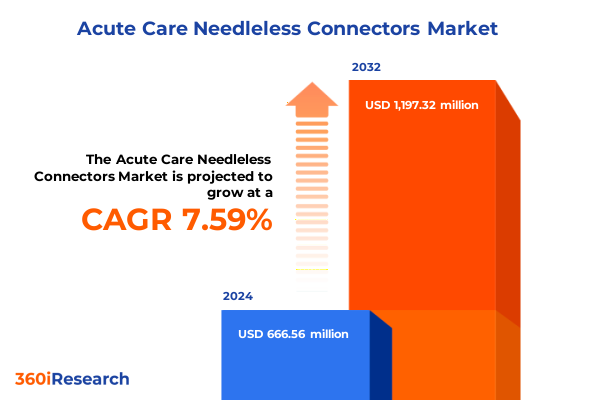

The Acute Care Needleless Connectors Market size was estimated at USD 708.29 million in 2025 and expected to reach USD 758.36 million in 2026, at a CAGR of 7.78% to reach USD 1,197.31 million by 2032.

Revolutionary Framework for Understanding the Rising Strategic Importance of Needleless Connectors in Acute Care

The landscape of acute care is undergoing a profound transformation as healthcare providers increasingly prioritize safety, precision, and operational efficiency. Needleless connectors have emerged as a critical technology at the heart of this evolution. These small yet sophisticated devices, designed to prevent bloodstream infections and ensure seamless fluid management, are redefining best practices in hospitals, ambulatory surgical centers, and home healthcare environments.

In recent years, heightened regulatory scrutiny, escalating concerns over patient safety, and the drive to reduce healthcare-associated costs have converged to elevate the strategic importance of needleless connectors. As hospitals adopt value-based care models and home infusion therapy becomes more widespread, the demand for connectors that offer reliable performance without compromising sterility has surged. This introduction provides a foundation for understanding why acute care needleless connectors are no longer a mere accessory but rather a cornerstone of modern patient management strategies.

Groundbreaking Evolution of Needleless Connectors Driven by Safety Innovations and Value-Based Care Dynamics

Over the last decade, the acute care needleless connector market has experienced several transformative shifts, driven by technological innovation and evolving clinical protocols. Initially, the emphasis centered on basic mechanisms that reduced needlestick injuries. However, the focus has since expanded to incorporate antimicrobial materials, closed system designs, and integrated safety features that actively minimize infection risks. Transitioning from passive components to active safety solutions, these connectors now offer enhanced fluid dynamics, user-friendly interfaces, and compatibility across a broad spectrum of medical devices.

Concurrently, the progression towards value-based care has prompted providers to quantify the return on investment for every device. This paradigm shift has spurred collaborations between connector manufacturers and healthcare institutions to conduct clinical validation studies, demonstrating reductions in catheter-related bloodstream infections and associated treatment costs. Moreover, the rise of home healthcare and outpatient infusion services has propelled design adaptations that cater to non-traditional care settings. As a result, needleless connectors have become more modular, with universal luer compatibility and simplified maintenance procedures that facilitate adoption beyond hospital walls.

Navigating the Ripple Effects of 2025 United States Tariffs on Acute Care Needleless Connector Supply Chains and Cost Structures

In 2025, the confluence of global trade tensions and domestic policy adjustments has introduced significant tariff implications for medical device components, including needleless connectors. The United States government implemented new tarifs aimed at balancing trade deficits and promoting local manufacturing resilience. These measures have increased duties on various polymers and specialty metals used in connector fabrication. As a consequence, manufacturers have re-evaluated their supply chains, facing higher input costs and potential disruptions in material availability.

To mitigate these challenges, leading producers have diversified sourcing strategies by qualifying alternative suppliers in tariff-exempt regions and investing in localized production capacities. Additionally, some companies are passing a portion of the increased costs to end users, while others are absorbing margins to preserve competitive pricing. Regulatory bodies have responded by accelerating approval processes for domestically produced connectors, incentivizing reshoring efforts. Looking ahead, sustained dialogue between industry stakeholders and policymakers will be crucial to balance economic objectives with the imperative of uninterrupted patient care.

Deep Dive into Segment-Specific Attributes Demonstrating How Material to Distribution Choices Drive Procurement Strategies

A nuanced understanding of market segmentation reveals how distinct materials, user environments, connector typologies, clinical applications, and distribution channels converge to shape procurement strategies. In terms of material composition, the market encompasses connectors fashioned from metal and plastic, with metal offerings subdivided into aluminum and stainless steel variants, while the plastic category spans durable polycarbonate and polypropylene grades. Each material class presents trade-offs between durability, sterilization compatibility, and cost efficiency, informing selection criteria for different care settings.

