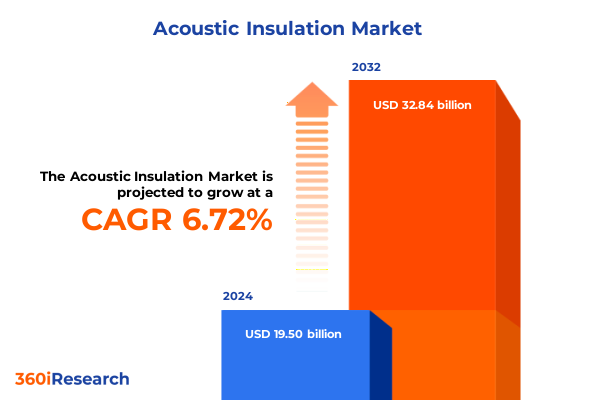

The Acoustic Insulation Market size was estimated at USD 20.55 billion in 2025 and expected to reach USD 21.65 billion in 2026, at a CAGR of 6.92% to reach USD 32.84 billion by 2032.

Navigating the Rising Demand for Acoustic Insulation Across Commercial, Residential, Industrial, and Infrastructure Sectors Amid Shifting Regulatory Frameworks Sustainability and Health Priorities

Acoustic insulation has emerged as a pivotal component in modern construction, driven by intensifying concerns over noise pollution and stricter building regulations aimed at protecting occupant well-being. Recent legislative updates across major economies mandate more rigorous acoustic performance standards, prompting architects, developers, and facility managers to prioritize high-efficiency solutions that deliver both sound attenuation and environmental sustainability. As a result, the industry is witnessing accelerated interest in low-impact materials and advanced installation techniques that can seamlessly integrate with contemporary design paradigms.

Simultaneously, the rising focus on occupant health and comfort has elevated acoustic performance to a critical metric in evaluating built environments. Studies linking noise exposure to stress and productivity declines have underscored the necessity for optimized insulation systems in workplaces, educational institutions, and healthcare facilities. Moreover, heightened awareness of sustainability has spurred innovation in bio-based and recycled insulation products that align acoustic benefits with circular economy principles, offering market participants opportunities to differentiate through eco-friendly offerings.

Looking ahead, the trajectory of acoustic insulation will be shaped by the interplay of regulatory tightening, sustainability imperatives, and technological advancements. Stakeholders who proactively adapt to these converging forces by embracing novel materials, digital integration, and collaborative design approaches will be best positioned to capitalize on emerging opportunities and establish leadership in a rapidly evolving landscape.

Embracing Next Generation Materials Smart Technologies and Regulatory Changes as Transformative Forces Redefining Acoustic Insulation Performance Sustainability and Cost Efficiency

The acoustic insulation industry is undergoing transformative shifts propelled by next-generation materials, sensor integration, and evolving regulatory mandates. Innovations such as phase-change materials and advanced polymer composites are redefining performance benchmarks, enabling thinner profiles that deliver equivalent or superior sound attenuation compared to traditional products. Concurrently, the integration of smart sensors allows real-time monitoring of acoustic conditions, empowering building managers to optimize performance and ensure compliance with dynamic environmental standards.

In parallel, sustainability has emerged as a core driver of material development. Recycled cellulose and mineral by-products are being repurposed into high-performance insulation, reducing carbon footprints and diverting waste from landfills. Regulatory frameworks across North America and Europe increasingly incentivize these eco-friendly alternatives, pushing manufacturers to invest heavily in R&D and certification pathways. These shifts are also fostering collaborations between insulation producers and construction technology firms to create modular systems that simplify installation and retrofit applications.

Finally, evolving policy landscapes are raising the bar for acoustic performance across diverse sectors. Building codes are expanding to include stricter noise emission limits for HVAC systems, industrial facilities, and multi-family dwellings. Consequently, industry players are realigning product portfolios to offer turnkey solutions that address both airborne and impact noise, setting the stage for a new era of acoustic design that seamlessly blends functional performance with aesthetic and environmental considerations.

