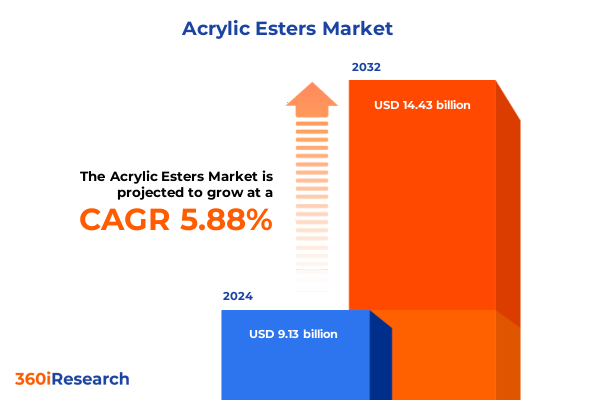

The Acrylic Esters Market size was estimated at USD 9.64 billion in 2025 and expected to reach USD 10.18 billion in 2026, at a CAGR of 5.92% to reach USD 14.43 billion by 2032.

Setting the Stage for Acrylic Esters: Unveiling Their Strategic Importance Across High-Performance Industries in Today's Competitive Market

The acrylic esters market holds a unique position at the junction of chemistry, engineering, and high-performance materials. These compounds, characterized by their versatile monomeric structures and tunable functional properties, serve as foundational building blocks in formulations ranging from adhesives and sealants to architectural coatings and specialty plastics. By manipulating ester side chains and copolymer configurations, manufacturers achieve precise performance attributes such as enhanced adhesion, controlled viscosity, and tailored mechanical resilience. As end-use industries increasingly demand materials that can withstand rigorous environmental, regulatory, and operational constraints, acrylic esters emerge as indispensable components in product innovation.

This executive summary navigates the essential dynamics shaping the acrylic esters space, offering an integrated perspective on regulatory shifts, supply chain realignments, and the strategic responses of key stakeholders. Readers are invited to explore the technological advancements that underpin next-generation formulations, to understand how tariff policies are reshaping sourcing decisions, and to examine segmentation insights that reveal nuanced demand patterns. With a clear focus on actionable intelligence, this introduction sets the stage for a comprehensive analysis that equips decision-makers with the insights necessary to navigate and capitalize on the evolving competitive landscape.

How Technological Innovations and Sustainable Practices Are Redefining Demand Dynamics and Value Chains in the Acrylic Esters Ecosystem

Recent years have witnessed transformative shifts in the acrylic esters landscape, driven by both technological breakthroughs and an unwavering push toward sustainability. Innovative reaction pathways-such as continuous flow processes and microwave-assisted polymerizations-have enhanced production efficiencies, reduced energy footprints, and unlocked new copolymer architectures. Concurrently, the integration of bio-based feedstocks, including plant-derived methacrylate precursors, has gained traction, reflecting a broader industry commitment to circular economy principles and tighter environmental regulations.

These developments have catalyzed downstream innovation, with formulators leveraging digital simulation tools and artificial intelligence to expedite product development cycles. Virtual screening platforms now predict copolymer behavior under diverse conditions, accelerating the path from concept to commercialization. Moreover, the rise of waterborne and powder coatings over traditional solventborne systems underscores a growing preference for lower volatile organic compound (VOC) emissions. As a result, manufacturers are reassessing legacy portfolios and forging collaborations with technology providers to embed green chemistry at every stage. This paradigm shift not only enhances performance metrics but also aligns with evolving end-user expectations for eco-efficient, compliant materials.

Assessing the Far-Reaching Consequences of Recent United States Tariff Measures on the Acrylic Esters Supply Chain and Market Competitiveness

In 2025, new customs duties imposed by the United States on certain acrylic monomers and intermediates have reverberated across the supply chain, prompting a comprehensive reassessment of sourcing strategies. Domestic producers, previously operating at a cost disadvantage, have capitalized on enhanced protection to bolster utilization rates and invest in capacity expansions along the Gulf Coast. Conversely, importing entities have confronted elevated landed costs, driving contractual renegotiations and intensified supplier diversification efforts.

