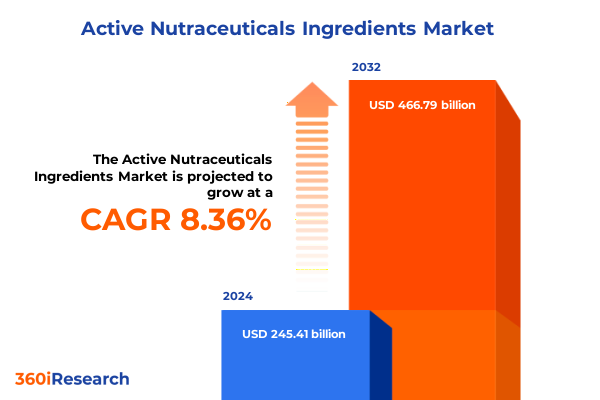

The Active Nutraceuticals Ingredients Market size was estimated at USD 265.40 billion in 2025 and expected to reach USD 287.02 billion in 2026, at a CAGR of 8.40% to reach USD 466.79 billion by 2032.

Emerging Potentials and Strategic Application of Active Nutraceutical Ingredients in Advancing Health Outcomes and Wellness Innovations Across Industries

Active nutraceutical ingredients have become a cornerstone of modern wellness and preventive healthcare strategies, with bioactive compounds playing an increasingly significant role in consumer health routines. From antioxidant-rich microalgae to novel microbial fermentation derivatives, these ingredients are unlocking new capabilities in product formulation and therapeutic efficacy. Driven by robust consumer demand for natural, science-backed solutions, the industry is witnessing a surge in innovation that bridges traditional botanical knowledge with advanced biotechnological processes.

As stakeholders across the value chain invest in research and development, the integration of emerging ingredients into functional foods, supplements, and personal care products is transforming market dynamics. Manufacturers are prioritizing ingredient efficacy, purity, and traceability, while regulatory bodies refine guidelines to ensure safety and quality. In this context, active nutraceutical ingredients are not only enhancing product differentiation but are also driving partnerships between ingredient suppliers, contract manufacturers, and end-user brands.

This introduction frames the broader landscape by highlighting the accelerating adoption of diverse bioactive sources, the critical role of science in validating health claims, and the strategic importance of supply chain resilience. It sets the stage for deeper analysis of transformative trends, tariff impacts, segmentation insights, regional dynamics, and competitive strategies that will be explored in the subsequent sections.

Major Disruptive Trends Redefining Active Nutraceutical Market Dynamics and Innovative Ingredient Sourcing Strategies in 2025 Ecosystem

The active nutraceutical ingredients landscape is undergoing transformative shifts that are redefining how value is created and delivered across the supply chain. Sustainability has emerged as a critical axis of innovation, with companies leveraging algae and marine extracts in closed-loop cultivation systems to reduce environmental footprints. Simultaneously, advances in microbial fermentation are enabling cost-efficient, high-purity production of probiotics and yeast derivatives, marking a departure from conventional extraction methods and paving the way for scalable manufacturing.

Parallel to these supply-side developments, digital health technologies are driving personalized nutrition approaches. Data analytics and biomarker profiling are empowering formulators to tailor functional ingredients to individual health profiles, accelerating the shift from one-size-fits-all supplements to targeted wellness solutions. This consumer-centric mindset is further reinforced by heightened regulatory scrutiny, which is pushing ingredient suppliers to invest in clinical validation and transparent labeling practices.

Collectively, these trends underscore a strategic pivot toward innovation ecosystems that blend sustainability, personalization, and scientific rigor. By embracing these disruptive forces, stakeholders can position themselves to meet evolving consumer expectations and regulatory requirements while unlocking new avenues for growth in a competitive marketplace.

Comprehensive Assessment of United States 2025 Tariff Policies and Their Widespread Impact on Active Nutraceuticals Ingredient Supply Chains

In 2025, the United States imposed revised tariff schedules that have far-reaching implications for active nutraceutical ingredient supply chains. The most consequential measures target key sources such as algae and marine extracts, reflecting broader trade tensions and domestic policy priorities. These tariff adjustments have elevated input costs, compelling ingredient suppliers to reassess procurement portfolios and optimize trade routes to maintain competitive pricing.

The ripple effects extend beyond raw material pricing. As cost pressures intensify, downstream manufacturers face margin squeezes that challenge existing business models. Some companies have responded by relocating production closer to raw-material hubs or investing in regional processing facilities to circumvent tariff burdens. Others are accelerating research into alternative sources, notably microbial fermentation, to mitigate exposure to volatile international levies.

Looking ahead, strategic dialogue between industry associations and trade regulators will be crucial in shaping future tariff frameworks. Companies that proactively engage in advocacy, develop joint-venture partnerships, and enhance supply-chain transparency will be better positioned to navigate the evolving tariff landscape. Ultimately, adaptability and collaborative problem-solving will determine which stakeholders can sustain growth amid shifting trade dynamics.