When examining end-user segmentation, ambulatory surgical centers, home healthcare providers, and hospitals represent the primary consumption nodes. Ambulatory surgical centers further differentiate between clinics and outpatient diagnostic centers, each with distinct workflow requirements. Home healthcare comprises home dialysis and home infusion therapy services, where ease of use and patient safety are paramount. Meanwhile, hospital demand originates from secondary- and tertiary-care units, where connectors must integrate seamlessly with high-volume infusion protocols and strict infection control standards.

Connector type segmentation highlights three principal categories: luer lock, luer slip, and quick disconnect. Both luer lock and luer slip connectors are available in female and male configurations to ensure universal compatibility, whereas quick disconnect types are engineered as either one-piece or two-piece assemblies for rapid, secure coupling. Each connector type is chosen based on clinical urgency, fluid viscosity, and the need for rapid detachments.

From an application standpoint, needleless connectors facilitate blood sampling, drug delivery, and infusion therapy. Blood sampling is further classified into arterial and venous procedures, each demanding precision and minimal contamination risk. Drug delivery segments include analgesics, antibiotics, and chemotherapy agents, which vary in dosing complexity and safety requirements. Infusion therapy use cases span bolus infusions that require quick dose administration and continuous infusions that demand steady flow control.

Finally, distribution channels influence availability and procurement timelines. Devices reach end users through direct sales teams, distributors, and online platforms. Distributor networks encompass both medical wholesalers and third-party partners, while online channels leverage e-commerce marketplaces and manufacturer websites. The choice of distribution pathway affects inventory management and responsiveness to urgent demand.

This comprehensive research report categorizes the Acute Care Needleless Connectors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Connector Type

- Distribution Channel

- Application

- End User

Comprehensive Regional Overview Highlighting Diverse Growth Pathways and Adoption Drivers Across Key Global Markets

Regional dynamics reveal unique growth trajectories and challenges across the Americas, Europe, Middle East & Africa, and Asia-Pacific territories. In the Americas, stringent regulatory frameworks and a mature healthcare infrastructure foster rapid adoption of advanced connector technologies. North American providers actively participate in clinical trials to validate next-generation safety features, while Latin American markets show growing interest in cost-effective solutions that meet evolving infection control standards.

In Europe, Middle East & Africa, diverse regulatory regimes and varying levels of healthcare funding create a mosaic of demand profiles. Western European nations continue to lead with high-performance connectors that meet rigorous European Union standards, whereas Eastern European and Middle Eastern regions prioritize affordability and ease of integration. African markets are nascent but exhibit strong potential, driven by partnerships with humanitarian organizations and initiatives to reduce hospital-acquired infections.

The Asia-Pacific region, powered by expanding hospital networks and increasing home healthcare services, is emerging as a key battleground for connector suppliers. Countries such as China, India, and Japan show strong investment in local manufacturing and regulatory harmonization. Southeast Asian markets are gradually standardizing clinical protocols, boosting demand for connectors that deliver consistency and reliability across heterogeneous care environments. Throughout all regions, the intersection of regulatory evolution, reimbursement policies, and public-private collaborations shapes market access and technology diffusion.

This comprehensive research report examines key regions that drive the evolution of the Acute Care Needleless Connectors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Insightful Corporate Movements and Technological Collaborations Underscoring Competitive Leadership in Connector Innovations

Leading companies in the acute care needleless connector domain are advancing their market positions through strategic innovation, collaborative partnerships, and targeted acquisitions. A pioneer in safety engineered devices recently introduced an antimicrobial connector line featuring integrated UV-resistant coatings, extending device integrity during extended infusions. Another prominent manufacturer expanded its footprint by acquiring a regional connector specialist, thereby securing immediate access to in-country production and accelerating distribution capabilities in emerging markets.

Innovative start-ups have entered the fray, leveraging 3D printing technologies to prototype connectors with custom flow profiles and ergonomic grips. These agile players often partner with contract manufacturers to scale production rapidly while minimizing capital expenditures. At the same time, contract sterilization and packaging providers are forging deeper alliances to ensure just-in-time delivery of sterile connectors, reducing inventory burdens for healthcare facilities. Across the competitive landscape, research collaborations between industry and academic institutions are unlocking novel materials and smart connector platforms capable of real-time monitoring of fluid integrity and usage patterns.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acute Care Needleless Connectors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- AdvaCare Pharma

- Amsino International, Inc.

- B. Braun Melsungen AG

- Baxter International, Inc.

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- ICU Medical, Inc.

