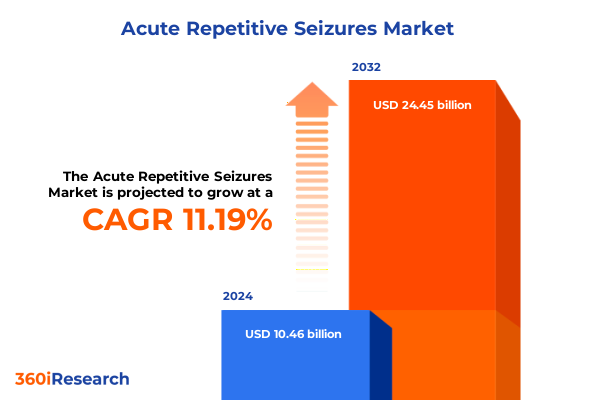

The Acute Repetitive Seizures Market size was estimated at USD 11.56 billion in 2025 and expected to reach USD 12.77 billion in 2026, at a CAGR of 11.29% to reach USD 24.45 billion by 2032.

Exploring the Critical Significance and Urgent Need for Advanced Strategies in Acute Repetitive Seizure Management Across Modern Neurological Practice

The global burden of epilepsy continues to pose a significant health challenge, affecting approximately 50 million individuals worldwide according to the World Health Organization’s most recent fact sheet. While epilepsy manifests in various forms, acute repetitive seizures-also known as seizure clusters-represent a particularly urgent subset characterized by multiple episodes within a short time frame, typically under 24 hours. A landmark epidemiological study leveraging the United Kingdom General Practice Research Database identified that acute repetitive seizures affect nearly 3% of people living with epilepsy and approximately 0.02% of the general population, with the highest prevalence among children under five years of age. These findings underscore the critical need for rescue therapies that can rapidly and effectively halt these recurrent seizures to prevent escalation into status epilepticus and reduce associated morbidity and mortality.

Despite advances in antiseizure medications for chronic management, breakthroughs still occur, often necessitating prompt out-of-hospital intervention. Clinical evidence from a chart review at a major adult epilepsy center demonstrated that intranasal benzodiazepines, specifically diazepam and midazolam nasal sprays, achieved seizure cessation in over 80% of patients after one or two doses, with user satisfaction ratings exceeding 4 out of 5. Adverse events were minor, primarily including fatigue and nasal discomfort, validating the tolerability and practicality of these noninvasive, self-administered formats. As seizure clusters carry heightened risk of complications, the advent of these patient-centric delivery platforms marks a pivotal shift in emergency seizure care, offering caregivers and patients a rapid-response tool that can be administered outside clinical settings.

Identifying Breakthrough Innovations and Patient Empowerment Trends That Are Redefining Delivery Methods and Access in Acute Seizure Rescue Therapies

Over the past two years, regulatory agencies have expedited approvals for innovative rescue therapies, transforming how acute repetitive seizures are managed. In April 2025, the U.S. Food and Drug Administration granted approval for VALTOCO® (diazepam nasal spray) to treat seizure clusters in patients aged two years and older, citing its clinically superior intranasal absorption technology compared to rectal gel formulations. That same month marked the FDA’s green light for Libervant™ (diazepam buccal film) in pediatric patients aged two to five, establishing the first orally administered rescue product for this age group and expanding treatment options beyond traditional rectal delivery. Additionally, Nayzilam® (midazolam nasal spray) has secured its status as a first-line acute therapy for epilepsy, offering a rapid-onset solution for patients twelve years and older. These approvals reflect a clear regulatory commitment to patient-centric, noninvasive delivery formats that prioritize ease of use, rapid onset of action, and enhanced safety profiles.

Concurrently, preclinical research is pushing the frontier of drug delivery innovation. Biotech firms are exploring nanocarrier systems engineered to co-deliver antiseizure drugs with diagnostic sensors, enabling theranostic approaches that detect seizure biomarkers and release therapeutics on demand. A recent systematic review of animal and in vitro studies found that antiseizure-loaded nanocarriers significantly reduced seizure frequency, neuroinflammation, and oxidative stress, while demonstrating low toxicity in multiple models. These advances suggest a future in which seizure rescue therapies not only interrupt clusters but also provide real-time monitoring and targeted drug release, reshaping emergency care paradigms and elevating outcomes for patients with refractory epilepsy.

