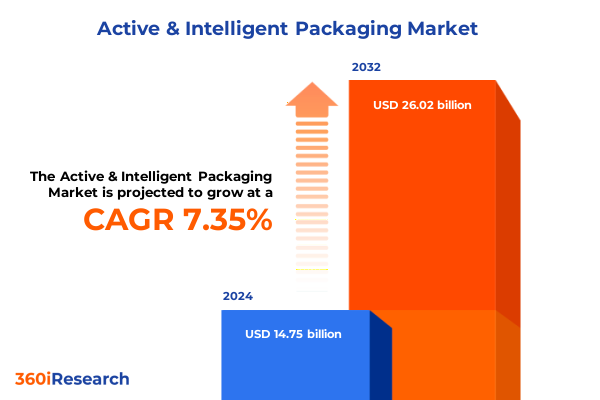

The Active & Intelligent Packaging Market size was estimated at USD 15.66 billion in 2025 and expected to reach USD 16.64 billion in 2026, at a CAGR of 7.51% to reach USD 26.02 billion by 2032.

Laying the Groundwork for Understanding the Evolution and Significance of Active and Intelligent Packaging in Modern Supply Chains

The advent of active and intelligent packaging has marked a paradigm shift in how brands safeguard product integrity, extend shelf life, and engage end consumers through embedded communication technologies. Historically, packaging served primarily as a passive barrier between product and environment; however, over the past two decades, innovations such as antimicrobial sachets, freshness indicators, and temperature-logging sensors have fundamentally altered industry expectations. These technologies not only address rising concerns over food safety and pharmaceutical efficacy but also enable brands to differentiate in crowded retail and e-commerce landscapes.

Increasing consumer awareness about product origin, freshness, and safety has acted as a catalyst for widespread adoption of packaging solutions that interact with internal and external variables. Regulatory bodies worldwide have concurrently tightened requirements around traceability and quality monitoring, prompting manufacturers to reassess conventional materials and processes. At the same time, digital transformation initiatives have paved the way for seamless integration of radio frequency identification and near-field communication in everyday packages, unlocking real-time data streams for supply chain stakeholders.

This executive summary distills critical findings on how active and intelligent packaging have evolved, identifies major forces reshaping the landscape, and surfaces actionable insights for decision-makers. By framing emerging trends, examining tariff implications, and revealing segmentation and regional nuances, this overview establishes the groundwork for strategic planning in today’s complex packaging ecosystem.

Exploring the Fundamental Shifts Driving Active and Intelligent Packaging Toward Greater Sustainability, Transparency, and Consumer Engagement

Across the packaging industry, transformative shifts are redefining how products are preserved, monitored, and communicated to end users. The first of these shifts revolves around sustainability: pressure from regulators, retailers, and environmentally conscious consumers has driven R&D investment into recyclable and bio-based active agents, as well as into refillable intelligent labeling systems that reduce single-use waste. Secondly, digital traceability has risen to prominence, particularly in food and pharmaceutical applications where blockchain-enabled sensor data offer unparalleled transparency and tamper-proof audit trails.

Simultaneously, heightened concerns about global health and safety-amplified by recent supply disruptions-have elevated demand for packaging solutions that proactively neutralize pathogens, control ambient humidity, and signal product degradation. The proliferation of Internet of Things architectures has further blurred the lines between packaging and logistics, allowing real-time monitoring of temperature excursions and spoilage markers during transit.

Together, these shifts have spurred a holistic view of packaging as an active component of the product lifecycle-one capable of extending shelf life, reducing waste, and enhancing consumer trust. Manufacturers and brand owners are increasingly partnering with technology providers to co-develop platforms that fuse antimicrobial chemistries with smart labels and cloud-based analytics, forging a new standard for product stewardship and consumer engagement.

