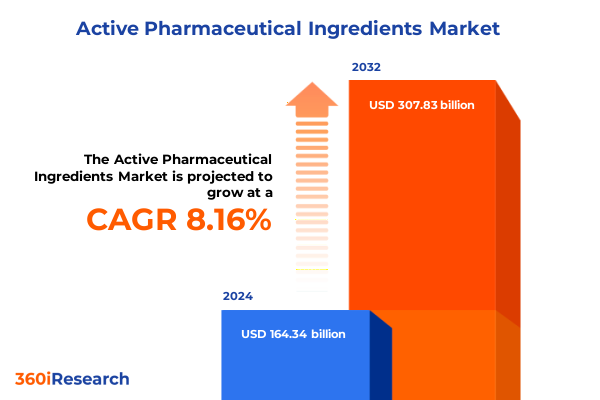

The Active Pharmaceutical Ingredients Market size was estimated at USD 177.52 billion in 2025 and expected to reach USD 190.87 billion in 2026, at a CAGR of 8.18% to reach USD 307.83 billion by 2032.

Unveiling the Pivotal Role of Active Pharmaceutical Ingredients in Shaping Future Drug Manufacturing and Supply Chain Resilience

Active Pharmaceutical Ingredients (APIs) represent the biochemical foundations of virtually every therapeutic compound, underscoring their indispensable role in global drug development and patient care delivery. While the United States accounts for over 40 percent of the global API production value, more than two-thirds of volume originates in China and India, reflecting a concentrated manufacturing footprint that carries both cost-efficiency benefits and supply chain vulnerabilities. These dynamics have been thrust into sharp relief by recent disruptions, from pandemic-related factory shutdowns to escalating geopolitical tensions, forcing stakeholders to reconsider traditional sourcing strategies and resilience measures.

Contemporary drug pipelines increasingly blend small molecules with large biomolecules, monoclonal antibodies, nucleic acids, and recombinant proteins, heightening the complexity of API development and production workflows. Concurrently, mounting regulatory scrutiny across critical markets emphasizes stringent quality controls, environmental compliance, and documentation rigor, challenging manufacturers to balance innovation with adherence to global standards. Within this context, the API sector emerges not only as a cost center but as a strategic enabler of future therapeutic breakthroughs.

This executive summary delves into the transformative forces reshaping API manufacturing, evaluates the cumulative impact of United States tariffs through mid-2025, delivers nuanced segmentation and regional insights, profiles key industry players, and proposes actionable recommendations to navigate the evolving landscape. Our objective is to equip decision-makers with a holistic understanding of the challenges and opportunities that lie ahead.

Embracing Technological and Regulatory Disruptions That Are Redefining API Production Paradigms Through Digitalization and Sustainable Innovation

The API manufacturing ecosystem is undergoing a profound transformation driven by converging technological, regulatory, and market forces. Continuous manufacturing, once confined to experimental pilot lines, has matured into a mainstream production approach that streamlines throughput, minimizes footprint, and enhances product consistency. Leading organizations report that real-time monitoring through digital twins and advanced data analytics enables predictive maintenance and swift process adjustments, significantly reducing batch failures and accelerating commercial launch timelines.

Parallel to manufacturing evolution, digitalization is redefining end-to-end process visibility. The integration of IoT sensors, electronic batch records, and process analytical technology (PAT) platforms is empowering manufacturers to capture granular data across every stage of production. Artificial intelligence and machine learning algorithms applied to these data streams are optimizing reaction parameters, supply chain logistics, and quality control thresholds, fostering agile responses to deviations and regulatory requirements. These capabilities are especially critical for high-value biologics, where precise control of reaction kinetics and contamination risks can determine clinical success.

Moreover, the surge in personalized medicine, cell and gene therapies, and novel oligonucleotide platforms has compelled CDMOs and in-house units alike to invest in modular, scalable facilities designed for small-batch flexibility. Sustainability initiatives and green chemistry principles are also gaining traction, with companies adopting solvent recovery systems, energy-efficient reactors, and waste minimization strategies to reduce environmental impact and comply with evolving eco-regulations. Collectively, these shifts underscore a strategic imperative: manufacturers must blend technological agility, regulatory foresight, and sustainability stewardship to secure long-term competitive advantage.