The ripple effects extend downstream, as formulators and end users absorb incremental price pressure or seek alternative chemistries to mitigate budgetary impact. To preserve margin integrity, several multinational players have entered long-term offtake agreements with vertically integrated manufacturers, while others have explored in-house synthesis capabilities. Simultaneously, spot market volatility has increased, with traders adjusting order volumes and delivery schedules to reflect shifting duty landscapes. As a result, supply reliability and contractual flexibility now rank among the principal criteria for partner selection, underscoring how tariff policy can recalibrate competitive positioning.

Deciphering Essential Segmentation Trends That Are Shaping Demand Patterns Across Product Types, Applications, End-Use Industries, and Purity Grades

Demand patterns within the acrylic esters market are best understood through a multidimensional segmentation lens. Based on product type, stakeholders navigate a portfolio that spans 2-Ethylhexyl Acrylate, Ethyl Acrylate, Methyl Acrylate, and n-Butyl Acrylate, each finding unique end-use applications. For instance, 2-Ethylhexyl Acrylate’s lower glass transition temperature underpins flexible adhesive formulations, while Methyl Acrylate’s rapid cure kinetics support performance-driven coatings. Ethyl Acrylate often bridges cost and performance in solventborne systems, whereas n-Butyl Acrylate delivers balanced film formation properties critical to waterborne paints.

Shifting to application segmentation, the market encompasses Adhesives & Sealants, Construction, Paints & Coatings, Plastics, and Textiles. Within paints and coatings, powder, solventborne, and waterborne technologies each exhibit distinct adoption trajectories. Waterborne systems continue to gain favor due to stricter VOC regulations, while powder coatings maintain strength in industrial and automotive sectors. In the larger realm of adhesives and sealants, increasing demand for structural bonding solutions drives selective monomer blending strategies.

End-use industry segmentation further refines insights, highlighting adhesives, architectural coatings, industrial coatings, plastics processing, and textile finishing. Each segment imposes specialized performance and regulatory criteria, shaping product design. Purity grade differentiation-spanning electronic, industrial, and lab reagent grades-reflects the criticality of trace impurity control for semiconductor encapsulation, general-purpose applications, and research laboratories. Moreover, market dynamics evolve across monomer and copolymer forms, with copolymer offerings facilitating tailored property profiles, while monomers enable granular formulation flexibility. Finally, distribution pathways via direct sales, distributors, and online platforms underscore the strategic importance of channel selection, as digital procurement solutions gain prominence in streamlining order fulfillment and customer engagement.

This comprehensive research report categorizes the Acrylic Esters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity Grade

- Form

- Application

- End Use Industry

- Sales Channel

Exploring How Geographic Variations from the Americas Through EMEA to Asia-Pacific Are Steering Innovation, Adoption Patterns, and Competitive Strategies

Regional dynamics in the acrylic esters market showcase the influence of localized feedstock availability, regulatory frameworks, and end-user demand profiles. In the Americas, a convergence of petrochemical access and robust downstream industries has fostered a landscape ripe for innovation. U.S. Gulf Coast investments in production capacity and integration of shale-based ethylene feedstocks continue to enhance cost competitiveness, while North American formulators capitalize on renewable feedstock initiatives to develop next-generation adhesive and coating systems.

Across Europe, the Middle East, and Africa (EMEA), stringent environmental regulations-particularly under the EU’s REACH framework-have catalyzed a pivot toward high-purity electronic grades and low-VOC formulations. In Western Europe, sustainability targets drive adoption of recycled copolymers, whereas in the Middle East, emerging export facilities leverage petrochemical reserves to serve global markets. Within Africa, nascent infrastructure and growing construction activity create pockets of opportunity for adhesive and sealant producers, albeit with logistical and quality control challenges.

