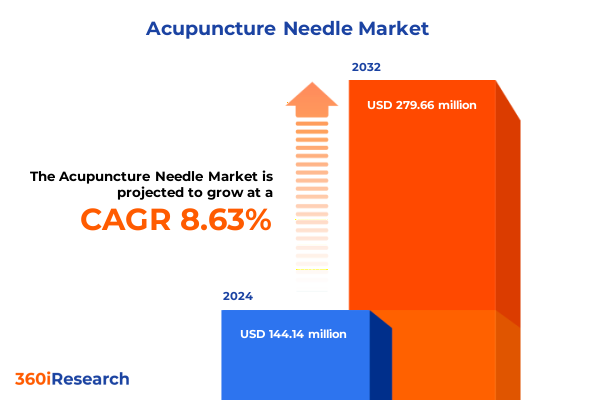

The Acupuncture Needle Market size was estimated at USD 156.62 million in 2025 and expected to reach USD 168.06 million in 2026, at a CAGR of 8.63% to reach USD 279.66 million by 2032.

Unveiling the Emerging Dynamics of the Global Acupuncture Needle Landscape and Strategic Implications for Holistic Healthcare Integration

In recent years, the acupuncture needle sector has surged into the spotlight as an integral component of integrative and holistic healthcare practices worldwide. At its core, acupuncture therapy relies on the precision and safety of needles, spurring innovations in design, materials, and manufacturing techniques. As patient demand for minimally invasive, drug-free treatment modalities escalates, there is a parallel emphasis on needle consistency, sterility, and ergonomic handling to elevate clinical outcomes and patient comfort.

Moreover, the convergence of traditional Eastern healing philosophies with Western evidence-based medicine has catalyzed a deeper exploration of acupuncture’s physiological mechanisms. This synthesis has fostered collaborations between clinicians, researchers, and manufacturers aimed at refining needle attributes such as surface coatings and structural integrity. Transitioning from rudimentary steel to specialized materials has enabled practitioners to access a broader spectrum of therapeutic applications, from pain management to stress relief and beyond.

Ultimately, the evolving acupuncture needle market reflects a broader shift in healthcare toward personalization and preventive care. As clinics and wellness centers broaden their service portfolios, and as at-home wellness routines gain traction, the demand for high-quality needles tailored to diverse patient profiles continues to rise. Looking ahead, the interplay between technological innovation and clinical validation will underscore the strategic importance of needle advancements within an increasingly competitive landscape.

Exploring the Pivotal Technological and Clinical Innovations Reshaping the Global Acupuncture Needle Market’s Future Trajectory

The acupuncture needle landscape is undergoing transformative shifts driven by cutting-edge technological advancements and evolving clinical protocols. For instance, the integration of micro-needling robotics and semi-automated insertion devices has introduced unprecedented precision in needle placement, minimizing patient discomfort and enhancing therapeutic efficacy. Concurrently, novel coating technologies that incorporate antimicrobial materials or slow-release bioactive compounds are redefining safety and performance benchmarks.

Parallel to these technological strides, clinical research is expanding beyond traditional meridian frameworks to elucidate neurophysiological responses to needling. Advanced imaging modalities, such as functional MRI and high-resolution ultrasound, are providing real-time insights into tissue responses, thereby informing the development of needles optimized for targeted stimulation. As evidence accumulates, professional societies and regulatory bodies are refining practice guidelines, fostering standardized training protocols that emphasize both practitioner skill and needle quality.

Taken together, these innovations herald a new era for acupuncture needle applications, wherein precision engineering and rigorous clinical validation converge. This convergence not only elevates practitioner confidence but also cultivates broader acceptance of acupuncture within mainstream medicine. Consequently, market participants are recalibrating their research and development priorities, positioning themselves at the forefront of a landscape increasingly defined by technological sophistication and evidence-based practice.

Assessing the Comprehensive Ramifications of 2025 United States Trade Tariffs on Acupuncture Needle Supply Chains and Cost Structures

The introduction of 2025 tariffs on Chinese-manufactured medical devices has prompted a thorough reassessment of global supply chains for acupuncture needles. Prior to these measures, a significant proportion of consumables, including fine-gauge needles, were sourced from Eastern production hubs known for cost-effective manufacturing. The new duty structure has led buyers and distributors to evaluate alternative sourcing strategies, balancing cost pressures with the imperative of maintaining stringent quality and sterility standards.

