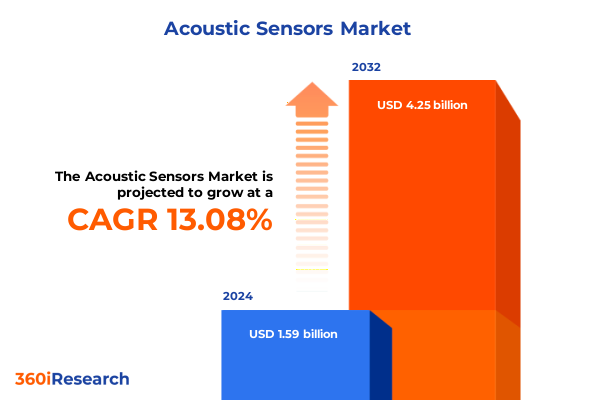

The Acoustic Sensors Market size was estimated at USD 1.79 billion in 2025 and expected to reach USD 2.02 billion in 2026, at a CAGR of 13.11% to reach USD 4.25 billion by 2032.

Exploring the Transformative Impact of Acoustic Sensors Across Industries as Innovations in Sensing Technology Drive Enhanced Performance and Application Horizons

The acoustic sensor industry has emerged as a cornerstone of modern technological innovation, enabling precise detection, monitoring, and analysis of sound waves across numerous markets. These devices convert physical vibrations into measurable electrical signals, unlocking insights that drive performance improvements and enhance safety in everything from automotive collision detection to underwater exploration. As digitalization accelerates, the integration of advanced signal processing and artificial intelligence is reshaping sensor capabilities, broadening application horizons and unlocking new value for manufacturers and end users alike.

In recent years, rapid progress in materials science and microfabrication has fueled the miniaturization of acoustic sensors, boosting sensitivity while reducing power consumption. Concurrently, the Internet of Things (IoT) revolution has spurred demand for connected sensing solutions that deliver real-time data streams, enabling predictive maintenance in industrial environments and health monitoring within medical devices. Regulatory mandates and heightened safety standards are further amplifying the need for reliable acoustic monitoring systems, driving procurement decisions across industries and setting the stage for sustained market expansion.

Unveiling the Major Technological and Market Shifts Reshaping the Acoustic Sensor Industry Through Connectivity, AI Integration and Advanced Materials

The competitive landscape of acoustic sensors is undergoing dramatic restructuring as converging technological trends forge new paths for product development and deployment. Advances in microelectromechanical systems (MEMS) have driven unprecedented levels of integration, power efficiency, and cost-effectiveness, empowering designers to embed sophisticated sensing capabilities directly into consumer devices, automotive platforms, and industrial machinery. At the same time, the proliferation of machine learning algorithms is enabling adaptive signal processing, where sensors can self-calibrate, filter noise, and detect complex acoustic patterns without external computing resources.

These shifts are complemented by breakthroughs in novel materials-from piezoelectric polymers to graphene composites-that offer enhanced sensitivity, broader frequency response, and greater environmental resilience. The rise of digital twins and virtualization in manufacturing and infrastructure management is also catalyzing demand for high-fidelity acoustic data, feeding analytics platforms that optimize operational workflows and asset lifecycles. Furthermore, the surging interest in smart cities and autonomous systems has positioned acoustic sensors as vital components of situational awareness architectures, reinforcing their strategic importance in future-proofed technology roadmaps.

Assessing the Cumulative Effects of 2025 United States Tariffs on Global Acoustic Sensor Supply Chains and Component Cost Structures

As the United States implements a new tranche of tariffs in 2025 targeting certain electronic components and raw materials, the acoustic sensor market is grappling with layered cost pressures and supply chain recalibrations. Tariffs on piezoelectric ceramics, semiconductor packaging, and related assembly components have driven component prices higher, compelling manufacturers to reassess sourcing strategies and push for renegotiated vendor contracts. These adjustments have ripple effects across global production networks, increasing lead times and incentivizing nearshoring initiatives to mitigate import duties and currency fluctuations.

In parallel, original equipment manufacturers (OEMs) and subsystem integrators are exploring alternative materials and modular designs to reduce dependency on tariff-exposed inputs. This has led to a wave of innovation in synthetic piezoelectric compounds and hybrid MEMS architectures, which aim to deliver comparable performance at lower landed costs. Moreover, strategic partnerships and joint ventures are emerging as viable mechanisms to share development expenses and distribute risk. Looking ahead, companies that proactively diversify their supplier base and invest in agile procurement processes will be better positioned to weather tariff volatility and capitalize on evolving trade policy dynamics.

Illuminating Critical Market Segmentation Drivers Across Types, Technologies, End Uses and Applications to Uncover Strategic Growth Opportunities

Market segmentation offers a nuanced lens to understand performance drivers and uncover areas of untapped potential. Based on type, detectors range from acoustic emission sensors-available in resonant and wideband formats-to hydrophones differentiated by high-frequency and low-frequency capabilities. Microphones span condenser, dynamic, and MemS-based designs, while sonar sensors are characterized as either multi-beam or single-beam systems. Ultrasonic sensors complete this landscape with distance, level, and proximity variants, each tailored to specific detection and measurement requirements.