Assessing the Multifaceted Consequences of the 2025 U.S. Tariff Regime on Pharmaceutical Sourcing, Cost Structures, and Supply Chain Resilience in Seizure Emergency Therapies

In April 2025, the United States instituted a uniform 10% global tariff on nearly all imported goods, encompassing critical healthcare items such as active pharmaceutical ingredients (APIs) and medical devices. This sweeping measure was designed to stimulate domestic manufacturing but has led to immediate cost pressures for pharmaceutical companies that rely heavily on foreign-sourced APIs, particularly for generic rescue medications. With an estimated 40% of all APIs for generic drugs sourced from China, generic drugmakers are facing margin compression and supply chain disruptions that threaten availability and affordability of seizure rescue therapies. Hospitals and pharmacies are reassessing procurement strategies and exploring alternative sourcing, while some manufacturers are accelerating reshoring efforts to mitigate tariff exposure, illustrating the far-reaching ripple effects of trade policy on therapeutic accessibility.

Further compounding these challenges, the Department of Commerce’s Section 232 investigation into pharmaceuticals initiated in April 2025 introduces the prospect of additional national security–driven tariffs. President Trump’s public threat to impose tariffs up to 200% on imported pharmaceuticals-while delaying enforcement by up to a year to allow industry adjustment-has injected uncertainty into corporate planning and capital allocation. Generic drugmakers, operating on narrow margins, warn that such drastic levies could exacerbate existing shortages, derail investments in new formulations, and undermine patient access to essential rescue therapies. In response, industry stakeholders are intensifying advocacy efforts for targeted exemptions and bolstering supply chain resilience through geographic diversification and strategic stockpiling, underscoring the need for agile operational frameworks to navigate an evolving policy environment.

Illuminating Comprehensive Segmentation Perspectives That Reveal Heterogeneity in Drug Type, Delivery Routes, Channels, End Users, Age Demographics, and Formulation Modalities

The landscape of rescue therapies for seizure clusters is defined by a clear dichotomy between branded and generic products, with branded formulations leveraging patented delivery mechanisms while generics compete on price and availability. Generic manufacturers of rectal diazepam are particularly vulnerable to input cost fluctuations under the new tariff regime, given their reliance on low-margin, high-volume API imports. Conversely, branded developers of nasal and buccal platforms maintain pricing power that can absorb moderate cost increases, but they too must monitor production economics closely to sustain distribution to home and hospital channels.

Routes of administration remain a critical determinant of patient and caregiver adoption. Buccal films like Libervant and intramuscular formulations of midazolam cater to pediatric and prehospital use, while intranasal sprays such as VALTOCO and Nayzilam offer rapid onset for adult populations. Intravenous options comprising diazepam and lorazepam sustain in-hospital emergency protocols, and rectal gels continue as a fallback for patients unable to tolerate other routes. Recent approvals and head-to-head analyses underscore the superior usability and onset profiles of noninvasive routes, prompting healthcare systems to integrate these options into seizure action plans and emergency response kits.

Distribution channels are evolving beyond traditional hospital pharmacies and retail networks, with online pharmacies gaining traction through direct-to-patient models. Digital platforms facilitate expedited delivery of rescue kits to caregivers and patients in home care settings, while inpatient units and specialty epilepsy clinics maintain dedicated stock for acute events. Telepharmacy services further enhance access in remote regions, underscoring the importance of multi-channel logistics to ensure continuity of care under tightening trade and regulatory constraints.

In end-user environments, family caregivers equipped with individualized seizure action plans administer therapies in home settings physiologically suited for timely intervention. Hospitals integrate advanced monitoring systems and emergency protocols that leverage auto-injectors and intranasal sprays to curtail seizure progression. Specialty clinics remain pivotal for training, device titration, and patient education, ensuring that high-risk cohorts receive tailored care pathways aligned with their treatment regimens and lifestyle needs.

Age-specific considerations further refine product selection, with pediatric-focused approvals for buccal films and nasal sprays driving adoption among young patients, and adult indications expanding for intranasal midazolam and buccal benzodiazepine films. Companies align dosing strengths and pouch sizes to meet the distinct pharmacokinetic and usability requirements across life stages, reinforcing the critical interplay between demographic segmentation and therapeutic design.

Formulation innovation spans from advanced hydrogels enabling intranasal delivery to prefilled film pouches that dissolve harmlessly in the buccal cavity. Development-stage programs are exploring auto-injector formats that activate upon seizure detection, leveraging sensor-integrated wearables to automate rescue dosing. These advancements underscore a sustained commitment to enhancing user autonomy, safety, and speed of onset in emergency seizure management.

