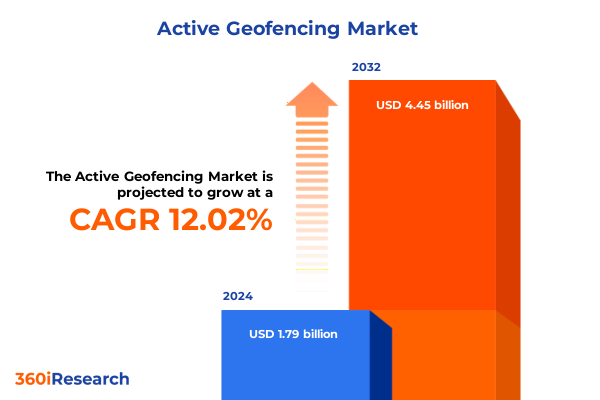

The Active Geofencing Market size was estimated at USD 2.01 billion in 2025 and expected to reach USD 2.26 billion in 2026, at a CAGR of 12.00% to reach USD 4.45 billion by 2032.

Exploring the Rise of Active Geofencing as a Critical Location-Based Service Driving Enhanced Security, Engagement, and Operational Efficiency Globally

Consumers are increasingly relying on mobile devices to make real-time decisions based on their location, a trend that underscores the strategic importance of active geofencing. Recent studies indicate that over three-quarters of local searches on smartphones lead to a business visit within a day, with more than a quarter of those searches resulting in a purchase shortly thereafter. This shift toward immediacy has created a fertile environment for location-based services that can trigger contextual interactions and personalized engagements as users enter, dwell, or exit predefined virtual perimeters.

At the technological frontier, active geofencing is benefiting from the convergence of artificial intelligence, augmented reality, and next-generation connectivity. Machine learning models are now capable of predicting movement patterns and dynamically adjusting virtual boundaries to optimize engagement. Meanwhile, the integration of AR overlays has begun to transform physical spaces into interactive experience zones, and the adoption of 5G networks is reducing latency and improving the precision of location event triggers.

Beyond marketing applications, organizations are discovering that geofencing offers significant operational benefits. By defining virtual zones around assets, facilities, or shipments, businesses can automate security alerts, streamline asset management workflows, and gain granular insights into foot traffic and workforce deployment. This level of spatial intelligence is propelling active geofencing from a niche promotional tool to a mission-critical service that enhances both customer engagement and enterprise efficiency.

Uncovering the Transformative Technological, Regulatory, and Market Shifts Redefining Active Geofencing Capabilities and Adoption Patterns Worldwide

Active geofencing is undergoing a profound transformation as emerging technologies redefine its potential and reshape market expectations. First, the integration of cloud-connected edge computing is enabling geofencing platforms to analyze location events locally on devices, triggering real-time actions without reliance on centralized servers. This shift not only reduces latency but also enhances data privacy by keeping sensitive location information at the edge. Concurrently, AI-driven analytics are delivering predictive insights into crowd flows and user behavior, empowering businesses to anticipate and respond to spatial trends with unprecedented agility.

Innovation extends into the security domain, where vendors are layering multispectral and thermal imaging capabilities onto geofencing systems to achieve continuous, context-aware monitoring. These advanced sensors, coupled with cloud-native architectures, support comprehensive surveillance applications that operate seamlessly in all lighting and weather conditions. Organizations in smart city initiatives, transportation hubs, and critical infrastructure projects are leveraging these converged capabilities to bolster situational awareness and automate incident response protocols.

At the same time, regulatory and societal shifts are reshaping the geofencing landscape. Recent state legislation has emerged to protect sensitive health data, prohibiting geofence tracking around reproductive health facilities and imposing strict consent requirements for location-based services. These new privacy guardrails underscore the importance of compliance and ethical data practices, prompting solution providers to embed robust consent frameworks and anonymization techniques into their platforms to maintain trust and avoid legal risks.