Assessing the Multifaceted Impact of 2025 United States Tariff Regimes on Acoustic Insulation Supply Chains Cost Structures and Strategic Sourcing Decisions

The introduction of new tariff regimes in the United States in early 2025 has exerted a multifaceted influence on the acoustic insulation supply chain, reshaping cost structures and sourcing strategies. Materials such as fiberglass and rock wool, traditionally imported from major manufacturing hubs in Europe and Asia, now incur elevated duties that have added pressure on profit margins. To mitigate these impacts, several stakeholders have pivoted toward domestically produced alternatives or invested in local manufacturing expansions to circumvent the tariff burden.

These protective measures have also triggered a reevaluation of supplier relationships and logistics networks. Companies are increasingly negotiating long-term contracts with suppliers that offer duty-resistant pricing models, while some have relocated manufacturing closer to key end-use markets to minimize cross-border exposure. Furthermore, the cost implications of the tariff landscape have accelerated interest in alternative insulation materials like bio-based foams and recycled cellulose, which are either exempt from the new levies or qualify for preferential treatment under certain trade agreements.

As a result, decision-makers must now balance the trade-offs between material performance, total landed cost, and regulatory compliance. Savvy organizations are leveraging advanced cost-modeling tools to assess the net impact of tariff scenarios on project economics and exploring collaborative ventures that enhance supply chain resilience. In this evolving context, those who can adapt their sourcing, manufacturing footprint, and product mix with agility will gain a sustainable competitive advantage.

Unlocking Market Nuances Through Comprehensive Segmentation by Material Types Applications Product Forms End Use Industries Installation Models and Distribution Channels

A deep understanding of acoustic insulation market segmentation reveals nuanced opportunities across material types including cellulose, fiberglass, foam variants, and mineral wool. Each segment offers distinct performance attributes, from the moisture resistance and thermal stability of polyisocyanurate foams to the cost-effectiveness and fire-resistance profiles of rock wool. As manufacturers refine their formulations, they are optimizing product lines to cater to specific acoustic and environmental requirements, driving a shift toward more specialized, high-value offerings.

Application-driven segmentation further highlights the divergent needs of floors, ceilings, HVAC ducts, pipes, roofs, and walls. In floor and ceiling assemblies, solid and suspended configurations demand different density and installation methods, while flat or pitched roof systems impose unique thermal and acoustic requirements. External and internal wall solutions must balance structural constraints with desired noise-reduction performance, prompting the development of hybrid systems that integrate insulation with structural panels for streamlined installation.

Examining product form, board, loose fill, panel, and roll formats each serve distinct operational contexts, with panels often favored for retrofits and loose fill for complex geometries. End use industry segmentation underscores the varied drivers across commercial, industrial, infrastructure, and residential construction, where hospitality spaces prioritize aesthetic integration, manufacturing facilities emphasize durability, and transport corridors require vibration dampening. Installation type-whether new construction or retrofit-further delineates solution development, while distribution channel dynamics reveal that direct sales often support large-scale projects, distributors serve regional requirements, and online platforms drive small-scale or specialized procurements.

This comprehensive research report categorizes the Acoustic Insulation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Application

- Product Form

- End Use Industry

- Installation Type

- Distribution Channel

Unveiling Regional Disparities and Growth Drivers in the Acoustic Insulation Landscape Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a pivotal role in shaping acoustic insulation strategies as market landscapes diverge significantly across the Americas, Europe Middle East and Africa, and Asia Pacific. In North America and Latin America, stringent building codes and growing urbanization are driving demand for both new construction and retrofit applications, with energy-efficient and fire-resistant solutions taking precedence. Rapid infrastructure investments in highways and rail corridors are fueling specialized product development for vibration control and long-term durability.

Within Europe, the Middle East, and Africa region, regulatory harmonization across the European Union has fostered the widespread adoption of eco-certified materials, while Middle Eastern markets are increasingly focused on high-performance insulation to combat extreme temperature fluctuations. Africa’s nascent construction sector presents a unique mix of low-cost, modular solutions for emerging residential and commercial developments, creating opportunities for scalable, adaptable insulation technologies.