In response, manufacturers have accelerated efforts to diversify procurement channels, with some electing to shift critical production steps to Southeast Asian facilities or nearshore locations to mitigate tariff burdens. This strategic realignment has been accompanied by increased investment in in-house sterilization infrastructure and domestic certification processes to ensure compliance with regulatory mandates. At the same time, tension between affordability and clinical excellence has intensified discussions around total cost of ownership, leading to more robust vendor qualification frameworks and collaborative partnerships.

As the industry adjusts to these tariff-driven dynamics, stakeholders are navigating a more complex cost environment, where incremental changes in raw material sourcing or production workflows can yield meaningful savings. In turn, this heightened focus on supply chain resilience is likely to influence long-term vendor relationships and may spur the reshaping of regional manufacturing footprints to better align with evolving trade policies and market demands.

In-Depth Examination of Market Segmentation Dimensions Unveiling Key Insights across Needle Type, Material, End User, Distribution Channels, Diameter, and Length

A nuanced exploration of needle type reveals divergent dynamics in the use of disposable versus reusable designs. While disposability addresses infection control imperatives and appeals to high-volume clinical settings, reusable options retain a dedicated following among cost-conscious practitioners who emphasize sterilization protocols and environmental considerations. Transitioning to material segmentation, gold-plated and silver-plated needles have gained traction for their perceived conductivity benefits and skin sensitivity performance, whereas stainless steel maintains its reputation for strength and broad clinical utility.

Turning the lens to end users, variations emerge across home care, hospitals, spa and wellness centers, and specialty clinics. Home care settings increasingly favor simplified needle kits with user-friendly guides, reflecting a consumer-driven turn toward self-administered therapies. Conversely, hospitals demand comprehensive product warranties and batch-level traceability to integrate with institutional risk management frameworks. Spa and wellness facilities, meanwhile, curate ergonomic, aesthetically refined needle sets to reinforce brand differentiation, while specialty clinics such as pain management centers seek bespoke gauges and tapers tailored to complex treatment protocols.

Distribution channels further illuminate market contours, spanning direct sales relationships, hospital pharmacies, online platforms, and retail pharmacy outlets. Direct sales foster deep technical engagement and service support, particularly for high-touch clinical accounts. In contrast, the proliferation of e-commerce channels has democratized access for smaller operators and end consumers, prompting heightened scrutiny around packaging security and cold chain controls. Finally, retail pharmacies remain pivotal in regions where traditional medicine enjoys consumer trust, underscoring the enduring relevance of brick-and-mortar availability.

Delving into physical specifications, the landscape of needle diameter encompasses 0.18 millimeter, 0.20 millimeter, 0.25 millimeter, and 0.30 millimeter variants, each offering trade-offs between minimal invasiveness and structural rigidity. Similarly, needle lengths ranging from 15 millimeter to 50 millimeter accommodate diverse anatomical targets, with shorter lengths favored for superficial facial treatments and longer lengths prescribed for deep musculoskeletal engagements. Together, these segmentation dimensions craft a richly textured market fabric, where practitioners calibrate their choices to clinical objectives, patient comfort, and procedural complexity.

This comprehensive research report categorizes the Acupuncture Needle market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Needle Type

- Material

- Needle Diameter

- Needle Length

- End User

- Distribution Channel

Critical Regional Perspectives on Drivers and Adoption Patterns of Acupuncture Needles in Americas, EMEA, and Asia-Pacific Markets

Regional dynamics across the Americas exhibit a vibrant embrace of acupuncture as a complementary therapy, with private clinics and integrative health centers driving demand for advanced needle options. Shifting reimbursement landscapes and evolving patient preferences have encouraged manufacturers to equip sales teams with robust educational materials and certification training, ensuring that practitioners remain versed in the latest sterility and manipulation techniques.

In Europe, the Middle East & Africa region, regulatory harmonization efforts are shaping procurement protocols, especially within hospital networks. As accreditation bodies tighten quality assurance standards, stakeholders are adopting comprehensive lot tracking and digital validation platforms. This emphasis on traceability and compliance has elevated the expectations placed on needle suppliers, who must now navigate a patchwork of regional directives while preserving cost-effectiveness.