This comprehensive research report categorizes the Acute Repetitive Seizures market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Route Of Administration

- Age Group

- Formulation

- Distribution Channel

- End User

Unveiling Pivotal Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia Pacific in the Evolution of Acute Repetitive Seizure Management Solutions

The Americas region leads the global arena in acute repetitive seizure management, anchored by robust healthcare infrastructure and high patient awareness. The Centers for Disease Control and Prevention reports over 3.4 million active epilepsy cases in the United States, including nearly half a million pediatric patients, solidifying acute rescue therapies as a critical component of standard care. FDA approvals of intranasal and buccal benzodiazepines have catalyzed adoption in both home and hospital settings, while state-level legislation in Ohio and New York mandates individualized seizure action plans and caregiver training, ensuring timely access to rescue medications in educational environments. These regulatory and clinical drivers reinforce North America’s preeminence in therapeutic innovation and policy support.

In Europe, Middle East & Africa, the European Medicines Agency’s positive CHMP opinion to extend Buccolam’s indication to adult populations signals a broadening of access beyond pediatric use, complementing long-standing approvals for buccal midazolam across EU member states. Neuraxpharm’s strategic expansion of Buccolam into 25 countries underscores the product’s pan-European dominance, while legislative frameworks-such as Washington, D.C.’s Seizure Safe Schools Amendment Act-reflect a growing emphasis on community-based management and liability protections for trained caregivers. Market dynamics in this region prioritize patient-friendly formulations and regulatory harmonization to drive consistent care pathways across diverse healthcare systems.

Asia-Pacific presents a compelling growth frontier buoyed by large patient populations and escalating healthcare investments. WHO data indicate that 80% of people with epilepsy reside in low- and middle-income countries, including China and India, where generic benzodiazepines remain integral to rescue protocols due to affordability considerations. Emerging markets are increasingly adopting intranasal and buccal therapies as healthcare access expands, with select countries issuing approvals for midazolam nasal sprays and exploring domestic production partnerships. However, supply chain disruptions arising from global tariffs have prompted regional governments to bolster local API manufacturing capabilities, signaling a shift toward self-reliance and cost containment in critical drug supplies.

This comprehensive research report examines key regions that drive the evolution of the Acute Repetitive Seizures market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players Driving Innovation, Strategic Collaborations, and Product Differentiation in Acute Rescue Therapies for Seizure Cluster Emergencies

The competitive landscape for acute seizure rescue therapies is shaped by a diverse mix of pure-play neuroscience innovators, generic giants, and emerging biotechs. Neurelis, a San Diego–based specialist, secured FDA approval for VALTOCO® (diazepam nasal spray) in April 2025, leveraging its proprietary INTRAVAIL® absorption technology to deliver orphan drug exclusivity for seizure clusters in both pediatric and adult populations. Aquestive Therapeutics distinguished itself with Libervant™ (diazepam buccal film), achieving the first FDA approval in April 2024 for an orally administered rescue product in children aged two to five, and subsequently earning orphan drug exclusivity that extends through 2031. UCB’s Nayzilam® (midazolam nasal spray) maintains a pivotal role in adult care, offering validated efficacy since its initial FDA approval in 2019 and integrating risk management measures to mitigate CNS depressant interactions. Meanwhile, Bausch Health’s Diastat® (diazepam rectal gel) persists as a baseline standard of care, supported by authorized generics from Oceanside Pharmaceuticals and Bryant Ranch Prepack, ensuring continuity of access for patients and caregivers familiar with rectal administration. Development-stage companies such as Polyrizon are poised to enter the market with intranasal hydrogels designed to refine dosing precision and enhance stability, reflecting a robust pipeline that spans device-based, nanocarrier, and sensor-integrated rescue modalities. Across this cohort, strategic collaborations, patent portfolios, and regulatory milestones serve as key differentiators that define market positioning and future growth trajectories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Acute Repetitive Seizures market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acorda Therapeutics, Inc.

- Aculys Pharma, Inc.

- Aquestive Therapeutics, Inc.

- Bausch Health Companies Inc.

- Epalex Corp.

- Hikma Pharmaceuticals PLC

- Jazz Pharmaceuticals, Inc.

- Lupin Limited

- Mallinckrodt Pharmaceuticals

- MonoSol Rx LLC

- Neurelis, Inc.

- Pfizer Inc.

- Pharmanovia

- Proximagen Limited

- Sandoz International GmbH

- SK Biopharmaceuticals Co., Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- UCB S.A.

- Upsher-Smith Laboratories, Inc.

- Veriton Pharma Ltd.

- Viatris Inc.

- Xeris Biopharma Holdings, Inc.

