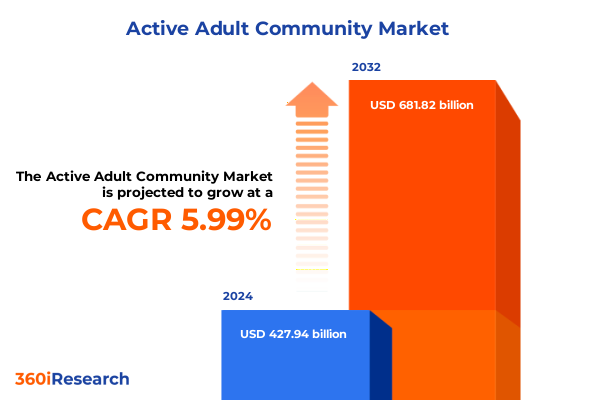

The Active Adult Community Market size was estimated at USD 427.94 billion in 2024 and expected to reach USD 453.49 billion in 2025, at a CAGR of 5.99% to reach USD 681.82 billion by 2032.

A concise and compelling orientation to the current strategic dynamics shaping active adult community development operations and resident experience expectations

The active adult community sector is undergoing a dynamic period of transformation driven by demographic momentum, lifestyle preferences, and evolving service expectations. This executive summary synthesizes the critical themes shaping development, operations, and strategic investment across communities designed for older adults, and it frames the opportunities and headwinds that executive teams, developers, and service providers must navigate. The narrative that follows emphasizes evidence-backed trends and pragmatic implications rather than numerical projections, offering a practical foundation for decision-making.

Throughout this document, stakeholders will find interpretations of how resident preferences for convenience, wellness, and social activation are redefining the design and operations of communities. The synthesis highlights how demographic cohorts differ in their expectations, how amenity mixes are shifting toward health-promoting and experience-driven offerings, and how external forces such as regulatory settings and trade policy intersect with development costs and supply chain dynamics. The tone is oriented toward actionable understanding: clarifying what is changing, why it matters, and where leaders should concentrate resources to secure competitive advantage.

How demographic evolution, digital enablement, and sustainability expectations are reshaping resident demand preferences and operational models across active adult communities

The landscape for active adult communities is being reshaped by intersecting shifts in demographics, technology adoption, and consumer expectations for lifestyle-centric housing. Population aging remains the foundational driver, but the character of demand is changing: newer cohorts entering these communities expect a blend of autonomy and curated social programming, seamless digital services, and flexible housing typologies that support longer, healthier independent living. Developers and operators are responding by blending residential product innovation with service-led differentiation to attract discerning buyers and renters.

Simultaneously, technology and data are altering operational models and resident engagement. Communities increasingly embed smart-home systems, telehealth integration, and digital platforms that facilitate community programming and maintenance reporting. These capabilities improve resident satisfaction and provide operational efficiencies, yet they also introduce new vendor relationships and cybersecurity considerations. Capital providers and operators must therefore balance investments in physical amenities with digital infrastructure and workforce training. Finally, sustainability and resilience expectations are influencing site selection and building practices, prompting a re-evaluation of lifecycle costs and reputational benefits tied to environmental performance.

The cumulative operational and procurement consequences of United States tariff policy shifts introduced in 2025 and how they are reframing sourcing risk and construction planning

Policy shifts on tariffs and trade can exert meaningful influence on construction inputs, imported equipment, and the broader supply chains that serve the active adult sector. Beginning in 2025, changes in tariff structures have amplified attention on sourcing strategies for materials and finished goods commonly used in residential construction and fit-out, including metals, appliances, and specialized medical and wellness equipment. Developers faced with elevated import costs have responded through a combination of strategic procurement, allocation of risk in contractor contracts, and substitution toward domestically produced components where available.

These adjustments have not been uniform; they vary by project scale, geographic proximity to manufacturing hubs, and the extent to which developers had pre-existing supplier relationships. In many cases, project timelines were extended as procurement teams sought alternative suppliers with acceptable lead times and quality standards. The cumulative effect has been an acceleration of strategic sourcing practices: longer-term supplier agreements, increased scrutiny of total landed cost rather than unit price alone, and closer collaboration with manufacturers to mitigate supply volatility. For operators, the tariff environment also underscored the value of modularity and repairability in amenity and finish selections, creating opportunities to reduce exposure to future trade-driven cost swings.

