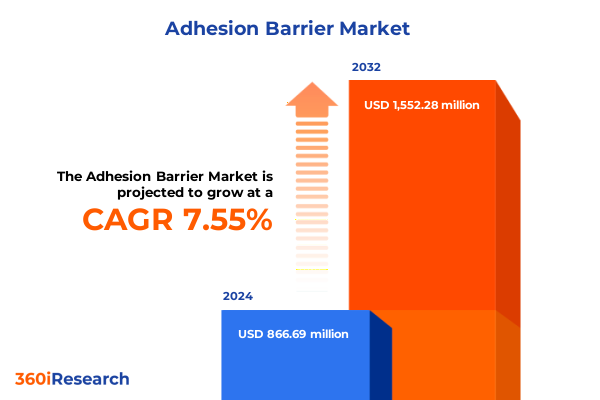

The Adhesion Barrier Market size was estimated at USD 923.62 million in 2025 and expected to reach USD 990.96 million in 2026, at a CAGR of 7.69% to reach USD 1,552.27 million by 2032.

Examining the Fundamental Role of Adhesion Barriers in Advancing Surgical Care Across Diverse Clinical Settings and Improving Patient Recovery

The surgical journey increasingly depends on targeted solutions designed to mitigate postoperative complications, making adhesion barriers a critical component in modern operative protocols. At the forefront of this transformative landscape, adhesion barrier technologies are deployed to prevent internal scar tissue formation, thereby reducing the incidence of chronic pain, reoperation rates, and associated healthcare costs. Understanding the fundamental role of these products is essential for stakeholders seeking to optimize patient outcomes and enhance the quality of care delivered across multiple clinical environments.

Recent studies underscore the clinical significance of adhesion barriers in a variety of procedures, from minimally invasive laparoscopic interventions to complex open surgeries. The integration of advanced film, gel, and powder formulations with procedural workflows has demonstrated measurable reductions in adhesions, translating into shorter hospital stays and improved patient satisfaction. Moreover, the expanding repertoire of barrier compositions, including synthetic polymers and bioresorbable compounds, reflects the industry’s commitment to innovation. This introduction lays the groundwork for an in-depth exploration of market dynamics, technological milestones, and strategic imperatives shaping the future of adhesion barriers.

Identifying Key Technological Breakthroughs and Evolving Clinical Practices That Are Driving Unprecedented Growth in the Adhesion Barrier Market

The adhesion barrier market is undergoing a paradigm shift driven by both technological innovation and evolving clinical practice standards. Cutting-edge research in biomaterial science has yielded next-generation barrier formulations that offer improved biocompatibility, enhanced resorption kinetics, and simplified application methods. These advancements are driving adoption among surgeons who demand consistent performance without compromising procedural efficiency.

Concurrently, the surgical community’s emphasis on value-based care has elevated the role of postoperative quality metrics. As healthcare payers increasingly scrutinize outcome data, the ability of adhesion barriers to demonstrably reduce complications and readmissions has become a compelling economic argument. Furthermore, the convergence of digital surgery platforms and real-time imaging opens new avenues for integrated delivery systems, where barrier deployment can be guided by intraoperative visualization tools. Together, these transformative forces are redefining industry benchmarks, forging pathways for novel market entrants, and setting the stage for accelerated growth.

Assessing the Cumulative Consequences of New US Tariff Measures in 2025 on Adhesion Barrier Supply Chains, Cost Structures, and Competitive Dynamics in Healthcare

In 2025, the introduction of revised United States tariff measures has exerted a multifaceted impact on the global adhesion barrier supply chain. Tariff impositions on raw polymer imports have elevated material costs for manufacturers headquartered in key production hubs. These increased input expenses have cascaded through procurement channels, compelling companies to reassess supplier agreements and explore alternative sourcing strategies to preserve margin structures.

