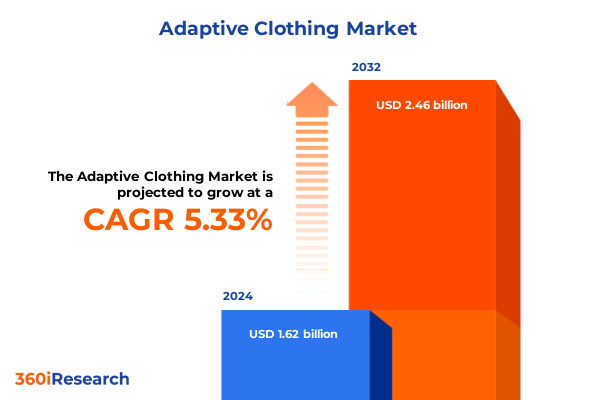

The Adaptive Clothing Market size was estimated at USD 1.70 billion in 2025 and expected to reach USD 1.79 billion in 2026, at a CAGR of 5.37% to reach USD 2.46 billion by 2032.

Setting the Stage for Inclusive Innovation: Exploring How Adaptive Clothing is Revolutionizing Accessibility, Industry Dynamics, and Consumer Experience

In recent years, the adaptive clothing sector has emerged from niche corners of the fashion industry to command broad attention from designers, retailers, and policymakers seeking to create truly inclusive apparel. Adaptive clothing transcends traditional style parameters by integrating functional modifications-such as magnetic closures, adjustable hems, and sensory-friendly fabrics-that address the diverse needs of individuals with disabilities. These innovations not only improve daily living for millions but also open new avenues for brands aiming to align with evolving consumer values around accessibility, equity, and social responsibility.

Today, more than one billion people worldwide-equivalent to roughly 16% of the global population-experience significant functional limitations, a figure that continues to rise due to population aging and the growth of chronic health conditions. Concurrently, in the United States, over 70 million adults, or more than one in four, report living with a disability, underscoring the vast and diverse demographic that adaptive apparel can serve. As consumers increasingly demand products that reflect their individual circumstances, adaptive clothing has become a focal point for companies seeking to combine performance, comfort, and style within an inclusive framework.

The sector’s growth is propelled by shifting societal attitudes and strengthened legal frameworks guaranteeing accessibility. The Americans with Disabilities Act’s ongoing enforcement, the European Accessibility Act’s implementation across the EU in mid-2025, and parallel inclusion mandates in key Asian markets are driving both design innovation and investments in product development. Furthermore, heightened visibility of disability rights through global observances and social media advocacy has amplified the voices of people with disabilities, ensuring that their lived experiences guide the evolution of adaptive offerings. As the market for adaptive clothing matures, industry stakeholders must navigate this complex landscape of regulatory requirements, diverse consumer preferences, and rapid technological progress to capture the opportunities ahead.

Unveiling the Transformative Shifts Driving the Adaptive Clothing Revolution Through Inclusive Design, Technological Breakthroughs, and Sustainability Integration

The adaptive clothing landscape has experienced a series of transformative shifts that are redefining the boundaries of mainstream fashion. At the forefront, inclusive design has moved from being a philanthropic sidebar to a core strategic imperative. Industry initiatives such as the CFDA/Vogue Fashion Fund challenge, which paired designers with accessibility advocates to create high-fashion adaptive garments, illustrate how leading voices in luxury are embracing functional inclusivity as a catalyst for creative expression and market differentiation. By showcasing adaptive collections alongside traditional runway pieces, the event underscored the potential for accessibility features to enhance overall design innovation while dismantling the notion of adaptive wear as a purely utilitarian niche.

Simultaneously, consumer expectations have evolved as individuals increasingly seek apparel that not only fits well and looks stylish but also aligns with broader social values. Brands are responding by embedding sustainable practices into adaptive lines, leveraging eco-friendly materials and circular production methods to mitigate waste. This shift reflects a broader commitment to responsible fashion that acknowledges the intersection between environmental stewardship and social equity. As adaptive offerings gain traction among environmentally conscious consumers, sustainability becomes an indispensable dimension of product differentiation and supply chain transparency.

Technological breakthroughs are further accelerating the sector’s evolution. Smart textiles with self-healing properties, embedded sensors for health monitoring, and digitally printed customizable elements are transforming the ways in which garments adapt to wearer needs. These innovations promise to enhance comfort, extend product lifespans, and deliver personalized fit through data-driven insights. Moreover, the integration of 3D printing and digital manufacturing capabilities is enabling rapid prototyping and small-batch production of bespoke adaptive solutions, reducing lead times and expanding possibilities for microtargeting of specific user requirements.

