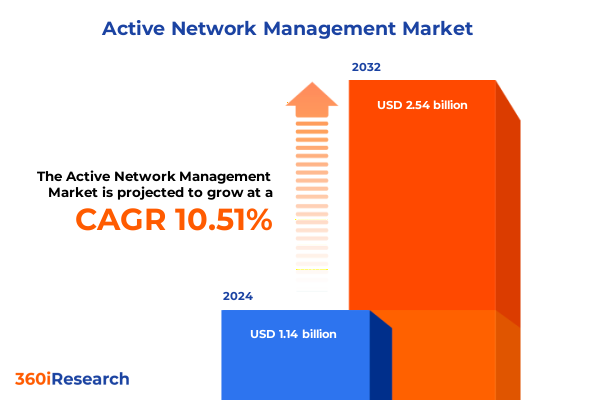

The Active Network Management Market size was estimated at USD 1.24 billion in 2025 and expected to reach USD 1.35 billion in 2026, at a CAGR of 10.73% to reach USD 2.54 billion by 2032.

Understanding the Evolution, Strategic Importance, and Foundational Role of Active Network Management in Contemporary Energy Distribution Ecosystems

Active Network Management has emerged as a pivotal cornerstone of modern energy distribution, transforming legacy power grids into dynamic, resilient systems capable of integrating distributed energy resources, enhancing reliability, and optimizing operational efficiency. At its core, this paradigm shift leverages real-time monitoring, advanced analytics, and automated controls to balance supply and demand in increasingly complex networks. By enabling utilities to proactively manage voltage, frequency, and power flow, Active Network Management not only mitigates the risk of outages but also paves the way for greater penetration of renewable energy sources and the proliferation of prosumers. Moreover, as digitalization accelerates across the energy landscape, stakeholders are recognizing that traditional passive distribution architectures are ill-equipped to handle bidirectional flows and rapid load variability. Consequently, ANM has garnered attention from grid operators, regulators, and technology providers seeking to future-proof their infrastructure.

Furthermore, the growing emphasis on decarbonization and net-zero targets has intensified the need for flexible grid solutions. By orchestrating demand response programs and voltage control mechanisms, Active Network Management facilitates the seamless integration of solar, wind, and storage assets, ultimately driving down operational costs and carbon emissions. Its strategic value extends beyond technical innovation; it represents a shift toward data-driven decision making in utility operations. Integrating machine learning models with historical and near real-time data streams empowers network managers to anticipate stress points, optimize asset utilization, and deliver superior power quality. As stakeholders navigate evolving regulatory frameworks and customer expectations, a clear understanding of the foundational principles and strategic significance of Active Network Management is essential for informed decision-making and sustained competitive advantage.

Analyzing the Profound Technological, Regulatory, and Operational Transformations Reshaping Active Network Management Practices Across the Industry

The landscape of Active Network Management has undergone a series of transformative shifts driven by rapid technological innovation, evolving regulatory mandates, and changing consumer expectations. Advances in sensor technology and Internet of Things connectivity have enabled utilities to capture granular data on power system performance, allowing for predictive analytics and automated control loops. In parallel, the maturation of edge computing has reduced latency in decision-making, empowering localized control actions to respond instantaneously to voltage fluctuations or fault conditions. Consequently, traditional centralized supervisory control frameworks are giving way to hybrid architectures that blend cloud-based analytics with edge-level decision engines.

Moreover, regulatory bodies across key markets have introduced incentive schemes and performance-based rate structures that reward grid operators for deploying flexible network solutions and integrating distributed energy resources. These policy levers have catalyzed investment in Active Network Management, shifting the narrative from cost-center expenditure to value-center enabler. As consumer adoption of electric vehicles and behind-the-meter renewable installations rises, utilities are reimagining their distribution networks to support bidirectional flows and dynamic load profiles. In response, software platforms capable of orchestrating resources in real-time have become indispensable, combining demand response, voltage regulation, and rapid fault isolation functionalities. Underpinning this operational evolution is the recognition that resilience and flexibility are no longer optional attributes but core requirements for a grid capable of meeting twenty-first century energy challenges.

