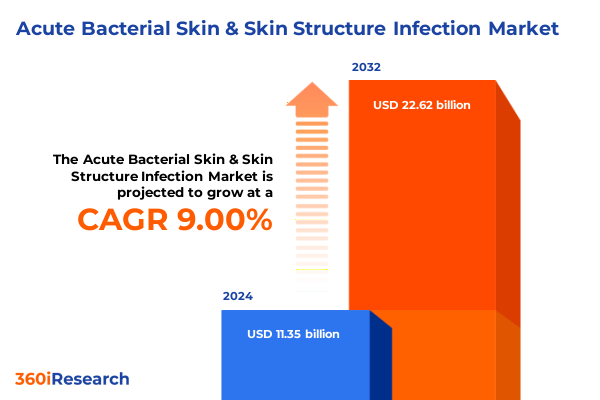

The Acute Bacterial Skin & Skin Structure Infection Market size was estimated at USD 12.35 billion in 2025 and expected to reach USD 13.50 billion in 2026, at a CAGR of 9.02% to reach USD 22.62 billion by 2032.

Exploring the critical unmet needs and evolving epidemiology shaping the acute bacterial skin and skin structure infection treatment environment

Acute bacterial skin and skin structure infections (ABSSSI) represent a pervasive and multifaceted healthcare challenge, driven by complex clinical presentations and evolving pathogen profiles. These infections encompass a wide spectrum of conditions-from simple cellulitis to severe necrotizing fasciitis-demanding diverse therapeutic approaches. Over the past decade, treating ABSSSI has become increasingly complicated by the emergence of resistant organisms and the need for rapid diagnostic and treatment decisions. This complexity underscores the necessity for a deeper understanding of the market environment and the forces shaping treatment paradigms.

In recent years, antibiotic stewardship initiatives have intensified, striving to optimize therapy to preserve efficacy and mitigate resistance. Yet despite these efforts, more than 2.8 million antimicrobial-resistant infections occur in the United States each year, resulting in over 35,000 deaths and imposing a significant public health burden. The prevalence of methicillin-resistant Staphylococcus aureus (MRSA) and other drug-resistant pathogens in both hospital and community settings has continued to rise through the pandemic years, with certain hospital-onset infections peaking in 2021 and remaining elevated in 2022. These trends highlight a critical gap between existing treatment options and the evolving microbial landscape, calling for strategic market insights to navigate this high-stakes arena.

Against this backdrop, stakeholders across the pharmaceutical value chain-from innovators developing novel agents to providers shaping care pathways-must align their strategies with shifting clinical needs, regulatory environments, and economic pressures. This executive summary distills the latest market intelligence, addressing key drivers, turbulent shifts, and actionable recommendations to empower decision-makers in the ABSSSI space, ensuring that therapeutic advancements translate into meaningful patient outcomes and sustainable growth.

Navigating paradigm-shifting forces including resistance evolution, therapeutic innovation, and care delivery transformations driving ABSSSI treatment strategies

The ABSSSI landscape is undergoing profound transformation, propelled by an accelerated rise in antimicrobial resistance and breakthroughs in therapeutic modalities. The advent of next-generation antibiotics, such as novel glycopeptides and beta-lactamase inhibitors, is redefining treatment algorithms. Concurrently, diagnostic innovations-including rapid polymerase chain reaction (PCR) assays and point-of-care biomarkers-are enabling targeted therapy, shortening time to effective intervention, and reducing empiric broad-spectrum usage. These technological advances are complemented by an evolving regulatory framework that incentivizes antibiotics development through streamlined approval pathways and extended exclusivity provisions.

In parallel, shifting reimbursement models and value-based healthcare initiatives are placing pressure on stakeholders to demonstrate clinical and economic value. Payer partnerships are increasingly focusing on outcome-driven contracts and stewardship programs that reward effective antibiotic use while penalizing avoidable complications. Moreover, care delivery is expanding beyond traditional inpatient settings; outpatient parenteral antibiotic therapy (OPAT), ambulatory infusion centers, and home healthcare services are emerging as critical avenues for ABSSSI management. These channels not only reduce hospital burden but also align with patient preferences for shorter hospital stays and greater convenience.

Such transformative shifts are forging a more dynamic, patient-centric market where precision medicine and integrated care pathways coalesce. Companies and providers must embrace these changes, leveraging digital health, diagnostics collaboration, and cross-sector alliances to stay ahead in a landscape defined by rapid clinical evolution and heightened economic scrutiny.

