoustic gas leak detection market and transform your strategic approach today by partnering with Ketan Rohom, Associate Director of Sales & Marketing. With direct access to detailed analyses of the latest technological innovations, regulatory impacts, and competitive dynamics, you can make informed decisions that align with evolving industry demands. Ketan Rohom’s expertise in tailoring comprehensive market intelligence ensures you receive a customized briefing highlighting the most relevant trends, risk factors, and growth opportunities specific to your organization.

Whether you aim to refine your product roadmap, optimize supply chains, or pursue new regional markets, Ketan Rohom is prepared to guide you through the complexities of this rapidly changing landscape. Engage with a seasoned expert who understands both the technical intricacies of acoustic detection and the strategic imperatives of high-stakes decision-making. Secure your competitive edge by accessing proprietary data, forward-looking recommendations, and actionable insights culled from rigorous research methodologies.

Take the next step toward driving operational excellence and sustainable growth. Contact Ketan Rohom for a personalized consultation and discover how this comprehensive acoustic gas leak detector market research report can serve as the foundation for your success story.

- How big is the Acoustic Gas Leak Detector Market?

- What is the Acoustic Gas Leak Detector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?