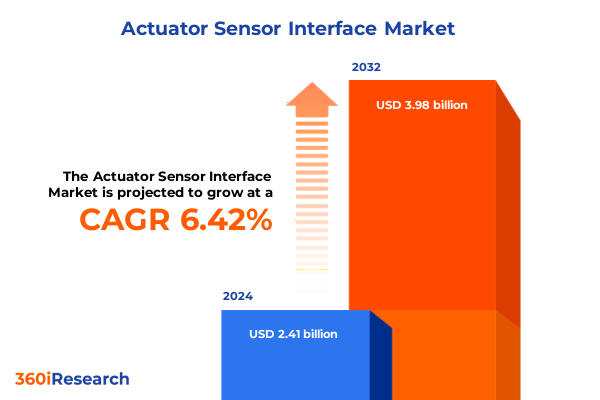

The Actuator Sensor Interface Market size was estimated at USD 2.56 billion in 2025 and expected to reach USD 2.71 billion in 2026, at a CAGR of 6.50% to reach USD 3.98 billion by 2032.

Emerging Dynamics in Actuator Sensor Interfaces: Pioneering Seamless Integration of Devices in Industry 4.0 Environments With Unparalleled Connectivity

The evolution of actuator sensor interfaces represents a foundational shift in how industry harnesses real-time data at the device level, laying the groundwork for smarter automation and enhanced operational efficiency. In an era defined by connected ecosystems, these interfaces serve as the critical juncture between sensors, actuators, and control systems, enabling rapid decision-making and precise motion control across diverse verticals. By embedding intelligence at the edge, modern actuator sensor interfaces deliver deterministic communication, simplified wiring, and reduced commissioning complexity, which collectively drive down the total cost of ownership.

As digital transformation accelerates, the need for robust, standardized communication protocols has never been more pronounced. Actuator sensor interfaces address this imperative by offering a harmonized framework that supports both analog and digital signal transmission, while also accommodating an expanding array of communication protocols. This convergence of simplicity and scalability underpins a new generation of industrial applications, from high-speed packaging lines to adaptive process control in chemical plants. Moreover, by minimizing hardware dependencies through uniform bus architectures, these interfaces facilitate modular design and rapid reconfiguration of production cells.

Looking ahead, the actuator sensor interface domain is poised for continued innovation driven by the convergence of edge computing, artificial intelligence, and advanced materials. This report’s executive summary provides a panoramic overview of the interface landscape, charting key shifts in technology adoption, regulatory influences, segment-level insights, and actionable recommendations. Stakeholders will emerge with a clear orientation on how to navigate the complexities of supply chain dynamics, tariff frameworks, and escalating performance demands, ensuring that their automation strategies remain both resilient and future-proof.

Revolutionary Advances in Interface Architectures and Edge Intelligence Shaping the Future of Real-Time Automation Control

In the last several years, the actuator sensor interface landscape has undergone transformative shifts as manufacturers seek ever-greater levels of interoperability, data fidelity, and system agility. Traditional point-to-point wiring schemes are giving way to streamlined bus architectures that consolidate numerous I/O channels onto a single cable, substantially reducing installation time and simplifying maintenance procedures. This architectural evolution dovetails with the proliferation of digital signal processing capabilities, which empower end devices to perform onboard diagnostics, error detection, and adaptive calibration, thereby elevating overall system reliability.

Another pivotal shift is the integration of edge intelligence, wherein interfaces are augmented with microprocessors capable of executing machine learning algorithms locally. These edge-enabled nodes not only minimize latency by processing data in situ but also alleviate bandwidth demands on higher-level control networks. Consequently, operations teams can leverage predictive maintenance models that continuously monitor vibration patterns, temperature profiles, and current signatures, preemptively addressing anomalies before they escalate into costly downtime.

Furthermore, the push toward open architecture frameworks has catalyzed collaboration across traditional vendor boundaries. Industry consortia and standards bodies are coalescing around common specifications that foster plug-and-play compatibility between devices from different manufacturers. This collaborative ethos extends into cross-domain interoperability, as actuator sensor interfaces increasingly interface with cloud-based analytics platforms, digital twin environments, and enterprise resource planning systems. In aggregate, these shifts are reshaping the interface market into a dynamic ecosystem characterized by modular innovation and cross-layer integration.

