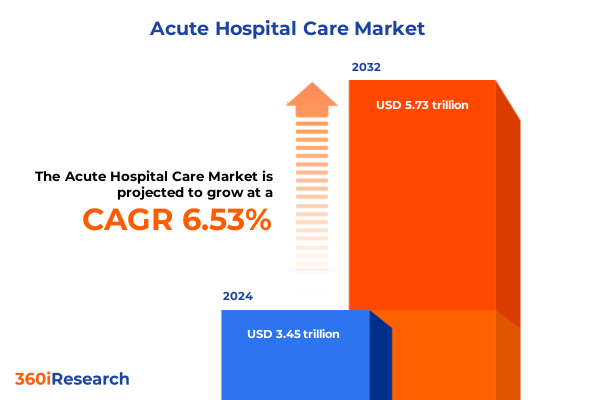

The Acute Hospital Care Market size was estimated at USD 3.65 trillion in 2025 and expected to reach USD 3.86 trillion in 2026, at a CAGR of 6.64% to reach USD 5.73 trillion by 2032.

Unveiling the Vital Role of Acute Hospital Care Amidst Rising Complexities and Evolving Patient Demands Across the Healthcare Ecosystem

Acute hospital care serves as the cornerstone of the broader healthcare delivery system, providing critical interventions for patients requiring immediate and intensive treatment. Recent performance by leading hospital operators underscores the resilience and enduring demand for complex inpatient and outpatient services, even in the face of economic headwinds. For instance, HCA Healthcare reported robust second-quarter revenues for 2025, driven by a 4% year-over-year rise in revenue per admission despite modest declines in surgical volumes, and reaffirmed its annual profit forecast based on long-term supply contracts that mitigate tariff risks. Concurrently, medical supply expenses comprised over 10% of a typical hospital’s budget in 2023, totaling approximately $146.9 billion-an increase of $6.6 billion from the prior year-highlighting the growing financial pressures on providers to balance cost and quality of care.

Transitioning from these financial imperatives, healthcare executives must navigate a complex tapestry of regulatory reforms, reimbursement shifts, and patient expectations. The sector’s reliance on a global supply chain for devices and pharmaceuticals exposes hospitals to external disruptions, which can directly impact critical care delivery and operational continuity. According to the American Hospital Association, tariffs affecting semiconductors, syringes, and other essential supplies could exacerbate existing headwinds, prompting industry stakeholders to advocate for strategic exemptions and supply chain resilience measures. As acute hospital care evolves, decision-makers will need to integrate these multifaceted challenges into their strategic planning to ensure sustainable growth and uninterrupted patient services.

Examining The Digital Revolution And Strategic Innovations That Are Redefining Acute Hospital Care In A Continuously Evolving Healthcare Environment

Digital technologies and patient-centric models are fundamentally reshaping acute hospital care, driving a departure from traditional inpatient frameworks toward more integrated and efficient service delivery. Across leading health systems, artificial intelligence is being leveraged to optimize clinical workflows, reduce administrative burden, and enhance diagnostic precision. For example, Cedars-Sinai’s AI-powered virtual care platform has processed over 42,000 patient interactions, streamlining intake and preliminary assessments with a chatbot interface that achieved a 77% optimal recommendation rate in peer-reviewed studies. Similarly, telehealth adoption continues to expand beyond pandemic-driven surges, with state healthcare associations urging the standardization of prior authorization processes and renewed home health initiatives to maintain momentum in remote care delivery.

Moreover, hospitals are harnessing predictive algorithms to manage resource allocation and address capacity challenges. In Connecticut, an AI model that integrates weather forecasts and historical patient volumes has demonstrated its ability to anticipate emergency department surges, thereby reducing overcrowding and ensuring optimal staffing levels during peak demand periods. Concurrently, major technology companies are intensifying investments in healthcare AI, forging partnerships with clinical stakeholders to embed machine learning into imaging, robotics, and personalized medicine platforms-a trend that underscores the sector’s shift toward ecosystem-based innovation and strategic alliances.

