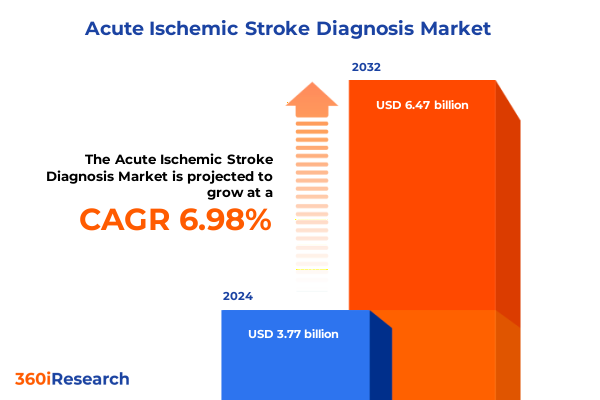

The Acute Ischemic Stroke Diagnosis Market size was estimated at USD 3.99 billion in 2025 and expected to reach USD 4.24 billion in 2026, at a CAGR of 7.13% to reach USD 6.47 billion by 2032.

Setting the Stage for Acute Ischemic Stroke Diagnosis with Urgent Clinical Imperatives Emerging Technologies and Patient-Centric Considerations

Acute ischemic stroke represents one of the most time-sensitive emergencies in modern medicine, demanding rapid diagnostic clarity to optimize patient outcomes. An introduction to this critical domain underscores the necessity of efficient triage protocols, the integration of advanced imaging modalities, and the innovative deployment of biomarker-based detection strategies. The evolving landscape of clinical practice guidelines emphasizes the golden hour concept, wherein every minute gained through diagnostic precision translates directly into preserved neurological function.

Recent shifts in acute care pathways highlight the growing role of interdisciplinary collaboration, combining emergency medicine, neurology, radiology, and laboratory sciences. As hospitals and care networks refine their stroke-ready certifications, the imperative for streamlined workflows and point-of-care testing capabilities becomes increasingly apparent. Furthermore, patient-centric considerations-such as minimizing transport delays and tailoring diagnostic approaches to comorbid conditions-serve as foundational pillars for enhancing both efficacy and equity in stroke care.

Understanding the convergence of clinical imperatives and emerging technologies is paramount for stakeholders aiming to navigate this high-stakes arena. By setting the stage with a comprehensive view of urgent diagnostic requirements and the promise of next-generation tools, decision-makers can better appreciate the strategic investments needed to reduce door-to-needle times and improve long-term recovery trajectories.

Charting Transformative Shifts in Acute Ischemic Stroke Care Landscape Driving Breakthrough Diagnostics and Evolving Clinical Pathways

The acute ischemic stroke diagnosis landscape is undergoing transformative shifts driven by technological maturation and shifts in care delivery models. Artificial intelligence algorithms are refining image interpretation, facilitating faster differentiation between infarct core and penumbra zones on CT and MRI scans. Simultaneously, the proliferation of portable ultrasound devices enables clinicians to perform carotid screening at the bedside, thereby expediting the identification of large vessel occlusions.

In parallel, biomarker-based detection methods are transitioning from research settings into early clinical applications. Blood biomarker assays targeting proteins and metabolites associated with neuronal injury are enabling more nuanced triage decisions in prehospital and emergency department contexts. These developments are complemented by growth in electroencephalography solutions that provide real-time functional assessments of cerebral activity, offering potential early warning signs of ischemic events before radiographic changes become apparent.

Moreover, telemedicine platforms continue to expand access to expert stroke neurologists for remote and underserved regions, augmenting diagnostic accuracy and facilitating rapid decision support. Together, these shifts herald a more connected, data-driven approach to acute stroke care, where decentralized testing, enhanced imaging capabilities, and integrated digital health solutions converge to redefine best practices and clinical workflows.

