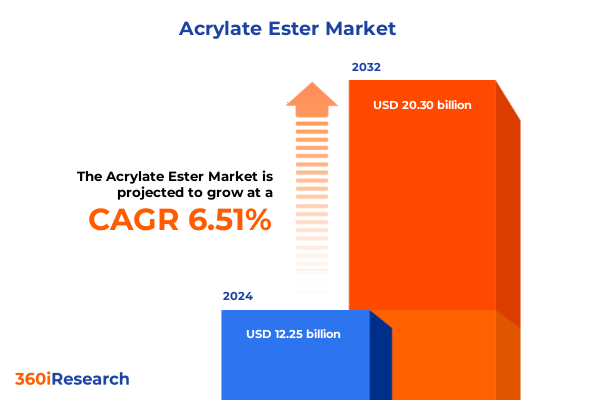

The Acrylate Ester Market size was estimated at USD 13.03 billion in 2025 and expected to reach USD 13.86 billion in 2026, at a CAGR of 6.54% to reach USD 20.30 billion by 2032.

Unveiling the Transformative Potential and Market Dynamics of Acrylate Esters Across Diverse Industrial Applications and Emerging Technologies

Acrylate esters represent a cornerstone of modern polymer chemistry, renowned for their versatility and robust performance characteristics across a breadth of industrial applications. At the molecular level, these compounds exhibit excellent adhesion properties, clarity, and flexibility, which underpin their prevalence in adhesives, coatings, plastics, and textile finishing. From construction adhesives that bond critical building materials to pressure sensitive adhesives that enable next-generation medical devices, the chemical and physical attributes of acrylate esters play a pivotal role in product innovation.

Driven by ongoing demand for durable yet lightweight materials, acrylate esters have become integral to formulations aimed at improving environmental performance and operational efficiency. Recent advancements in polymerization techniques and raw material sourcing have elevated the functional profile of these esters, allowing manufacturers to tailor viscosity, tack, and film formation characteristics to exacting specifications. Consequently, stakeholders across the value chain-from raw material producers to end-use product developers-view acrylate esters as essential enablers of differentiated performance and cost-effective manufacturing.

Transitioning seamlessly from conventional solvent-based systems toward waterborne and high-solid architectures, the acrylate ester market continues to evolve in response to regulatory pressures and sustainability targets. As industry participants strive to balance performance requirements with emissions reduction mandates, the role of acrylate esters in facilitating low-VOC adhesives and coatings has never been more pronounced. This introductory overview sets the stage for deeper examination into the dynamic forces shaping this critical segment of the specialty chemicals landscape.

Identifying Key Technological Advances and Market Shifts Reshaping Global Acrylate Ester Production and Application Landscape

The acrylate ester landscape is undergoing significant transformation as industry participants integrate advanced polymerization processes and tailor molecular architectures to meet evolving end-use demands. Emulsion polymerization techniques, for instance, have been optimized to produce finely dispersed polymer particles, yielding coatings and adhesives with superior film integrity and environmental friendliness. In parallel, solution and suspension polymerization methods are being refined to deliver products with precise molecular weight distributions, enhancing mechanical performance in high-end applications.

Emerging trends in bio-based feedstocks are further reshaping the market, as manufacturers explore biomass-derived monomers to reduce dependency on petrochemical sources. This shift not only addresses sustainability objectives but also introduces unique functional properties, such as enhanced adhesion on difficult substrates. Meanwhile, the proliferation of nanotechnology has inspired the incorporation of nanofillers into acrylate ester matrices, driving improvements in barrier properties, thermal stability, and scratch resistance for advanced coatings applications.

Regulatory developments in key regions are acting as catalysts for innovation, with low-VOC and non-hazardous formulations gaining regulatory approval and customer acceptance. At the same time, digitalization in manufacturing-from process control to supply chain visibility-is enabling real-time quality monitoring and predictive maintenance, which reduces variability and strengthens product consistency. Collectively, these technological and regulatory shifts are unlocking new growth corridors and compelling stakeholders to adopt a more agile, innovation-driven approach.