Assessing the Cumulative Effect of 2025 United States Tariffs on Active Geofencing Supply Chains, Component Costs, and Go-to-Market Strategies

The imposition of a series of United States tariffs throughout 2025 has introduced multiple cost layers affecting the supply chain of geofencing hardware components. Early in the year, a blanket 25 percent ad valorem duty was applied to all steel and aluminum imports, subsequently doubling to 50 percent for select products in June. Concurrently, a 25 percent tariff on automobile assemblies and parts went into effect in early April, impacting the transportation of sensor-laden vehicles used in mobile geofencing solutions.

Further compounding these measures, reciprocal tariffs imposed in mid-April introduced a universal 10 percent duty on all imported goods, coupled with country-specific reciprocal rates ranging from 11 to 50 percent. These levies sit alongside existing Section 301 tariffs of between 7.5 and 25 percent targeting Chinese goods, as well as a 20 percent “fentanyl tariff” applied to certain electronic components and raw materials. In early May, an additional 50 percent tariff was announced on semiconductors, robotics, and electric vehicle parts, elevating the effective duty on critical geofencing processors to as high as 85 percent under layered tariffs.

Collectively, these cumulative tariffs have prompted key component manufacturers to reevaluate sourcing strategies, accelerate localization of production, and adjust pricing models. The inflated cost of raw materials and electronic modules has led to longer lead times and has forced integrators to secure buffer stocks of critical components. Meanwhile, some providers have begun qualifying alternative suppliers outside the tariff jurisdictions, emphasizing regional manufacturing hubs in Southeast Asia and Eastern Europe to maintain competitive margins and ensure continuity of geofencing deployments.

Delving into Multidimensional Market Segmentation to Reveal Diverse End-User Applications, Deployment Models, and Pricing Paradigms Influencing Active Geofencing Adoption

Understanding the active geofencing market requires a nuanced view of its segmentation, which reveals how solution providers and end users interact across dimensions of use cases, technology, and business models. By end user, geofencing has found applications in sectors as varied as financial services-where banks deploy virtual perimeters around ATMs and branch lobbies for fraud detection-and government entities that use geofenced zones for defense training exercises and public safety alerts. Healthcare organizations integrate geofencing into clinics and hospital environments to automate asset tracking and patient wayfinding, while retail chains leverage it for personalized in-store promotions in both brick-and-mortar and e-commerce contexts. Transportation companies overlay geofence zones across fleet operations and public transit networks to optimize routing and monitor vehicle dwell times.

Component-based segmentation highlights that hardware platforms-from BLE beacons to GPS-modules-are complemented by software suites and professional services offerings. Consulting and integration services ensure that enterprises can tailor geofencing solutions to their architecture, while software licensing models govern access to location analytics engines and rule-based event frameworks. Solutions range from dynamic geofences that adjust to real-world conditions to static perimeters that enforce fixed security boundaries.

Deployment choices further refine this landscape, with cloud-based geofencing services offering scalability and rapid iteration, and on-premise installations providing tighter control over data residency and compliance. Pricing paradigms span perpetual licenses, subscription tiers, and consumption-based pay-per-use structures, enabling organizations to align costs with their operational rhythms. Applications include workforce management, traffic monitoring, shopper analytics, safety and security protocols, and asset tracking functions. Finally, demand dynamics vary significantly between large enterprises-where geofencing is embedded into broad digital transformation agendas-and small and medium-sized businesses seeking cost-effective, plug-and-play geofencing modules.

This comprehensive research report categorizes the Active Geofencing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- End User

- Component

- Type

- Location Type

- Deployment Mode

- Application

- Organization Size

- Pricing Model

Analyzing Distinct Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Unveil Opportunities and Challenges in Active Geofencing Expansion

Regional dynamics in the active geofencing market are shaped by economic priorities, infrastructure readiness, and regulatory frameworks that differ markedly across the Americas, EMEA, and Asia-Pacific. In the Americas, the United States and Canada boast advanced telecommunication networks and high cloud adoption rates, creating fertile ground for rapid rollout of geofencing campaigns spanning retail foot traffic analysis to public safety initiatives. Latin American countries are also embracing geofencing for agricultural asset management and localized marketing in urban centers, supported by increasing smartphone penetration and digital payments infrastructure.