The Asia-Pacific region presents a dual narrative of rapid consumption growth and intense competition. China’s expansive coatings and plastics industries consume large volumes of n-Butyl and Ethyl Acrylate, supported by domestic manufacturers scaling capacity. India’s construction boom and textile finishing sector propel demand for versatile monomers, while Southeast Asian markets adopt both cost-effective solventborne solutions and more advanced waterborne technologies. Collectively, these regional nuances underscore the imperative for tailored strategies that align product attributes, regulatory compliance, and supply chain resilience in each geography.

This comprehensive research report examines key regions that drive the evolution of the Acrylic Esters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Moves, Partnerships, and Innovation Pipelines of Leading Corporations Shaping the Future Landscape of Acrylic Esters

Leading companies in the acrylic esters domain are deploying a range of strategic maneuvers to fortify their market positions. One global specialty chemicals manufacturer has announced a significant expansion of its Gulf Coast acrylic acid and ester facilities, leveraging vertical integration to secure monomer supplies and shield margins from tariff fluctuations. Another industry heavyweight has established joint ventures in Asia-Pacific, combining local feedstock sourcing with proprietary copolymer technology to address burgeoning demand for waterborne coatings.

Partnerships between established producers and biotechnology firms signal a commitment to bio-based monomer development, with pilot plants targeting renewable methacrylate derivatives. Concurrently, several players have entered licensing agreements with research institutions to explore advanced copolymer architectures for high-temperature seals and adhesives. On the product innovation front, a leading European conglomerate has launched a series of low-odor, low-VOC acrylic emulsions designed for indoor applications in residential and commercial settings.

These coordinated efforts reflect an industry-wide recognition that future success hinges on agility in capacity management, responsiveness to regulatory evolution, and sustained investment in R&D. Companies that excel in forging cross-sector alliances, optimizing feedstock security, and delivering differentiated performance characteristics are best positioned to shape the competitive fabric of the acrylic esters market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acrylic Esters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alfa Chemistry

- Arkema SA

- BASF SE

- Chemra GmbH

- Dow Chemical Company

- Evonik Industries AG

- Fuji Chemical Industry Co., Ltd.

- Hexion

- LG Chem Ltd.

- Lubrizol Corporation

- Merck KGaA

- Mitsubishi Chemical Corporation

- Momentive Specialty Chemicals Inc.

- Nippon Shokubai Co., Ltd.

- Parchem Fine & Specialty Chemicals

- Prasol Chemicals Limited

- PTT Global Chemical

- Sasol Ltd.

- SIBUR International GmbH

- Sinochem Corporation

- Tecnon OrbiChem

- The Dow Chemical Company

- Thermo Fisher Scientific Inc.

- Toagosei Co., Ltd.

- Vizag chemical

Practical Strategies and Forward-Looking Recommendations to Enable Industry Leaders to Capitalize on Emerging Opportunities in Acrylic Esters

To thrive amid the complexities of global supply shifts and escalating sustainability imperatives, industry leaders should prioritize a suite of targeted initiatives. First, integrating renewable and recycled feedstock streams into existing production platforms can mitigate raw material volatility and bolster environmental credentials. Establishing strategic alliances with biomass suppliers and technology providers accelerates the transition to circular production models. Second, advancing digital transformation through process modeling, predictive maintenance, and real-time quality analytics enhances operational efficiency and safeguards against unplanned disruptions.

Moreover, pursuing vertical integration-either through acquisitions or long-term offtake partnerships-strengthens supply chain resilience and reduces exposure to external tariff shocks. Companies should also expand their technical service capabilities to offer value-added support, enabling formulators to optimize acrylic ester performance across diverse environments. Tailoring product portfolios to meet segment-specific needs, such as high-purity grades for electronics or specialty copolymers for construction adhesives, fosters deeper customer engagement and premium pricing potential.

Finally, forging robust distribution networks that leverage both direct and digital channels ensures seamless market access. Investment in e-commerce platforms can streamline procurement and enhance data-driven customer insights. Collectively, these actions empower leaders to capture emerging opportunities, navigate evolving regulatory landscapes, and secure a competitive advantage in the dynamic acrylic esters ecosystem.