Assessing how 2025 U.S. trade measures on APIs, packaging, and machinery are reshaping supply chain economics and strategic planning in ABSSSI

The United States’ tariff policies in 2025 have exerted a cumulative impact on the ABSSSI therapeutic supply chain, triggering cost pressures and strategic realignments across the industry. As of April 2025, a global 10% tariff on all healthcare imports has raised the price of active pharmaceutical ingredients (APIs), sterilization materials, and medical packaging-elements essential to antibiotic production-by double-digit margins. Meanwhile, specific duties of up to 25% on APIs sourced from China and 20% on those from India have directly inflated input costs for both branded and generic antibiotic manufacturers. The immediate consequence has been elevated production expenses, which in sectors operating on thin margins-such as generic cephalosporins and penicillins-have proven challenging to absorb.

These financial stresses have precipitated supply chain disruptions, with hospitals and healthcare systems reporting delivery delays and shortages of key antibiotics. A survey conducted by Black Book Research indicated that nearly 70% of supply chain professionals anticipate at least a 15% cost increase for essential drugs within six months of tariff implementation. Simultaneously, warnings have surfaced that tariff-induced price hikes could exacerbate existing shortages, as manufacturers face diminishing returns on low-margin sterile injectables and may opt to discontinue production. The American Hospital Association has petitioned for medical product exemptions, underscoring the risk to patient care if international sourcing constraints persist.

Corporate responses have been marked by increased domestic investment and localized capacity building. Pharmaceutical giants, including AstraZeneca and Roche, have pledged multi-billion-dollar allocations to U.S. manufacturing and R&D expansions, aiming to mitigate tariff exposure and reinforce supply resilience. However, experts caution that reshoring pharmaceutical production is a complex, long-term endeavor unlikely to offset short-term cost impacts. Consequently, industry players are exploring strategic sourcing diversification, tiered pricing mechanisms, and enhanced contractual flexibility with payers and providers to navigate the tariff-induced market volatility.

Interweaving product, administration, end-user, channel and treatment distinctions to unveil nuanced ABSSSI segmentation opportunities

Dissecting the ABSSSI landscape through the lens of product type reveals divergent growth trajectories for branded antibiotics, generic offerings, and novel agents. Branded antibiotics continue to leverage patent-protected formulations and extended-release profiles to command premium pricing, while generic versions of cephalosporins, lincosamides, macrolides, and penicillins drive accessibility through cost-effective alternatives. Novel agents, particularly those targeting resistant pathogens such as MRSA and ESBL producers, are carving out niche positions where clinical differentiation and stewardship alignment underpin value propositions.

Route of administration remains a pivotal influencer of treatment pathways. Intravenous therapies dominate hospital-based care, providing rapid bactericidal activity for severe presentations, whereas oral regimens facilitate outpatient transitions and prisoner adherences in community settings. Topical formulations, though primarily adjunctive, are gaining interest for mild to moderate skin infections, offering localized delivery with minimal systemic exposure. As healthcare models evolve, the interplay between administration routes and care settings will be crucial in shaping prescribing patterns and patient experiences.

End-user segmentation underscores the role of diverse care venues in ABSSSI management. Hospitals continue to serve as primary sites for acute care, while ambulatory surgical centers are increasingly equipped to handle moderate infections through streamlined OPAT protocols. Home healthcare settings are emerging as critical platforms for extended therapy, emphasizing patient convenience and reducing inpatient days. These shifts necessitate tailored distribution and engagement strategies to address unique logistical and clinical requirements in each setting.

Distribution channels further influence market access, with hospital pharmacies anchoring institutional supply, retail pharmacies offering patient-centric pick-up options, and online pharmacies expanding reach through digital ordering models. In parallel, treatment type segmentation bifurcates into empiric approaches-where broad-spectrum coverage is initiated based on clinical suspicion-and targeted treatments guided by culture-driven or PCR-driven diagnostics, each pathway reflecting a balance between urgency and precision in antibiotic stewardship.

This comprehensive research report categorizes the Acute Bacterial Skin & Skin Structure Infection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Route Of Administration

- End User

- Distribution Channel

- Treatment Type

Unpacking divergent regional factors in the Americas, EMEA, and Asia-Pacific that influence ABSSSI access and adoption

Regional dynamics in the ABSSSI space present distinct imperatives across the Americas, EMEA, and Asia-Pacific. In the Americas, particularly the United States and Canada, stringent antibiotic stewardship frameworks and payer-driven value assessments are driving demand for agents that demonstrate clear clinical and economic benefits. Emerging focus on outpatient infusion services and home-based care in North America is reshaping the supply chain, demanding coordination between pharmaceutical manufacturers, specialty pharmacies, and home infusion providers.

