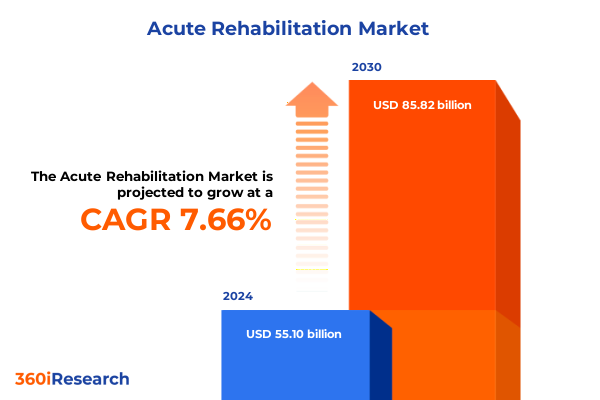

The Acute Rehabilitation Market size was estimated at USD 55.10 billion in 2024 and expected to reach USD 59.21 billion in 2025, at a CAGR of 7.66% to reach USD 85.82 billion by 2030.

Charting the Future of Acute Rehabilitation with Innovative Care Models, Technological Breakthroughs, and Enhanced Patient Engagement Strategies

Acute rehabilitation represents a critical inflection point in the patient care continuum where intensive, multidisciplinary interventions converge to restore functional independence and facilitate safe transitions from hospital to home. Defined by its focus on rapid mobilization, comprehensive therapy regimens, and medically managed recovery, this phase bridges acute medical treatment and long-term restorative care, setting the foundation for sustained health outcomes. As populations age and the prevalence of chronic and post-surgical conditions rises, the importance of acute rehabilitation has surged, underscoring its role in minimizing complications, reducing readmissions, and optimizing resource utilization within healthcare systems.

Amid evolving reimbursement models that reward value over volume, providers are under increasing pressure to demonstrate tangible improvements in patient outcomes while controlling costs. Concurrently, policy initiatives at international and national levels have elevated rehabilitation as an essential component of universal health coverage, reflecting a recognition that early, high‐intensity interventions yield long‐term economic and societal benefits. As a result, stakeholders across the continuum-from hospital administrators to therapy specialists-are collaborating to reimagine acute rehabilitation delivery through patient‐centric program design, integrated technology platforms, and performance‐driven quality metrics. This report delivers a panoramic view of the acute rehabilitation landscape, offering decision‐makers a robust analytical framework to navigate emerging trends and capitalize on strategic opportunities.

Disruptive Shifts in Acute Rehabilitation Landscape Driven by Digital Therapies, AI-Enabled Tools, and Evolving Care Paradigms

The acute rehabilitation landscape is undergoing a profound transformation driven by disruptive technologies, shifting care paradigms, and changing patient expectations. Recent breakthroughs in robotic‐assisted therapy and immersive virtual reality platforms are redefining functional restoration, enabling precision‐guided exercises, real‐time biofeedback, and gamified engagement that enhance adherence and accelerate recovery trajectories. These smart technologies, which range from exoskeletal gait trainers to interactive VR modules, are seamlessly integrating with traditional therapy workflows, fostering more personalized and data‐driven interventions.

Artificial intelligence and machine learning algorithms have further amplified this shift by enabling predictive analytics for patient stratification and outcome forecasting. AI‐enabled monitoring tools can detect subtle changes in muscle activation or movement patterns, allowing therapists to optimize treatment plans dynamically and allocate resources more effectively. Concurrently, the proliferation of tele‐rehabilitation platforms has expanded access to specialized care, especially in underserved or remote areas, with millions of virtual therapy sessions now conducted annually to support continuity of care beyond the inpatient setting.

At the same time, healthcare delivery models are evolving to embrace value‐based frameworks that tie reimbursement to functional gains, readmission rates, and patient satisfaction. This shift is prompting providers to innovate care pathways, integrating home‐based services, remote monitoring, and interdisciplinary coordination to ensure seamless handoffs between acute and post‐acute phases. As patient empowerment gains prominence, consumer expectations for convenience, transparency, and outcome visibility are reshaping service design, compelling stakeholders to cultivate digital engagement tools, self‐management apps, and collaborative decision‐making platforms.

Assessing the Cumulative Impact of United States Trade Tariffs on Acute Rehabilitation Supply Chains, Device Costs, and Market Accessibility

Since 2018, the United States has maintained Section 301 tariffs on imports from China to address trade imbalances, and these measures have been periodically revised to include new product categories and rate increases. In late 2024 and early 2025, the Office of the U.S. Trade Representative finalized tariff increases on a range of products integral to acute rehabilitation supply chains, including medical gloves, syringes, masks, critical minerals, and semiconductor components, with rates escalating to as high as 100% for certain items and 50% for key protective equipment.

