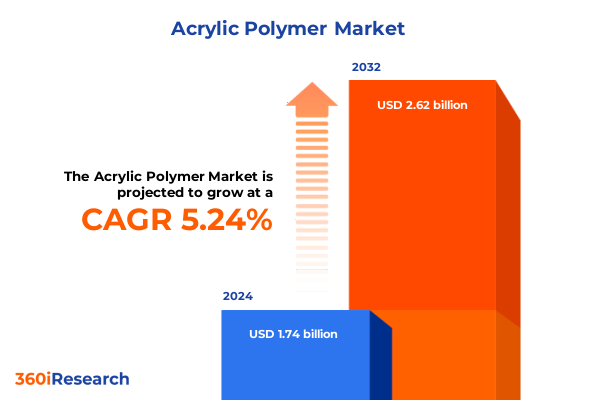

The Acrylic Polymer Market size was estimated at USD 1.83 billion in 2025 and expected to reach USD 1.93 billion in 2026, at a CAGR of 5.27% to reach USD 2.62 billion by 2032.

Discover How Innovative Acrylic Polymer Solutions Are Shaping Diverse Industries Through Emerging Trends, Technological Advances, and Market Drivers

The acrylic polymer sector stands at an inflection point, propelled by a confluence of technological breakthroughs and shifting industry priorities. In recent years, manufacturers have accelerated research into advanced formulations to meet escalating demands for high-performance materials across diverse end-use industries. This has prompted a wave of innovation, as stakeholders pursue novel chemistries, refined polymerization techniques, and eco-efficient production methods.

Emerging trends such as the migration from solvent-borne systems toward water-borne variants highlight the industry’s commitment to sustainability. Similarly, the integration of nanotechnology and green crosslinking agents is redefining performance benchmarks for adhesives, coatings, and specialty applications. The pursuit of lightweight, durable, and multifunctional materials is catalyzing collaborations between chemical producers, equipment suppliers, and end users, fostering a dynamic ecosystem of co-development and knowledge exchange.

As regulatory frameworks tighten and consumer expectations evolve, the acrylic polymer landscape continues to adapt. Stringent environmental mandates and accelerated digitalization are reshaping supply chains, driving the adoption of real-time analytics for process optimization. In turn, manufacturers are realigning their R&D investments to deliver enhanced product attributes, paving the way for next-generation polymer solutions that meet both technical and sustainability criteria.

Exploring Major Disruptive Advances and Strategic Shifts That Are Redefining the Acrylic Polymer Landscape Across Multiple End-User Industries Globally

The landscape for acrylic polymers is undergoing a profound transformation driven by disruptive advancements in polymer chemistry, processing technologies, and application paradigms. Breakthroughs in controlled radical polymerization have unlocked unprecedented control over molecular architecture, enabling the design of tailor-made polymers that deliver enhanced adhesion, clarity, and resistance properties. This molecular precision is redefining performance expectations for paints, coatings, and adhesives, elevating end-product quality.

Simultaneously, digital technologies are revolutionizing manufacturing processes. Industry 4.0 practices such as predictive maintenance, real-time process monitoring, and advanced analytics are optimizing reactor performance, reducing downtime, and minimizing waste. These smart factory initiatives are rapidly gaining traction, positioning forward-thinking producers to achieve unparalleled operational efficiency and resource utilization.

Moreover, the evolving regulatory environment is prompting a strategic pivot toward low-VOC and solvent-free formulations. The shift from traditional solvent-borne systems to water-borne technologies underscores the industry’s commitment to environmental stewardship, driving cross-sector partnerships to scale up sustainable alternatives. These transformative shifts are converging to create a more resilient, innovative, and market-responsive acrylic polymer ecosystem.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Measures on Acrylic Polymer Supply Chains, Pricing Structures, and Trade Dynamics

In early 2025, updated United States tariff measures introduced higher duty rates on select acrylic polymer imports, prompting a comprehensive reassessment of supply chains. These elevated tariffs have imposed additional costs on foreign-sourced resin volumes, compelling manufacturers to reconsider sourcing strategies and to explore domestic production expansion.

As a result, end users have faced upward pressure on material expenses, triggering a wave of negotiations with suppliers to mitigate margin erosion. Many have accelerated plans to qualify alternative suppliers in lower-cost jurisdictions or to secure long-term agreements that provide price stability and supply certainty. Concurrently, regional producers are scaling capacity to capitalize on import substitution opportunities, reinforcing near-shoring initiatives that enhance supply chain resilience.

While these tariff-driven dynamics have created short-term challenges, they have also catalyzed strategic investments in local infrastructure and innovation. Companies are channeling resources to optimize process efficiencies, integrate recycling streams, and develop higher-value polymer grades. In this context, the tariff environment of 2025 has emerged as a pivotal catalyst for strengthening domestic capabilities and fostering a more agile, diversified supply landscape.