Ultimately, these transformative shifts reflect a broader industry imperative to enhance operational resilience, improve patient outcomes, and drive cost efficiencies. As hospitals embrace data interoperability, remote monitoring, and generative AI, they are repositioning themselves as integrated care hubs capable of delivering seamless experiences across the continuum. This evolution demands proactive leadership, flexible strategies, and ongoing investment in digital infrastructure to sustain competitive advantage in an increasingly complex landscape.

Analyzing The Broad Financial And Operational Repercussions Of New U.S. Tariff Policies On Acute Hospital Care Delivery Systems In 2025

The reimposition and escalation of U.S. tariffs on medical equipment and supplies in 2025 have introduced substantial cost pressures throughout the acute hospital care ecosystem. Tariffs on imported medical gloves, syringes, and other high-volume consumables have risen to 50%, while duties on critical minerals and raw materials average 25%, representing a significant spike from previous levels. Hospitals across the country are bracing for these added expenses by conducting comprehensive supply chain audits, modeling worst-case cost scenarios, and engaging with group purchasing organizations to renegotiate contracts and secure domestic sourcing alternatives.

Furthermore, leading healthcare providers have highlighted the operational uncertainties that accompany tariff volatility. Providers like HCA Healthcare have noted that long-term agreements with equipment manufacturers have helped mitigate immediate tariff-related risks, but the broader industry remains vulnerable to downstream effects such as delayed capital investments and postponed technology upgrades, as evidenced by Siemens Healthineers facing potential sales declines for its advanced CT scanners due to proposed EU tariffs on U.S. imports. Meanwhile, financial surveys indicate that 90% of hospital finance executives expect to pass increased supply chain costs onto insurers and patients, potentially driving higher out-of-pocket expenses and elevated service charges in outpatient and inpatient settings alike.

In sum, the cumulative impact of these tariff measures is likely to exacerbate existing financial headwinds, strain resource allocation, and complicate budget planning for acute care providers. As stakeholders advocate for targeted exemptions and pursue legislative relief, the imperative for resilient supply networks and diversified sourcing strategies has never been more pronounced.

Uncovering Strategic Opportunities Through In-Depth Analysis Of Service, Specialty, Payor, Application, And Demographic Segmentation

Insight into the market’s segmentation by service type reveals nuanced variations in demand and profitability across care pathways. Ambulatory surgery centers offering general, ophthalmology, and orthopedic procedures are experiencing accelerated growth as providers shift lower-acuity cases away from inpatient settings and optimize capacity utilization. Diagnostic services, including cardiac diagnostics, advanced imaging, and laboratory testing, continue to expand their role in early detection and care planning, bolstered by growing emphasis on value-based reimbursement frameworks. Emergency services remain critical for high-acuity presentations, particularly in cardiac, neurological, and trauma care, as aging populations and chronic disease prevalence drive sustained ER volumes. Within inpatient services, acute medical care, critical care, oncology, and surgical specialties underpin hospital revenue streams, while outpatient services spanning consultation, day surgery, diagnostics, and rehabilitation further diversify provider portfolios.

Examining segmentation by specialty highlights areas of clinical innovation and investment. Cardiology services, encompassing interventional, surgical, and non-invasive care, are integrating minimally invasive techniques and remote monitoring solutions to improve outcomes and reduce readmissions. Neurology segments such as epilepsy care, neuro-intensive units, and stroke services are leveraging tele-neuro platforms and AI-assisted diagnostics to accelerate time-to-treatment and enhance recovery paths. Oncology’s tripartite structure of medical, radiation, and surgical interventions is driving multidisciplinary care models, while orthopedics is benefiting from arthroscopic technologies, robotic joint replacement, and advanced spinal procedures that shorten hospital stays and enhance patient mobility.

Additional segmentation dimensions further refine strategic priorities. Payor type dynamics underscore the diverse reimbursement landscapes of out-of-pocket, private, and public insurance patients, influencing access, utilization, and financial planning. Application areas-diagnosis, monitoring, rehabilitation, and treatment-map onto evolving care pathways supported by digital therapeutics and remote patient management platforms. Age group considerations from neonatal to geriatric care inform specialized staffing models, facility design, and service offerings that address the unique needs of each demographic cohort.