Assessing the Cumulative Impact of 2025 United States Tariffs on Acute Ischemic Stroke Diagnostic Supply Chains and Healthcare Delivery Ecosystems

The introduction of new United States tariffs in 2025 has introduced fresh complexities to the supply chain dynamics supporting acute ischemic stroke diagnosis. Diagnostic imaging equipment, including CT scanners and MRI systems, now faces increased import duties that have ripple effects across procurement budgets and maintenance agreements. Manufacturers and healthcare providers are encountering heightened costs that can translate into extended equipment onboarding timelines and reevaluation of capital expenditure priorities.

Contrast agents essential for enhanced vessel visualization have also seen price recalibrations, prompting imaging centers to optimize usage protocols and explore alternative suppliers. At the same time, specialized disposables-such as point-of-care testing cartridges and biomarker assay kits-are subject to the same tariff constraints, compelling laboratories to reassess inventory strategies and negotiate bulk purchasing arrangements to mitigate cost pressures.

Response strategies have emerged in parallel, with several companies accelerating investments in domestic manufacturing capabilities to localize production of critical components. Healthcare networks are bolstering collaborative purchasing consortia to leverage collective bargaining power. In combination, these adaptations underscore the need for a proactive approach to navigate tariff-driven uncertainty while maintaining uninterrupted access to the diagnostic tools essential for timely acute stroke care.

Uncovering Key Segmentation Insights Revealing Market Dynamics Across Product Types Test Modalities Disease Classifications Technologies and End Users

A nuanced understanding of the acute ischemic stroke diagnostics market emerges when evaluating it through multiple segmentation lenses. From a product perspective, diagnostic imaging holds a dominant position, with CT scanners offering rapid non-contrast head imaging while MRI systems provide detailed soft-tissue resolution. Complementing these modalities are blood biomarkers, which facilitate early biochemical detection, carotid ultrasound for vascular assessment, and electroencephalography to monitor neural function dynamically.

When considering test types, laboratories and diagnostic centers balance the deployment of traditional lab tests-such as complete blood counts and metabolic panels-against the need for sophisticated imaging tests. The ability to integrate blood and imaging data into a unified diagnostic profile is driving more holistic clinical decision-making. Disease classification further refines this picture, as embolic, lacunar, and thrombotic strokes each present distinct pathophysiological challenges that influence the selection of diagnostic pathways.

Technology segmentation reveals a divergence between biomarker-based detection platforms that offer high sensitivity to ischemic injury and point-of-care testing systems designed for rapid deployment in emergency and prehospital settings. Finally, end-user segmentation highlights that hospitals and clinics serve as pivotal hubs for acute diagnostics, while ambulatory surgical centers, diagnostic centers, and research laboratories each play specialized roles in pre- and post-acute care. Together, these segmentation insights illuminate the intricate interplay of modalities, technologies, and stakeholder needs that characterize the acute ischemic stroke diagnostics ecosystem.

This comprehensive research report categorizes the Acute Ischemic Stroke Diagnosis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Test Type

- Disease Type

- Technology

- End-User

Delivering a Comparative Regional Analysis Unveiling Unique Drivers Opportunities and Barriers Across the Americas EMEA and Asia-Pacific Markets

Regional dynamics play a critical role in shaping acute ischemic stroke diagnostic capabilities across the Americas, EMEA, and Asia-Pacific regions. In the Americas, established reimbursement frameworks and robust healthcare infrastructure underpin widespread adoption of advanced imaging and biomarker assays. Cross-border collaborations between the United States and Canada have fostered knowledge-sharing initiatives, accelerating the implementation of stroke-ready hospital networks and standardized telemedicine protocols.

In the Europe, Middle East & Africa region, heterogeneous regulatory environments and varied levels of healthcare infrastructure influence market uptake. Western European countries frequently lead in integrating AI-driven imaging solutions and point-of-care testing, while certain Middle Eastern nations are investing heavily in state-of-the-art stroke centers. In contrast, parts of Africa continue to grapple with foundational infrastructure challenges, highlighting opportunities for public-private partnerships to bolster diagnostic accessibility.