Europe, the Middle East, and Africa exhibit heterogeneous regulatory landscapes and reimbursement environments. In Western Europe, tight pricing regulations and reference-based reimbursement models heighten the premium on cost-effectiveness and real-world data, while parts of the Middle East and Africa present burgeoning opportunities aligned with expanding healthcare infrastructure and rising awareness of antimicrobial resistance. Cross-border tenders and pooled procurement initiatives are gaining traction in EMEA, underscoring the need for adaptable market access strategies that accommodate both centralized purchasing and local stakeholder engagement.

Asia-Pacific is characterized by rapid growth in healthcare spending, bolstered by population expansion and government-led initiatives to enhance access to essential medicines. China and India, as major manufacturing hubs, are simultaneously wrestling with domestic resistance challenges and export dynamics. Southeast Asia and Oceania show increasing uptake of novel agents and point-of-care diagnostics, driven by investment in public health programs and evolving insurance coverage. Navigating the APAC region requires a nuanced understanding of diverse healthcare systems, supply chain maturity, and regulatory pathways to tailor product portfolios and market entry strategies.

This comprehensive research report examines key regions that drive the evolution of the Acute Bacterial Skin & Skin Structure Infection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating how top-tier pharma players and emerging biotech innovators are reshaping ABSSSI with targeted R&D and strategic alliances

Leading global pharmaceutical companies continue to shape the ABSSSI market through targeted R&D investments, strategic collaborations, and lifecycle management tactics. Industry titans with well-established antibiotic portfolios are bolstering their pipelines via in-licensing agreements and partnerships with biotech firms specializing in resistance-targeted platforms. These alliances focus on novel mechanism classes, such as siderophore-conjugated antibiotics and next-generation beta-lactamase inhibitors, designed to overcome entrenched resistance mechanisms.

Mergers and acquisitions have further concentrated market power, enabling larger players to integrate distribution capabilities and optimize manufacturing footprints. Simultaneously, emerging biopharmaceutical companies are gaining traction by leveraging precision diagnostics to differentiate their compounds in a crowded marketplace. Contract development and manufacturing organizations are playing a critical role by offering flexible, scalable production for both small-molecule antibiotics and advanced biologic therapies, catering to fluctuating demand and specialized formulations.

In addition, key stakeholders are increasingly engaging in public-private collaborations to secure funding for antibiotic R&D and to support antimicrobial stewardship initiatives. This multi-sector engagement underscores a shared recognition of the unique challenges in developing and commercializing ABSSSI therapies, including regulatory hurdles, narrow stewardship-focused usage, and the pressing need to replenish the antibiotic pipeline with truly differentiated assets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acute Bacterial Skin & Skin Structure Infection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc

- Basilea Pharmaceutica Ltd

- Bayer AG

- Cipher Pharmaceuticals Inc

- Cipla Limited

- Cumberland Pharmaceuticals Inc

- Dr. Reddy's Laboratories Ltd

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd

- Lupin Limited

- Melinta Therapeutics LLC

- Menarini Group

- Merck & Co. Inc

- Nabriva Therapeutics plc

- Novartis AG

- Paratek Pharmaceuticals Inc

- Pfizer Inc

- Teva Pharmaceutical Industries Ltd

- Viatris Inc

- Zydus Lifesciences Limited

Implementing integrated strategies in diagnostics, supply chain resilience, and value-based partnerships to excel in ABSSSI markets

Industry leaders aiming to thrive in the ABSSSI domain must prioritize integrated approaches that align scientific innovation with market realities. First, accelerating the development and adoption of rapid diagnostic tools can enhance targeted treatment, reduce unnecessary broad-spectrum use, and strengthen antibiotic stewardship programs across care settings. Building partnerships with diagnostic companies and clinical laboratories will be essential to embed these technologies into standard care pathways.

Second, optimizing supply chain resilience through diversified sourcing and flexible manufacturing strategies can mitigate tariff-related cost pressures and reduce vulnerability to single-source disruptions. Investments in domestic production capacity and strategic alliances with contract manufacturers will facilitate a more secure and responsive supply network, safeguarding continuity of antibiotic availability.

Third, crafting compelling value propositions through real-world evidence generation and outcomes-based contracting can address payer demands in value-based healthcare models. Demonstrating clear clinical benefits, such as reduced hospitalization duration and lower overall treatment costs, will be critical to securing formulary placement and favorable reimbursement terms. Engaging early with payers and health systems to co-develop outcome metrics will foster shared accountability for patient outcomes.