Across Europe, the Middle East, and Africa, stringent data privacy rules have driven the development of geofencing solutions that emphasize consent management and anonymization. Western European markets are focusing on smart city integrations-linking geofence alerts to traffic control systems and environmental monitoring platforms-while the Gulf Cooperation Council states are investing heavily in geofencing for security applications in mega-events and critical infrastructure. In sub-Saharan Africa, adoption is accelerating in logistics and supply chain sectors, where geofencing helps track high-value medical shipments and last-mile deliveries in regions with challenging terrain and nascent digital ecosystems.

In Asia-Pacific, government-led smart city and Industry 4.0 programs are a significant catalyst. Countries like China, Japan, and South Korea are integrating geofencing with advanced sensor networks and AI-driven analytics to enable autonomous factory robotics, contactless retail experiences, and contact tracing initiatives. Southeast Asian economies are leveraging geofencing to bolster e-commerce logistics, while Australia and New Zealand apply geofencing in environmental management and indigenous land stewardship projects, reflecting the broad spectrum of regional use cases.

This comprehensive research report examines key regions that drive the evolution of the Active Geofencing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Firms Shaping the Competitive Active Geofencing Landscape Through Strategic Collaborations, Innovative Geolocation Solutions, and Global Market Reach

Leading technology companies and specialized geolocation providers are actively shaping the active geofencing arena through differentiated offerings, strategic partnerships, and an expanding global footprint. Industry titans such as Apple and Google extend geofencing capabilities through their respective mobile operating systems and map platforms, embedding virtual perimeter triggers into the core smartphone experience. In the enterprise sphere, IBM offers geospatial analytics services that ingest streaming location data to deliver real-time decision support, while Microsoft’s Azure Maps provides a turnkey geofencing API within its broader cloud ecosystem.

Beyond the hyperscale cloud providers, nimble specialists are capturing market share by focusing on developer-centric experiences and high-volume event processing. Radar Labs, for example, touts a geofencing platform supporting unlimited polygon geofences, sub-five-meter accuracy, and 99.99 percent uptime at scale, emphasizing ease of integration via open-source SDKs and REST APIs. This approach has resonated with digital-first brands seeking to avoid the operational overhead of building proprietary geolocation infrastructure.

Strategic alliances are also fuelling competitive evolution. Location intelligence firms join forces with system integrators to embed geofencing into complex IoT deployments, while collaborations with telecommunication carriers aim to leverage network-based location data for fallback accuracy when GPS signals are weak. As consolidation accelerates, audiences can expect to see further mergers, acquisitions, and co-development agreements that expand technical capabilities, amplify geographic reach, and integrate geofencing within holistic location-based service portfolios.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Geofencing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airship

- Bluedot Innovation Pty Ltd

- Esri Global Inc

- Foursquare Labs Inc

- Google LLC

- GroundTruth

- IBM Corporation

- Infillion

- LiveViewGPS

- LocationSmart

- Mapbox

- Mapsted Corp

- Microsoft Corporation

- Oracle Corporation

- Palo Alto Networks

- PlotProjects B.V.

- Propellant Media

- Pulsate Mobile Ltd

- Qualcomm Incorporated

- Radar Labs Inc

- Salesforce Inc

- SAP SE

- Thumbvista

- WebFX

Equipping Industry Leaders with Actionable Strategic Guidance to Capitalize on Emerging Active Geofencing Trends, Overcome Operational Barriers, and Drive Sustainable Growth

To position themselves for success in the dynamic active geofencing market, industry leaders should begin by establishing clear governance structures for location data. This includes defining ownership, access controls, and consent mechanisms that align with evolving privacy regulations. By embedding privacy-by-design principles into platform architecture, organizations can preempt compliance issues and foster consumer trust as a competitive differentiator.

Next, technology teams should prioritize a modular, API-driven approach to geofencing deployment. By decoupling virtual perimeter management from analytics and messaging layers, enterprises can iterate rapidly, integrate new sensor modalities, and pivot workflows without disrupting core services. Embracing containerized microservices on cloud-native infrastructures will also enable elastic scaling to accommodate event surges and geographic expansion.