Turning to the Asia-Pacific frontier, long-standing traditions coexist with rapid modernization, resulting in a bifurcated market where artisanal craftsmanship meets industrial-scale production. In metropolitan centers, high-end wellness resorts and hospital groups demand luxury-grade silver and gold-plated needles, whereas broader urban and rural practitioners continue to rely on cost-efficient stainless steel variants. Furthermore, the region’s digital health proliferation has birthed tele-acupuncture services, propelling a novel demand for at-home needle kits supported by remote practitioner oversight.

Taken together, these regional narratives underscore the importance of tailored go-to-market strategies. Whether leveraging direct partnerships in the Americas, ensuring regulatory compliance across EMEA corridors, or balancing tradition and innovation in Asia-Pacific, a one-size-fits-all approach is giving way to regionally attuned value propositions.

This comprehensive research report examines key regions that drive the evolution of the Acupuncture Needle market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Corporate Profiles and Competitive Strategies of Leading Acupuncture Needle Manufacturers Driving Innovation and Market Expansion Dynamics

Industry leaders are undertaking strategic investments to consolidate R&D capabilities and expand global footprints. Among these, established medical device companies are enhancing their product portfolios through proprietary surface engineering techniques and proprietary ergonomic handle designs. These advancements facilitate smoother insertions and reduced insertion force variability, catering to the growing demand for patient-centric therapies.

Meanwhile, emerging specialized manufacturers are forging partnerships with research institutions to explore novel needle coatings that release bioactive agents post-insertion, positioning themselves at the vanguard of next-generation therapeutic delivery. Such collaborations underscore a broader trend toward integrated solutions that combine needling with adjunctive therapeutic modalities, including microcurrent stimulation and photobiomodulation.

Competitive strategies also extend to geographic expansion, with key players leveraging brownfield enhancements in existing plants to scale output in low-tariff jurisdictions. Concurrently, strategic alliances with regional distributors have enabled agility in navigating complex regulatory landscapes and fostering long-term customer relationships. These initiatives reflect a dual emphasis on operational efficiency and market responsiveness, as supply chain robustness and customer-centric service become increasingly intertwined.

Collectively, these corporate maneuvers shape a competitive arena defined by innovation velocity, manufacturing agility, and differentiated service models. The interplay between entrenched incumbents and nimble disruptors continues to redefine market expectations, creating a dynamic environment that rewards both scale and specialization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acupuncture Needle market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AcuLife Ltd.

- AcuMedic Ltd.

- AcuPrime Co., Ltd.

- Acupuncture Services Ltd.

- AcuTools AG

- Asia-Med GmbH

- Boqi Medical Products Co., Ltd.

- Cloud & Dragon Medical Devices Co., Ltd.

- DBC Healthcare Co., Ltd.

- Dongbang Acupuncture Inc.

- Emperra GmbH

- Herbal Leaf Co., Ltd.

- Lhasa Medical Co., Ltd.

- Mai Bang Medical Device Co., Ltd.

- Mayfair Medical Supply Ltd.

- Meridian Acupuncture Supplies Ltd.

- Qingdao Great Times Co., Ltd.

- Seirin Corporation

- Suzhou Medical Appliance Factory

- Tai Chi Medical Instruments Co., Ltd.

- Zen Healthcare Ltd.

Practical Strategic Roadmap Offering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in the Acupuncture Needle Sector

Industry leaders seeking to capitalize on emerging trends should prioritize investments in advanced surface technology and ergonomic design, ensuring that their product offerings outperform legacy alternatives in both patient comfort and clinical precision. By forging collaborations with clinical research centers and thought leaders, manufacturers can generate robust clinical evidence to substantiate product claims and bolster adoption in evidence-driven environments.

Moreover, strengthening supply chain resilience must be a cornerstone of strategic planning, entailing diversification of manufacturing sites and proactive tariff risk assessments. This approach will mitigate cost shocks and streamline logistical workflows, ultimately preserving margin integrity. Simultaneously, organizations should cultivate omnichannel engagement models that integrate direct sales expertise with digital self-service portals, thereby enhancing accessibility for a spectrum of end users, from large hospitals to independent wellness practitioners.

In parallel, custom-tailored segmentation strategies can drive deeper market penetration. By developing targeted solutions for home care, spa wellness, specialty clinics, and institutional buyers, companies can align product differentiation with end-user expectations. Initiatives such as interactive training modules and certification programs will further reinforce brand credibility and foster practitioner loyalty.