- JCM-MED

- MEDEREN

- Medline Industries, LP.

- Merit Medical Systems, Inc.

- Narang Medical Limited

- Nexus Medical

- Nipro Corporation

- Polymedicur

- Romsons Group of Industries

- Smiths Medical, Inc.

- Surgmed Group

- Teleflex Incorporated

- Terumo Corporation

- Vygon SAS

Strategic Blueprint for Industry Leaders to Future-Proof Portfolios and Strengthen Supply Chain and Clinical Adoption

Industry leaders should prioritize strategic initiatives that align with evolving clinical demands and regulatory expectations. First, investing in modular connector platforms with interchangeable components can future-proof product portfolios against shifting care environments, from high-acuity hospital wards to decentralized home infusion services. Complementary to this, establishing proof-of-concept studies with key opinion leaders will accelerate clinical adoption and underpin value-based contracting discussions.

Second, strengthening supply chain resilience through diversified sourcing and localized manufacturing investments will mitigate tariff exposure and logistics disruptions. Companies should explore co-manufacturing agreements in tariff-exempt regions and leverage digital supply chain analytics to forecast component shortages proactively. Third, enhancing digital integration by embedding data-capture capabilities within connectors can offer real-time usage insights to providers and payers, supporting quality improvement programs and reimbursement negotiations. Finally, cultivating an ecosystem of strategic partnerships-from sterilization specialists to hospital group alliances-will enable end-to-end solutions that differentiate offerings and drive sustainable revenue growth.

Rigorous Multi-Dimensional Research Methodology Leveraging Primary Stakeholder Interviews and Secondary Data for Unbiased Market Insights

This research adopts a multi-angle methodology combining primary interviews, secondary literature, and expert validation to ensure robust and unbiased insights. Primary research involved structured conversations with clinicians, procurement managers, and regulatory experts across major healthcare markets, capturing first-hand perspectives on clinical performance, safety priorities, and purchasing drivers. These qualitative inputs were supplemented by secondary analysis of peer-reviewed journals, white papers from health authorities, and industry association guidelines.

In addition, supply chain assessments were performed by evaluating import-export data, tariff schedules, and procurement policies to understand cost dynamics and localization trends. Market segmentation frameworks were developed through rigorous classification of materials, end-user categories, connector types, applications, and distribution channels, ensuring granular visibility into market behavior. All findings underwent validation workshops with domain experts, including leading vascular access clinicians and biomedical engineers, to refine assumptions and affirm the credibility of strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acute Care Needleless Connectors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acute Care Needleless Connectors Market, by Material

- Acute Care Needleless Connectors Market, by Connector Type

- Acute Care Needleless Connectors Market, by Distribution Channel

- Acute Care Needleless Connectors Market, by Application

- Acute Care Needleless Connectors Market, by End User

- Acute Care Needleless Connectors Market, by Region

- Acute Care Needleless Connectors Market, by Group

- Acute Care Needleless Connectors Market, by Country

- United States Acute Care Needleless Connectors Market

- China Acute Care Needleless Connectors Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Conclusive Reflections on Innovation Imperatives and Strategic Alignment for Sustainable Leadership in the Connector Market

Acute care needleless connectors stand at the intersection of patient safety, clinical efficiency, and supply chain robustness. The convergence of antimicrobial innovations, regulatory incentives, and evolving care delivery models underscores the critical role these devices play in infection prevention and operational excellence. As end users demand both high performance and cost-effectiveness, manufacturers must continuously refine materials, features, and service offerings to stay ahead of the curve.

Ultimately, those organizations that integrate deep clinical validation with agile manufacturing strategies and digital integration will capture the greatest value. By weaving together insights on tariffs, regional growth patterns, segmentation nuances, and competitive dynamics, stakeholders can craft targeted action plans that mitigate risks and capitalize on emerging opportunities. This comprehensive perspective equips decision-makers to navigate the complexities of the acute care needleless connector market with confidence and strategic foresight.

Empower Your Strategic Decisions with Direct Engagement to Secure the Definitive Acute Care Needleless Connector Market Research Report

For tailored insights that drive strategic advantage in the acute care needleless connector market, engage directly with Ketan Rohom, the Associate Director, Sales & Marketing at 360iResearch. His deep expertise and consultative approach ensure you receive personalized guidance and the precise data you need to inform your next steps. Connect with Ketan to secure your comprehensive market research report, unlock exclusive executive summaries, and gain early access to proprietary analysis that positions your organization for sustainable growth and operational excellence.

- How big is the Acute Care Needleless Connectors Market?

- What is the Acute Care Needleless Connectors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?