Alongside these rate hikes, exemptions for select medical equipment-such as blood pressure monitors and DC electric motors-have been extended to mid-2025, providing temporary relief for suppliers dependent on specialized Chinese manufacturers. Nonetheless, the broader effect has been a marked increase in input costs for rehabilitation device producers, particularly those reliant on robotic actuators, advanced sensors, and smart-material components now subject to 25% duties. These added expenses have reverberated through pricing structures, compelling many original equipment manufacturers to either absorb costs or pass them along to payers and providers, thereby impacting treatment affordability and reimbursement negotiations.

In response, industry leaders have accelerated efforts to diversify supply chains and nearshore critical component production. Federal incentives, including tax credits under the Inflation Reduction Act and credits for domestic medical device manufacturing delineated in the MADE in America Act, are catalyzing investments in U.S.-based production facilities and R&D capabilities. While these policy measures promise to bolster resilience and reduce long‐term tariff exposure, the transitional period has introduced complexity into procurement strategies, highlighted the strategic importance of local manufacturing partnerships, and underscored the need for agile sourcing frameworks.

Uncovering Key Insights Across Service, Disease, Phase, Device, Age, Provider, and End-User Segmentation That Define Acute Rehabilitation Dynamics

The acute rehabilitation market is richly nuanced, characterized by a multi‐layered segmentation that informs tailored service delivery and investment strategies. Based on service type, the market encompasses a spectrum of specialized therapies, including cardiac rehabilitation-comprising post‐cardiac surgery therapy and post‐heart attack rehabilitation-neurological rehabilitation, such as stroke and traumatic brain injury programs, and a range of physical, occupational, pulmonary, and speech and language services that address diverse patient needs. Occupational therapy complements these service lines by facilitating activities of daily living and vocational reintegration, while pulmonary rehabilitation focuses on respiratory function restoration, highlighting the interdependence of service modalities in patient outcomes.

Disease type segmentation further refines the landscape, with programs targeted to conditions ranging from abnormal heart rhythms, angina, and atrial fibrillation to coronary artery disease, diabetes, hypertension, pulmonary hypertension, and heart failure or transplant recovery. This granularity enables providers and payers to design protocols that optimize clinical pathways and resource allocation, aligning therapeutic intensity with disease severity and comorbidity profiles.

Phase type segmentation delineates the continuum of care across acute, sub‐acute, long‐term, and reintegration phases. Phase I (acute) prioritizes medical stabilization and intensive therapy, Phase II (sub‐acute) extends functional gains, Phase III (long‐term) focuses on sustained reinforcement of mobility and independence, and Phase IV (reintegration) emphasizes community participation and self‐management. This phased framework ensures structured progression and outcome tracking, facilitating calibrations to therapy intensity and care settings.

Device type segmentation spans cognitive and speech devices, mobility aids, monitoring tools, physiotherapy equipment, and robotic systems. Within this ecosystem, balance and coordination platforms, strength and endurance training devices, and mobility training modules interact to form integrated rehabilitation suites. Patient age groups-pediatrics, adults, and geriatrics-further modulate service design, as each cohort presents distinct biomechanical, cognitive, and psychosocial considerations. Provider types range from home‐based rehabilitation services and outpatient clinics to inpatient acute centers and hospitals, each offering unique care environments. End‐user segments, including government and public health agencies, healthcare providers, and patients themselves, complete this holistic matrix of market drivers and decision levers.

This comprehensive research report categorizes the Acute Rehabilitation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Disease Type

- Phase Type

- Device Type

- Patient Age Group

- Provider Type

- End User

Exploring Regional Nuances and Strategic Drivers Shaping Acute Rehabilitation Adoption in the Americas, EMEA, and Asia-Pacific

Distinctions between global regions are pronounced in acute rehabilitation, reflecting variations in healthcare infrastructure, regulatory frameworks, and demographic pressures. In the Americas, the United States leads market adoption, underpinned by advanced reimbursement models, widespread integration of cutting-edge technologies, and a high prevalence of chronic and post‐surgical cases. This region accounts for over a quarter of global rehabilitation equipment utilization, driven by robust capital expenditure in smart devices and AI‐enabled therapy tools.