This comprehensive research report categorizes the Acute Hospital Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Specialty

- Payor Type

- Age Group

- Application

Evaluating Regional Dynamics In Acute Hospital Care Highlighting Leadership, Expansion Strategies, And Growth Trajectories In Major Markets

North America dominates the acute hospital care landscape, with leading providers like HCA Healthcare and Community Health Systems benefiting from advanced infrastructure, robust private sector investment, and a mature reimbursement ecosystem. The region’s emphasis on technological adoption and quality metrics has solidified its position as the benchmark for operational excellence and clinical innovation, despite ongoing cost containment pressures and regulatory shifts.

In Europe, Middle East & Africa, the integration of cross-border regulatory frameworks and public-private partnerships is driving healthcare expansion and harmonization. Within the European Union, interoperability mandates and value-based purchasing are propelling digital transformation, while Gulf Cooperation Council nations are investing heavily in healthcare infrastructure-projecting combined expenditure growth at nearly 8% annually-and prioritizing private sector participation to enhance capacity and service breadth by 2025.

Asia-Pacific represents the fastest-growing regional market, fueled by rising medical inflation, expanding middle-class access, and government-led initiatives to modernize acute care facilities. Projections estimate that the region’s hospital market will generate revenues exceeding US$1.47 trillion in 2025, underpinned by double-digit growth rates in remote monitoring, AI-powered diagnostics, and digital health solutions. Major healthcare systems are embracing generative AI and agentic automation to streamline workflows and improve patient engagement, positioning the region at the forefront of next-generation acute care delivery.

This comprehensive research report examines key regions that drive the evolution of the Acute Hospital Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Providers And Technology Innovators Driving Growth Through Strategic Partnerships And Advanced Service Portfolios

The acute hospital care sector is characterized by a diverse ecosystem of provider networks and medical technology firms, each driving innovation through strategic collaborations and targeted investments. In the United States, operator conglomerates such as HCA Healthcare, Tenet Healthcare, Universal Health Services, and Community Health Systems maintain extensive national footprints and are expanding their ambulatory and outpatient service lines to enhance patient convenience and margin stability. These providers are also forging partnerships with technology companies and academic centers to advance robotic surgery, precision diagnostics, and virtual care models that augment traditional inpatient volumes.

On the medical device front, industry leaders like Medtronic, GE Healthcare, Philips HealthTech, and Siemens Healthineers are competing to deliver the next generation of imaging modalities, interventional platforms, and surgical robotics. Notably, Siemens’ photon-counting CT technology has set new benchmarks for image clarity and dose reduction, although recent tariff proposals threaten to delay adoption in U.S. hospitals. At the same time, emerging digital health vendors and AI-driven startups are collaborating with established manufacturers to embed machine learning into diagnostic workflows, remote monitoring devices, and clinical decision support systems, underscoring the collaborative imperative for sustained innovation in acute care environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acute Hospital Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABM Respiratory Care

- American Well Corporation

- Ardent Health Services

- Ascension

- Asklepios Kliniken GmbH & Co. KGaA

- Community Health Systems, Inc.

- eClinicalWorks, LLC

- Emerus Hospital Partners, LLC

- Fresenius Medical Care AG & Co. KGaA

- Genesis HealthCare System

- Helios Kliniken GmbH

- IHH Healthcare Berhad

- Inbound Health

- Lifepoint Health, Inc.

- Mediclinic Group

- Medsphere Systems Corporation

- Ramsay Group

- Sound Physicians

- Tenet Healthcare Corporation

- UnitedHealthcare

- Universal Health Services, Inc.

- UpHealth, Inc.

- US Acute Care Solutions (USACS)

- Vantive by Baxter International Inc

Implementing Proactive Supply Chain Strategies And Digital Investments To Balance Cost Pressures With Enhanced Patient Outcomes

To navigate the evolving acute hospital care landscape, industry leaders should prioritize the diversification of supply chain networks by identifying and qualifying domestic and nearshore manufacturers for critical supplies and equipment. Establishing multi-sourced agreements and leveraging group purchasing organizations proactively can help buffer against tariff-induced cost shocks and ensure consistent inventory levels, as recommended by healthcare M&A experts who emphasize rigorous contingency planning and contract resilience analysis.