Formulating Targeted Strategic Actions for Healthcare and Pharmaceutical Leaders to Enhance Access, Foster Innovation, and Navigate Emerging Policy and Market Challenges

To capitalize on rapidly shifting therapeutic and policy landscapes, industry leaders should prioritize multi-pronged strategies. First, securing diversified API supply chains through partnerships with domestic manufacturers and alternative sourcing hubs in India and Germany will mitigate tariff pressures and ensure uninterrupted production of both branded and generic rescue therapies. Second, investing in next-generation delivery technologies such as sensor-triggered auto-injectors and pH-responsive nanocarriers can extend product portfolios beyond benzodiazepines and address unmet needs in refractory patient subsets. Third, forging alliances with telehealth and digital health platforms to integrate seizure monitoring, automated dosing prompts, and remote caregiver training will enhance patient adherence and reduce time to treatment. Equally important is active engagement in regulatory and legislative dialogues at state and federal levels to advocate for sustained tariff exemptions, expanded school seizure action plan mandates, and streamlined approval pathways for pediatric and rare disease indications. By aligning clinical, technological, and policy initiatives, companies can strengthen market resilience, drive differentiated value propositions, and ultimately improve outcomes for patients experiencing acute seizure clusters.

Detailing Rigorous and Transparent Methodological Frameworks That Underpin the Research Approach, Data Collection, and Analytical Rigor in Seizure Emergency Therapeutics Studies

Our research methodology integrates a rigorous, multi-tiered approach to ensure analytical depth and data integrity. We conducted comprehensive secondary research, reviewing peer-reviewed journals, regulatory databases, government legislation, and reputable news outlets to capture the latest clinical, market, and policy developments. Publicly accessible sources included the FDA, EMA, WHO, and national health agencies, supplemented by insights from professional associations and specialty epilepsy groups.

Primary research comprised in-depth interviews with neurologists, epileptologists, pharmacists, and industry executives spanning branded, generic, and development-stage companies. These qualitative engagements yielded firsthand perspectives on product performance, supply chain dynamics, and emergent innovation trends. We triangulated findings from secondary and primary inputs through quantitative validation using proprietary databases on regulatory approvals, tariff enactments, and legislative mandates.

Analytical rigor was maintained through cross-functional peer reviews, in which internal subject-matter experts in neurology, trade policy, and pharmaceutical economics scrutinized assumptions and conclusions. This iterative validation process ensured alignment between observed market behaviors, documented data points, and strategic forecasts. Finally, the report’s conclusions and recommendations were reviewed by an external advisory panel comprising senior executives from healthcare providers, advocacy groups, and academic institutions, reinforcing the report’s credibility and practical relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Acute Repetitive Seizures market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Acute Repetitive Seizures Market, by Drug Type

- Acute Repetitive Seizures Market, by Route Of Administration

- Acute Repetitive Seizures Market, by Age Group

- Acute Repetitive Seizures Market, by Formulation

- Acute Repetitive Seizures Market, by Distribution Channel

- Acute Repetitive Seizures Market, by End User

- Acute Repetitive Seizures Market, by Region

- Acute Repetitive Seizures Market, by Group

- Acute Repetitive Seizures Market, by Country

- United States Acute Repetitive Seizures Market

- China Acute Repetitive Seizures Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Strategic Perspectives to Provide a Cohesive Synopsis of Market Innovations, Challenges, and Future Directions in Seizure Cluster Management

This executive summary has outlined the urgent clinical imperative of acute repetitive seizure management, the dynamic evolution of rescue therapy approvals, and the disruptive influence of trade policy on pharmaceutical supply chains. We dissected segmentation nuances across drug types, administration routes, distribution channels, and demographic cohorts, while highlighting pivotal regional and competitive insights. Our analysis underscores a clear trajectory toward patient-empowering delivery platforms, regulatory alignment for broader age indications, and strategic imperatives to bolster supply chain resilience.

Looking ahead, the convergence of digital health integration, advanced drug delivery systems, and proactive policy engagement will define leadership success in this space. Companies that anticipate tariff fluctuations, invest in next-generation formulations, and cultivate multi-stakeholder partnerships will emerge as the most adaptable and innovative. Above all, the continued prioritization of patient-centric care paradigms-anchored in rapid onset, ease of use, and accessibility-will drive superior outcomes for individuals confronted with seizure clusters, ultimately advancing the standard of emergency neurological care.

Engage with Ketan Rohom to Gain Specialized Market Intelligence and Strategic Expertise in Acute Repetitive Seizure Therapeutics

Ready to transform your organization’s approach to acute repetitive seizure management with unparalleled insights? Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to discuss how our comprehensive market research report can empower your strategic decisions and accelerate your product success. Whether you’re seeking customized data extracts, expert consultations, or a deep dive into emerging trends, Ketan stands ready to guide you toward unlocking the full potential of this evolving therapeutic landscape

- How big is the Acute Repetitive Seizures Market?

- What is the Acute Repetitive Seizures Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?