When viewed through a technological prism, analog and digital platforms coexist alongside MemS solutions, the latter subdivided into capacitive and piezoelectric architectures. Pure piezoelectric technologies further bifurcate into ceramic and crystal implementations, each balancing sensitivity with cost efficiency. Across end-use sectors, the appetite for acoustic sensing is evident in automotive collision detection, infotainment, and parking assistance; consumer electronics applications such as smart home devices, smartphones, and wearable gadgets; healthcare deployments in hearing aids, patient monitoring, and telehealth platforms; industrial functions including environmental monitoring, machine condition assessment, and process control; and military and defense systems for communication, sonar surveillance, and reconnaissance support.

Further delineating application areas, leak detection solutions monitor pipelines and storage tanks, non-destructive testing addresses flaw detection and weld inspection, and structural health monitoring oversees bridges and dams. Underwater exploration extends from maritime surveying to submerged communication links, while voice recognition platforms drive smart speakers and virtual assistants. Each segment exhibits distinct growth dynamics, feeding into the broader market narrative and informing targeted strategies.

This comprehensive research report categorizes the Acoustic Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- End Use

- Application

Revealing Distinct Regional Dynamics and Emerging Trends in the Americas, Europe Middle East and Africa and Asia Pacific Acoustic Sensor Markets

Regional nuances shape the trajectory of acoustic sensor adoption, with the Americas leading in research investment and early commercial uptake. In North America, strong demand from automotive manufacturers and aerospace developers fuels continuous innovation, supported by public-private partnerships and robust regulatory frameworks that emphasize safety and environmental monitoring. Latin America, while still developing its manufacturing base, is witnessing pilot deployments in oil and gas leak detection as aging infrastructure warrants enhanced surveillance.

Europe, Middle East and Africa present a mosaic of market conditions, from advanced industrialized economies prioritizing structural health monitoring for critical assets to emerging markets in the Gulf investing in offshore exploration and defense capabilities. Strict emissions and safety standards in the European Union have catalyzed acoustic solutions for machinery condition monitoring and workplace noise management. Simultaneously, energy-rich nations in the Middle East are funding large-scale underwater projects that expand demand for hydrophones and sonar arrays.

In the Asia-Pacific region, rapid urbanization and digital transformation are driving the fastest growth rates globally. China’s smart city initiatives and Japan’s leadership in robotics create fertile ground for integrated acoustic sensing products. India’s burgeoning healthcare sector is accelerating adoption of auditory diagnostics, and Southeast Asian manufacturing hubs are scaling production of cost-effective MEMS-based microphones. These contrasting regional forces collectively shape the global market expansion trajectory.

This comprehensive research report examines key regions that drive the evolution of the Acoustic Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Initiatives and Competitive Positioning of Leading Players Shaping the Future of Acoustic Sensor Innovation and Partnerships

Key industry participants are deploying diverse strategic playbooks to assert their market leadership and catalyze future growth. Leading manufacturers are prioritizing research and development investments to refine MEMS processes, develop proprietary materials formulations, and integrate AI-driven signal interpretation into sensor platforms. Collaboration between sensor OEMs and software providers has accelerated the emergence of turnkey solutions that combine hardware, analytics, and cloud connectivity.

Strategic acquisitions and partnerships are consolidating supply chain capabilities and broadening product portfolios. Several top-tier firms have acquired specialty component makers to secure intellectual property and optimize vertical integration, while alliances with academic institutions are generating breakthroughs in nano-fabrication and advanced piezoelectric composites. In parallel, market players are strengthening after-sales services and launching digital portals to streamline calibration, maintenance, and remote diagnostics, reinforcing loyalty among high-value industrial accounts.

Businesses that demonstrate agility in channel expansion-leveraging e-commerce platforms and forging distribution agreements across emerging markets-are gaining traction. Ultimately, the competitive landscape is defined by the ability to deliver differentiated performance, comprehensive support, and scalable pricing models, positioning certain innovators as preferred partners across multiple sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acoustic Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAC Technologies Holdings Inc.

- Analog Devices, Inc.

- Cirrus Logic, Inc.

- Goertek Inc.

- Hosiden Corporation

- Infineon Technologies AG

- Knowles Electronics, LLC

- MEMSensing Microsystems Co., Ltd.

- Qualcomm Incorporated

- Robert Bosch GmbH

- Sonion

- STMicroelectronics N.V.