Assessing the Cumulative Impact of 2025 United States Tariff Policies on Supply Chains, Technology Adoption, and Cost Dynamics within Active Network Management

United States tariffs imposed in 2025 have exerted a cumulative impact on supply chains, technology procurement, and cost structures within the Active Network Management ecosystem. Tariffs on key grid components such as power electronics, transformers, and specialized control hardware have resulted in elevated equipment costs, creating pressure on project timelines and budget allocations. Suppliers have responded by diversifying manufacturing footprints, sourcing components locally where possible, and reengineering designs to mitigate tariff exposure. However, these adjustments have lengthened lead times and, in some cases, constrained the availability of critical parts for time-sensitive grid modernization projects.

Furthermore, the imposition of higher duties on select semiconductor imports has complicated the procurement of advanced controllers and communication devices. Technology providers have navigated this landscape by forging strategic partnerships with domestic chip manufacturers and leveraging stockpiling strategies to ensure uninterrupted supply. The cost escalation has also driven increased emphasis on software-centric solutions that rely less on specialized hardware and more on existing network assets. As a result, utilities have expanded pilot deployments of software-only Active Network Management modules to validate use cases before committing to full hardware roll-outs. Although these strategies have partially offset tariff-driven cost pressures, the broader implication has been a heightened focus on supply chain resilience, localization of production, and long-term partnership models between component manufacturers and system integrators.

Unveiling Key Market Segmentation Insights Through End-User Industry, Organization Size, Deployment Model, Solution Type, and Component Perspectives

Market segmentation reveals nuanced insights into how different end-user industries, organization sizes, deployment models, solution types, and component categories are driving demand for Active Network Management solutions. When examining end‐user industries, commercial operations including hospitality and retail corridors are prioritizing rapid response capabilities to manage peak demand surges, while manufacturing facilities in both discrete and process sectors seek voltage optimization and fault management to maintain uninterrupted production. Residential applications, notably within smart homes and microgrid developments, emphasize seamless integration of home‐based solar and storage systems. Meanwhile, transportation networks spanning rail and road corridors are advancing dynamic load balancing to support electrified vehicle fleets, and utilities at both transmission and distribution levels focus on granular grid monitoring to uphold reliability standards.

Turning to organization size, large utilities categorized as tier one and tier two entities are mobilizing significant capital to implement comprehensive ANM platforms capable of handling extensive geographic footprints. Small and medium‐sized enterprises, including medium‐scale utilities, are adopting modular, scalable offerings that allow phased deployment aligned with budget cycles. Regarding deployment models, hybrid cloud environments are gaining traction as they offer the flexibility of public cloud scalability with private cloud security for critical grid data, whereas on‐premise infrastructures remain attractive to network operators seeking full control over sensitive operational technologies. In the realm of solution types, demand response across commercial, industrial, and residential segments is evolving into fully automated regimes, while distribution management functions such as fault location and automated restoration are being augmented by advanced Volt Var Control modules designed for both distribution and transmission applications. Finally, in the component landscape, communication devices, controllers, and sensors are underpinning hardware investments, professional services from consulting to implementation are ensuring successful rollouts, and analytics, control, and monitoring software suites are delivering the intelligence layer that orchestrates these diverse elements into a cohesive Active Network Management strategy.

This comprehensive research report categorizes the Active Network Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Component

- Organization Size

- End-User Industry

- Deployment Model

Illuminating Critical Regional Trends and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific in Active Network Management

Regional dynamics in Active Network Management adoption underscore significant variations in regulatory frameworks, investment priorities, and technology maturity across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, grid operators are harnessing federal and state incentives to modernize aging infrastructure, with an emphasis on integrating distributed energy assets and strengthening resilience against extreme weather events. Demand response initiatives are particularly robust in North America, supported by advanced meter installations and market mechanisms that reward rapid load adjustments. In Latin America, emerging utilities are leveraging ANM solutions to manage growing urban loads and maintain reliability amid constrained network capacities.

