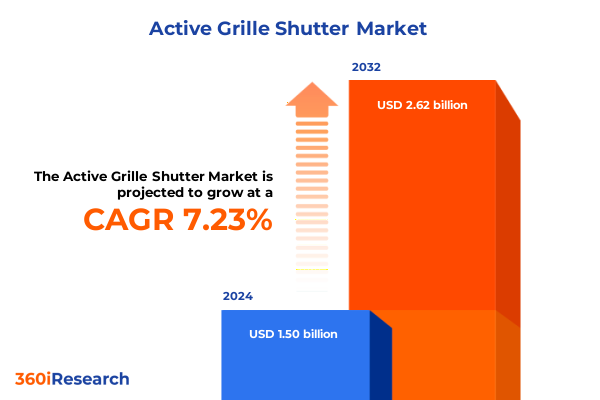

The Active Grille Shutter Market size was estimated at USD 1.60 billion in 2025 and expected to reach USD 1.71 billion in 2026, at a CAGR of 7.28% to reach USD 2.62 billion by 2032.

Discover How Active Grille Shutter Technology is Revolutionizing Vehicle Aerodynamics and Cooling Efficiency for Modern Automotive Applications

Active grille shutter systems have emerged as a transformative automotive technology that balances the dual imperatives of aerodynamic performance and thermal management. By dynamically modulating airflow through a vehicle’s radiator opening, these shutters reduce drag at highway speeds and enhance engine warm-up efficiency under cold conditions. The result is a refined powertrain response, improved fuel economy, and a reduction in greenhouse gas emissions-all critical factors as regulatory requirements tighten across global automotive markets.

Over the past decade, active grille shutters have evolved from niche OEM offerings to a mainstream feature across passenger cars, commercial vehicles, and high-performance segments. Pioneering implementations focused primarily on thermodynamic benefits, while the latest iterations integrate electronic control units, network connectivity, and advanced materials to meet stringent weight and efficiency targets. This convergence of mechanical design, electrical architecture, and material science underscores the strategic importance of these systems to automakers and tier-one supply partners.

This executive summary distills key dynamics reshaping the active grille shutter landscape, including transformative industry shifts, the impact of 2025 tariff regimes, segmentation insights, regional variations, and leading competitive strategies. It lays the groundwork for actionable recommendations and highlights how stakeholders can harness emerging opportunities in a market defined by rapid technological innovations and evolving regulatory constraints.

Exploring the Latest Industry Drivers Accelerating Active Grille Shutter Adoption Amid Shifts Toward Electrification Lightweighting and Digital Manufacturing

The active grille shutter ecosystem is currently experiencing transformative shifts driven by a confluence of electrification, sustainability imperatives, and digital manufacturing advances. First and foremost, the global pivot to electric and hybrid powertrains has prompted engineers to reimagine front-end thermal systems. In battery-electric vehicles, optimized air management transcends fuel economy, directly influencing battery thermal stability and cabin comfort. Consequently, active grille shutters have become indispensable modules in vehicle thermal management strategies.

In parallel, lightweighting initiatives are pushing manufacturers to adopt novel composite materials and streamlined actuation mechanisms. The integration of carbon fiber reinforced polymers and high-performance plastics enables shutters to respond more rapidly, while minimizing the weight penalty. Meanwhile, digital twins and advanced simulation tools accelerate the prototyping phase, allowing designers to validate aerodynamic performance under diverse driving conditions virtually.

Regulatory bodies worldwide are reinforcing the economic case for active grille shutters by tightening emissions standards and incentivizing energy-efficient technologies. As a result, consumer awareness of fuel efficiency and brand sustainability credentials has intensified. This alignment of policy goals, end-user expectations, and technological progress is setting the stage for a new era in which active grille shutter solutions will serve as a critical differentiator for both established automakers and innovative mobility startups.