Analyzing the Cumulative Impact of 2025 U.S. Tariff Policies on Adaptive Clothing Supply Chains, Consumer Pricing, and Market Entry Strategies

U.S. trade policies enacted in 2025 have substantially altered the cost structures and competitive dynamics of adaptive clothing imports. Under proposals that substantially increased baseline tariffs on apparel imports-raising effective rates to an average of 20.2%, the highest level since the early twentieth century-brands and retailers have encountered steeper duties that have reshaped sourcing decisions and margin calculations. According to the Yale Budget Lab, these heightened tariffs are projected to contribute to a 2% overall price increase in consumer goods by 2025, disproportionately affecting cost-sensitive segments such as footwear and apparel, where price hikes of 36% have been estimated in the short term.

Compounding the impact of broad-based tariff hikes, policy changes to the “de minimis” exemption for low-value shipments have removed the prior exclusion for packages valued under $800. This shift has particularly affected digital-native platforms such as Shein, which could formerly deliver small parcels duty-free. The reinstatement of import duties on sub-$800 shipments has led to noticeable price increases for end consumers and compelled e-commerce operators to reevaluate their logistics strategies. As a result, many are negotiating revised terms with vendors or exploring regional distribution centers to absorb or mitigate new costs.

In response to these cumulative trade measures, apparel firms have accelerated supply chain realignments away from higher-tariff jurisdictions. Data indicate that the share of U.S. imports from mainland China fell from 33.8% in 2017 to just over 21% in the past twelve months, with production gravitating toward Vietnam, Bangladesh, India, and USMCA partners. While tactical multi-sourcing has allowed large-scale brands with diversified footprints to maintain relative margin stability, smaller enterprises have faced financial stress, often lacking the scale and leverage to offset increased import costs. This realignment underscores the critical need for agility in sourcing and the adoption of regional nearshoring strategies to safeguard profitability amidst evolving trade policies.

Illuminating Key Segmentation Insights Across Disability Types, Distribution Channels, User Demographics, and Product Categories

An in-depth view of segmentation across the adaptive clothing market reveals nuanced consumer needs and strategic imperatives for targeted product development. By disability type, individuals with cognitive impairments-spanning conditions such as autism and dementia-require garments featuring clear closures, simplified fasteners, and non-distracting sensory profiles, while those living with mobility impairments that include amputees, elderly mobility challenges, and wheelchair dependence benefit from adjustable waistbands, seated-friendly hemlines, and accessible entry points. Sensory impairments, encompassing hearing limitations and touch sensitivity, drive demand for tactilely optimized fabrics and seamless closures that minimize noise, and visual impairments-both blind and low vision-heighten the importance of high-contrast trims, easily distinguishable textures, and tactile labeling to facilitate independent dressing.

Distribution channel preferences underscore the importance of seamless omnichannel integration. Within offline environments, department stores and specialty medical suppliers offer tactile experiences where consumers may request hands-on demonstrations, while brand-owned boutiques and medical supply outlets enable personalized consultations. Online platforms-both brand-operated websites and third-party e-commerce marketplaces-are critical for reaching consumer segments prioritizing convenience, with digital interfaces evolving to include accessibility features such as descriptive imagery, voice-guided navigation, and virtual fittings to bridge the gap between physical and virtual experiences.

End users present distinct requirements at each life stage. Adult consumers-men and women-seek collections that balance professional and casual aesthetics with functional design, whereas geriatric segments-both assisted living and independent living residents-value adaptive features that reduce dressing time and enable self-sufficiency. Pediatric categories, from toddlers through adolescents, call for adjustable sizing systems, durable fabrics, and playful designs that support developmental needs without sacrificing comfort.

Product-type segmentation offers further clarity on development priorities. Adaptive accessories such as belts, headwear, and jewelry must combine ease of use with discretionary styling, adaptive bottoms-including pants, shorts, and skirts-require ergonomic cuts and modular fastenings, while adaptive footwear spans casual, formal, and sports models, each demanding specialized sole designs and magnetic or elastic closures. Adaptive tops, ranging from blouses to jackets and shirts, depend on side openings, stretch panels, and sensory-friendly fabrications to accommodate varying mobility and comfort preferences.

This comprehensive research report categorizes the Adaptive Clothing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material & Fabric

- Age Group

- End User

- Distribution Channel

Revealing Strategic Regional Insights Across the Americas, Europe Middle East & Africa, and Asia-Pacific Markets to Guide Adaptive Clothing Expansion

Across the Americas, adaptive clothing is experiencing robust consumer engagement and rapid channel expansion. In the United States, rising average import tariffs have prompted many brands to onshore production or establish regional distribution centers, ensuring more reliable delivery times and price stability. Specialist retailers and large omnichannel chains alike are investing in dedicated adaptive sections to cater to an aging populace and a sizeable constituency of adults with disabilities, capitalizing on the purchasing power of more than 70 million U.S. consumers living with functional limitations. Additionally, Canada and Brazil are witnessing notable growth in adaptive wear offerings, supported by government incentives that promote export-oriented manufacturing and inclusive retail policies.