Across Europe Middle East & Africa, stringent emissions targets and ambitious renewable integration goals have propelled network operators toward sophisticated management strategies. European Union directives mandating dynamic grid services have catalyzed deployment of Volt Var Control and automated fault management platforms. In the Middle East, rapid urbanization and large-scale solar developments have created demand for hybrid cloud deployments to manage geographically dispersed assets. African utilities, contending with both grid expansion and reliability challenges, are increasingly adopting modular solutions that can be scaled as network coverage and electrification rates improve.

Asia-Pacific markets exhibit a blend of aggressive renewable targets and substantial grid investments. China’s drive for carbon neutrality has spurred extensive ANM pilot programs integrating wind and solar clusters. India’s distribution sector is focusing on reducing technical losses through advanced voltage regulation and network automation. In developed APAC economies such as Australia, utilities are leveraging edge computing and AI-powered analytics to optimize microgrid operations. Across the region, public-private partnerships and regional interconnection initiatives are fostering knowledge sharing and accelerating ANM maturity levels.

This comprehensive research report examines key regions that drive the evolution of the Active Network Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Vendors and Innovative Players Driving Advancements and Competitive Dynamics in the Active Network Management Market

Leading technology providers and innovative newcomers alike are shaping competitive dynamics in the Active Network Management market, each driving advancements in specific functional domains. Global infrastructure giants are integrating ANM modules into broader smart grid portfolios, offering utilities end-to-end solutions encompassing advanced distribution management systems, automated voltage regulation, and fault management capabilities. Simultaneously, specialized software firms are focusing on cloud-native analytics platforms that leverage machine learning to deliver predictive insights on load behavior, equipment health, and network stability.

In parallel, hardware manufacturers are investing in next-generation power electronics and adaptive controllers engineered for high-speed communication and interoperability with legacy systems. System integrators play a critical role, orchestrating cross-vendor implementations and ensuring seamless deployment across diverse network topologies. Partnerships between telecom operators and grid technology providers are also accelerating, as secure, low-latency communication channels become integral to real-time decision-making in geographically distributed networks. Meanwhile, startup ventures are disrupting traditional paradigms with modular ANM toolkits designed for rapid proof-of-concept trials, enabling utilities to validate ROI before scaling solutions. Collectively, these competitive forces are fostering a dynamic ecosystem in which collaboration and convergence are as prevalent as differentiation and specialization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Network Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Argand Solutions Ltd.

- Camlin Limited

- Chemtrols Industries Pvt. Ltd

- Chetu, Inc.

- Cisco Systems, Inc.

- Dhyan Networks and Technologies Inc.

- DNV AS

- Electronic Specifier Ltd.

- Fortra LLC

- General Electric Company

- International Business Machines Corporation

- Intrada Technologies

- Itron Inc.

- Landis+Gyr AG

- Mitsubishi Electric Corporation

- NAAC Energy Controls Pvt. Limited

- National Grid Electricity Distribution PLC

- Operation Technology, Inc.

- Oracle Corporation

- Pacific Controls Smart Grid Services Inc.

- Roadnight Taylor Ltd.

- Schneider Electric SE

- Scottish and Southern Electricity Networks

- Siemens AG

- SolarWinds Worldwide, LLC

- Weidmüller Interface GmbH & Co. KG

- Zenoss, Inc.

- ZIV Aplicaciones y Tecnología, S.L.

- Zoho Corporation Pvt. Ltd.

Strategic Actionable Recommendations for Industry Leaders to Accelerate Adoption, Foster Innovation, and Enhance Resilience in Network Management Operations

To capitalize on emerging opportunities and navigate escalating complexity in network operations, industry leaders must adopt a proactive strategic posture that encompasses technological, organizational, and partnership dimensions. First, accelerating the adoption of cloud-edge hybrid architectures will enable real-time analytics and control at scale while preserving data sovereignty for critical operational systems. Executives should mandate pilot programs that validate performance gains from distributed control algorithms and AI-driven load forecasting, thereby building organizational confidence and uncovering use cases ripe for rapid expansion.