Meanwhile, the Asia-Pacific region demonstrates dynamic growth fueled by government-led health programs and increasing per capita healthcare expenditure. Urban centers in Japan, China, and Australia routinely deploy cutting-edge CT and MRI technologies, while emerging markets in Southeast Asia prioritize portable ultrasound and biomarker kits to extend acute diagnostic reach. Collectively, these regional insights underscore the need for context-specific strategies that align technological offerings with local infrastructure, regulatory considerations, and healthcare priorities.

This comprehensive research report examines key regions that drive the evolution of the Acute Ischemic Stroke Diagnosis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Highlighting Strategic Capabilities Partnerships and Innovation Trajectories in Acute Ischemic Stroke Diagnostics

The acute ischemic stroke diagnostics landscape is defined by a diverse array of industry stakeholders, ranging from global imaging giants to specialized biotechnology firms. Leading diagnostic imaging manufacturers have leveraged their expertise in CT and MRI innovation to introduce systems optimized for rapid stroke evaluation, incorporating software enhancements that accelerate infarct visualization.

Concurrently, pioneering biomarker developers have forged partnerships with clinical laboratories to validate novel assays capable of detecting ischemic injury markers in peripheral blood samples. Point-of-care device manufacturers are collaborating with emergency medical services to integrate portable testing platforms into prehospital workflows, bridging critical gaps between symptom onset and definitive hospital assessment.

Strategic alliances between technology providers and academic research institutions are fostering the validation of next-generation neural monitoring tools, including advanced electroencephalography arrays. Moreover, several market participants are engaging in cross-sector collaborations with digital health and telemedicine companies to deliver integrated diagnostic and decision-support solutions. Through these concerted efforts, industry leaders are driving a cohesive ecosystem that aligns clinical requirements with technological innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acute Ischemic Stroke Diagnosis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Aidoc Medical Ltd.

- BIOTRONIK SE & Co KG

- Boehringer Ingelheim International GmbH

- Boston Scientific Corporation

- Canon Medical Systems Corporation

- F. Hoffmann-La Roche Ltd.

- Fujifilm Holdings Corporation

- GE Healthcare Technologies Inc.

- Hitachi, Ltd.

- Integral Diagnostics (IDX) Group

- Johnson & Johnson Services, Inc.

- Koninklijke Philips N.V.

- Mediso Ltd.

- Medtronic PLC

- Merck & Co.

- Neusoft Corporation

- Nihon Kohden Corporation

- Planmed Oy

- Samsung Electronics Co. Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shimadzu Corporation

- Shionogi & Co., Ltd.

- Siemens Healthineers

- Stryker Corporation

- Toshiba International Corporation

Implementing Actionable Strategies for Industry Leaders to Drive Adoption Efficiency and Patient Outcomes in Stroke Diagnosis and Treatment Pathways

Industry leaders can capitalize on current momentum by implementing strategic initiatives that enhance diagnostic efficiency, improve patient outcomes, and fortify market positioning. First, strengthening collaborative networks between emergency medical services, stroke centers, and diagnostic laboratories will reduce handoff delays and optimize utilization of imaging and biomarker resources. Embedding point-of-care testing within ambulance protocols can further compress timelines from symptom onset to treatment initiation.

Second, investing in AI-enabled diagnostic platforms and advanced imaging software can support rapid, standardized interpretations while alleviating clinician workload. Integrating these solutions into existing radiology information systems and electronic health records will foster seamless data exchange and real-time decision support. Third, diversifying supply chains through nearshoring or onshore manufacturing of critical diagnostic components can mitigate tariff-induced cost pressures and ensure continuity of essential reagent and equipment availability.

Lastly, cultivating partnerships with academic and clinical research organizations will drive evidence generation for emerging diagnostic modalities. By sponsoring multicenter validation studies, industry leaders can strengthen regulatory submissions, expand market acceptance, and reinforce payer confidence. Together, these actionable strategies provide a roadmap for stakeholders seeking to elevate diagnostic capabilities, enhance clinical outcomes, and sustain competitive advantage in the acute ischemic stroke space.