In Europe, the Middle East, and Africa, the implementation of the European Accessibility Act as of June 28, 2025 has harmonized accessibility requirements across 27 member states, driving manufacturers and retailers to embed compliance in product design and supply chain operations. Unified standards on product accessibility have unlocked cross-border trade opportunities, while localized enforcement frameworks ensure accountability. Simultaneously, leading luxury and mass-market brands are launching adaptive lines in key metropolitan centers, reflecting strong consumer demand for high-quality functional apparel that meets regulatory and experiential benchmarks.

In Asia-Pacific, established manufacturing hubs in China continue to produce competitive adaptive apparel despite higher duties, while alternative centers in Vietnam, India, and Bangladesh have gained traction for tariff-free or lower-duty exports to North America and EMEA. The ASEAN region has emerged as an outlier with growth in export pricing and volume, reflecting reduced duty burdens and strategic realignments by global supply chains. Meanwhile, major e-commerce platforms across Japan, South Korea, and Australia are actively integrating accessibility features into their online storefronts, tailoring interfaces to local language needs and sensory considerations that reflect diverse cultural expectations around disability and fashion.

This comprehensive research report examines key regions that drive the evolution of the Adaptive Clothing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Company Leadership and Industry Pioneers Shaping the Future of Adaptive Clothing Through Innovation and Strategic Partnerships

Key industry players are setting benchmarks for product innovation, market reach, and consumer engagement within the adaptive clothing sector. Tommy Hilfiger, a pioneer since 2016, continues to expand its adaptive line globally and has lent its expertise to industry showcases, exemplifying how luxury brands can seamlessly integrate accessibility features without compromising aesthetic appeal. Designers such as Chromat and Ashley Moubayed are likewise forging collaborations with advocacy groups and specialist consultancies, underlining the importance of co-creation in developing functional fashion that resonates with end users.

Mass-market retailers have also elevated their adaptive offerings. Target’s Universal Thread collection and Zappos’ adaptive footwear and apparel assortments illustrate how established retail platforms can leverage omnichannel capabilities to serve a wide consumer base, combining department store presence with robust e-commerce infrastructures. These initiatives underscore the commercial viability of dedicated adaptive ranges within mainstream channels, driving greater visibility and normalization of inclusive apparel.

In the activewear segment, Nike’s FlyEase line has demonstrated the power of athlete-driven design, employing magnetic heel closures and adjustable straps tested by individuals with varying mobility needs. Simultaneously, Victoria’s Secret’s partnership with Liberare highlights an emerging focus on adaptive undergarments, integrating magnetized closures and adjustable fits that blend discreet functionality with high-quality materials. Such alliances between established brands and niche specialists are accelerating the adoption of adaptive innovations across broader product portfolios.

Meanwhile, digital-native platforms face unique challenges and opportunities. Entities such as Shein and Temu, once known for low-cost dropship models, are recalibrating operations in light of new tariff burdens and de minimis rule changes. By renegotiating supply agreements and exploring regional fulfillment centers, these e-commerce players are striving to maintain competitiveness, underscoring the critical interplay between trade policy and digital retail economics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adaptive Clothing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abilitee Adaptive Wear

- ABL Denim

- Able2 Wear Ltd

- Adaptions by Adrian

- Adaptive Clothing Australia

- Adidas AG

- Buck & Buck, Inc.

- Création Confort

- Guangzhou Haoyu Garments Co., Ltd

- Haxor

- JAM

- Joe & Bella

- MagnaReady, Inc.

- MAS Holdings

- Mode Eze Plus

- Primark Limited

- Professional Fit Clothing

- Raja Impex Pvt. Ltd.

- Silverts Universal Dressing Solutions, Inc

- The Able Label

- The LYCRA Company

- Tommy Hilfiger by PVH Corp

Empowering Industry Leaders with Actionable Recommendations to Accelerate Inclusive Design, Supply Chain Resilience, and Technological Integration

To capitalize on the expanding adaptive clothing market, industry leaders should prioritize formal partnerships with disability advocacy organizations and inclusive design specialists. Such collaborations accelerate the co-creation of solutions that resonate authentically with end users while avoiding common missteps in product development. By embedding diverse perspectives early in the design process, companies can enhance fit, function, and user satisfaction, ultimately driving stronger brand loyalty.

Supply chain resilience is critical in an environment of shifting trade policies and rising tariffs. Brands should diversify sourcing footprints by integrating nearshoring options within USMCA countries, expanding relationships in ASEAN production centers, and establishing contingency partnerships in South Asia. Employing multi-modal logistics networks and regional distribution hubs helps stabilize lead times and mitigate cost volatility.