Assessing the Layered Impact of United States Trade Measures and Tariff Policies on the API Sector Through Mid-2025 Supply Chain Pressures

In 2025, the United States has layered multiple tariff measures that directly affect API sourcing and manufacturing economics. A 10 percent global tariff on pharmaceuticals, implemented in April, applies broadly to imports of active substances, devices, and equipment, compelling U.S. producers to reassess supply chains and cost structures. On top of this, China-sourced APIs face a 25 percent duty, while imports from India are subject to a 20 percent tariff, reflecting heightened scrutiny of critical drug inputs and a strategic push toward domestic self-reliance.

An Ernst & Young analysis for a major industry lobby quantified the potential impact: a 25 percent tariff on finished pharmaceutical imports could elevate U.S. drug costs by up to $51 billion annually, with retail prices rising by as much as 12.9 percent if fully passed on to consumers. Moreover, tariffs on intermediate inputs are expected to increase domestic API manufacturing costs by approximately 4.1 percent, eroding the global competitiveness of U.S.-made drugs and placing pressure on export volumes and related jobs.

Despite these challenges, the pharmaceutical sector has sought partial protections. Essential medicines and therapeutics have been initially spared under certain Section 232 investigations, acknowledging the risk of exacerbating drug shortages if tariffs are too broadly applied. Nonetheless, uncertainty remains high as the administration evaluates phased implementations, exemption requests, and potential retaliatory measures from trading partners. For API manufacturers and drug sponsors, proactive scenario planning and near-term hedging strategies are now critical to mitigate tariff-induced margin compression and ensure uninterrupted access to vital ingredients.

Deriving Strategic Insights from Diverse API Market Segments to Illuminate Opportunities Across Molecule Types, Sources, and Therapeutic Applications

The API landscape can be dissected across a spectrum of interrelated market segments that illuminate strategic priorities and investment imperatives. At the molecular level, the bifurcation between large molecules and small molecules underscores distinct manufacturing paradigms. Large molecules, encompassing monoclonal antibodies, nucleic acids, peptides, and recombinant proteins, command specialized bioprocessing suites and stringent cold-chain logistics, whereas small molecules leverage well-established synthetic chemistry platforms that benefit from scale economics and streamlined purification workflows. Within the monoclonal antibody subset, the emergence of antibody-drug conjugates, bispecific antibodies, and checkpoint inhibitors signifies an advanced innovation frontier demanding heightened process control and analytical rigor.

Source differentiation further nuances the API value chain. Biotech-derived APIs, produced through enzymatic synthesis, fermentation, or recombinant DNA techniques, cater to the biologics market’s rapid growth in oncology and immunotherapy. In contrast, natural and synthetic sources continue to underpin the generics sector, where cost efficiency and manufacturing throughput are paramount. Concurrently, the choice of route of administration-from inhalation aerosols to injectable intramuscular, intravenous, and subcutaneous delivery-drives formulation complexity and influences manufacturing investments in sterile fill-finish capabilities.

Product category segmentation highlights a dual narrative: branded APIs, anchored by patent-protected innovation and higher margin profiles, coexist with generic APIs, characterized by price competition and high volume. Therapeutic applications span anti-infective, cardiovascular, central nervous system, diabetes, gastrointestinal, oncology, and respiratory domains, each with unique regulatory landscapes and scale requirements. Finally, the distinction between human and veterinary applications, the latter subdivided into companion animal and livestock markets, reveals divergent demand drivers, supply chain channels, and pricing models. Together, these segmentation insights shed light on where R&D resources, capacity expansions, and strategic partnerships should be prioritized to capture emerging opportunities.

This comprehensive research report categorizes the Active Pharmaceutical Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Molecule Type

- Source

- Route Of Administration

- Product Category

- Therapeutic Application

- Application

Examining Regional Dynamics Shaping API Manufacturing Hubs and Supply Chains Across the Americas, EMEA Territories, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the competitive contours of global API manufacturing and supply. The Americas region, led by the United States, emphasizes high-value production, with nearly 40 percent of global API value generated domestically. Robust regulatory infrastructure, comprehensive intellectual property protections, and proximity to leading pharmaceutical companies drive demand for both in-house and outsourced API capabilities. At the same time, supply chain diversification efforts have prompted U.S. stakeholders to explore nearshoring options in Canada and Mexico to mitigate tariff impacts and reduce lead times amid evolving trade policies.

Across Europe, the Middle East, and Africa (EMEA), Germany, Switzerland, and Ireland serve as key API hubs, leveraging advanced chemical engineering expertise and favorable tax regimes. However, Europe remains both a prominent exporter of finished pharmaceuticals and a significant importer of critical ingredients, with 73 percent of U.S. pharmaceutical imports in 2023 sourced from Europe, reinforcing transatlantic supply interdependencies. Regulatory harmonization under the European Medicines Agency, coupled with growing emphasis on sustainable manufacturing standards, is prompting regional players to invest in green chemistry and digital process control solutions to maintain compliance and competitive positioning.