Analyzing the Far-Reaching Effects of 2025 United States Tariffs on Acrylate Ester Supply Chains and Industry Economics

The implementation of targeted import duties by the United States in 2025 has introduced layered cost pressures and supply chain realignments within the acrylate ester industry. Importers of raw monomers have encountered incremental tariff expenses, prompting end-users to reassess sourcing strategies and negotiate long-term contracts with domestic producers. This shift has, in turn, influenced pricing dynamics throughout the value chain, as distributors and formulators absorb or pass on these additional costs to downstream customers.

Supply chain optimization has become paramount in mitigating the ripple effects of tariffs. Companies have increased buffer stocks of critical monomers and diversified procurement channels to include non-tariff jurisdictions. Concurrently, there has been a notable uptick in investments to expand onshore production capacity, enabling manufacturers to localize supply and reduce exposure to import levies. As a result, collaborative partnerships between domestic producers and downstream formulators have intensified, focusing on supply security and cost predictability.

Despite the short-term disruptions caused by tariff implementation, longer-term market participants are leveraging this period to fortify their competitive positions. By optimizing logistics networks, integrating vertically, and enhancing operational efficiencies, stakeholders are building resilience to potential future trade barriers. This strategic recalibration underscores the industry’s capacity to adapt to policy shifts while maintaining continuity in product availability and service excellence.

Exploring Segmentation Strategies to Illuminate Application Product Polymer Technology Source Form and Sales Channel Trends in Acrylate Ester Markets

Insights into application-based segmentation reveal that adhesives and sealants maintain a commanding presence, with construction adhesives harnessing acrylate ester’s rapid cure times to improve building productivity, medical adhesives leveraging biocompatible formulations for wound care, and pressure sensitive adhesives facilitating adhesive tapes and labels with optimized tack profiles. Although paints and coatings are predominantly anchored by architectural substrates seeking UV resistance and weather durability, industrial coatings prioritize chemical resistance and adhesion on metal and plastic assemblies. In plastics, acrylate esters serve as reactive modifiers that enhance impact resistance and surface finish, while within the textiles segment, fiber modification applications impart hydrophobicity or antimicrobial functionality, and textile finishing processes utilize acrylate chemistries for improved hand feel and durability.

When examining product type distinctions, 2-ethylhexyl acrylate emerges as a preferred monomer in formulations where flexibility and low-temperature performance are critical, whereas butyl acrylate underpins formulations requiring balanced hardness and adhesion. Ethyl acrylate offers a middle ground for coatings that demand moderate hardness and clarity, and methyl acrylate is selected where rapid polymerization and high reactivity are essential. Across polymer types, homopolymers provide targeted property enhancement in single-component systems, while copolymers-both acrylic and styrene-acrylic-enable fine-tuning of hardness, adhesion, and chemical resistance for specialized applications.

The choice of polymerization technology plays a decisive role in final product attributes: bulk polymerization yields high-purity polymer streams, emulsion processes enable ease of handling and reduced VOC emissions, solution polymerization grants molecular weight control, and suspension polymerization offers spherical particle morphologies favored in powder coatings and injection molding. Raw material source is increasingly bifurcated between petrochemical origins and bio-based alternatives, each selected for cost competitiveness or sustainability credentials. In terms of form factor, liquid esters remain dominant for ease of mixing, while pelletized and powdered grades support simplified transport and direct incorporation into extrusion or molding processes. Finally, sales channels span direct relationships with strategic accounts and indirect distribution networks that include traditional distributors, e-commerce platforms, and retail outlets, addressing the diverse procurement preferences of bulk purchasers and small-scale users alike.

This comprehensive research report categorizes the Acrylate Ester market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Polymer Type

- Technology

- Source

- Form

- Application

- Sales Channel

Assessing Regional Dynamics and Demand Drivers Across Americas Europe Middle East Africa and Asia Pacific Acrylate Ester Markets

Across the Americas, infrastructure investment and construction activity continue to drive significant consumption of acrylate esters in adhesives and sealants. The region’s emphasis on renovation and retrofit projects has catalyzed demand for pressure sensitive adhesives and low-VOC coatings, while advancements in medical device manufacturing have expanded the use of medical grade acrylate formulations. North American producers have also capitalized on shale-derived feedstocks to secure cost advantages, prompting downstream manufacturers to reinforce domestic supply chains.