Europe, the Middle East, and Africa (EMEA) exhibit heterogeneity in service delivery, where Western Europe’s harmonized regulatory standards and public‐private partnerships foster rapid adoption of tele‐rehabilitation and digital health solutions. Meanwhile, emerging markets in Eastern Europe and the Middle East are expanding infrastructure through strategic investments, often leveraging EU grant funding and bilateral health programs. In Africa, nascent rehabilitation initiatives are scaling through NGO partnerships and blended financing models, addressing burgeoning needs stemming from trauma and non‐communicable disease burdens.

Asia‐Pacific is characterized by rapidly ageing populations and increasing governmental prioritization of rehabilitation services. Nations such as Japan and South Korea are at the forefront of robotics and AI integration, deploying exoskeleton networks and remote monitoring platforms within public systems. China’s domestic capacity has accelerated, motivated by health policy reforms and insurance expansion, while India and Southeast Asian markets are experiencing growth in affordable tele‐rehab solutions and home‐based care models to reach rural communities. These divergent regional dynamics underscore the importance of localized strategies that align innovation with policy incentives and demographic realities.

This comprehensive research report examines key regions that drive the evolution of the Acute Rehabilitation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players in Acute Rehabilitation Highlighting Strategies, Partnerships, and Innovation Trails Driving Market Excellence

Key industry players are charting the course for acute rehabilitation’s technological evolution and market expansion. Invacare, a leader in mobility solutions, continues to enhance its product portfolio through acquisitions and partnerships that integrate sensor‐based monitoring and AI analytics into everyday aids. Medline Industries has expanded its reach by developing comprehensive therapy kits that bundle consumables with digital tracking platforms, strengthening its position in hospital and home‐based settings. Dynatronics Corp is investing in research collaborations to refine its robotic rehabilitation devices and hydrotherapy systems, capitalizing on clinical trial evidence demonstrating improved patient adherence.

In the exoskeleton space, Ekso Bionics Holdings Inc has broadened deployment of its wearable robotic units, advancing features such as adaptive gait algorithms and cloud‐based performance dashboards, which empower therapists to remotely adjust therapy protocols and monitor patient progress. Harmonic Bionics made a notable entry with Harmony SHR, a Class II exempt upper extremity rehabilitative device that merges robotics with cloud analytics to deliver personalized therapy routines and real‐time progress feedback. Regional specialists like Ottobock and Hocoma emphasize localized support networks, offering modular training devices that address balance, coordination, and mobility across diverse patient populations.

These companies are forging strategic alliances with academic research centers, technology startups, and public health agencies to accelerate product innovation, validate clinical outcomes, and expand reimbursement pathways. Their collective efforts galvanize a competitive landscape where rapid iteration, evidence‐based validation, and seamless integration into care pathways determine market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acute Rehabilitation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acadia Healthcare Company, Inc.

- Amedisys, Inc.

- Athena Health Care Systems

- Aurora Behavioral Health System

- Cambridge Medical and Rehabilitation Center

- CareOne Management, LLC by New Frontier Energy, Inc.

- ClearSky Health

- Covenant Care

- Ekso Bionics Holdings, Inc.

- Encompass Health Corporation

- Five Star Senior Living by AlerisLife Inc.

- Genesis Healthcare, Inc.

- HCA Healthcare, Inc.

- LHC Group, Inc. by UnitedHealth Group Incorporated

- LifePoint Health, Inc.

- National Healthcare Corporation

- Nexion Health, Inc.

- Oceans Healthcare

- Paradigm Healthcare

- Promises Behavioral Health, LLC

- Select Medical Corporation

- St. Ann's Community

- Tenet Healthcare Corporation

- The Alden Network

- The Ensign Group, Inc.

- Universal Health Services Inc.

Formulating Actionable Roadmap for Industry Leaders to Capitalize on Emerging Innovations, Navigate Policy Shifts, and Optimize Operational Performance

To capitalize on the momentum within acute rehabilitation, industry leaders should pursue a multifaceted strategy. First, organizations must accelerate integration of digital and AI‐driven solutions, ensuring platforms for remote monitoring, outcome analytics, and patient engagement are interoperable with electronic medical records. This integration will facilitate seamless data exchange and support value‐based care models. Furthermore, forging partnerships with technology innovators-such as VR developers and robotics startups-can expedite the deployment of next‐generation therapy tools.

Second, near-term cost pressures from tariffs and supply chain disruptions call for diversification of sourcing strategies and investments in domestic manufacturing partnerships. Companies should leverage incentives embedded in the MADE in America Act to establish or expand U.S. production facilities, thereby mitigating tariff exposure and strengthening supply resilience.