Assessing the Cumulative Consequences of United States Tariffs on Active Grille Shutter Production Supply Chains and OEM Sourcing Strategies Through 2025

The United States has enacted a series of tariff measures throughout 2025 that are reshaping the economics of active grille shutter production and distribution. Cumulative import duties on key components-ranging from stepper motors to advanced composite housing-have elevated input costs, prompting tier-one suppliers and OEMs to recalibrate supply chain strategies. In response, many manufacturers are evaluating alternative sourcing locations within North America to mitigate the impact of these levies and maintain pricing parity.

At the same time, higher costs have spurred investment in domestic tooling and automated assembly lines that can accommodate a broader range of shutter designs locally. Companies leveraging regional free trade agreements and domestic content incentives have gained an edge by streamlining customs clearances and reducing lead times. Conversely, smaller aftermarket players reliant on offshore imports face margin compression and are exploring collaborative ventures with domestic distributors to preserve competitive pricing.

Looking ahead, the interplay between tariff adjustments and evolving trade negotiations will remain a focal point for strategic planning. Businesses that proactively diversify their component portfolios and forge resilient partnerships with regional suppliers will be better positioned to navigate volatility. As the regulatory landscape continues to shift, staying informed on tariff schedules and leveraging governmental support programs will be essential for sustaining growth.

Unveiling Actionable Insights from End Use Vehicle Type Actuation Application Distribution and Material Segmentation to Refine Active Grille Shutter Strategies

Insights drawn from end use analysis reveal that original equipment manufacturers and aftermarket channels exhibit distinct demand drivers for active grille shutters. While OEM programs prioritize seamless integration into vehicle platform architectures and compliance with factory calibration protocols, aftermarket applications emphasize retrofit ease of installation and cost effectiveness. Within the aftermarket segment, traditional offline retail operations coexist with a rapidly expanding online retail environment, where digital commerce portals are reshaping customer acquisition models.

When segmenting by vehicle type, commercial vehicles and passenger cars showcase divergent performance requirements. Buses and coaches demand shutters engineered for high-volume thermal loads and durability, whereas heavy commercial transport benefits from increased aerodynamic efficiency on long-haul routes. Light commercial vehicles require a hybrid approach balancing cost sensitivity with moderate fuel savings. In the passenger car domain, compact and economy models focus on accessible price points, while luxury and mid-size variants integrate shutters as part of premium thermal comfort and noise reduction packages.

Actuation type segmentation indicates growing preference for electric actuation, particularly stepper and synchronous motor systems, due to their precise control and compatibility with advanced driver assistance systems. Manual and vacuum actuation remain viable for cost-driven markets. Functional applications range from optimizing fuel efficiency during highway cruising to maintaining optimal intercooler and radiator temperatures under varying engine loads.

Distribution channels further differentiate market dynamics: distributor sales and independent workshops anchor traditional service networks, while e-commerce portals and manufacturer websites enable direct-to-consumer engagement for retrofit kits. Material choices span robust aluminum housings to high-strength composites such as carbon fiber reinforced polymer; plastic variants including ABS, polycarbonate and polypropylene are increasingly leveraged for lightweight end-use scenarios.

This comprehensive research report categorizes the Active Grille Shutter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Actuation Type

- Material

- End Use

- Application

- Distribution Channel

Highlighting Regional Variations in Active Grille Shutter Adoption Trends and Technological Priorities Across Americas EMEA and Asia-Pacific Markets

In the Americas, activity around active grille shutter technology is concentrated in North America where OEMs are incorporating these systems into both traditional combustion engine vehicles and the growing portfolio of hybrid models. Regional free trade agreements and domestic manufacturing incentives have encouraged suppliers to localize production of key subcomponents, strengthening resilience against international tariff fluctuations. Meanwhile, aftermarket development is driven by a culture of vehicle modification and performance tuning, offering tailored solutions for enthusiasts and fleet operators alike.

Europe, Middle East & Africa present a diverse regulatory and market landscape. Stricter emission regulations within the European Union have accelerated active grille shutter adoption as an enabling technology for reducing aerodynamic drag under real-world driving cycles. In the Middle East, high ambient temperatures and extensive fleet operations underscore the value of shutters for enhancing intercooler efficiency. African markets display opportunistic growth patterns, with infrastructure development and fleet modernization prompting targeted OEM partnerships.