- TDK Corporation

- Texas Instruments Incorporated

Delivering Actionable Recommendations to Guide Industry Leaders in Leveraging Technological Advances and Market Dynamics for Sustainable Growth

Industry leaders seeking to capitalize on market momentum should adopt a multifaceted approach that balances technological exploration with pragmatic business considerations. Prioritizing partnerships with analytics firms and system integrators can expedite the evolution from standalone sensors to cohesive solutions, enhancing value propositions for end users. Investing in flexible manufacturing capacity and just-in-time inventory strategies will mitigate the impact of tariff shocks and component shortages, while diversifying supplier networks can safeguard against geopolitical risk.

In parallel, channel strategies must adapt to evolving customer buying behaviors. Digital commerce platforms, direct-to-consumer models, and bundled service offerings will be critical to capture a broader addressable market, especially in consumer electronics and healthcare segments. Fostering innovation ecosystems through open sensor development kits and developer communities can also spur new applications and accelerate time to market.

Finally, sustainability considerations-from eco-conscious materials selection to energy-efficient designs-are becoming non-negotiable criteria for many enterprise accounts. Embedding circular economy principles in product lifecycles and transparently reporting environmental impact metrics will strengthen brand reputation and align with emerging regulatory requirements globally.

Detailing Rigorous Research Methodology Combining Primary Insights and Secondary Data to Ensure Robust and Credible Market Analysis

This study is underpinned by a robust research design, combining primary insights from in-depth interviews with C-level executives, product managers, and technical experts across key markets. These qualitative inputs were complemented by quantitative surveys targeting end users in automotive, aerospace, healthcare, industrial, and defense sectors, ensuring balanced representation of demand-side perspectives.

Secondary research drew upon a wide array of publicly available sources, including corporate disclosures, regulatory filings, academic journals, and conference proceedings, providing historical context and technical validation. Proprietary databases were analyzed to track patent activity, funding trends, and emerging start-up developments, while rigorous data triangulation techniques ensured the reliability of findings.

Analytical methodologies encompassed both bottom-up and top-down approaches, enabling cross-verification of revenue streams, technology adoption rates, and end-use consumption patterns. A scenario-based sensitivity analysis was also conducted to assess the implications of variable factors such as tariff changes, raw material price fluctuations, and shifts in regulatory standards. Geographic and temporal scopes were clearly defined, with a focus on trends observed from 2020 onward and projections extending through 2027.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acoustic Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acoustic Sensors Market, by Type

- Acoustic Sensors Market, by Technology

- Acoustic Sensors Market, by End Use

- Acoustic Sensors Market, by Application

- Acoustic Sensors Market, by Region

- Acoustic Sensors Market, by Group

- Acoustic Sensors Market, by Country

- United States Acoustic Sensors Market

- China Acoustic Sensors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3498 ]

Concluding Strategic Implications and Outlook for the Acoustic Sensor Industry Amidst Evolving Technologies and Global Market Trends

In summary, the acoustic sensor industry stands at the cusp of transformative growth, driven by converging advances in MEMS, AI-enabled signal processing, and novel material sciences. While escalating trade tensions and tariff regimes present headwinds, they are also catalyzing innovation in alternative component sourcing and modular design architectures. Strategic segmentation analysis highlights clear pathways to value creation across types, technologies, end-use sectors, and applications, underscoring the importance of tailored approaches to market entry and expansion.

Regional dynamics reveal that while mature markets continue to demand performance optimization and regulatory compliance, emerging markets in Asia-Pacific are embracing digital integration and ambitious infrastructure projects that promise outsized growth. Competitive positioning will increasingly hinge on the ability to forge cross-industry partnerships, deliver turnkey solution frameworks, and maintain agile supply chains that can adapt to policy shifts.

Ultimately, companies that embrace data-driven decision making, foster open innovation ecosystems, and commit to sustainability will be poised to lead the next wave of acoustic sensor adoption. This research serves as a strategic compass, offering industry stakeholders a clear line of sight into opportunities and challenges shaping the sector’s evolution.

Secure In-Depth Acoustic Sensor Market Insights Today by Engaging Directly with Associate Director of Sales and Marketing to Empower Your Decisions

To secure unparalleled strategic insights into the rapidly evolving acoustic sensor market, we invite you to engage directly with Ketan Rohom, Associate Director of Sales and Marketing. By connecting with Ketan, you will gain personalized guidance on how the comprehensive market research report can be tailored to your unique business objectives, uncovering opportunities that align with your strategic priorities and mitigating potential risks before they arise. This engagement ensures that you not only receive detailed data and analysis but also actionable frameworks designed to accelerate innovation, optimize supply chains, and enhance competitive positioning.

Don’t miss the chance to transform your decision-making process with data-driven clarity. Reach out today and leverage this opportunity to discuss customized packages, licensing options, and enterprise-wide deployments. Elevate your understanding of emerging applications, shifting regulatory landscapes, and competitive dynamics by partnering with an expert who understands both the technical nuances and commercial imperatives of acoustic sensors. Act now to gain a strategic advantage and ensure your organization remains at the forefront of industry developments.

- How big is the Acoustic Sensors Market?

- What is the Acoustic Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?