Granular segmentation insights across residence type, amenity mix, age cohorts, gender dynamics, and community formats to guide product design and resident engagement strategy

Understanding resident and buyer profiles requires careful segmentation by type, amenities, age, gender, and community format to inform product design, pricing strategies, and service portfolios. Type distinctions between age-restricted communities, which impose minimum age criteria, and age-targeted communities, which market to older adults without formal restrictions, result in divergent regulatory implications and marketing approaches. Amenities shape daily life and competitive positioning; lifestyle and recreational services drive community vibrancy while security and maintenance services underpin resident confidence, and wellness services increasingly anchor value propositions. Real estate offerings span condominiums, rentals, single-family homes, and townhouses, with each tenure model presenting distinct operating and capital implications.

Age cohorts also reveal differentiated preferences: residents aged 55 to 65 often prioritize active programming and downsizing conveniences, those aged 66 to 75 emphasize health services and social connectivity, and older cohorts frequently seek accessible design and graduated care pathways. Gender segmentation highlights nuanced differences in amenity usage patterns and social programming preferences that can inform targeted engagement strategies for female and male residents. Community types offer further granularity: gated communities emphasize privacy and control, golf and resort communities center on recreation and leisure, luxury communities prioritize high-end finishes and concierge services, religion-specific communities tailor programming and rituals, retirement parks offer affordability and mobility, and university-affiliated retirement communities leverage campus amenities and lifelong learning opportunities. Integrating these segmentation lenses enables more precise product-market fit testing and portfolio-level optimization.

This comprehensive research report categorizes the Active Adult Community market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Amenities

- Age Groups

- Gender

- Communities

How regional demographic patterns, policy frameworks, and cultural preferences across the Americas, Europe Middle East & Africa, and Asia-Pacific dictate differentiated development and operations approaches

Regional dynamics materially influence product design, operations, and investor interest across the active adult community sector. In the Americas, demographic shifts and suburbanization patterns continue to incentivize both suburban single-family and condominium models, while climate and regional labor markets shape development costs and operating strategies. Developers in this region often prioritize mixed-tenure approaches that combine rental inventory with owned units to broaden appeal and manage cash flow dynamics.

Across Europe, the Middle East & Africa, cultural norms and regulatory frameworks create a mosaic of demand drivers, where intergenerational living patterns and public health systems affect the role of private active adult communities. Operators in these markets balance localized programming with scalable operational platforms. In the Asia-Pacific region, rapid urbanization and high-density living preferences have encouraged compact product types like condominiums and integrated campus models, and strong interest in technology-enabled wellness solutions. Each regional context requires adaptive strategies for pricing, service delivery, and partnership models, and successful operators tailor their approaches to local labor markets, regulatory constraints, and resident lifestyle expectations.

This comprehensive research report examines key regions that drive the evolution of the Active Adult Community market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive strategies and organizational moves that established players and challengers are using to scale services, integrate operations, and strengthen resident lifetime value

Industry participants are deploying a range of strategic moves to differentiate their offerings, optimize operations, and capture resident loyalty. Leading organizations are investing in vertically integrated service capabilities that combine property management, wellness programming, and technology platforms to create a cohesive living experience. These capabilities reduce friction for residents and allow operators to capture higher lifetime value through bundled services and enhanced retention.

Strategic partnerships and selective acquisitions are common pathways for expanding service breadth rapidly, particularly in areas such as in-home care, telehealth provisioning, and specialized community programming. Firms are also experimenting with capital-light franchising and management-contract models to scale presence without proportionate increases in balance-sheet risk. Across the competitive landscape, successful firms emphasize resident-centric design, data-driven operations, and flexible tenure options to address diverse demand signals while preserving margins and operational resilience.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Adult Community market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A Place for Mom, Inc.

- Affinity Living Communities Group

- AgeWell Solvere Living

- Allure Lifestyle Communities

- Ashiana Housing Ltd.

- Ashton Woods USA L.L.C.

- Atria Senior Living Group

- Avenida Partners, LLC

- Beijing Sino-Ocean Group Holding Limited.

- Brookdale Senior Living Inc.

- Cortland

- D.R. Horton, Inc.

- Erickson Senior Living Management, LLC

- FirstService Residential, Inc.

- Greater Fort Myers Team

- Greystar Worldwide, LLC

- Guild Living International Italy s.r.l.

- HC-One Ltd.

- Highland 55

- Hovnanian Enterprises, Inc.

- J.F. Shea Co, Inc.

- Keppel Ltd.

- Leisure Village West Association, Inc.

- Lennar Corporation

- LGI Homes, Inc.

- Life Care Centers of America Inc.

- Luana Senior Living by Eurofund Group

- Margaritaville Enterprises, LLC

- Meritage Homes Corporation

- On Top of the World Communities, LLC

- Pultegroup, Inc.

- Robson Communities, Inc.