Unlocking Actionable Insights from Comprehensive Acrylic Polymer Segmentation Spanning Product Types, Solution Variants, Forms, Technologies, and Industry Applications

A comprehensive segmentation analysis reveals critical insights into how product types shape market opportunities and technological imperatives. Polyacrylamide grades are gaining traction in water treatment and papermaking applications due to their flocculation efficiency. Polymethyl methacrylate variants continue to dominate optical and specialty coating segments, while polyvinyl acetate is foundational in adhesive and sealant formulations. Meanwhile, sodium polyacrylate’s superabsorbent properties underpin its use in hygiene products and oilfield applications.

Examining solution types highlights a clear momentum toward water-borne systems, driven by regulatory constraints and end-user sustainability goals. Despite solvent-borne formulations retaining technical advantages in certain high-performance contexts, the trajectory favors aqueous dispersions that reduce VOC emissions. This shift is particularly pronounced in formulations for paints, coatings, and construction adhesives.

Investigating form factors uncovers evolving preferences that influence logistics and processing. Flakes and granules facilitate handling in bulk manufacturing, whereas liquid polymers are gaining favor for continuous process integration. Powder forms, often used in specialty applications, offer benefits in storage stability and transportation efficiency. Each form type aligns with specific production workflows and end-use requirements.

Delineating by polymerization technology exposes the competitive dynamics shaping production costs and polymer performance. Bulk polymerization remains cost-effective for commodity grades, while emulsion and suspension processes excel in dispersion quality for coatings and adhesives. Solution polymerization offers precise control over molecular weight distribution, appealing to niche specialty markets seeking bespoke polymer characteristics.

Application-based segmentation underscores the diversity of end-use drivers. Adhesives and sealants demand strong bonding and flexibility, detergents and household care prioritize dispersibility and rheology control, while paints and coatings require clarity and weatherability. In paper and textiles, dry-strength additives and surface treatments dominate, and in water treatment, flocculant performance is paramount.

Turning to end-user sectors reveals the breadth of acrylic polymer adoption. The automotive industry leverages polymers for lightweight structural components and clear coatings. Chemical producers integrate them as process aids and functional additives. Construction stakeholders rely on acrylic-based mortar additives and surface treatments, while electronics manufacturers use polymers for encapsulation and dielectric applications. Healthcare formulations benefit from biocompatible polymer grades, and the paper and packaging sector utilizes water-treatment chemicals and coatings. Personal care and cosmetics incorporate acrylic emulsions in creams and lotions, and the textile industry applies size treatments and finishes.

This comprehensive research report categorizes the Acrylic Polymer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Solution Type

- Form

- Technology Used

- Application

- End-User

Revealing Significant Regional Dynamics Influencing Acrylic Polymer Demand and Production Patterns in the Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics reveal differentiated demand drivers and production capabilities across major global markets. In the Americas, sustainability regulations and robust end-use sectors such as automotive and construction incentivize investment in low-VOC water-borne solutions and high-performance specialty grades. Local producers are expanding capacity to meet onshore demand, supported by near-shoring trends that enhance supply chain resilience against tariff fluctuations.

In Europe, Middle East & Africa, stringent environmental standards and a strong base in automotive coatings and personal care ingredients are fueling demand for advanced acrylic emulsions. Investments in biobased monomers and recycling technologies are intensifying, as companies strive to meet the European Green Deal’s circular economy targets. Meanwhile, growth in the Middle East is underpinned by petrochemical integration, with regional producers leveraging feedstock advantages to develop value-added polymer grades.

Across Asia-Pacific, rapid urbanization and infrastructure expansion drive demand for construction chemicals, paints, and adhesives. The region’s diverse economic landscape sees established markets in Japan and South Korea focusing on high-value specialty polymers, while emerging economies in Southeast Asia prioritize cost-effective commodity grades. China’s leadership in production capacity and ongoing capacity additions continue to influence global supply balances, compelling international players to refine competitive strategies and localize offerings.

This comprehensive research report examines key regions that drive the evolution of the Acrylic Polymer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Driving Innovation, Sustainability, and Competitive Strategies within the Acrylic Polymer Value Chain

Leading chemical companies are executing multi-dimensional strategies to secure competitive advantage in the acrylic polymer value chain. Major producers are prioritizing R&D collaborations to develop next-generation polymers that combine performance and sustainability, investing in pilot plants to accelerate scale-up of water-borne and bio-based chemistries. Some are integrating digital solutions to enhance production forecasting, quality control, and traceability, reinforcing their reputation for reliability and innovation.

Strategic partnerships between polymer producers and end-use innovators are also on the rise, facilitating co-development of application-specific formulations. These alliances enable faster market entry and differentiation by leveraging combined expertise in polymer science and application engineering. In parallel, select companies are pursuing targeted acquisitions to expand their geographic footprint and supplement their product portfolios, focusing on high-growth niches such as healthcare-grade acrylics and advanced coatings.

Sustainability commitments are increasingly shaping corporate agendas, with leading firms setting ambitious targets for reducing greenhouse gas emissions, minimizing wastewater, and incorporating recycled content. Supply chain transparency initiatives, underpinned by blockchain and digital tracking, are reinforcing trust with environmentally conscious end users. This emphasis on ESG integration is becoming a key competitive lever, influencing contract negotiations and brand positioning across the industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acrylic Polymer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuro Organics Limited

- Anhui Newman Fine Chemicals Co., Ltd.