Third, stakeholders must align service models with emerging reimbursement policies by demonstrating clinical efficacy through real‐world evidence generation and engaging proactively with payers. Adoption of standardized outcome metrics and rigorous health economics studies will be critical to securing favorable coverage determinations under value‐based purchasing frameworks.

Lastly, providers and device manufacturers should intensify focus on patient‐centric care design, employing user experience research to co-create solutions that enhance adherence, accessibility, and satisfaction. Personalized therapy pathways, multilingual tele‐rehab platforms, and culturally attuned outreach programs will drive adoption across diverse patient cohorts and geographic regions.

Detailing Rigorous Research Methodology Employed to Ensure Data Integrity, Analytical Depth, and Comprehensive Coverage of Acute Rehabilitation Trends

This analysis synthesizes insights from a rigorous research methodology that combines primary and secondary data sources, expert stakeholder interviews, and quantitative data validation. Primary research included in‐depth consultations with hospital administrators, rehabilitation clinicians, payers, and technology providers to capture real-world perspectives on service delivery challenges and innovation adoption. Secondary research comprised comprehensive review of peer-reviewed journals, government trade reports, industry whitepapers, and financial filings to ensure breadth and depth of coverage.

Data triangulation techniques were applied to reconcile discrepancies across sources, while key assumptions were stress-tested through scenario analysis. Regulatory and policy landscapes were mapped using official U.S. Trade Representative and congressional documentation, and global market dynamics were benchmarked against authoritative institutional publications. Rigorous quality controls, including methodological audit trails and peer reviews by independent subject matter experts, ensured analytical integrity and reproducibility.

Segmentation frameworks were developed to reflect the multifaceted nature of acute rehabilitation, enabling targeted insights across service lines, disease states, care phases, device categories, patient demographics, provider settings, and end-user groups. Regional analyses incorporated macroeconomic indicators, healthcare infrastructure metrics, and demographic data to contextualize adoption trends. The resulting research outcomes deliver a robust evidence base to inform strategic decision-making and guide investments in acute rehabilitation innovation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acute Rehabilitation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acute Rehabilitation Market, by Service Type

- Acute Rehabilitation Market, by Disease Type

- Acute Rehabilitation Market, by Phase Type

- Acute Rehabilitation Market, by Device Type

- Acute Rehabilitation Market, by Patient Age Group

- Acute Rehabilitation Market, by Provider Type

- Acute Rehabilitation Market, by End User

- Acute Rehabilitation Market, by Region

- Acute Rehabilitation Market, by Group

- Acute Rehabilitation Market, by Country

- United States Acute Rehabilitation Market

- China Acute Rehabilitation Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Distilling Comprehensive Conclusions on Acute Rehabilitation Trends, Challenges, and Opportunities to Empower Strategic Decision-Making

In conclusion, acute rehabilitation is at a pivotal crossroads where technological innovation, policy evolution, and shifting care models intersect to redefine patient recovery experiences. The convergence of AI, robotics, tele-rehabilitation, and immersive digital therapies is unlocking new frontiers in personalized care, improved functional outcomes, and operational efficiencies. However, supply chain disruptions and tariff pressures underscore the critical need for strategic sourcing, domestic manufacturing partnerships, and adaptive policy navigation.

Segmentation insights reveal that tailored therapies across cardiac, neurological, orthopedic, pulmonary, and speech domains, delivered through phased care pathways, are essential to meet diverse patient needs. Regional nuances highlight the significance of localized approaches-from advanced reimbursement and digital adoption in the Americas to capacity building in EMEA and rapid scale-up in Asia-Pacific. Leading companies are responding with integrated solutions, strategic alliances, and evidence-based validation to secure competitive advantage.

For industry leaders, the path forward entails embracing data-driven care delivery, forging resilient supply networks, and illustrating clinical value to payers and policymakers. By adopting a holistic strategy that combines technological leadership, policy acumen, and patient-centric innovation, stakeholders can drive sustainable growth and elevate standards of acute rehabilitation worldwide.

Connect with Our Sales and Marketing Lead to Access Exclusive Acute Rehabilitation Market Research Report and Unlock Competitive Intelligence

To explore the full depth of acute rehabilitation market insights, including comprehensive competitive analysis, strategic opportunities, and in-depth policy impact reviews, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you through the report’s rich findings and help tailor a solution that addresses your organization’s specific needs. Engage today to unlock actionable intelligence and secure a competitive edge in the rapidly evolving acute rehabilitation landscape.

- How big is the Acute Rehabilitation Market?

- What is the Acute Rehabilitation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?