Detailed Overview of Research Foundations and Methodological Approaches That Underpin the Insights Within This Acrylic Esters Market Analysis

The insights presented in this analysis are grounded in a comprehensive, multi-phase research methodology. Primary research comprised in-depth interviews with senior executives, technical directors, and procurement specialists from manufacturing, formulation, and distribution organizations. Field visits to production facilities and distribution centers enriched the understanding of process flows, cost drivers, and quality control protocols. In addition, structured surveys captured end-user preferences and emerging application requirements across key geographies.

Secondary research involved systematic review of industry publications, patent filings, regulatory databases, and corporate disclosures, ensuring that historical trends and recent policy changes were accurately represented. A rigorous data triangulation process cross-validated quantitative findings with qualitative insights, while expert panel workshops provided peer review and refinement of segment definitions and emerging themes. Geospatial analysis techniques were applied to map production clusters and logistics corridors, highlighting regional cost variances and infrastructure constraints.

This layered approach-combining primary, secondary, and expert-led validation-ensures that the strategic perspectives and actionable recommendations offered herein are both robust and directly applicable to decision-makers seeking to navigate the complex dynamics of the acrylic esters market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acrylic Esters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acrylic Esters Market, by Product Type

- Acrylic Esters Market, by Purity Grade

- Acrylic Esters Market, by Form

- Acrylic Esters Market, by Application

- Acrylic Esters Market, by End Use Industry

- Acrylic Esters Market, by Sales Channel

- Acrylic Esters Market, by Region

- Acrylic Esters Market, by Group

- Acrylic Esters Market, by Country

- United States Acrylic Esters Market

- China Acrylic Esters Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Conclusive Perspective Summarizing Core Findings and Their Implications for Stakeholders in the Evolving Acrylic Esters Marketplace

The assessment of acrylic esters reveals an industry at the crossroads of innovation and regulatory transformation. Sustainable process technologies, heightened by regulatory mandates and environmental stewardship goals, are reshaping production paradigms. Tariff realignments have reset competitive benchmarks, compelling manufacturers and formulators to reevaluate supply chain configurations and cost management strategies. Simultaneously, the breadth of segmentation-from monomer types and application platforms to purity grades and sales channels-underscores the importance of nuanced portfolio design and channel differentiation.

Regional variations further accentuate the need for tailored approaches, as North American feedstock advantages, EMEA regulatory stringency, and Asia-Pacific growth trajectories each demand distinct strategic responses. Against this backdrop, leading corporations are leveraging innovation pipelines, strategic partnerships, and digital tools to secure market leadership. The actionable recommendations outlined provide a roadmap for stakeholders to harness emerging opportunities, mitigate risk exposures, and position their operations for sustainable growth.

In conclusion, stakeholders equipped with an integrated understanding of technological, regulatory, and market forces will be best placed to capitalize on the evolving acrylic esters landscape and drive competitive advantage.

Connect with Ketan Rohom, Associate Director of Sales and Marketing, to Acquire In-Depth Market Insights and Propel Your Acrylic Esters Strategies Forward

To secure comprehensive insights into the evolving acrylic esters landscape and gain a competitive edge, connect directly with Ketan Rohom, Associate Director of Sales and Marketing. He will guide you through the report’s in-depth analysis of supply chain dynamics, tariff impacts, segmentation deep dives, and regional intelligence tailored to your strategic priorities. Engaging with Ketan Rohom ensures you receive personalized support, including sample excerpts, detailed methodology breakdowns, and a collaborative discussion on how to translate these findings into decisive action. Reach out today to explore bespoke licensing options, enterprise packages, and consulting add-ons that align with your growth objectives. Position your organization at the forefront of innovation in high-performance adhesives, coatings, plastics, and beyond by leveraging this authoritative market research report.

- How big is the Acrylic Esters Market?

- What is the Acrylic Esters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?