Asia-Pacific stands out for aggressive electrification roadmaps and high production volumes. Major automotive hubs in China, Japan, and South Korea are integrating shutters into new energy vehicles, while India and Southeast Asia show burgeoning aftermarket demand. Local suppliers are innovating with cost-effective actuation mechanisms and biodegradable plastics to align with emerging sustainability commitments. Cross-border joint ventures have become commonplace, fostering technology transfer and accelerating product launches.

This comprehensive research report examines key regions that drive the evolution of the Active Grille Shutter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Competitive Movements Innovations and Partnerships Among Leading Active Grille Shutter Manufacturers Driving Market Differentiation

Leading component manufacturers have adopted distinct strategies to capture value in the active grille shutter domain. One global supplier solidified its position by acquiring a specialized motor technology firm, enhancing its electric actuation portfolio and accelerating its entry into premium OEM programs. Another major player has forged partnerships with composite material innovators to develop next-generation lightweight shutter assemblies featuring carbon fiber reinforced polymer and glass fiber reinforced polymer elements.

Tier-one system integrators are differentiating their offerings through modular designs that accommodate rapid customization for diverse vehicle platforms. Strategic alliances with automotive software developers have enabled the rollout of intelligent control modules capable of predictive airflow management based on GPS data and driver behavior analytics. In parallel, aftermarket innovators are collaborating with e-commerce platforms to streamline distribution and installation support for end users.

Smaller suppliers are carving out niches by focusing on regional regulatory expertise and local supply chain agility. By aligning with regional content requirements and leveraging proximity to assembly plants, these companies are securing contracts for high-volume commercial vehicle applications. Collectively, these competitive movements underscore a market where innovation, collaboration, and supply chain optimization drive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Grille Shutter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Corporation

- BorgWarner Inc.

- Coburg Industries, Inc.

- Continental Aktiengesellschaft

- Denso Corporation

- Hella KGaA Hueck & Co.

- Hyundai Mobis Co., Ltd.

- Johnson Electric Holdings Limited

- Keboda Chongqing Automotive Electronics Co., Ltd.

- Magna International Inc.

- Mahle GmbH

- Marelli Holdings Co., Ltd.

- Mitsubishi Heavy Industries, Ltd.

- Padmini VNA Mechatronics Ltd.

- Plastic Omnium S.A.

- Röchling SE & Co. KG

- Schaeffler Technologies AG & Co. KG

- Shape Corporation

- SRG Global Ltd.

- Standard Motor Products, Inc.

- STARLITE Co., Ltd.

- Stoneridge Inc.

- Tong Yang Group Co., Ltd.

- Valeo S.A.

Delivering Actionable Recommendations for Automotive Stakeholders to Capitalize on Emerging Active Grille Shutter Opportunities and Overcome Supply Chain Complexities

Automotive stakeholders should prioritize integrating advanced sensor arrays and model-based control algorithms to elevate active grille shutter performance beyond traditional thermal management. By leveraging machine learning techniques within the ECU environment, shutter response can be optimized dynamically based on real-time traffic conditions, ambient temperature, and thermal load predictions. This approach will confer both regulatory compliance benefits and perceptible improvements in fuel economy and battery range.

Supply chain diversification is another essential strategy for mitigating tariff exposure. Investing in near-shore production capabilities and forging collaborative agreements with local distributors can ensure component continuity and cost stability. Equally important is the cultivation of strategic relationships with material innovators focusing on high-strength composites and recyclable plastics, aligning with circular economy principles and future regulatory requirements.

As product complexity intensifies, adopting digital twin frameworks for rapid prototyping and in-service diagnostics will accelerate development cycles and support predictive maintenance models. Finally, engaging with aftermarket channels through integrated training programs and digital installation guides will expand revenue streams while reinforcing brand positioning across both OEM and post-sale segments.