Despite these headwinds, innovative manufacturers have turned to localized production partnerships and backward integration efforts to mitigate tariff-induced cost pressures. Moreover, the recalibrated cost structure has amplified competitive dynamics, as players with diversified geographic footprints and in-house polymer synthesis capabilities are better positioned to absorb or absorb and offset price escalations. Ultimately, the cumulative impact of the 2025 tariff framework is shaping market consolidation patterns and fostering resilience among suppliers willing to adapt their operational models to the evolving trade environment.

Uncovering Actionable Insights from Detailed End User, Product Type, and Application Segmentation Revealing Market Dynamics and Growth Opportunities

A detailed examination of market segmentation reveals critical pathways for targeted growth and innovation. End users vary significantly, with ambulatory surgical centers emerging as agile adopters, particularly those positioned as hospital-affiliated outpatient units where streamlined procedural throughput drives demand for rapid-deployment barrier forms. Conversely, private and public hospitals have shown differentiated purchasing behaviors, influenced by budget cycles and formulary alignment, with private institutions often investing in premium barrier technologies to support specialized surgical programs. Meanwhile, fertility clinics and outpatient specialty centers-operating under unique clinical imperatives-prioritize formulations that balance ease of use with stringent biocompatibility profiles.

Product type segmentation uncovers further opportunities. Film-based barriers remain the backbone of the market, valued for their tensile strength and handling predictability, whereas gel and powder variants are gaining traction for minimally invasive and endoscopic procedures, where conformability and spray-on delivery systems minimize procedural steps. Application analysis highlights that cardiovascular surgery continues to drive barrier utilization in coronary artery bypass and valve replacement cases, while general surgery segments-spanning both laparoscopic and open approaches-benefit from broad-spectrum adhesion control. Gynecological interventions, particularly hysterectomy and myomectomy, are increasingly reliant on targeted barrier solutions to preserve fertility outcomes. Orthopedic surgery represents a growing frontier, with joint replacement and spinal surgery procedures adopting barriers to mitigate postoperative limitations in range of motion.

This comprehensive research report categorizes the Adhesion Barrier market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- End User

- Application

Revealing Regional Performance Patterns and Strategic Drivers Shaping Adhesion Barrier Adoption Across the Americas, EMEA, and Asia-Pacific in Diverse Economic and Clinical Environments

Regional analysis underscores divergent growth drivers and adoption rates across global markets. In the Americas, robust reimbursement frameworks and a well-established hospital infrastructure have bolstered adhesion barrier deployment, especially within leading health systems that routinely integrate evidence-based adjuncts to improve surgical quality. However, localized cost-containment initiatives and shifting payer policies have injected complexity into procurement cycles, necessitating flexible commercial models and outcome-linked pricing agreements.

In contrast, Europe, the Middle East, and Africa exhibit a heterogeneous landscape where regulatory harmonization within the European Union facilitates market entry for high-quality barrier products, yet emerging economies in MEA are constrained by budgetary limitations and slower hospital capital expenditure cycles. Strategic partnerships and targeted educational programs are critical to expand clinical awareness and justify barrier economics in these regions. Meanwhile, Asia-Pacific markets reveal rapid growth propelled by expanding healthcare infrastructure, rising procedural volumes in cardiovascular and gynecological surgeries, and government investments in advanced medical technologies. Nonetheless, local manufacturing incentives and regional content requirements are shaping supplier strategies and distribution networks across these diverse jurisdictions.

This comprehensive research report examines key regions that drive the evolution of the Adhesion Barrier market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Innovation Pipelines, and Competitive Positioning of Leading Companies Influencing the Global Adhesion Barrier Market Landscape

The competitive landscape of the adhesion barrier market is defined by a mix of established medical device conglomerates and agile specialist companies. Leading players have fortified their market positions through diversified portfolios encompassing film, gel, and powder formats, supported by extensive clinical evidence. Strategic acquisitions and co-development agreements have broadened the scope of product pipelines, enabling rapid entry into underpenetrated segments such as minimally invasive and robotic surgery adjuncts.

