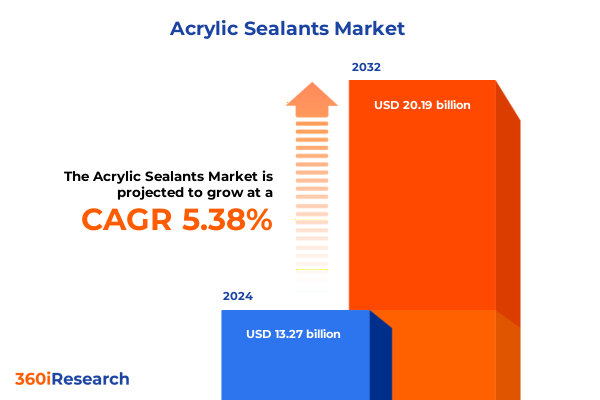

The Acrylic Sealants Market size was estimated at USD 13.89 billion in 2025 and expected to reach USD 14.55 billion in 2026, at a CAGR of 5.48% to reach USD 20.19 billion by 2032.

Exploring the Fundamental Role of Acrylic Sealants in Ensuring Structural Integrity, Durability, and Performance Across Diverse Industries

Acrylic sealants are polymer-based materials formulated to seal joints, fill gaps, and bond substrates by leveraging acrylic emulsions or solvent-based polymers. Emulsion-type sealants, often water-based, provide good adhesion to porous materials like wood, concrete, and plaster and are plastomeric with moderate movement resistance and UV stability. Conversely, solvent-based acrylic sealants offer outstanding adhesion to diverse surfaces including metals and glass, though they require careful handling due to higher solvent content. Manufacturing variants also include hybrid formulations that combine acrylic properties with polyurethane or silicone chemistries to achieve enhanced flexibility, durability, and chemical resistance.

How Sustainability Imperatives, Advanced Material Innovations, and Evolving Supply Chains Are Reshaping the Acrylic Sealants Market Dynamics Worldwide

The acrylic sealant market is undergoing a transformative shift driven by stringent environmental regulations and heightened customer demand for low-VOC and biodegradable solutions. Manufacturers are reformulating traditional compounds into eco-friendly, waterborne and bio-based alternatives, with a growing emphasis on circular economy principles and product lifecycle sustainability. Enterprise R&D teams are accelerating the development of sealants that not only meet or exceed emerging regulatory thresholds for VOC emissions but also align with green building certifications and consumer expectations.

Evaluating the Cumulative Effect of 2025 US Tariffs on Acrylic Sealant Supply Chains, Cost Structures, and Market Competitiveness

The introduction of additional duties on imported acrylic monomers and performance additives in 2025 has reshaped cost structures and supply chain configurations for sealant producers. Tariffs of up to 25% on inputs from Canada and Mexico and a baseline 10% on Chinese imports have elevated landed costs, compelling downstream manufacturers to choose between margin compression or passing costs to end-users. This scenario has spurred strategic reassessments of procurement footprints and tariff engineering approaches, such as product reformulation and rerouting imports through lower-duty jurisdictions.

Insights into Product, Application, End-User Industry, and Distribution Channel Segmentation That Define Acrylic Sealant Market Opportunities and Challenges

Detailed segmentation analysis reveals significant variations in performance and margin potential across product categories and customer applications. Within Product Type, hot melt varieties - particularly EVA and polyamide hot melts - stand out for rapid adhesion and low-temperature flexibility, while solvent-based acrylics, polyurethanes, and silicones maintain stronger weather resistance in exterior settings. UV-curable acrylics like epoxy and radcure acrylates cater to precision electronics and industrial sealing, and water-based acrylics or polyurethane dispersions dominate environmentally sensitive construction and packaging applications.

This comprehensive research report categorizes the Acrylic Sealants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Application

- End-User Industry

Examining Key Regional Dynamics in the Americas, Europe Middle East Africa, and Asia-Pacific That Drive Acrylic Sealant Market Development

In the Americas, the U.S. construction recovery-underpinned by sustained housing starts and government infrastructure investment-continues to drive demand for acrylic sealants in both residential and commercial segments. Yet, trade policy uncertainty has injected caution into reshoring initiatives, delaying certain projects despite resilient fundamentals for energy-efficient building and automotive sealant applications. Canada’s and Mexico’s proximity to U.S. markets also underscores the strategic importance of cross-border supply chain realignments to mitigate tariff exposures.