Lastly, fostering cross-sector collaborations-combining expertise in R&D, manufacturing, diagnostics, and healthcare delivery-can drive holistic solutions that address both clinical and commercial challenges. Such ecosystem integration will enhance the adaptability and impact of ABSSSI strategies, positioning leaders to capture emerging opportunities and deliver sustainable growth.

Detailing a robust multi-source methodology integrating secondary and primary insights to ensure comprehensive ABSSSI market analysis

This research employs a rigorous, multi-source methodology to ensure analytical depth and reliability. Secondary research encompassed extensive reviews of regulatory filings, clinical trial registries, peer-reviewed literature, company financial disclosures, and public policy documents to map the evolving ABSSSI landscape. Government databases and reputable public health resources provided foundational insights on antimicrobial resistance trends and healthcare utilization patterns.

Primary research involved structured interviews with industry experts, including pharmaceutical executives, healthcare providers, diagnostic specialists, and payers. These discussions validated secondary data findings and enriched the analysis with real-world perspectives on market dynamics, clinical adoption drivers, and strategic imperatives. The collected qualitative insights were triangulated with quantitative data to achieve robust conclusions.

Data triangulation processes integrated diverse inputs to minimize bias and enhance accuracy, with iterative reviews by subject matter experts ensuring consistency. The segmentation framework was refined through collaborative workshops involving cross-functional analysts, reflecting the nuances of product types, administration routes, end-user behaviors, distribution channels, and treatment modalities. Continuous quality assurance measures, including cross-verification against external benchmarks, uphold the credibility of the research deliverables.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acute Bacterial Skin & Skin Structure Infection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acute Bacterial Skin & Skin Structure Infection Market, by Product Type

- Acute Bacterial Skin & Skin Structure Infection Market, by Route Of Administration

- Acute Bacterial Skin & Skin Structure Infection Market, by End User

- Acute Bacterial Skin & Skin Structure Infection Market, by Distribution Channel

- Acute Bacterial Skin & Skin Structure Infection Market, by Treatment Type

- Acute Bacterial Skin & Skin Structure Infection Market, by Region

- Acute Bacterial Skin & Skin Structure Infection Market, by Group

- Acute Bacterial Skin & Skin Structure Infection Market, by Country

- United States Acute Bacterial Skin & Skin Structure Infection Market

- China Acute Bacterial Skin & Skin Structure Infection Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing strategic imperatives and collaborative approaches to drive innovation and competitive advantage in ABSSSI

The acute bacterial skin and skin structure infection market is at a pivotal juncture, shaped by mounting resistance threats, therapeutic innovations, and economic pressures. Navigating this complex environment requires a delicate balance between advancing novel antibiotic development, safeguarding supply chain resilience, and demonstrating quantifiable clinical value. Stakeholders must embrace diagnostic-driven treatment paradigms and value-based care models to meet payer and provider expectations, while also addressing patient-centric demands for accessible, effective therapies.

Emerging regional divergences, evolving distribution channels, and shifting care delivery models underscore the necessity for tailored strategies that reflect local market realities. In this context, collaboration across the pharmaceutical ecosystem-spanning R&D, manufacturing, diagnostics, and healthcare delivery-will be instrumental in translating scientific breakthroughs into sustainable commercial success. By adopting integrated approaches, leveraging real-world evidence, and reinforcing stewardship initiatives, market participants can capitalize on growth opportunities and contribute to improved patient outcomes.

Ultimately, the ability to adapt to tariff-driven supply chain dynamics, harness segmentation insights, and foster cross-sector partnerships will distinguish industry leaders poised for long-term impact. As the ABSSSI treatment landscape continues to evolve, grounded strategic planning and agile execution will be essential to drive innovation and maintain competitive advantage.

Secure your competitive edge today by partnering with Ketan Rohom for personalized access to our ABSSSI market research report

Engaging directly with Ketan Rohom will ensure you gain unparalleled access to our comprehensive market research report, tailored to support strategic decision-making and business development in the acute bacterial skin and skin structure infection landscape. His expertise in sales and marketing within the pharmaceutical and healthcare sectors can guide you through the report’s rich insights, enabling your organization to capitalize on emerging opportunities and navigate industry challenges with confidence.

Don’t miss the opportunity to leverage our data-driven analysis, expert commentary, and forward-looking recommendations that can inform your product development, investment strategies, and go-to-market plans. Reach out to Ketan Rohom today to secure your copy of this essential market research report and position your organization at the forefront of innovation and growth in the treatment of acute bacterial skin and skin structure infections.

- How big is the Acute Bacterial Skin & Skin Structure Infection Market?

- What is the Acute Bacterial Skin & Skin Structure Infection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?