Navigating the Complexities of 2025 U.S. Tariff Impacts on Actuator Sensor Interface Supply Chains and Design Innovation

The imposition of cumulative United States tariffs in 2025 has significantly impacted the actuator sensor interface supply chain, compelling stakeholders to reevaluate sourcing strategies and supplier relationships. In response to tariff escalations on electronic components imported from key manufacturing hubs, original equipment manufacturers (OEMs) have pursued nearshoring initiatives, relocating critical assembly processes closer to end markets to mitigate duty burdens and logistical bottlenecks. This realignment has not only shortened lead times but also enhanced supply chain resilience, enabling more agile responses to fluctuating demand patterns and regulatory changes.

Concurrently, the cost pressures engendered by tariffs have accelerated the adoption of multifunctional modules that integrate signal conditioning, power regulation, and diagnostic capabilities into a single package. By consolidating these functions, suppliers reduce the bill of materials and offset incremental tariff-related expenses, passing a portion of the savings to customers while maintaining competitive pricing. However, this consolidation also raises technical challenges around thermal management and electromagnetic compatibility, necessitating advanced engineering techniques and rigorous compliance testing regimes.

Looking beyond immediate cost containment, tariff-driven market dynamics have spurred heightened focus on design innovation and intellectual property protection. With cross-border transactions subject to more stringent scrutiny, stakeholders are investing in proprietary communication algorithms, hardened firmware, and specialized connector technologies, thereby creating differentiated offerings that command premium positioning. These strategic pivots underscore the broader industry trend toward value-added solutions that transcend basic I/O functionality, as manufacturers seek to defend margins and foster long-term customer loyalty despite evolving trade landscapes.

In-Depth Dissection of Actuator Sensor Interface Segmentation Unveils Critical Drivers Across Types, Protocols, Technologies, and Applications

A granular examination of actuator sensor interface market segmentation reveals distinct performance drivers across multiple vectors. When analyzing interfaces by type, it becomes evident that analog channels-subdivided into current output and voltage output-continue to serve legacy installations where analog feedback loops predominate, while digital channels, powered by CMOS, LVDS, and TTL standards, are gaining traction in high-speed motion and precision applications. The digital segment’s ascendancy is underpinned by superior noise immunity and the ability to carry diagnostic data alongside process signals.

Communication protocol segmentation further highlights the divergent priorities of end users. Fieldbus technologies, encompassing CAN, Modbus, and Profibus, remain essential for deterministic networking in heavy industrial applications, while serial protocols such as RS-232 and RS-485 maintain relevance for point-to-point connections in simpler control schemes. Wireless protocols-Bluetooth, Wi-Fi, and Zigbee-are carving out a unique niche in applications where mobility and ease of retrofitting outweigh the need for ultra-low latency, such as in asset tracking and mobile robotics.

Technology typologies elucidate another layer of differentiation. Capacitive and resistive interfaces continue to excel in cost-sensitive contexts, whereas MEMS-based offerings-spanning inertial, pressure, and ultrasonic variants-are prized for their compact form factors and high accuracy. Piezoelectric modules, whether differential or direct, deliver exceptional responsiveness in dynamic monitoring scenarios. Finally, the application segmentation across automotive ADAS, engine control, and safety; consumer electronics like smartphones and wearables; healthcare diagnostics and patient monitoring; and industrial automation including process control and robotics underscores the broad utility of actuator sensor interfaces across diverse end markets.

This comprehensive research report categorizes the Actuator Sensor Interface market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Interface Type

- Communication Protocol

- Technology Type

- Application

Unveiling Regional Nuances in Actuator Sensor Interface Adoption Driven by Industry, Regulation, and Infrastructure Investments

Regional dynamics in the actuator sensor interface ecosystem reveal nuanced patterns of adoption, regulation, and technological investment. In the Americas, early mover advantage is conferred by a robust network of OEMs and system integrators that leverage proximity to end-user industries such as automotive and aerospace. The United States, in particular, benefits from deep research collaborations between private industry and academic institutions, accelerating the translation of edge analytics and AI-based diagnostics into commercial interface solutions.