Explaining Rigorous Research Methodology Employed to Ensure Depth Validity and Reliability of Active Grille Shutter Market Intelligence Findings

This research employs a comprehensive methodology combining primary and secondary data collection to ensure rigorous depth and validity. Secondary sources include industry white papers, patent filings, regulatory publications, and technical standards from global automotive authorities. These materials provide foundational insights into emerging actuation technologies, material innovations, and regulatory trajectories shaping active grille shutter systems.

Primary research comprises structured interviews with OEM thermal management engineers, tier-one component suppliers, aftermarket specialists, and material scientists. These qualitative discussions yield nuanced perspectives on design challenges, integration timelines, and performance metrics. In parallel, extensive surveys of automotive procurement teams and fleet operators furnish quantitative data on cost drivers, lead time expectations, and service requirements.

Data triangulation techniques validate findings by cross-referencing disparate inputs and resolving inconsistencies. A dedicated analysis team maps supply chain flows, assesses tariff implications, and benchmarks competitive strategies across regions. Quality control protocols, such as dual-review processes and statistical confidence checks, underpin the reliability of the conclusions. Limitations and assumptions are transparently documented to facilitate interpretation and support further inquiry.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Grille Shutter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Grille Shutter Market, by Vehicle Type

- Active Grille Shutter Market, by Actuation Type

- Active Grille Shutter Market, by Material

- Active Grille Shutter Market, by End Use

- Active Grille Shutter Market, by Application

- Active Grille Shutter Market, by Distribution Channel

- Active Grille Shutter Market, by Region

- Active Grille Shutter Market, by Group

- Active Grille Shutter Market, by Country

- United States Active Grille Shutter Market

- China Active Grille Shutter Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Key Takeaways Underscoring Strategic Imperatives for Stakeholders in the Evolving Active Grille Shutter Ecosystem

The active grille shutter landscape is at a pivotal juncture, influenced by technological innovation, regulatory dynamics, and supply chain recalibrations. Key takeaways emphasize the critical role of electric actuation and advanced materials in driving next-generation solutions, as well as the importance of tariff-informed sourcing strategies for cost containment and resilience. Regional insights underscore the varied adoption pathways-from aftermarket growth in the Americas to electrification-driven deployments in Asia-Pacific and regulatory imperatives in EMEA.

Competitive analysis reveals that alliances between motor technology pioneers, composite specialists, and software integrators are creating modular, smart shutter systems that deliver measurable performance gains. Meanwhile, decentralized production and e-commerce partnerships are redefining distribution models across aftermarket segments. To secure a meaningful advantage, stakeholders must adopt a holistic approach-integrating predictive control algorithms, embracing circular material strategies, and leveraging digital twin frameworks.

Ultimately, success in the evolving active grille shutter ecosystem will depend on the ability to anticipate regulatory shifts, cultivate agile supply chains, and invest in data-driven product innovation. Organizations that embrace these strategic imperatives will be well positioned to influence the direction of vehicle thermal and aerodynamic technologies in the years ahead.

Empowering Decision Makers with Exclusive Access to In-Depth Active Grille Shutter Research Insights via Engagement with Associate Director Sales & Marketing

If you’re ready to secure a competitive advantage by leveraging in-depth insights into evolving vehicle front-end thermal and aerodynamic technologies, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) today. He can guide you through tailored data packages, clarify any nuanced findings, and arrange access to the full report that aligns with your strategic priorities.

Engaging directly with Ketan ensures you receive prompt support in customizing the research elements most critical to your operations-be it component sourcing optimization, OEM partnership strategies, or material innovation roadmaps. Don’t miss the opportunity to equip your team with the perfect combination of technical analysis, supply chain intelligence, and competitive benchmarking crafted specifically for the active grille shutter ecosystem.

Contact Ketan Rohom to begin unlocking actionable market insights that drive more informed decisions, faster time-to-market, and stronger bottom-line outcomes.

- How big is the Active Grille Shutter Market?

- What is the Active Grille Shutter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?