- Anshika Polysurf Limited

- Arkema S.A

- BASF SE

- BASF SE

- CHEMIPOL, S.A.

- Evonik Industries AG

- Gellner Industrial LLC

- H.B. Fuller Company

- Jatko, LLC

- Kamsons Chemicals Pvt. Ltd.

- LG Chem, Ltd.

- Lubrizol Corporation

- Makevale Limited

- Maxwell Additives Pvt. Ltd.

- MCTRON Inc.

- Mitsubishi Chemical Group

- NIPPON SHOKUBAI CO., LTD.

- Nouryon B.V.

- Protex International S.A

- Saudi Basic Industries Corporation

- STI Polymer Inc.

- Sumitomo Seika Chemicals Company, Ltd.

- Synthomer PLC

- The Dow Chemical Company

- Toagosei Co., Ltd.

Implementing Strategic Initiatives for Industry Leaders to Enhance Operational Resilience, Drive Sustainability, and Capitalize on Evolving Acrylic Polymer Trends

To navigate the evolving acrylic polymer ecosystem, industry leaders should accelerate investments in water-borne and bio-based polymer technologies, fostering partnerships with research institutions to co-develop disruptive formulations. By integrating advanced analytics and digital twins into production facilities, companies can optimize throughput, reduce waste, and enhance product consistency in real time.

Leaders must also diversify supply chains by qualifying multiple feedstock and resin sources, balancing cost efficiency with resilience against tariff volatility and raw material disruptions. Developing strategic inventory buffers and establishing regional distribution hubs can further mitigate risk and ensure service continuity for critical end users.

Sustainability should be embedded at the core of growth strategies, with clear targets for VOC reduction, renewable feedstock incorporation, and closed-loop recycling. Transparent reporting on ESG performance will strengthen stakeholder trust and unlock new opportunities in environmentally regulated markets. Finally, proactive regulatory engagement and participation in standard-setting forums will enable organizations to influence evolving policy frameworks and align product development roadmaps with future compliance requirements.

Outlining a Robust Research Methodology Integrating Primary Consultations and Secondary Analysis to Ensure Comprehensive Acrylic Polymer Market Intelligence

This study is underpinned by a rigorous research framework combining both primary and secondary approaches. Primary interactions include in-depth consultations with senior executives, technical experts, and procurement professionals spanning the acrylic polymer value chain. These discussions provided direct insights into production challenges, market priorities, and emerging application requirements.

Complementing primary research, extensive secondary analysis was conducted through industry journals, patent filings, regulatory filings, and corporate disclosures. Publicly available technical papers and trade publications informed assessments of technology trends and innovation trajectories. Data points were triangulated to validate consistency across multiple sources and ensure robust interpretation of market dynamics.

Expert panels and peer reviews were convened to vet preliminary findings, refining conclusions and recommendations. This iterative validation process enhanced the study’s accuracy and relevance, delivering a comprehensive perspective on industry developments, competitive landscapes, and future growth enablers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acrylic Polymer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acrylic Polymer Market, by Product Type

- Acrylic Polymer Market, by Solution Type

- Acrylic Polymer Market, by Form

- Acrylic Polymer Market, by Technology Used

- Acrylic Polymer Market, by Application

- Acrylic Polymer Market, by End-User

- Acrylic Polymer Market, by Region

- Acrylic Polymer Market, by Group

- Acrylic Polymer Market, by Country

- United States Acrylic Polymer Market

- China Acrylic Polymer Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Concluding Perspectives on Sustainability, Innovation, and Strategic Imperatives Shaping the Future of Acrylic Polymer Markets

In summary, the acrylic polymer industry is poised for sustained evolution driven by regulatory imperatives, technological innovation, and shifting consumer preferences. The proliferation of water-borne and bio-based formulations reflects a broader sustainability paradigm, while advanced polymerization techniques are unlocking tailored performance attributes that cater to high-value applications.

Tariff adjustments in 2025 have catalyzed strategic realignments across supply chains, spurring investment in domestic capacity and near-shoring initiatives. Regional variations underscore the importance of localized strategies, with differentiated dynamics emerging across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Leading companies are leveraging partnerships, digital transformation, and ESG commitments to strengthen their competitive position. For industry participants, the imperative is clear: adopt agile sourcing models, embrace innovation in polymer design, and integrate sustainability into every facet of operations. By doing so, organizations will be well-equipped to harness the full potential of the acrylic polymer market.

Partner with Ketan Rohom to Secure Comprehensive Acrylic Polymer Market Insights That Drive Strategic Growth and Competitive Advantage

If you are ready to gain an authoritative edge in the dynamic acrylic polymer market, reach out to Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. He can provide immediate assistance in securing this in-depth report, illuminating regulatory impacts, innovative technologies, and strategic pathways tailored to your organization’s needs.

- How big is the Acrylic Polymer Market?

- What is the Acrylic Polymer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?