Taken together, these recommendations form a practical roadmap for securing sustainable competitive advantage in an evolving acupuncture needle ecosystem. By balancing innovation, operational excellence, and customer-centric engagement, industry leaders can unlock new avenues of growth and reinforce their leadership positions.

Comprehensive Overview of Research Methodology Highlighting Rigorous Data Collection, Validation Procedures, and Analytical Techniques Underpinning the Insights

The research underpinning this report entailed a comprehensive, multi-faceted methodology designed to ensure depth, rigor, and validity. Primary interviews were conducted with leading healthcare professionals, procurement specialists, and regulatory authorities, providing firsthand perspectives on clinical requirements and compliance thresholds. These qualitative insights were complemented by direct engagement with manufacturers and distributors, which illuminated operational practices and distribution strategies.

Secondary research protocols included systematic reviews of peer-reviewed clinical studies, regulatory dossiers, and industry white papers to validate material performance claims and to map out the evolution of safety standards. Additionally, supply chain assessments leveraged proprietary databases and customs intelligence to trace tariff impacts and regional sourcing patterns. This triangulation of data sources facilitated a holistic view of the dynamic interplay between regulatory frameworks and market behavior.

Quantitative analyses incorporated scenario-based modeling to examine the effects of duty fluctuations on cost structures, while sensitivity testing refined our understanding of price elasticity across needle specifications. Throughout the process, rigorous validation procedures such as data triangulation, member checks, and expert consultations were employed to ensure accuracy and credibility. The resultant findings rest on a robust methodological foundation, offering stakeholders confidence in the strategic insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acupuncture Needle market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acupuncture Needle Market, by Needle Type

- Acupuncture Needle Market, by Material

- Acupuncture Needle Market, by Needle Diameter

- Acupuncture Needle Market, by Needle Length

- Acupuncture Needle Market, by End User

- Acupuncture Needle Market, by Distribution Channel

- Acupuncture Needle Market, by Region

- Acupuncture Needle Market, by Group

- Acupuncture Needle Market, by Country

- United States Acupuncture Needle Market

- China Acupuncture Needle Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings and Strategic Implications Delivering a Clear, Concise Conclusion on the Future Trajectory of the Acupuncture Needle Market

Synthesizing the breadth of technological, regulatory, and market dynamics reveals a landscape brimming with both challenges and opportunities. Advancements in needle design and material science are narrowing the gap between traditional acupuncture practices and modern clinical requirements, while tariff-induced supply chain realignments are prompting the industry to embrace greater resilience and diversification.

Segmentation analyses highlight the multifaceted nature of practitioner and patient needs, from precision-driven specialty clinics to consumer-friendly home care kits and multiple distribution pathways. Regional perspectives further underscore the importance of localized go-to-market strategies, as cultural norms and regulatory demands shape adoption patterns across the Americas, Europe, the Middle East & Africa, and the Asia-Pacific.

Corporate activity reflects a balance of scale-driven enhancements and nimble innovation, with market leaders consolidating R&D investments and emerging players collaborating on bioactive coatings and next-gen therapeutic solutions. Taken as a whole, these trends coalesce into a future trajectory characterized by incremental innovation, regulatory sophistication, and a relentless focus on patient comfort and clinical efficacy. This integrated view sets the stage for informed decision-making and strategic planning in the acupuncture needle domain.

Engage Directly with Ketan Rohom to Secure Comprehensive Market Insights through Acquisition of the Detailed Acupuncture Needle Research Report

I invite you to reach out to Ketan Rohom, whose expertise in weaving market intelligence with actionable strategies can illuminate the nuances of the acupuncture needle domain. A brief conversation with Ketan will clarify how this comprehensive research report can be tailored to address your organization’s unique challenges, whether you seek to optimize supply chains, differentiate product portfolios, or unlock untapped regional markets. His consultative approach ensures that decision-makers receive bespoke insights and strategic guidance essential for driving growth and innovation. Engage today to secure the fine-grained analysis and evidence-based recommendations contained in this flagship report, and transform your strategic roadmap with confidence and precision.

- How big is the Acupuncture Needle Market?

- What is the Acupuncture Needle Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?