Asia Pacific stands out as a dynamic market characterized by rapid urban expansion, a surge in high-rise construction, and a rising middle class demanding enhanced acoustic comfort. Countries such as China, Japan, and South Korea are investing heavily in smart building initiatives, integrating sensor-enabled insulation systems to monitor environmental conditions in real-time. Conversely, Southeast Asian and Oceanic markets are balancing cost pressures with sustainability goals, leading to growth in recycled and bio-based insulation alternatives.

This comprehensive research report examines key regions that drive the evolution of the Acoustic Insulation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Imperatives and Innovation Pathways of Leading Global Acoustic Insulation Manufacturers Driving Competitive Advantage and Market Leadership

Leading manufacturers are strategically positioning themselves through targeted innovation, production footprint optimization, and collaborative partnerships to capture emergent acoustic insulation opportunities. One major player has established dedicated research centers focused on advanced polymer blends and sustainable foam options, leveraging proprietary formulations to enhance fire safety and moisture resistance. Another global competitor has expanded its regional manufacturing capacity in North America to reduce tariff exposure while benefiting from localized supply chains and rapid delivery capabilities.

Collaborative ecosystems are also shaping the competitive landscape, as companies partner with academic institutions and material science startups to accelerate product development cycles. These alliances are yielding breakthroughs such as nanofiber-enhanced board insulation that offers superior sound absorption with reduced material thickness. Furthermore, digital platforms are enabling manufacturers to deliver value-added services including installation training, performance monitoring dashboards, and lifecycle assessments, reinforcing customer loyalty and creating recurring revenue streams.

As these leading entities refine their go-to-market strategies, they are increasingly integrating sustainability credentials and smart capabilities into their flagship offerings. This multi-pronged approach underscores the necessity for continuous innovation, agile supply chain management, and ecosystem engagement to sustain competitive differentiation in a rapidly evolving market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acoustic Insulation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armacell International S.A.

- Armstrong World Industries, Inc.

- Autex Industries Ltd.

- BASF SE

- Cellecta Ltd.

- Compagnie de Saint-Gobain S.A.

- Fletcher Insulation Ltd.

- Huntsman Corporation

- Johns Manville

- Johns Manville Corporation

- Kingspan Group PLC

- Knauf Insulation GmbH

- K‑FLEX S.p.A.

- Meisei Industrial Co., Ltd.

- Owens Corning

- Paroc Group Oy

- Rockwool International A/S

- Sichuan ZISEN Acoustics Technology Co., Ltd.

- Siderise Group Ltd.

- Sika AG

- Trelleborg AB

- Ursa Insulation S.A.

Actionable Strategies for Industry Leaders to Enhance Acoustic Insulation Portfolios Drive Sustainable Growth and Mitigate Supply Chain and Regulatory Risks

To thrive amidst intensifying competition and evolving regulatory landscapes, industry leaders should prioritize the integration of sustainable materials and circular-economy principles across their product portfolios. By investing in bio-based and recycled raw materials, organizations can not only meet stringent environmental standards but also open new channels for cost optimization through waste valorization. Simultaneously, adopting smart insulation systems equipped with real-time monitoring capabilities will enable clients to demonstrate ongoing compliance and capture operational insights that drive repeat business.

Another critical recommendation is to diversify manufacturing footprints and supplier networks to mitigate tariff and geopolitical risks. Establishing regional production hubs in close proximity to key markets will reduce lead times and duty exposure, while flexible sourcing models can accommodate shifts in trade policy. Equally important is fostering collaborative R&D partnerships with technology startups and research institutions to accelerate the development of next-generation materials that deliver differentiated acoustic and thermal performance.

Finally, industry leaders should enhance customer engagement by offering end-to-end service models that encompass consultation, installation support, and lifecycle performance analysis. By positioning themselves as strategic partners rather than commodity suppliers, companies can build deeper relationships that transcend transactional interactions and drive sustainable revenue growth.

Detailing a Rigorous Mixed Methods Research Framework Combining Primary Interviews Data Triangulation and Secondary Analysis to Ensure Robust Market Intelligence

The research underpinning this analysis combined an extensive review of secondary sources with targeted primary interviews and advanced data triangulation techniques. Secondary research encompassed industry publications, regulatory documents, and technical whitepapers to establish foundational insights into material innovation, tariff developments, and regional market dynamics. Simultaneously, primary research comprised in-depth interviews with executives across manufacturing, distribution, and construction firms to validate emerging trends and capture firsthand perspectives on evolving challenges.