Finally, cross-functional collaboration between marketing, operations, and security functions is essential. Joint roadmaps should identify high-impact use cases-such as hyper-local promotions, asset theft prevention, or dynamic workforce allocation-and define metrics for measuring return on investment. Leaders should invest in customizable dashboards that surface real-time geofence event data alongside business KPIs, ensuring that strategic decisions are informed by a unified view of spatial intelligence.

Outlining a Robust Methodological Framework Combining Qualitative Interviews, Secondary Research, and Quantitative Data Analysis to Ensure Credible Active Geofencing Insights

This research employed a blended methodology designed to ensure the accuracy, reliability, and comprehensiveness of active geofencing insights. Primary data was collected through structured interviews with forty industry experts, including technology architects, solution integrators, and end-user representatives across multiple verticals. These interviews provided firsthand perspectives on deployment challenges, innovation priorities, and regulatory considerations.

Secondary research involved a rigorous review of over one hundred publicly available sources, including regulatory filings, technology white papers, patent databases, and industry news outlets. Special emphasis was placed on tracking legislative developments affecting location data privacy, as well as analyzing corporate announcements related to product launches and strategic partnerships.

Quantitative data analysis leveraged a proprietary database of more than fifty thousand geofence event records to identify usage patterns, latency distributions, and error rates across different hardware platforms and network conditions. Statistical modeling techniques-such as regression analysis and clustering algorithms-were applied to uncover correlations between geofence accuracy, environmental variables, and hardware configurations, ensuring that findings are grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Geofencing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Geofencing Market, by End User

- Active Geofencing Market, by Component

- Active Geofencing Market, by Type

- Active Geofencing Market, by Location Type

- Active Geofencing Market, by Deployment Mode

- Active Geofencing Market, by Application

- Active Geofencing Market, by Organization Size

- Active Geofencing Market, by Pricing Model

- Active Geofencing Market, by Region

- Active Geofencing Market, by Group

- Active Geofencing Market, by Country

- United States Active Geofencing Market

- China Active Geofencing Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2385 ]

Synthesizing Core Insights to Illustrate Strategic Imperatives and Future Pathways for Stakeholders Navigating the Evolving Active Geofencing Ecosystem Amid Technological and Regulatory Change

The evolution of active geofencing has reached an inflection point where technological advances, regulatory developments, and market dynamics are converging to redefine location-based services. Key findings highlight the centrality of edge computing in driving low-latency interactions, the growing importance of AI-powered analytics for predictive spatial intelligence, and the critical need for privacy safeguards in geofence deployments.

Looking ahead, organizations that can seamlessly integrate geofencing within broader digital transformation initiatives-such as smart city ecosystems, autonomous logistics networks, and personalized retail experiences-will unlock new value streams and operational efficiencies. Meanwhile, solution providers that differentiate through developer-friendly APIs, modular architectures, and compliance-centric design will command leadership positions in the competitive landscape.

Ultimately, the path forward for active geofencing stakeholders involves balancing innovation with responsibility-pursuing advanced capabilities while safeguarding user trust and navigating an increasingly complex regulatory tapestry. Those who succeed will shape the next generation of location-based services, enabling smarter decisions and richer experiences in a truly connected world.

Unlock Comprehensive Active Geofencing Intelligence by Engaging with Ketan Rohom to Secure Your Definitive Market Research Report and Drive Strategic Location-Based Decisions

Don’t miss the chance to deepen your understanding of the active geofencing landscape and gain a competitive edge through data-driven insights and analysis. Ketan Rohom, the Associate Director for Sales & Marketing, is ready to guide you through the comprehensive market research report, ensuring you receive tailored intelligence that addresses your organization’s unique location-based service challenges and objectives. Engage with Ketan today to explore how you can integrate advanced geofencing strategies into your roadmap, optimize resource allocation, and position your business at the forefront of this rapidly evolving field. Secure your definitive report now and transform emerging opportunities into measurable outcomes for your team.

- How big is the Active Geofencing Market?

- What is the Active Geofencing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?