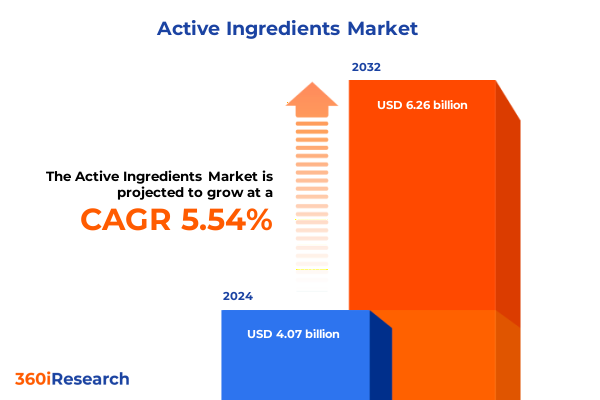

The Active Ingredients Market size was estimated at USD 4.26 billion in 2025 and expected to reach USD 4.46 billion in 2026, at a CAGR of 5.66% to reach USD 6.26 billion by 2032.

Diving into the Pivotal Role of Active Ingredients Across Diverse Industries and the Driving Forces Shaping Their Future Trajectory

The world of active ingredients represents a cornerstone of innovation across an array of industries, underpinning developments in health, agriculture, personal care, and beyond. As scientific breakthroughs accelerate, the importance of formulating and delivering bioactive compounds with precision and efficacy has never been more pronounced. Driven by rising consumer expectations for safer, more effective products and by regulatory agencies mandating higher standards, manufacturers are compelled to reevaluate their product pipelines and invest in cutting-edge R&D to maintain competitive differentiation.

Against this backdrop, resilience and agility emerge as defining virtues for organizations seeking to harness the potential of active ingredients. Rapidly evolving supply chains, heightened sustainability criteria, and technological advancements in bioprocessing and synthetic chemistry are reshaping end-to-end value creation. Drawing upon the latest market intelligence, this executive summary distills these drivers into clear strategic narratives, setting the stage for a deeper exploration of transformative shifts, segmentation dynamics, and critical regional and company insights.

Uncovering the Transformative Technological, Regulatory, and Sustainability Shifts Redefining the Active Ingredients Market Landscape Today

Fundamental transformations in the active ingredients landscape are being propelled by convergent forces that span technological breakthroughs, environmental mandates, and evolving consumer preferences. Adoption of precision fermentation and enzyme engineering has unlocked new pathways for producing high-purity molecules at scale, while digital twins and artificial intelligence are streamlining process optimization. These advances have not only improved yield and consistency but also reduced waste and energy consumption, aligning product innovation with corporate sustainability objectives.

Simultaneously, regulatory frameworks are tightening oversight around traceability, contamination control, and ecological impact. Companies are responding by embedding lifecycle assessments into early-stage development and by forging partnerships with specialized contract research and manufacturing organizations to navigate compliance complexities. Moreover, the growing emphasis on natural and bio-based active ingredients is reshaping R&D portfolios, compelling incumbents to balance legacy chemical platforms with emerging bio-derived alternatives. These multifaceted shifts are setting the parameters for strategic differentiation in an increasingly competitive arena.

Examining the Far-Reaching Cumulative Impact of 2025 Tariff Policies on Active Ingredient Supply Chains, Costs, and Strategic Sourcing

The introduction of new tariff measures in 2025 has reverberated across global supply chains for active ingredients, precipitating a reassessment of sourcing strategies and cost structures. Suppliers and end users alike have experienced heightened input costs, prompting an agile response to mitigate margin erosion. In particular, downstream manufacturers have explored near-shoring and dual-sourcing arrangements to diversify risk and cushion the impact of import duties.

Over time, these tariffs have catalyzed structural adjustments. Companies have intensified their focus on vertical integration in order to gain greater control over raw material throughput and tariff classifications. At the same time, contract manufacturers in regions unaffected by these duties have garnered increased interest from multinational firms seeking to stabilize supply. While short-term price volatility has posed challenges, the cumulative effect has stimulated strategic innovation in logistics, procurement, and product formulation, ultimately strengthening operational resilience and long-range competitiveness.