Outlining Robust Mixed-Method Research Methodologies Ensuring Data Integrity Validity and Comprehensive Analysis for Acute Stroke Diagnostic Studies

The research methodology underpinning this executive summary combines quantitative and qualitative approaches to deliver holistic insights into acute ischemic stroke diagnostics. Secondary research involved an extensive review of peer-reviewed journals, regulatory filings, and clinical practice guidelines to identify prevailing diagnostic technologies, evolving clinical pathways, and policy developments. This foundational analysis established the contextual framework for deeper exploration.

Primary research comprised interviews with thought leaders spanning radiology, neurology, emergency medicine, and laboratory sciences. These discussions provided firsthand perspectives on diagnostic workflow optimization, technology adoption barriers, and anticipated clinical trial outcomes. Data triangulation was achieved by cross-referencing stakeholder interviews with publicly available performance metrics and case studies, ensuring the robustness and validity of key findings.

In addition, an expert panel review was conducted to scrutinize preliminary insights, challenge assumptions, and refine strategic imperatives. This iterative validation process bolstered the credibility of segmentation analyses, regional assessments, and tariff impact evaluations. Collectively, this mixed-methods approach guarantees a rigorous, transparent, and comprehensive exploration of the acute ischemic stroke diagnostics landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acute Ischemic Stroke Diagnosis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acute Ischemic Stroke Diagnosis Market, by Product Type

- Acute Ischemic Stroke Diagnosis Market, by Test Type

- Acute Ischemic Stroke Diagnosis Market, by Disease Type

- Acute Ischemic Stroke Diagnosis Market, by Technology

- Acute Ischemic Stroke Diagnosis Market, by End-User

- Acute Ischemic Stroke Diagnosis Market, by Region

- Acute Ischemic Stroke Diagnosis Market, by Group

- Acute Ischemic Stroke Diagnosis Market, by Country

- United States Acute Ischemic Stroke Diagnosis Market

- China Acute Ischemic Stroke Diagnosis Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Imperatives to Advance Acute Ischemic Stroke Diagnostics and Foster Continued Innovation in Clinical Practice

The synthesis of segmentation, regional, and competitive analyses reveals several core findings and strategic imperatives. Diagnostic imaging continues to anchor acute stroke workflows, yet biomarker-based detection and point-of-care testing are rapidly emerging as vital complements that enhance early detection and treatment decision-making. These modalities, when integrated with AI-driven software and telemedicine platforms, create a synergistic diagnostic ecosystem.

Regional variability underscores the importance of tailoring market entry and expansion strategies. While developed markets benefit from established reimbursement models and advanced infrastructure, emerging regions offer growth potential through targeted investments in portable technologies and public-private partnerships. Adapting solutions to align with local healthcare frameworks will be critical for maximizing reach and impact.

Strategically, stakeholders should prioritize supply chain resilience, clinical validation partnerships, and digital integration to sustain momentum in an increasingly competitive field. By embracing collaborative innovation and evidence-based adoption, organizations can drive meaningful improvements in stroke diagnosis, reduce time-to-treatment, and ultimately elevate patient outcomes. These insights form the foundation for informed decision-making and continued advancement in acute ischemic stroke diagnostics.

Engage with Associate Director Sales and Marketing to Secure Comprehensive Acute Ischemic Stroke Diagnostic Market Insights and Reporting Package

To secure a comprehensive understanding of acute ischemic stroke diagnostic dynamics and gain access to in-depth analyses that can shape strategic decisions, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. By engaging with Ketan, stakeholders will benefit from tailored insights, priority research deliverables, and guidance on leveraging the full suite of diagnostic innovations and market intelligence.

Connect with Ketan to explore bespoke partnerships, schedule a personalized briefing, and obtain the latest report that distills critical trends, competitive landscapes, and actionable strategies. Take this opportunity to empower your organization with the targeted knowledge necessary to excel in the rapidly evolving acute ischemic stroke diagnostics space, ensuring both clinical impact and commercial success.

- How big is the Acute Ischemic Stroke Diagnosis Market?

- What is the Acute Ischemic Stroke Diagnosis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?