Europe, Middle East & Africa exhibit a heterogeneous landscape shaped by varying regulatory regimes and infrastructure maturity levels. The European Union’s stringent functional safety and electromagnetic compatibility standards have driven a wave of compliance-oriented innovation, particularly in automotive and process industries. In the Middle East, infrastructure modernization initiatives linked to energy diversification have fueled demand for durable, high-performance interfaces, while in Africa, the focus remains on cost-effective, modular systems that can be deployed in challenging environments.

Asia-Pacific stands out as a hotbed of manufacturing scale and technological experimentation, with China, Japan, South Korea, and Southeast Asian nations all investing heavily in automation to sustain export-oriented growth. Local suppliers are leveraging economies of scale to introduce competitively priced interface modules, while strategic partnerships between multinational corporations and regional players foster knowledge transfer and rapid localization of advanced designs. Government initiatives supporting Industry 4.0 and industrial IoT further accelerate adoption across the region.

This comprehensive research report examines key regions that drive the evolution of the Actuator Sensor Interface market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Highlights Innovation, Alliances, and Emerging Niches Shaping the Interface Ecosystem

A review of leading companies in the actuator sensor interface space underscores the importance of continuous innovation, strategic alliances, and portfolio diversification. Key global players have systematically expanded their offerings through targeted acquisitions, enabling them to integrate specialized sensor technologies and proprietary communication layers into turnkey interface solutions. This trend is complemented by partnerships with software vendors that specialize in digital twin platforms, predictive analytics, and edge orchestration tools, thereby creating cohesive ecosystems rather than standalone hardware modules.

Innovation leadership has been particularly evident in the development of intelligent node architectures that embed microcontrollers and machine learning inference engines at the sensor level. By deploying self-diagnostic routines and secure firmware update mechanisms, these companies help customers mitigate cybersecurity risks and comply with emerging functional safety regulations. Moreover, several market stalwarts are forging cross-industry collaborations to co-develop standardized interface form factors, simplifying interchangeability and supporting circular economy objectives.

While established incumbents maintain strong brand recognition and global distribution networks, emerging challengers are differentiating through niche offerings such as ultra-low-power wireless modules for battery-powered sensor arrays and high-temperature resistant interfaces for oil and gas applications. These new entrants are also adept at leveraging cloud-native architectures to deliver subscription-based data services, shifting the value proposition from hardware-centric models to outcome-based engagements focused on uptime optimization and operational excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Actuator Sensor Interface market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Balluff GmbH

- Baumer Holding AG

- Bihl+Wiedemann GmbH

- Emerson Electric Co.

- Festo SE & Co. KG

- Honeywell International Inc.

- ifm electronic GmbH

- Mitsubishi Electric Corporation

- OMRON Corporation

- Pepperl+Fuchs SE

- Phoenix Contact GmbH & Co. KG

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

Strategic Pathways for Industry Leaders to Accelerate Adoption and Foster Ecosystem Synergies in Interface Solutions

Industry leaders aiming to capitalize on the accelerating demand for advanced actuator sensor interfaces should prioritize the establishment of open, interoperable platforms that facilitate rapid integration across multiple protocols and technologies. By adopting modular hardware architectures with standardized form factors and leveraging software-defined configurations, organizations can significantly reduce time to market and accommodate evolving end-user requirements without costly redesigns.

Equally important is the investment in ecosystem partnerships that span component suppliers, system integrators, and software vendors. Collaborative proof-of-concept initiatives focused on edge analytics, digital twin integration, and cloud-based performance monitoring can yield best-practice frameworks and reference designs, which accelerate customer adoption and reinforce vendor credibility. Additionally, incorporating secure over-the-air firmware update mechanisms at the interface layer will proactively address emerging cybersecurity mandates and warranty challenges.

From a market engagement perspective, leaders should deploy outcome-based commercial models that align pricing with realized operational benefits, such as reduced downtime or enhanced throughput. This shift towards subscription or pay-per-use arrangements increases customer stickiness and opens opportunities for data monetization through advanced analytics services. Finally, a concerted focus on workforce training and developer enablement programs will ensure that integrators and end users are fully equipped to harness the advanced diagnostic and control features embedded within next-generation actuator sensor interfaces.