Revealing Critical Segmentation Insights Spanning Applications, Delivery Forms, and Source Origins Underpinning Market Diversity and Opportunities

A granular understanding of market segmentation reveals the breadth and depth of opportunities across application areas, form factors, and source origins. Within application domains, active ingredients designed for animal health encompass anti-parasitic compounds, antibiotics, and vaccines, each optimized for safety profiles and efficacious delivery. Crop protection chemistries span fungicidal, herbicidal, and insecticidal formulations, refined through advanced screening and adjuvant technologies. Meanwhile, solutions in food and feed are tailored as flavor enhancement and nutraceutical actives, integrating sensory science with nutritional profiling to address consumer demand for functional foods. Industrial applications tap into adhesives, coatings, and detergents where performance attributes such as bonding strength, corrosion resistance, and surfactant efficacy are paramount. Personal care products leverage hair care, oral care, and skin care actives engineered for bioavailability and dermatological compatibility, and pharmaceutical actives continue to push boundaries in therapeutic innovation.

Equally diverse is the morphology of delivery formats. Emulsions appear in both oil-in-water and water-in-oil variants to support stability and bioaccessibility, while solids are presented as granules, pellets, and powders, the latter encompassing micronized and spray-dried particles engineered for precise dosing. Liquids are formulated as suspensions or true solutions to facilitate uniform dispersion and ease of handling. This spectrum of formats reflects a relentless drive to optimize usability, shelf life, and manufacturing yield.

The origins of these compounds add another dimension, with natural sources spanning animal-derived extracts, microbial fermentation products, and plant-based phytochemicals. Recombinant technologies leverage bacterial, mammalian, and yeast expression platforms to produce high-purity biomolecules. Semi-synthetic pathways marry natural starting materials with chemically synthesized intermediates to balance cost and complexity, while fully synthetic processes harness chemical or chemoenzymatic routes to deliver molecules not accessible through biological routes. Together, these segmentation frameworks underscore the multiplicity of R&D and commercial pathways that companies can deploy to capture value in a dynamic market.

This comprehensive research report categorizes the Active Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Source

- Application

Analyzing Regional Market Dynamics and Distinctive Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific Territories

Regional dynamics in the active ingredients space are shaped by local demand drivers, regulatory environments, and supply chain infrastructures. In the Americas, innovation centers in North America continue to lead with robust R&D funding, advanced manufacturing clusters, and a regulatory backdrop that fosters accelerated approvals. Latin America is increasingly emerging as a strategic sourcing hub, thanks to cost advantages in raw materials production and growing investment in biotechnology research.

Across Europe, the Middle East and Africa, stringent environmental and safety regulations are accelerating the phase-out of legacy chemistries and the adoption of greener alternatives. The European Union’s Green Deal has incentivized end-to-end sustainability, propelling formulators toward bio-based actives, circular economy initiatives, and comprehensive risk assessments. At the same time, Middle Eastern markets are intensifying investments in capacity expansion for pharmaceutical intermediates, while select African economies are cultivating local manufacturing through public-private partnerships.

In the Asia-Pacific region, rapid agricultural modernization, a burgeoning middle class demanding premium consumer products, and favorable government policies on biotechnology have combined to create a fertile landscape for active ingredient innovation. Established producers in East Asia are expanding into novel high-value segments, while Southeast Asian economies are investing in infrastructure upgrades to support contract manufacturing and export-oriented growth. This tapestry of regional drivers underscores the importance of tailored market entry and expansion strategies.

This comprehensive research report examines key regions that drive the evolution of the Active Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Players’ Strategic Initiatives, Collaborations, and Innovations Driving Competitive Advantage in the Active Ingredients Arena

Leading companies in the active ingredients sector are deploying a range of strategic initiatives to fortify their competitive positions. Vertical integration strategies have gained traction, with several global players acquiring upstream fermentation and synthesis capabilities to secure supply and optimize cost structures. Strategic collaborations between specialty ingredient suppliers and academic institutions are yielding novel biocatalysts and discovery platforms, accelerating time to market for high-potential molecules.

Furthermore, alliances between multinational chemical firms and regional contract development and manufacturing organizations are expanding global footprint and reducing time zones in innovation cycles. Investment in digital infrastructure, including predictive maintenance and quality-by-design frameworks, has become a key differentiator, enabling real-time process control and reducing batch variability. Meanwhile, sustainability credentials are increasingly at the forefront, with top companies publishing comprehensive life-cycle metrics and setting science-based targets for emissions, water usage, and waste reduction. These concerted efforts illustrate a multi-pronged approach to securing long-term growth in an intensely competitive environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Adeka Corporation

- Air Liquide S.A.

- AmbioPharm Inc.

- Archer-Daniels-Midland Company

- BASF SE

- Clariant AG

- Corbion NV

- COSMEDIQUE Co.,Ltd.