This comprehensive research report examines key regions that drive the evolution of the Acrylic Sealants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiles of Leading Acrylic Sealant Manufacturers Highlighting Their Sustainability Initiatives, Innovation Portfolios, and Strategic Market Positioning

Leading companies are prioritizing sustainable product portfolios while expanding production capacities to navigate evolving regulations and tariff volatility. Henkel’s Adhesive Technologies unit, for instance, has committed to 90% greenhouse gas emission reductions by 2045 and achieved a 64% cut in production CO₂ intensity, leveraging recycled raw materials and bio-based hot melt adhesives to maintain competitive differentiation. 3M and BASF are also deploying self-leveling and custom-formulated acrylic sealants, respectively, to address modular construction and seismic infrastructure needs, while Arkema’s Bostik has expanded its Malaysian facility and H.B. Fuller launched a bio-renewable polymer line to capture growth in Asia-Pacific markets. Dow’s trials of phase-change acrylic sealants signal a strategic pivot toward energy-efficient building envelope solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acrylic Sealants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- American Sealants Inc.

- Arkema S.A.

- Astral Adhesives by Resinova Chemie Limited

- BASF SE

- DuPont de Nemours, Inc.

- Dymax Corporation

- Ellsworth Adhesives

- General Electric Company

- H.B Fuller Company

- Henkel AG & Co. KGaA

- Hilti India Pvt. Ltd.

- Hodgson Sealants Ltd

- Key Resin Company

- MAPEI S.p.A.

- Master Bond Inc.

- Momentive Performance Materials Inc.

- PFE Technologies Pte Ltd

- Premier Building Solutions

- RPM International Inc.

- Sika AG

- Soudal Holding N.V.

- The Dow Chemical Company

- THE YOKOHAMA RUBBER CO., LTD.

- ThreeBond Holdings Co., Ltd.

- Wacker Chemie AG

- Warren Paint & Color Co.

Strategic Actions for Industry Leaders to Unlock Growth, Enhance Supply Chain Resilience, and Drive Sustainability in the Acrylic Sealant Sector

Industry leaders should accelerate investments in domestic feedstock capacity and joint ventures with petrochemical suppliers to secure preferential raw material access and hedge against tariff fluctuations. Concurrently, prioritizing R&D in low-VOC, bio-based compositions will resonate with both regulatory agencies and eco-conscious customers, strengthening brand equity. Strategic segmentation-tailoring go-to-market strategies by product type, application, and end-user industry-will optimize resource allocation and maximize margin capture. Furthermore, expanding digital tools for predictive demand forecasting and end-to-end supply chain visibility can preempt disruptions and enhance operational agility.

Comprehensive Research Methodology Detailing Secondary Data Analysis, Primary Stakeholder Interviews, and Rigorous Data Triangulation Processes

This study leverages a multi-tiered research methodology encompassing exhaustive secondary research, in which industry publications, regulatory filings, and trade journals were analyzed alongside proprietary databases. Primary research comprised in-depth interviews with C-level executives, R&D heads, and procurement managers across major adhesive and sealant manufacturers to validate market dynamics and emerging trends. Quantitative data were triangulated with expert inputs to ensure accuracy and consistency, while scenario analysis was employed to assess tariff impacts and technological adoption rates. This rigorous approach ensures the reliability of strategic recommendations and market intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acrylic Sealants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acrylic Sealants Market, by Product Type

- Acrylic Sealants Market, by Distribution Channel

- Acrylic Sealants Market, by Application

- Acrylic Sealants Market, by End-User Industry

- Acrylic Sealants Market, by Region

- Acrylic Sealants Market, by Group

- Acrylic Sealants Market, by Country

- United States Acrylic Sealants Market

- China Acrylic Sealants Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3339 ]

Consolidating Key Findings on Market Trends, Tariff Impacts, and Strategic Imperatives Shaping the Acrylic Sealant Industry’s Future Trajectory

The acrylic sealant industry stands at an inflection point where sustainability mandates, technological breakthroughs, and geopolitical factors converge to redefine competitive dynamics. Companies that align product development with low-emission and high-performance benchmarks, while proactively mitigating tariff-induced cost pressures through localized production and supply chain innovation, will secure lasting market leadership. By leveraging detailed segmentation insights and region-specific strategies, industry participants can navigate complexity, capitalize on growth pockets, and deliver differentiated value to end-users across construction, automotive, electronics, and packaging sectors.

Engage with Associate Director Ketan Rohom to Secure Your In-Depth Acrylic Sealant Market Research Report and Empower Strategic Decision-Making Today

For tailored insights into the dynamics of the acrylic sealant market and strategic guidance drawn from this comprehensive analysis, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can walk you through the report’s detailed findings, from tariff implications to segmentation and regional breakthroughs, ensuring you leverage actionable intelligence to drive growth and innovation. Connect with Ketan to secure your copy of the in-depth market research report and empower your organization with data-driven strategies that deliver measurable results.

- How big is the Acrylic Sealants Market?

- What is the Acrylic Sealants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?