- Rossmoor Walnut Creek

- Senior Lifestyle Corp.

- Solivita Living

- Specht Group Italia Srl

- SRM Development

- Sunrise Senior Living by Revera Inc.

- The Holiday Retirement by Welltower Inc.

- The Kolter Group LLC

- The Minto Group

- The Villages, Inc.

- Thrive Senior Living

- Toll Brothers Inc.

Practical and prioritized recommendations for industry leaders to reduce sourcing risk, elevate resident experience, and align product portfolios with shifting demand dynamics

Leaders can take immediate and medium-term actions to secure competitive advantage in a shifting environment. In the near term, prioritizing supplier diversification and longer-term procurement agreements will reduce exposure to trade-related cost and timing volatility. Enhancing digital resident platforms to support telehealth, community programming, and maintenance requests improves service delivery efficiency and resident satisfaction while creating a data foundation for continuous improvement.

Over the medium term, executives should align product portfolios with granular segmentation insights, calibrating amenity mixes and tenure options to specific age cohorts and community formats. Investing in staff training and cross-disciplinary partnerships will elevate service quality and expand in-place care capabilities, which is increasingly important as resident health needs evolve. Finally, integrating sustainability and resilience measures into design and operations-such as energy efficiency, water stewardship, and building-material life-cycle planning-will reduce operating risk and appeal to environmentally conscious residents and institutional capital partners.

A rigorous mixed-method research framework combining primary stakeholder engagement, direct community observation, and triangulated secondary analysis to underpin conclusions

This analysis synthesizes findings from a structured, mixed-method research approach combining primary interviews, qualitative site visits, and rigorous secondary-source review. Primary research involved structured interviews with developers, operators, capital providers, and service vendors to capture first-hand perspectives on operations, resident preferences, and procurement practices. Site visits and virtual walkthroughs of diverse community types provided contextual understanding of amenity usage, unit layouts, and staff workflows, informing the operational implications outlined in the report.

Secondary research encompassed a curated review of policy documents, demographic datasets, industry publications, and vendor literature to triangulate primary findings and contextualize regional differences. Data synthesis prioritized cross-validation, seeking corroboration across multiple information sources before drawing conclusions. The qualitative insights were further vetted through expert peer review sessions with sector practitioners to ensure relevance and practical applicability. Where quantitative inputs were referenced, they were used for directional analysis rather than precise valuation, consistent with the objective of deriving actionable strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Adult Community market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Adult Community Market, by Type

- Active Adult Community Market, by Amenities

- Active Adult Community Market, by Age Groups

- Active Adult Community Market, by Gender

- Active Adult Community Market, by Communities

- Active Adult Community Market, by Region

- Active Adult Community Market, by Group

- Active Adult Community Market, by Country

- United States Active Adult Community Market

- China Active Adult Community Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

A strategic synthesis highlighting the critical tactical and structural actions operators must take to navigate demographic shifts, policy headwinds, and evolving resident expectations

In summary, the active adult community sector is at an inflection point where demographic tailwinds intersect with evolving resident expectations and external policy pressures. Developers and operators that integrate resident-centric design, resilient procurement strategies, and digital service platforms will be better positioned to capture value and sustain occupancy over the long term. Emphasizing flexible tenure models and diversified amenity bundles allows organizations to address heterogeneous demand across age cohorts, genders, and community preferences while managing operational complexity.

The interplay of regional dynamics and trade policy underscores the importance of localized strategy and supplier risk management. Organizations that adopt a proactive approach-optimizing procurement, investing in workforce capabilities, and embedding sustainability into building practices-will reduce exposure to external shocks and enhance long-term appeal. Executives should treat the insights in this analysis as a practical roadmap: prioritize tactical interventions that deliver near-term resilience while allocating resources to longer-term strategic shifts that create differentiated resident value.

Secure personalized access to the comprehensive active adult community research report through a senior sales and marketing lead for tailored briefings and report purchase guidance

To explore the full, in-depth market research report and obtain tailored insights, reach out to Ketan Rohom, Associate Director, Sales & Marketing, who can facilitate access to the comprehensive analysis and licensing options. Engage with a dedicated representative to discuss enterprise licensing, bespoke data extracts, and custom advisory briefings that align with your strategic priorities and investment horizon.

Contacting the named representative will enable prospective clients to review sample chapters, obtain detailed methodological appendices, and arrange a briefing that highlights implications for development pipelines, capital allocation, and partner selection. A direct conversation will also clarify available deliverables, timelines for report delivery, and options for ongoing consultancy support tied to the research findings.

- How big is the Active Adult Community Market?

- What is the Active Adult Community Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?