In-Depth Market Segmentation Reveals Critical Performance Drivers Across Ingredient Types, Applications, End Users, and Distribution Channels

A nuanced examination of market segmentation reveals the distinct drivers and performance levers across multiple dimensions. When viewed through the lens of ingredient source, the algae extracts segment-anchored by chlorella and spirulina-continues to command attention for its antioxidant and nutrient-dense profiles, while marine extracts such as fish oil and krill oil remain indispensable for cardiovascular health formulations. Microbial fermentation has carved out a critical niche with probiotics and yeast derivatives, catering to gut health and immune support applications. Plant extracts, including echinacea, ginseng, and turmeric, sustain their popularity in traditional herbal supplement portfolios, and synthetic options, whether single compounds or combination formulations, provide precision dosing and consistency in specialty applications.

Shifting focus to application contexts, active nutraceutical ingredients permeate animal nutrition formulations-ranging from aquaculture and pet feed to poultry-to enhance growth performance and disease resilience. Clinical nutrition leverages medical foods and parenteral nutrition to support patient recovery and metabolic health, while dietary supplements harness herbal extracts, minerals, and multivitamins to address everyday nutritional gaps. Functional foods and beverages integrate fortified drinks, probiotic foods, and sports nutrition drinks to meet consumer demand for convenient wellness solutions, and personal care and cosmetics employ oral care products and topical formulations to deliver bioactive benefits through non-invasive modalities.

Considering end-user engagement, contract manufacturing organizations-from large-scale to small-scale operators-provide critical capacity and expertise, while nutraceutical manufacturers navigate between generic formulations and specialty ingredient blends to capture niche markets. Pharmaceutical manufacturers, whether global enterprises or regional players, increasingly incorporate active nutraceutical ingredients into adjunct therapies and wellness-oriented product lines. Distribution channels, spanning direct B2B relationships, e-commerce platforms via company websites and third-party marketplaces, and retail pharmacies that include independent outlets and major chains, shape market access strategies and influence product availability in key markets.

This comprehensive research report categorizes the Active Nutraceuticals Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Source

- Application

- End User

- Distribution Channel

Regional Dynamics Shaping the Active Nutraceuticals Landscape Highlighting Opportunities Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics exert a profound influence on the active nutraceutical ingredients market. In the Americas, the United States stands at the forefront of innovation, propelled by strong consumer demand for preventive health solutions and well-established regulatory frameworks. Canada’s emphasis on natural health products propels research into botanical extracts, while Latin American markets benefit from rich biodiversity, creating opportunities for novel ingredient discovery.

Within Europe, Middle East, and Africa, stringent quality standards in the European Union drive investments in clinical validation and GMP-compliant manufacturing, while Middle Eastern stakeholders focus on high-value marine and plant extracts supported by government-led diversification initiatives. Africa, though nascent, is emerging as a source of unique botanical and microbial strains, attracting interest from global ingredient suppliers seeking sustainable sourcing partnerships.

Asia-Pacific markets present a dual landscape of maturity and rapid growth. China and India combine deep traditional herbal knowledge with expanding bioprocessing capabilities, catalyzing innovation in echinacea, turmeric, and fermentation-derived ingredients. Southeast Asia and Japan contribute through advanced marine biotechnology and consumer hospitality trends, respectively, positioning the region as both a consumption powerhouse and a global production hub.

This comprehensive research report examines key regions that drive the evolution of the Active Nutraceuticals Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Analysis of Leading Players in Active Nutraceutical Ingredients Market Unveiling Innovation, Partnerships, and Growth Initiatives

Leading companies in the active nutraceutical ingredients space are distinguished by strategic investments in R&D, targeted acquisitions, and collaborative partnerships. Global specialty ingredient suppliers continue to expand their portfolios through the integration of high-purity marine and microbial fermentation technologies. These players are also scaling up advanced extraction facilities and forging alliances with academic institutions to secure first-mover advantage in emerging bioactive compounds.

In parallel, mid-tier innovators are capitalizing on niche applications such as personalized nutrition and clinical support formulations, carving out market share by offering tailored ingredient blends backed by clinical studies. Strategic collaborations with contract research organizations and healthcare providers are enabling these companies to enhance credibility and accelerate product commercialization.

Additionally, ingredient distributors and contract manufacturing organizations are differentiating by providing turnkey solutions-from ingredient sourcing and formulation development to packaging and regulatory support. Their integrated service models are streamlining time-to-market for brands seeking to outsource complex nutraceutical projects, reinforcing the importance of agility and end-to-end capabilities in a competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Nutraceuticals Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Activ'Inside

- Ajinomoto Co., Inc.

- Amway Corporation

- Archer-Daniels-Midland Company

- Arla Foods Ingredients P/S

- BASF SE

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- Frutarom Industries Ltd.

- Glanbia plc

- Herbalife Nutrition Ltd.

- Ingredion Incorporated

- Ingredion Incorporated

- Kemin Industries, Inc.

- Kerry Group PLC

- Koninklijke DSM N.V.

- Kyowa Kirin Co., Ltd.