- Cosvision Co., Ltd.

- DSM-Firmenich AG

- Elementis PLC

- Evonik Industries AG

- GROUPE BERKEM

- ICHIMARU PHARCOS

- INKOS Co., Ltd

- Innospec Inc.

- irodori Shisei Co., Ltd.

- ITO Co., Ltd.

- Kao Corporation

- Lonza Group Ltd.

- Lubrizol Corporation

- MakingCosmetics Inc.

- Merck KGaA

- Nouryon Chemicals Holding B.V.

- SEIWA KASEI CO., LTD.

- Solvay S.A.

- STOCKMEIER Group

- Sunjin Beauty Science

- Syensqo SA

Delivering Actionable Recommendations for Industry Leaders to Navigate Disruptive Trends, Enhance Agility, and Capitalize on Emerging Growth Pathways

To navigate the complex and evolving active ingredients landscape, industry leaders should prioritize the integration of advanced analytics and artificial intelligence across R&D, manufacturing, and supply chain operations. By leveraging predictive modeling, companies can shorten development cycles and allocate resources to high-value programs. Embedding sustainability criteria within early-stage compound screening will ensure that environmental and regulatory risks are mitigated before they escalate into cost or compliance issues.

Organizations should also cultivate flexible sourcing networks, combining regional production hubs with dual-sourcing strategies to enhance supply continuity in the face of tariff fluctuations and geopolitical uncertainty. Strategic partnerships with specialty contract manufacturers and academic innovators can unlock novel product platforms while sharing technical risk. Finally, empowering cross-functional teams with real-time data dashboards and key performance indicators will foster a culture of agility, enabling swift pivoting in response to market signals and emerging end-user needs.

Detailing a Robust and Transparent Research Methodology Integrating Primary Interviews, Secondary Data, and Analytical Frameworks for Market Intelligence

This study was conducted through a blend of primary and secondary research mechanisms to ensure rigor and comprehensiveness. Primary data were gathered via in-depth interviews with executives, technical experts, and procurement specialists across the active ingredients value chain. These conversations provided firsthand perspectives on supply chain resilience, regulatory compliance challenges, and evolving application requirements.

Complementing the qualitative insights, secondary research encompassed analysis of regulatory filings, patent landscaping, scientific publications, and industry white papers. Company annual reports and investor presentations were also meticulously reviewed to capture corporate strategies, mergers and acquisitions activity, and sustainability commitments. Data triangulation and validation were applied through cross-referencing quantitative findings with expert feedback, resulting in a robust analytical framework that underpins the report’s conclusions and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Ingredients Market, by Type

- Active Ingredients Market, by Form

- Active Ingredients Market, by Source

- Active Ingredients Market, by Application

- Active Ingredients Market, by Region

- Active Ingredients Market, by Group

- Active Ingredients Market, by Country

- United States Active Ingredients Market

- China Active Ingredients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Synthesizing Core Findings and Strategic Imperatives to Guide Stakeholders Toward Informed Decisions in a Rapidly Evolving Active Ingredients Sector

Together, the insights presented herein paint a picture of an active ingredients market at an inflection point, shaped by rapid scientific innovation, shifting regulatory agendas, and evolving consumer priorities. Segment analyses reveal expansive opportunities across application areas, delivery formats, and source technologies, while regional overviews underscore the need for tailored strategies in the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Companies that effectively blend digitalization, sustainability, and strategic partnerships will be best positioned to capture long-term growth. As tariff policies and regulatory landscapes continue to evolve, proactive supply chain diversification and integrated life-cycle management will be critical for maintaining resilience. Ultimately, the synthesis of technological, commercial, and environmental imperatives outlined in this summary provides a clear roadmap for stakeholders seeking to make informed decisions and secure competitive advantage in a dynamic market environment.

Seize the Opportunity: Connect with Ketan Rohom to Secure Your Comprehensive Active Ingredient Market Research Report and Elevate Your Strategic Edge

Elevate your strategic planning by accessing the most comprehensive market research on active ingredients. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, who can guide you through tailored insights and bespoke data packages designed to address your organization’s unique challenges. His expertise and consultative approach will ensure that you derive maximum value from the report’s in-depth analysis and actionable recommendations. Reach out today to secure your copy and empower your team with the clarity and foresight required to thrive in the rapidly evolving active ingredients landscape.

- How big is the Active Ingredients Market?

- What is the Active Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?