Rigorous Multi-Stage Research Combining Secondary Intelligence and Primary Stakeholder Engagements to Validate Key Market Insights

This research harnessed a multi-stage methodology combining exhaustive secondary investigation with targeted primary engagements to ensure comprehensive coverage of the actuator sensor interface domain. The secondary phase involved a deep analysis of industry publications, white papers, regulatory standards, and patent filings to map technological trajectories and competitive dynamics. Concurrently, customs and trade databases were scrutinized to trace product flows and assess the impacts of tariff adjustments, while academic journals provided validation of emerging sensor materials and signal processing techniques.

The primary research phase comprised in-depth interviews with C-level executives, product managers, and R&D directors at leading interface manufacturers and system integrators. These dialogues yielded granular perspectives on design priorities, adoption barriers, and strategic roadmaps. Supplementing these insights, a series of virtual roundtables with automation specialists and end-user procurement leads in automotive, healthcare, and industrial automation verticals captured real-world use cases and pain points.

Data triangulation underpinned the analytical framework, enabling cross-validation of quantitative supply chain statistics against qualitative feedback from market participants. Key findings were stress-tested through sensitivity analyses around tariff scenarios, interoperability case studies, and technology migration pathways. The outcome is a cohesive, evidence-based narrative that balances macro-level trends with micro-level technical specificity, offering stakeholders a robust foundation for strategic planning and investment decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Actuator Sensor Interface market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Actuator Sensor Interface Market, by Interface Type

- Actuator Sensor Interface Market, by Communication Protocol

- Actuator Sensor Interface Market, by Technology Type

- Actuator Sensor Interface Market, by Application

- Actuator Sensor Interface Market, by Region

- Actuator Sensor Interface Market, by Group

- Actuator Sensor Interface Market, by Country

- United States Actuator Sensor Interface Market

- China Actuator Sensor Interface Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Comprehensive Synthesis of Trends, Regional Dynamics, and Competitive Forces Shaping the Future of Interface Technologies

In summary, the actuator sensor interface landscape is undergoing a rapid metamorphosis fueled by the dual imperatives of simplification and intelligence. Traditional wiring schemes are giving way to digital bus architectures that offer unparalleled flexibility, while edge-embedded analytics and AI-driven diagnostics are transforming passive I/O nodes into proactive system participants. Despite the headwinds posed by evolving tariff regimes, the industry has demonstrated resilience through regional diversification, supplier consolidation, and design innovation that mitigates cost pressures without compromising performance.

Segmentation analyses underscore the distinct growth vectors across interface types, communication protocols, technology platforms, and end-use applications, illuminating strategic priorities for stakeholders in each segment. Simultaneously, regional insights reveal how regulatory landscapes, infrastructure investments, and local manufacturing capabilities influence adoption patterns and competitive positioning. The competitive terrain is characterized by a dynamic interplay of incumbent scale and challenger agility, with both camps leveraging partnerships to extend their value propositions beyond hardware into software and services.

Ultimately, success in this arena hinges on a holistic approach that marries technical interoperability with commercial creativity. By embracing modular architectures, open standards, and outcome-oriented business models, industry participants can navigate market complexities and capitalize on the transformative potential of advanced actuator sensor interfaces. The recommendations outlined herein provide a clear blueprint for innovation, collaboration, and sustained growth in a landscape that promises to redefine real-time industrial connectivity.

Unlock Strategic Growth and Secure Your Executive-Level Market Intelligence through a Personalized Consultation with Ketan Rohom

The comprehensive insights on actuator sensor interfaces unveil critical pathways for securing a competitive edge through informed investment and strategic alignment. Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, will empower your organization to harness the full depth of our rigorous market study, incorporating nuanced analysis of emerging connectivity standards, tariff impacts, segmentation insights, and regional dynamics. Through personalized consultation, you will gain targeted recommendations tailored to your unique position in the ecosystem, ensuring that every decision is grounded in a robust understanding of the technology landscape.

By partnering with Ketan Rohom, you benefit from an in-depth walkthrough of the report’s methodology, exclusive access to proprietary data, and actionable frameworks designed to facilitate rapid deployment of advanced actuator sensor interface solutions. This tailored support extends beyond static pages, providing ongoing guidance as market conditions evolve, particularly in response to regulatory shifts and evolving end-user requirements. Secure your copy of the report today to transform observational knowledge into decisive market leadership.

- How big is the Actuator Sensor Interface Market?

- What is the Actuator Sensor Interface Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?