Within Europe, Middle East, and Africa, stringent environmental regulations have propelled the adoption of sustainable acrylate technologies. Manufacturers in Western Europe, underpinned by rigorous emissions targets, are heavily investing in waterborne and high-solid systems, whereas emerging economies in the Middle East eye infrastructure expansion to broaden application horizons. Furthermore, the region’s strategic ports facilitate export of specialized ester grades to neighboring markets, underscoring its dual role as innovation hub and distribution gateway.

Asia-Pacific stands as the most dynamic region, buoyed by rapid urbanization and industrialization. Major economies are scaling up production capacities to satisfy surging demand for paints and coatings in residential and automotive applications. Meanwhile, textile hubs are implementing advanced finishing processes that rely on acrylate esters to deliver value-added fabric functionalities. Geographic proximity to raw material sources, coupled with competitive labor and logistics ecosystems, has positioned Asia-Pacific as both a major consumer and exporter of acrylate ester derivatives.

This comprehensive research report examines key regions that drive the evolution of the Acrylate Ester market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Acrylate Ester Manufacturers and Their Strategic Initiatives in Innovation Partnerships and Market Expansion

Leading chemical companies have intensified their focus on acrylate ester innovation through targeted R&D initiatives and strategic collaborations. Major producers have entered joint ventures with specialty polymer firms to co-develop next-generation monomers offering enhanced sustainability profiles. For instance, partnerships aimed at commercializing bio-derived acrylate monomers are gaining traction, reflecting a broader industry pivot toward renewable feedstocks and circular economy principles.

Additionally, capacity expansions at key manufacturing sites have been announced to meet rising global demand. Select stakeholders have optimized existing plants to accommodate dual processing lines capable of producing both petrochemical and bio-based esters, thereby affording greater flexibility in response to raw material cost fluctuations. Concurrently, technology licensing agreements have proliferated, enabling smaller regional players to adopt advanced polymerization platforms without significant capital investment.

To strengthen market presence, several leading players are integrating digital platforms that offer real-time analytics on production performance and quality metrics. This digital transformation has been complemented by supply chain ecosystems that leverage blockchain and IoT technologies to enhance traceability and transparency. Furthermore, customer engagement strategies have evolved to include technical service hubs that assist formulators in optimizing acrylate ester formulations for novel applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acrylate Ester market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Allnex Group S.à r.l.

- Arkema S.A.

- Ashland Global Holdings Inc.

- BASF SE

- Celanese Corporation

- Dow Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Formosa Plastics Corporation

- Hexion Inc.

- Jiangsu Jurong Chemical Co., Ltd.

- Jilin Carbon Group Co., Ltd.

- Kaneka Corporation

- Kolon Industries Inc

- LG Chem Ltd.

- Mitsubishi Chemical Holdings Corporation

- Momentive Performance Materials Inc.

- Sasol Limited

- Shandong Yousuo Chemical Co., Ltd.

- Shanghai Huayi Acrylic Acid Co., Ltd.

- Sibur Holding PJSC

- Sumitomo Chemical Co., Ltd.

- Toagosei Co., Ltd.

- Wanhua Chemical Group Co., Ltd.

Crafting Strategic Pathways for Industry Leaders to Capitalize on Emerging Opportunities and Navigate Challenges in the Acrylate Ester Market

Industry leaders should prioritize the development of bio-based acrylate monomers by establishing feedstock collaborations with agricultural and waste biomass suppliers. Such alliances can mitigate feedstock volatility and reinforce sustainability credentials, while enabling first-mover advantage in emerging green chemistry segments. In parallel, investment in modular manufacturing units capable of rapid scale-up and product diversification will enhance responsiveness to market shifts and regulatory changes.

Integrating digital supply chain management solutions is equally critical to optimize inventory levels and reduce lead times. By deploying advanced analytics and AI-driven forecasting tools, companies can anticipate demand fluctuations, adjust production schedules, and minimize working capital tying up raw materials. These technologies also support quality control, enabling rapid identification and correction of process deviations to uphold stringent performance standards.