Additionally, accelerating digital transformation initiatives will be essential to sustain operational efficiency and enhance patient experience. Hospitals should invest in scalable AI-driven solutions-ranging from virtual intake assistants to analytics platforms for predictive staffing-and integrate these technologies within existing electronic health record systems to maximize interoperability and data-driven decision-making. Furthermore, aligning service delivery models with emerging patient preferences for outpatient, home-based, and telemedicine encounters can unlock new revenue streams while relieving inpatient capacity constraints. Finally, proactive policy engagement with regulatory bodies to secure targeted tariff exemptions for medical goods will mitigate financial exposure and support the uninterrupted modernization of acute care facilities.

Detailing A Comprehensive Blend Of Secondary And Primary Research Protocols Ensuring Robust Data Integrity And Strategic Relevance

This report’s methodology underpins its strategic insights through a rigorous combination of secondary and primary research approaches. Secondary data was sourced from reputable government publications, healthcare association fact sheets, corporate disclosures, and peer-reviewed journals, ensuring a comprehensive baseline of industry trends, policy developments, and financial performance metrics. Consistent with executive-level analyses, frameworks from leading advisory firms informed the examination of digital adoption, service segmentation, and regional market dynamics.

Primary research included in-depth interviews with senior executives at major hospital operators, healthcare consultants, and technology providers to validate key findings and capture emerging strategic initiatives. Quantitative data was triangulated through both bottom-up and top-down models, with cross-verification against publicly available financial statements and tariff schedules. Finally, iterative data validation workshops with subject matter experts refined the dataset and contextualized the implications for long-term planning in acute hospital care.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acute Hospital Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acute Hospital Care Market, by Service Type

- Acute Hospital Care Market, by Specialty

- Acute Hospital Care Market, by Payor Type

- Acute Hospital Care Market, by Age Group

- Acute Hospital Care Market, by Application

- Acute Hospital Care Market, by Region

- Acute Hospital Care Market, by Group

- Acute Hospital Care Market, by Country

- United States Acute Hospital Care Market

- China Acute Hospital Care Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Consolidating Key Findings And Predictive Strategies To Guide Leadership Decisions In A Rapidly Shifting Acute Hospital Care Market

The acute hospital care sector stands at a critical inflection point, shaped by transformative digital adoption, evolving patient expectations, and external economic pressures such as tariffs. Leading providers have demonstrated resilience by leveraging long-term supply contracts and advanced analytics to sustain performance in 2025, while major technology and medtech companies continue to invest in AI-driven solutions that redefine care pathways. Yet, the cumulative impact of increased duties on essential supplies underscores the need for proactive supply chain diversification and targeted policy advocacy to safeguard operational continuity and clinical excellence.

Looking ahead, the convergence of outpatient care expansion, remote monitoring integration, and precision medicine adoption will create substantial opportunities for differentiation and value creation. Providers that strategically align digital investments with service line optimization, cultivate strategic partnerships, and engage with regulatory stakeholders will be best positioned to navigate cost headwinds and deliver superior patient outcomes. This executive summary underscores the imperative for agile leadership and data-driven decision-making as the blueprint for sustainable growth in the dynamic acute hospital care landscape.

Engage With Our Associate Director To Access Exclusive Acute Hospital Care Research Insights And Tailored Strategic Guidance

To explore this comprehensive market research report and gain in-depth strategic insights tailored to your organization’s needs, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings a wealth of experience in guiding healthcare stakeholders through critical decisions and will work closely with you to ensure the report aligns with your strategic objectives. Engage directly with Ketan to receive a detailed proposal, discuss custom research requirements, and unlock the full value of the Acute Hospital Care market analysis. Elevate your decision-making with targeted data and expert guidance by connecting with Ketan today

- How big is the Acute Hospital Care Market?

- What is the Acute Hospital Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?