Quantitative data was curated from proprietary databases and cross-referenced with public records to ensure accuracy and consistency. Key variables such as material performance metrics, tariff impact scenarios, and regional adoption rates were systematically analyzed using statistical modeling to identify significant correlations and forecast potential trajectories. A rigorous validation process, including peer reviews and expert consensus workshops, was conducted to confirm the robustness of findings and recommendations.

By integrating qualitative insights with quantitative analysis, this mixed-methods framework delivers comprehensive market intelligence that balances depth with actionable precision. The methodology ensures that strategic recommendations are grounded in real-world dynamics and that the conclusions drawn reflect both current market realities and anticipated future developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acoustic Insulation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acoustic Insulation Market, by Material Type

- Acoustic Insulation Market, by Application

- Acoustic Insulation Market, by Product Form

- Acoustic Insulation Market, by End Use Industry

- Acoustic Insulation Market, by Installation Type

- Acoustic Insulation Market, by Distribution Channel

- Acoustic Insulation Market, by Region

- Acoustic Insulation Market, by Group

- Acoustic Insulation Market, by Country

- United States Acoustic Insulation Market

- China Acoustic Insulation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings on Acoustic Insulation Trends Tariff Impacts Segmentation Insights and Strategic Outlook to Empower Informed Decision Making

In synthesizing the critical findings across regulatory shifts, tariff impacts, segmentation insights, and regional dynamics, it becomes evident that acoustic insulation is poised for transformative growth driven by innovation and sustainability. Stakeholders who proactively embrace advanced materials, digital integration, and strategic supply chain realignment will be best equipped to navigate the evolving landscape and capitalize on emerging opportunities.

The cumulative impact of 2025 United States tariffs underscores the importance of agile sourcing strategies and local manufacturing investments to mitigate cost volatility. Meanwhile, granular segmentation analysis reveals that tailored solutions for distinct applications and end-use industries can unlock differentiated value propositions and foster deeper customer engagement. Regional insights further highlight the diverse market drivers across the Americas, EMEA, and Asia Pacific, emphasizing the need for customized go-to-market approaches.

Looking forward, sustained competitive advantage will hinge on continuous innovation, strategic partnerships, and an unwavering commitment to sustainability principles. By leveraging the insights and recommendations presented in this report, industry participants can forge resilient business models that deliver superior acoustic performance, regulatory compliance, and long-term growth.

Engage with Ketan Rohom Associate Director Sales and Marketing to Secure In-Depth Acoustic Insulation Market Research Insights and Drive Your Strategic Initiatives

Building on the insights and analyses presented, industry decision-makers are encouraged to connect with Ketan Rohom, Associate Director of Sales and Marketing, to explore how a tailored market research report can provide the granular intelligence needed to navigate emerging acoustic insulation opportunities. Engaging with his expertise will enable deeper understanding of disruptive material technologies, tariff-driven supply chain realignments, and regional demand dynamics that are reshaping the landscape. By securing a comprehensive report, stakeholders gain access to exclusive data-driven recommendations that can inform investment priorities, product development roadmaps, and partnership strategies designed to maximize competitive advantage.

Ketan Rohom’s extensive experience in guiding clients through complex market environments ensures that each report is customized to address specific organizational goals, whether optimizing distribution networks, accelerating innovation pipelines, or mitigating regulatory risks. Interested professionals can initiate discussions to define key deliverables, choose the most relevant research modules, and schedule interactive briefing sessions that deliver actionable intelligence. This collaborative approach not only clarifies critical market drivers but also provides a strategic blueprint for sustainable growth in a rapidly evolving acoustic insulation sector.

We invite industry leaders to reach out today and leverage this unparalleled opportunity to access forward-looking analysis and expert guidance. By partnering directly with Ketan Rohom, you will secure the insights needed to make informed decisions, drive revenue growth, and establish a lasting competitive edge.

- How big is the Acoustic Insulation Market?

- What is the Acoustic Insulation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?