In the Asia-Pacific region, China and India dominate volume production, together accounting for almost two-thirds of global API output by volume. China’s massive infrastructure investments and cost advantages, with production costs 35 to 40 percent below Western counterparts, underpin its status as the world’s foremost API supplier. India, renowned as the pharmacy of the world, contributes approximately 8.8 percent of global API output by value and supplies over 50 percent of the U.S. generic drug market’s API requirements, supported by more than 670 U.S. FDA-approved facilities. Yet geopolitical and quality concerns are accelerating diversification initiatives, with stakeholders evaluating manufacturing options in Southeast Asia and Latin America to ensure continuity.

This comprehensive research report examines key regions that drive the evolution of the Active Pharmaceutical Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading API Manufacturers and Innovators Who Are Driving Competitive Advantage Through Capacity Expansion and Strategic Alliances

The competitive landscape of API manufacturing is defined by a mix of legacy chemical companies, specialized CDMOs, and integrated pharmaceutical giants. Leading players leverage global footprints and diversified portfolios to support both small-molecule and biologics pipelines. For instance, Lonza, a pioneer in contract development and manufacturing, continues to expand its mammalian cell culture capacity and single-use bioreactor installations to meet rising demand for complex proteins. Meanwhile, Thermo Fisher Scientific has augmented its small-molecule synthesis capabilities through strategic acquisitions and process optimization platforms.

Biotech-focused service providers such as WuXi AppTec and Samsung Biologics have scaled their operations to capture a larger share of the burgeoning gene therapy and antibody markets. These companies emphasize turnkey solutions, combining R&D services with cGMP manufacturing to accelerate time to clinic. Simultaneously, traditional chemical conglomerates like Evonik and BASF are fortifying their API divisions with green process engineering and continuous flow chemistry to enhance operational efficiency and reduce waste footprints.

Innovation-driven pharmaceutical firms, including Pfizer, Roche, and AstraZeneca, are also vertically integrating select API production activities to secure supply for high-value, patent-protected molecules. AstraZeneca’s $50 billion investment commitment through 2030, focused on new U.S. manufacturing sites for critical drug ingredients, exemplifies the trend toward reshoring and capacity expansion in response to trade uncertainties. Across these varied profiles, the ability to deliver consistent quality, navigate regulatory complexity, and provide flexible scale will determine which organizations lead the next wave of API innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Pharmaceutical Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurobindo Pharma Limited

- BASF SE

- Boehringer Ingelheim International GmbH

- Cambrex Corporation

- Cipla Limited

- Divi's Laboratories Limited

- Dr. Reddy's Laboratories Limited

- Jubilant Life Sciences Limited

- Laurus Labs Limited

- Lonza Group Ltd

- Lupin Limited

- Merck KGaA

- Novartis AG

- Pfizer Inc.

- Piramal Enterprises Limited

- Sai Life Sciences Limited

- Sun Pharmaceutical Industries Limited

- Syngene International Limited

- Thermo Fisher Scientific Inc.

- WuXi AppTec Co., Ltd.

Charting Actionable Strategies for Industry Stakeholders to Navigate Volatile Tariff Environments, Supply Chain Disruptions, and Rapid Technological Change

In an environment marked by tariff pressures, supply chain volatility, and rapid technological advancement, industry leaders must adopt proactive strategies to secure resilience and growth. First, diversifying sourcing routes through a China-plus-one approach and nearshoring initiatives can reduce dependency on single markets and cushion against policy shifts. Coupled with dynamic inventory management and supply risk modeling, this approach ensures uninterrupted API availability for critical therapies.

Second, investing in continuous manufacturing and digital process control frameworks delivers both operational efficiency gains and enhanced compliance capabilities. Embedding IoT-enabled sensors and AI algorithms into production lines not only optimizes throughput but also generates the data lineage required for accelerated regulatory submissions and real-time quality assurance. Organizations that harness these tools will achieve faster scale-up and reduced time to market.

Third, forging collaborative partnerships with specialized CDMOs and technology providers allows for access to niche expertise-particularly in high-growth biologics and oligonucleotide segments-without the capital burden of in-house development. Equally important is the adoption of green chemistry principles and sustainable sourcing practices, which meet rising stakeholder expectations and anticipate tightening environmental regulations. By aligning innovation roadmaps with ESG commitments, firms can differentiate their offerings and strengthen license acquisition prospects.