In addition, fostering deeper collaboration across the value chain is imperative. Utilities, technology vendors, and research institutions should co-create proof-of-concept projects that test interoperable frameworks, ensuring that disparate devices and software modules can seamlessly coordinate system-wide actions. By establishing joint innovation labs and cross-industry consortia, stakeholders can share risk, accelerate standardization efforts, and collectively address cybersecurity and regulatory compliance challenges.

Lastly, embedding change management principles into ANM roll-outs will be crucial for sustaining momentum. Executive leadership must communicate a clear vision of enhanced reliability, cost efficiency, and environmental benefits, while empowering frontline engineers with training programs focused on data interpretation, automation oversight, and adaptive troubleshooting. Through this multifaceted approach, organizations can derive maximum value from Active Network Management, translating advanced capabilities into improved service continuity and strategic differentiation.

Detailing the Comprehensive Research Methodology, Data Sources, and Analytical Framework Employed to Ensure Robustness and Accuracy in Market Insights

The research underpinning these insights was conducted through a rigorous methodology combining primary and secondary intelligence to ensure a robust and unbiased perspective. Primary research comprised in-depth interviews with senior executives, grid operators, solution architects, and regulatory experts across key geographies. These discussions were designed to capture firsthand experiences with deployment challenges, performance metrics, and strategic objectives. Complementing this qualitative data, a comprehensive survey of utility procurement officers provided quantitative validation of technology adoption rates, budgetary priorities, and anticipated growth areas.

Secondary research involved exhaustive reviews of technical whitepapers, regulatory filings, industry association reports, and peer-reviewed journals to establish a factual baseline for technological capabilities and market dynamics. Data triangulation techniques were employed to cross-validate findings across multiple sources, minimizing bias and enhancing the credibility of conclusions. Analysts also monitored ongoing pilot projects and proof-of-concept initiatives to track performance outcomes and scalability considerations in real-world environments. Finally, a dedicated peer review process with external experts in power systems engineering and energy policy ensured that all assumptions and interpretations adhered to the highest standards of academic rigor and industry relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Network Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Network Management Market, by Solution Type

- Active Network Management Market, by Component

- Active Network Management Market, by Organization Size

- Active Network Management Market, by End-User Industry

- Active Network Management Market, by Deployment Model

- Active Network Management Market, by Region

- Active Network Management Market, by Group

- Active Network Management Market, by Country

- United States Active Network Management Market

- China Active Network Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3339 ]

Concluding Insights on the Future Trajectory, Strategic Imperatives, and Industry Implications of Active Network Management in the Evolving Energy Landscape

As the energy landscape continues to evolve under the influences of digital transformation, decarbonization mandates, and rising consumer expectations, Active Network Management has firmly established itself as an indispensable capability for modern grid operators. Its ability to orchestrate distributed resources, optimize network performance, and enhance resilience positions it at the center of strategic planning for utilities worldwide. Looking ahead, further maturation of AI-enabled automation, advanced power electronics, and interoperable communication frameworks will unlock new levels of operational efficiency and reliability.

Importantly, the convergence of grid modernization objectives with broader sustainability goals underscores Active Network Management’s role in facilitating the energy transition. By enabling higher renewable integration and more responsive demand‐side participation, ANM accelerates progress toward net-zero targets while delivering tangible benefits in service quality and cost management. Ultimately, organizations that embrace this technology with strategic clarity, collaborative spirit, and operational discipline will emerge as leaders in the next era of energy distribution.

Take Action Now to Secure In-Depth Strategic Guidance and Exclusive Market Intelligence with Associate Director Ketan Rohom Leading Your Engagement

To explore the full breadth of strategic insights, granular segment analysis, and actionable guidance in Active Network Management, contact Ketan Rohom, Associate Director, Sales & Marketing. He will help you unlock exclusive intelligence on key technological advancements, regulatory implications, and competitive strategies. Engage with Ketan to tailor a comprehensive subscription or single-client report that addresses your organization’s specific challenges and growth aspirations. Don’t miss the opportunity to position your enterprise at the forefront of grid modernization and digital transformation. Reach out to Ketan to purchase the definitive market research report today and secure your competitive advantage in a rapidly evolving energy ecosystem.

- How big is the Active Network Management Market?

- What is the Active Network Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?