- Lonza Group AG

- Nestlé Health Science S.A.

- NR LIFE CARE

- Roquette Frères

- Sabinsa Corporation

- Tate & Lyle PLC

- Tate & Lyle PLC

- The Lubrizol Corporation

Targeted Strategic Recommendations Empowering Industry Leaders to Optimize Supply Chains, Diversify Portfolios, and Capitalize on Emerging Trends

Industry leaders should prioritize diversifying supply sources to mitigate risks associated with tariff volatility and raw-material scarcity. Investing in microbial fermentation platforms and regional processing facilities can enhance production flexibility and cost efficiency, while collaborative sourcing agreements with raw material producers can secure long-term access to critical biomasses.

Building stronger partnerships across the value chain-spanning contract manufacturers, clinical research organizations, and distribution networks-will accelerate innovation and streamline product launch cycles. Technology integration, such as digital traceability and blockchain for ingredient authentication, will not only bolster regulatory compliance but also reinforce consumer trust in provenance claims.

To capture growth in high-potential segments, companies should tailor formulations for targeted applications, leveraging clinical data to substantiate health claims in dietary supplements, functional foods, and medical nutrition. Engaging in joint ventures or licensing agreements with specialized ingredient developers can expand product pipelines and enhance competitiveness. Finally, adopting agile pricing and distribution strategies across both e-commerce and traditional retail channels will ensure responsiveness to evolving consumer preferences and market disruptions.

Rigorous Research Methodology Combining Comprehensive Data Collection, Expert Interviews, and Multi-Source Validation for Market Insights

This research draws on a rigorous methodology that integrates both secondary and primary data sources to ensure robust and actionable insights. The secondary phase involved systematic analysis of peer-reviewed journals, industry publications, and patent filings, complemented by reviews of regulatory databases to capture evolving compliance requirements.

The primary phase comprised in-depth interviews with senior executives from ingredient suppliers, contract manufacturers, and healthcare practitioners, as well as consultations with academic researchers specializing in bioactive compound development. These expert perspectives were triangulated with proprietary supply-chain data and validated through cross-comparison with market databases.

Segment mapping was conducted by aligning product attributes with application use-cases, end-user requirements, and distribution channel dynamics. Quality assurance processes, including multi-level peer reviews and statistical triangulation, were employed to verify consistency and reliability. This multi-source, multi-method approach ensures that the insights presented reflect current market realities and strategic imperatives for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Nutraceuticals Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Nutraceuticals Ingredients Market, by Source

- Active Nutraceuticals Ingredients Market, by Application

- Active Nutraceuticals Ingredients Market, by End User

- Active Nutraceuticals Ingredients Market, by Distribution Channel

- Active Nutraceuticals Ingredients Market, by Region

- Active Nutraceuticals Ingredients Market, by Group

- Active Nutraceuticals Ingredients Market, by Country

- United States Active Nutraceuticals Ingredients Market

- China Active Nutraceuticals Ingredients Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3180 ]

Synthesized Conclusions Highlighting Key Takeaways, Market Imperatives, and Strategic Pathways for Active Nutraceutical Ingredient Stakeholders

The findings of this executive summary underscore the multifaceted evolution of the active nutraceutical ingredients market, driven by sustainability imperatives, technological advancements, and shifting regulatory landscapes. Transformative sourcing strategies-from marine and algae extracts to microbial fermentation and precision-engineered synthetics-are reshaping product innovation trajectories and competitive dynamics.

The 2025 U.S. tariff adjustments have crystallized the importance of supply-chain resilience and strategic diversification, compelling stakeholders to explore alternative production hubs and technology platforms. Deep segmentation analysis highlights the critical role of ingredient source, application context, end-user engagement, and distribution channels in unlocking growth opportunities. Regional insights reveal differentiated growth pathways, with established markets balancing regulatory rigor and consumer sophistication while emerging regions offer prospects for novel ingredient discovery and strategic partnerships.

Ultimately, success in this rapidly evolving landscape hinges on proactive collaboration, data-driven decision-making, and strategic investments that align with consumer health priorities and regulatory requirements. Stakeholders who embrace these imperatives will be well-positioned to lead the next generation of active nutraceutical innovation.

Seize the Competitive Advantage with an In-Depth Active Nutraceuticals Market Report to Drive Strategic Decisions and Growth Momentum

To obtain the comprehensive market research report on active nutraceutical ingredients, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you through the depth and breadth of findings, help tailor insights to your strategic priorities, and facilitate a seamless transaction process for immediate access. Engaging with Ketan ensures you leverage expert support in aligning report deliverables with your organizational objectives.

By contacting Ketan, you will gain a clear roadmap for tapping into emerging ingredient segments, navigating evolving tariff landscapes, and capitalizing on regional growth corridors. His in-depth understanding of industry challenges and opportunities will equip your team to translate research insights into actionable initiatives. Secure your copy today to stay ahead in an increasingly competitive nutraceutical ecosystem.

- How big is the Active Nutraceuticals Ingredients Market?

- What is the Active Nutraceuticals Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?