Finally, scenario planning around tariff trajectories and regulatory shifts-incorporating flexible contracting terms, step-in rights, and hedge mechanisms-will enable more predictable margins and robust supply commitments. These actionable measures, executed in concert, provide a blueprint for navigating complexity and sustaining competitive advantage.

Outlining a Robust Research Framework Combining Primary Interviews, Secondary Analysis, and Rigorous Data Validation to Inform Strategic Decision-Making

Our research methodology integrates a rigorous blend of primary and secondary approaches to ensure comprehensive coverage and analytical depth. Primary insights were derived from in-depth interviews with C-suite executives at leading API manufacturers, R&D heads at multinational pharmaceutical firms, and regulatory specialists at global agencies. These discussions provided qualitative perspectives on capacity planning, quality management, and regulatory strategy.

Secondary data were gathered from industry publications, trade association reports, regulatory filings, and patent databases to quantify production volumes, tariff impacts, and technological adoption rates. High-resolution datasets from global customs and trade bodies were analyzed to map import/export flows and identify emerging supply nodes. Inputs were triangulated with publicly available financial statements, company press releases, and reputable market intelligence platforms to validate trends and growth vectors.

All quantitative findings underwent statistical verification and sensitivity analysis to assess the robustness of observed patterns under varying tariff scenarios and demand assumptions. Subject-matter experts reviewed draft deliverables to ensure contextual accuracy, and all data sources were cross-referenced for consistency. This multi-tiered approach underpins the reliability of our strategic insights and supports informed decision-making in a dynamically evolving API sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Pharmaceutical Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Pharmaceutical Ingredients Market, by Molecule Type

- Active Pharmaceutical Ingredients Market, by Source

- Active Pharmaceutical Ingredients Market, by Route Of Administration

- Active Pharmaceutical Ingredients Market, by Product Category

- Active Pharmaceutical Ingredients Market, by Therapeutic Application

- Active Pharmaceutical Ingredients Market, by Application

- Active Pharmaceutical Ingredients Market, by Region

- Active Pharmaceutical Ingredients Market, by Group

- Active Pharmaceutical Ingredients Market, by Country

- United States Active Pharmaceutical Ingredients Market

- China Active Pharmaceutical Ingredients Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings to Highlight Imperatives for API Manufacturers in an Era of Heightened Regulatory Scrutiny and Geopolitical Realignment

The landscape of API manufacturing stands at a strategic inflection point where technological innovation, regulatory scrutiny, and geopolitical dynamics intersect. High-value biologics and personalized therapies are driving demand for specialized processes, while continuous manufacturing and digitalization are setting new benchmarks for efficiency and quality control. At the same time, layered U.S. tariffs and global trade tensions underscore the necessity of supply chain diversification and agile sourcing strategies.

Segmentation insights reveal that both small-molecule generics and large-molecule biologics offer distinct growth pathways, contingent on targeted investments in infrastructure, analytical capabilities, and sustainable practices. Regional analyses highlight the value proposition of near-shoring to the Americas and reinforcing resilience in EMEA, even as Asia-Pacific remains a vital volume hub. Key players are redefining competitive advantage through strategic capacity expansions, technology partnerships, and reshoring commitments.

As the API sector navigates these converging trends, industry leaders must prioritize integrated risk management, digital transformation roadmaps, and an unwavering focus on quality and compliance. By aligning operational models with evolving market demands and policy environments, manufacturers can not only mitigate challenges but also unlock new opportunities for innovation and growth. The insights presented here form a strategic compass for stakeholders seeking to thrive in this rapidly evolving landscape.

Connect with Associate Director Ketan Rohom to Gain Exclusive Access to the Comprehensive API Market Research Report and Drive Strategic Advantage

To secure unparalleled insights into the evolving dynamics of the API landscape and maintain a competitive edge in this rapidly shifting environment, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan Rohom can provide personalized guidance on report features, answer questions on data applications, and facilitate access to the full depth of our market intelligence offerings. Whether you are evaluating strategic partnerships, assessing supply chain vulnerabilities, or exploring emerging opportunities in biologics and small-molecule production, Ketan will ensure you have the critical information needed to drive informed decisions and capitalize on market trends.

- How big is the Active Pharmaceutical Ingredients Market?

- What is the Active Pharmaceutical Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?