Assessing How United States Tariff Changes in 2025 Are Reshaping Material Costs, Supply Chains, and Innovation Trajectories in Packaging

In 2025, significant tariff adjustments enacted by U.S. policymakers have reverberated across the packaging supply chain, compelling manufacturers and brand owners to reevaluate their sourcing and production strategies. Imported metals such as aluminum and steel-critical for beverage cans and metalized films-have seen duty increases designed to bolster domestic capacity, driving up upstream costs and incentivizing suppliers to explore alternative materials. Similarly, levies on certain plastics have disrupted established resin flows, prompting a transition toward recycled content and higher-value bio-polymers to mitigate financial exposure.

Beyond raw material pricing, the tariffs have catalyzed shifts in global trade patterns. Asian manufacturers of intelligent sensors and RFID tags have accelerated local partnerships within the Americas to circumvent import duties, while regional converters are expanding capacity for active packaging films to capture demand previously met through transpacific shipments. Domestic R&D initiatives have concurrently intensified as companies seek to innovate around tariff constraints, developing hybrid materials that blend glass or paperboard substrates with embedded antimicrobial or indicator chemistries.

While short-term challenges include inventory restocking delays and margin compression, the cumulative impact of these tariff measures is fostering greater supply chain resilience and technological autonomy. Stakeholders are now placing higher value on vertically integrated capabilities, forging supplier alliances that guarantee material access, and investing in in-house formulation expertise to sustain innovation pipelines amid evolving trade landscapes.

Uncovering Critical Insights From Market Segmentation Across Packaging Types, Materials, Technologies, and End Use Applications

Market segmentation sheds light on where and how active and intelligent packaging solutions create the greatest impact. When examining offerings by packaging type, the distinction between active and intelligent systems becomes evident through subcategories such as antimicrobial agents, ethylene scavengers, moisture regulators, and oxygen scavengers on one hand, and indicator-enabled, RFID-enabled, and sensor-enabled on the other. Within indicator-enabled packaging, freshness and time-temperature indicators provide immediate visual cues on product quality, whereas active RFID and passive RFID solutions facilitate end-to-end asset tracking. Sensor-enabled packages integrate freshness, gas, and temperature sensors to deliver data-driven insights throughout the supply chain.

Shifting focus to materials underscores the importance of substrate selection in performance and sustainability. Glass, metals, paperboard, and plastics each present unique advantages and challenges. Aluminum and steel remain indispensable for barrier properties, while folding carton and kraft paperboard find favor in eco-friendly applications. Plastics such as PE, PET, PP, and PVC continue to dominate flexible packaging, even as recycled and bio-based resin variants gain traction.

From a technology perspective, advanced printing techniques and smart labels such as NFC tags and QR codes are converging with traditional indicators, RFID, and sensor platforms to streamline consumer engagement and data collection. Finally, application-level segmentation reveals that sectors including cosmetics, food and beverages, healthcare and pharmaceuticals, and retail derive differentiated value from tailored active and intelligent solutions-from diagnostic kit packaging and drug containment to apparel authenticity and electronic warranty tracking.

This comprehensive research report categorizes the Active & Intelligent Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Type

- Material

- Technology

- Application

Analyzing Regional Dynamics to Reveal How Americas, EMEA, and Asia-Pacific Markets Are Adapting to Active and Intelligent Packaging Trends

Regional dynamics play a pivotal role in shaping demand for active and intelligent packaging solutions. In the Americas, robust e-commerce growth paired with stringent FDA and USDA regulations has accelerated uptake of freshness sensors and time-temperature indicators, particularly within perishable food and beverage segments. Domestic investments in circular economy initiatives have further prompted brands to integrate moisture regulators and oxygen scavengers into recyclable packaging formats.

Across Europe, the Middle East, and Africa, sustainability mandates and extended producer responsibility frameworks have fueled innovation in bio-based active chemistries and intelligent labeling. European market leaders are piloting sensor-embedded glass bottles for high-value wines, while Middle Eastern pharmaceutical companies increasingly rely on RFID-enabled systems to secure supply chains. In Africa, initiatives to reduce food loss are driving adoption of low-cost freshness indicators in last-mile distribution.