Investments in smart textile research and digital manufacturing capabilities will yield long-term competitive advantage. Firms should allocate resources to pilot advanced materials-such as self-healing fabrics and embedded sensors-that deliver measurable benefits in comfort, durability, and personalization. Establishing innovation labs and cross-functional teams can fast-track prototyping and facilitate rapid iteration in response to real-world feedback.

Enhancing digital experiences for consumers with disabilities is another imperative. E-commerce platforms must adopt comprehensive accessibility measures, including voice navigation, screen-reader compatibility, and virtual fitting rooms, to ensure frictionless online journeys. Concurrently, investing in staff training for physical retail and customer support teams will reinforce consistent service quality across touchpoints.

Finally, proactive regulatory compliance frameworks must be established to navigate evolving legislative landscapes. Monitoring accessibility mandates-such as the European Accessibility Act, the Americans with Disabilities Act, and emergent guidelines in Asia-Pacific markets-and integrating compliance checkpoints into product development cycles will safeguard against legal risks and strengthen market trust.

Detailing the Robust Research Methodology Employed to Gather Comprehensive Market Insights Through Mixed-Methods and Rigorous Validation

This research synthesis employed a multi-stage mixed-method approach to ensure comprehensive and reliable insights. Initial stages involved secondary research, including analysis of regulatory documentation, industry publications, and global trade data to map policy impacts and supply chain realignments. Concurrently, a systematic review of academic journals, white papers, and technical blogs informed the landscape of technological innovations and sustainable practices.

Primary research consisted of structured interviews and roundtable discussions with senior executives at leading adaptive apparel brands, design directors, supply chain specialists, and accessibility consultants. These sessions provided real-world perspectives on market challenges, emerging opportunities, and strategic responses to tariff shifts and regulatory mandates. In addition, consumer focus groups spanned multiple regions, capturing voice-of-customer feedback across disability types, end-user demographics, and shopping preferences.

Quantitative validation was achieved through data triangulation, integrating publicly available import-export statistics with proprietary shipment and pricing data to quantify tariff impacts and regional trade flows. Advanced data modeling techniques were applied to project the implications of supply chain diversification and digital transformation on cost structures and time-to-market metrics. Rigorous quality assurance protocols, including peer review and cross-referencing against primary sources, ensured the accuracy and robustness of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adaptive Clothing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adaptive Clothing Market, by Product Type

- Adaptive Clothing Market, by Material & Fabric

- Adaptive Clothing Market, by Age Group

- Adaptive Clothing Market, by End User

- Adaptive Clothing Market, by Distribution Channel

- Adaptive Clothing Market, by Region

- Adaptive Clothing Market, by Group

- Adaptive Clothing Market, by Country

- United States Adaptive Clothing Market

- China Adaptive Clothing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Insights That Synthesize Market Dynamics, Regulatory Trends, Consumer Demands, and Strategic Imperatives for Adaptive Clothing Success

Adaptive clothing represents a convergence of social progress, design innovation, and market opportunity. The sector’s rapid transformation-from inclusive runway showcases to technological integration in textile production-demonstrates that accessibility and style are not mutually exclusive but rather complementary drivers of value creation. As consumers become more attuned to the importance of inclusive design, the demand for adaptive apparel will continue to broaden across age groups, ability types, and regional markets.

Regulatory developments, such as heightened U.S. tariff regimes and the enforcement of the European Accessibility Act, are reshaping supply chains and cost dynamics, compelling brands to adopt agile sourcing strategies and invest in nearshoring to maintain competitiveness. Simultaneously, pioneering companies are leveraging collaborations with disability advocates, deploying smart textile innovations, and enhancing omnichannel accessibility, establishing new benchmarks for industry best practices.

For industry leaders, the imperative is clear: embrace an inclusive product development ethos that integrates user insights, sustain innovation through strategic partnerships, and fortify global supply chains against policy volatility. By doing so, companies will not only meet the unmet needs of a sizable and growing consumer base but also position themselves at the forefront of an industry defined by purpose-driven progress and commercial resilience.

Connect with Ketan Rohom to Acquire Tailored Adaptive Clothing Market Research Insights That Drive Informed Decisions and Competitive Advantage

For specialized briefings, customized data extracts, or a comprehensive walk-through of global adaptive clothing insights that directly address your strategic priorities, please reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan can provide you with the necessary support to secure the complete market research report, unlock exclusive datasets, and arrange tailored presentations that empower your decision-making. Gain access to in-depth analysis, proprietary dashboards, and expert consultations by contacting Ketan today

- How big is the Adaptive Clothing Market?

- What is the Adaptive Clothing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?