Finally, forging strategic partnerships across the value chain-from raw material suppliers to end-use customers-will facilitate co-innovation and secure long-term contracts that stabilize revenue streams. Collaborative R&D programs with downstream formulators can uncover novel application niches, while co-marketing initiatives can accelerate commercialization of differentiated acrylate ester solutions. Such multidimensional engagement will position organizations to capture growth opportunities and navigate evolving market dynamics with confidence.

Detailing Robust Research Methodologies and Data Collection Techniques Employed to Ensure Insightful Analysis of the Global Acrylate Ester Market

This analysis is built upon a rigorous secondary research framework that encompassed peer-reviewed journals, industry white papers, patent filings, and regulatory documents. Comprehensive data collection extended to corporate disclosures, technical presentations, and public financial reports to ensure a holistic understanding of production technologies and business strategies. Information was synthesized to identify technological trends, policy impacts, and competitive landscapes without relying on proprietary databases.

Primary research supplemented these findings through in-depth interviews with key stakeholders, including chemical engineers, product managers, and procurement executives. These conversations illuminated current manufacturing practices, supply chain vulnerabilities, and innovation roadmaps, providing qualitative insight into real-time industry dynamics. Inputs were triangulated with observational studies of manufacturing sites to validate process innovations and capacity utilization profiles.

Data integrity was maintained through a stringent validation protocol, wherein multiple analysts cross-verified facts, figures, and qualitative assertions. Each thematic section underwent peer review to uphold analytical rigor and minimize bias. The resulting methodology ensures that the conclusions drawn reflect both macro-level trends and micro-level operational realities within the global acrylate ester ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acrylate Ester market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acrylate Ester Market, by Product Type

- Acrylate Ester Market, by Polymer Type

- Acrylate Ester Market, by Technology

- Acrylate Ester Market, by Source

- Acrylate Ester Market, by Form

- Acrylate Ester Market, by Application

- Acrylate Ester Market, by Sales Channel

- Acrylate Ester Market, by Region

- Acrylate Ester Market, by Group

- Acrylate Ester Market, by Country

- United States Acrylate Ester Market

- China Acrylate Ester Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Summarizing Critical Insights and Strategic Imperatives That Define the Future Trajectory and Competitive Edge in the Acrylate Ester Industry

Through examination of molecular innovations, shifting regulatory frameworks, and evolving trade policies, it is evident that the acrylate ester industry is poised for sustained transformation. The convergence of advanced polymerization technologies, sustainability imperatives, and digitalization initiatives has created a landscape in which agility and innovation are paramount. Stakeholders who embrace these multifaceted drivers will be best positioned to capitalize on emerging market segments.

The cumulative impact of the 2025 United States tariffs underscores the importance of supply chain resilience and strategic sourcing. Companies that proactively diversify their procurement channels and enhance domestic production capabilities are mitigating risks and preserving competitive advantage. Likewise, those who leverage segmentation insights to tailor products for specific applications-including construction adhesives, industrial coatings, and textile finishing-are unlocking value across the value chain.

By harnessing regional market dynamics-spanning the Americas’ infrastructure growth, EMEA’s regulatory stringency, and Asia-Pacific’s capacity expansions-forward-thinking organizations can navigate complexity and drive innovation. Ultimately, the interplay of technology, policy, and partnership strategies will define the trajectory of the acrylate ester sector, making strategic alignment with these imperatives essential for future success.

Engage with Ketan Rohom to Unlock Comprehensive Acrylate Ester Market Insights and Drive Informed Strategic Decisions with Expert Guidance

To explore the comprehensive market intelligence and strategic insights outlined in this report, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Engaging with Ketan will provide you with tailored guidance on how these findings relate to your organization’s objectives and operational context. With his in-depth understanding of industry dynamics and client-specific imperatives, he can assist in designing a bespoke approach to leverage the full breadth of analysis provided.

By partnering with Ketan, you gain access to exclusive advisory sessions that translate broad market trends into actionable plans for innovation, risk mitigation, and growth acceleration. His consultative expertise ensures that you receive targeted recommendations aligned with your strategic goals, whether you are a manufacturer, supplier, or downstream user of acrylate esters. Contact Ketan now to secure your copy of the complete market research report and unlock the insights you need to stay ahead in this competitive landscape.

- How big is the Acrylate Ester Market?

- What is the Acrylate Ester Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?