Asia-Pacific remains a hotbed of manufacturing competence, with China, Japan, and South Korea spearheading advancements in sensor miniaturization and printed electronics. Regional electronics giants are partnering with packaging converters to embed IoT capabilities directly into label stock, while fast-growing economies such as India and Southeast Asia are deploying ethylene scavengers and antimicrobial agents to preserve fruits and vegetables in humid climates. These regional nuances underscore the necessity for adaptive strategies that align technology performance with local market drivers.

This comprehensive research report examines key regions that drive the evolution of the Active & Intelligent Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading Organizations' Strategies and Innovations That Are Defining the Competitive Landscape of Active and Intelligent Packaging

Companies at the forefront of active and intelligent packaging are leveraging strategic partnerships, targeted acquisitions, and robust R&D pipelines to differentiate their offerings. Established packaging manufacturers have integrated sensor and RFID capabilities through alliances with electronics specialists, offering fully scalable solutions that span rigid and flexible formats. Simultaneously, chemical providers focused on moisture and oxygen control are expanding their portfolios of antimicrobial and ethylene trapping compounds, collaborating with converters to optimize application processes.

Market leaders are also pursuing vertical integration, securing downstream access to consumer brands through co-development agreements for smart label technologies and indicator systems. Investment in pilot lines and test-bed facilities allows these organizations to validate new materials, sensors, and printing methods under real-world conditions, accelerating time to market. Furthermore, select players are forming consortiums with logistics providers and retail chains to deploy Internet of Things test cases that demonstrate end-to-end traceability and consumer engagement models.

Emerging entrants are targeting niche applications, introducing cost-effective freshness sensors for emerging markets and leveraging advanced printing to embed QR codes and NFC tags directly into recyclable substrates. These companies often emphasize sustainability credentials, securing partnerships with fiber suppliers and resin recyclers to deliver integrated solutions that meet stringent environmental standards. Collectively, these initiatives reflect a competitive landscape driven by collaboration, technological convergence, and sustainability imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active & Intelligent Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Amcor PLC

- Ampacet Corporation

- Avery Dennison Corporation

- Ball Corporation

- BASF SE

- Coveris Holding SA

- Crown Holdings, Inc.

- Desiccare Inc

- DuPont de Nemours, Inc.

- Graham Packaging Company

- Graphic Packaging International, Inc.

- Honeywell International Inc.

- Huhtamäki Oyj

- KP Holding GmbH & Co. KG

- Lifecore Biomedical

- Linde plc

- Mitsubishi Gas Chemical Company Inc.

- Sealed Air Corporation

- The International Paper Company

- Thin Film Electronics ASA

- Timestrip UK Ltd

- W. R. Grace & Co. -Conn.

- WestRock Company

- Zebra Technologies Corporation

Actionable Strategies for Industry Stakeholders to Capitalize on Technological Advancements, Regulatory Changes, and Emerging Market Opportunities

To capitalize on the momentum in active and intelligent packaging, stakeholders should prioritize cross-functional collaboration and open innovation models. By establishing co-innovation centers with materials scientists, electronics engineers, and data analysts, industry leaders can accelerate the development of multifunctional substrates that integrate active agents, sensors, and connectivity features. In parallel, forging strategic partnerships with logistics and retail ecosystems will enable live pilot deployments that validate performance under diverse supply chain conditions.

Supply chain resilience can be bolstered by diversifying material sourcing and fostering relationships with regional converters and resin recyclers. Investing in dual-sourcing frameworks for key metals, plastics, and paperboard substrates will mitigate the impact of tariff fluctuations and geopolitical disruptions. Moreover, aligning procurement strategies with sustainability goals-such as incorporating post-consumer recycled content and bio-based polymers-will not only reduce carbon footprints but also resonate with eco-conscious consumers and regulators.

Finally, developing a robust data governance and analytics strategy is critical for maximizing the value of intelligent packaging. By implementing standardized data schemas and cloud-based dashboards, organizations can transform raw sensor outputs into actionable insights on spoilage patterns, route optimization, and consumer behavior. Collectively, these recommendations will empower industry leaders to harness technological advances, navigate regulatory complexities, and drive long-term growth in active and intelligent packaging markets.

Detailing the Rigorous Research Approach and Methodological Framework Underpinning the Analysis of Active and Intelligent Packaging Trends

The analysis underpinning this report combines extensive secondary research with primary interviews and rigorous data validation. Secondary sources included academic publications, regulatory filings, and patent databases to identify emerging chemistries, sensor technologies, and connectivity standards. Simultaneously, market intelligence was gathered from industry white papers and technical consortium reports to capture the latest developments in packaging substrates and additive manufacturing.

Primary research involved structured consultations with senior executives, research scientists, and supply chain managers across packaging manufacturers, chemical suppliers, electronics integrators, and brand-owner organizations. These interviews provided qualitative insights into strategic priorities, technology roadmaps, and operational challenges. Quantitative data was triangulated against trade statistics, customs records, and logistics performance indices to ensure accuracy and consistency.

To mitigate bias and enhance reliability, all findings were cross-referenced through a multi-stage review process involving an external advisory panel of packaging experts and academic scholars. Statistical methodologies were applied to validate trends, and scenario analyses were conducted to assess the sensitivity of tariff impacts and regional adoption rates. This robust methodological framework ensures that conclusions drawn in this report are both defensible and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active & Intelligent Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active & Intelligent Packaging Market, by Packaging Type

- Active & Intelligent Packaging Market, by Material

- Active & Intelligent Packaging Market, by Technology

- Active & Intelligent Packaging Market, by Application

- Active & Intelligent Packaging Market, by Region

- Active & Intelligent Packaging Market, by Group

- Active & Intelligent Packaging Market, by Country

- United States Active & Intelligent Packaging Market

- China Active & Intelligent Packaging Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3339 ]

Synthesizing Key Findings to Highlight the Strategic Imperatives and Future Directions for Active and Intelligent Packaging Stakeholders

This executive summary has outlined the transformative journey of active and intelligent packaging, highlighting the critical shifts in sustainability, digital traceability, and consumer engagement that are reshaping the industry. We have examined the ripple effects of U.S. trade policy on material sourcing and innovation, unpacked segmentation insights across types, materials, technologies, and applications, and revealed how regional dynamics in the Americas, EMEA, and Asia-Pacific are influencing adoption patterns.

By evaluating the strategies of leading organizations and articulating practical recommendations, this overview equips stakeholders with a clear understanding of the competitive landscape and the levers available to drive growth. The methodological rigor applied throughout the research process ensures that insights are grounded in empirical data and expert testimony, enhancing their relevance and applicability.

As the packaging ecosystem continues to evolve, decision-makers are encouraged to leverage this analysis to align investment priorities, forging partnerships that blend material science, electronics integration, and data analytics. Doing so will enable organizations to anticipate regulatory demands, differentiate product offerings, and establish resilient supply chains. Ultimately, active and intelligent packaging will not only protect and preserve products but also serve as a dynamic interface for consumer trust, sustainability, and innovation.

Engaging Directly With Our Associate Director of Sales and Marketing to Secure Your Comprehensive Report on Active and Intelligent Packaging

Harnessing the insights compiled in this comprehensive study can empower your organization to seize emerging opportunities, mitigate risks, and establish a leadership position in the rapidly evolving realm of active and intelligent packaging. To access in-depth data, detailed analyses, and strategic guidance, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engage today to secure your copy of the full market research report and embark on a path toward informed decision-making and sustained competitive advantage under expert guidance.

- How big is the Active & Intelligent Packaging Market?

- What is the Active & Intelligent Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?