Mid-tier companies are leveraging niche applications and proprietary biomaterial platforms to carve out specialized positions. These firms often partner with academic centers and surgical opinion leaders to validate new barrier formulations in targeted procedures. As market dynamics evolve, collaboration and open innovation models are emerging as differentiators, fostering faster iteration cycles and localized regulatory capabilities. Collectively, the interplay between market capital intensity, clinical validation rigor, and go-to-market agility is establishing distinct competitive tiers within the global adhesion barrier ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adhesion Barrier market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anika Therapeutics, Inc.

- Atrium Medical Corporation

- B. Braun Melsungen AG

- Baxter International Inc.

- Betatech Medical A.Ş.

- CorMatrix Cardiovascular, Inc.

- CryoLife, Inc.

- Ethicon US, LLC

- FzioMed, Inc.

- Getinge AB

- Hangzhou Singclean Medical Products Co., Ltd.

- Innocoll Holdings plc

- Integra LifeSciences Holdings Corporation

- Leader Biomedical Co., Ltd.

- MAST Biosurgery AG

- Medtronic plc

- PlantTec Medical GmbH

- Sanofi S.A.

- Terumo Corporation

- Tissuemed Ltd

Charting Practical and Impactful Strategies for Industry Leaders to Capitalize on Emerging Trends and Optimize Their Position in the Adhesion Barrier Market

Industry leaders seeking to capitalize on adhesive barrier market growth should prioritize a multi-pronged approach that integrates product innovation, stakeholder engagement, and value demonstration. Companies must accelerate translational research efforts to develop next-generation barrier materials that address emerging surgical modalities, including robotic and endoscopic platforms. Concurrently, evidence generation through real-world data initiatives and post-market surveillance can substantiate economic and clinical benefits to payers and providers.

Strategic partnerships with healthcare systems and provider networks offer pathways to co-develop bundled solutions that align barrier use with bundled payments and risk-sharing models. In parallel, sales and marketing teams should deploy targeted educational programs for surgeons and procurement decision-makers, emphasizing comparative outcomes and return-on-investment analyses. Finally, establishing agile supply chain frameworks that can swiftly adapt to regulatory changes and trade fluctuations will ensure consistent product availability, safeguarding market share and reputation.

Outlining Rigorous Research Methodologies and Data Triangulation Approaches Underpinning High-Integrity Insights into the Adhesion Barrier Market

This research is underpinned by a rigorous methodology combining primary expert interviews, in-depth secondary research, and comprehensive data triangulation. Primary insights were gathered through structured discussions with leading surgeons, procurement leaders, and clinical researchers across major healthcare markets. These qualitative inputs were mapped against secondary sources such as peer-reviewed journals, regulatory filings, and public financial disclosures to validate commercial and technological trends.

Quantitative modeling involved cross-referencing procedure volumes, device utilization rates, and reimbursement frameworks to ensure robust market characterization. Data triangulation techniques were applied to reconcile discrepancies and to validate regional adoption projections. Additionally, scenario analysis was utilized to assess the sensitivity of market variables-particularly tariff impacts and reimbursement shifts-to provide stakeholders with high-confidence strategic insights. This combined approach ensures that the findings reflect both the granular realities of clinical practice and the overarching economic landscapes across global healthcare ecosystems.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adhesion Barrier market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adhesion Barrier Market, by Product Type

- Adhesion Barrier Market, by End User

- Adhesion Barrier Market, by Application

- Adhesion Barrier Market, by Region

- Adhesion Barrier Market, by Group

- Adhesion Barrier Market, by Country

- United States Adhesion Barrier Market

- China Adhesion Barrier Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Synthesizing Critical Insights and Industry Imperatives to Frame the Future Trajectory of Adhesion Barrier Technology and Market Evolution

As adhesion barrier technologies continue to evolve, their significance within the surgical continuum cannot be overstated. Innovations in materials and delivery systems are broadening clinical applications and establishing new benchmarks for postoperative care. The industry’s response to trade policy shifts further underscores the importance of operational resilience and strategic supply chain design.

Looking ahead, stakeholders who invest in evidence-driven commercialization strategies, robust clinical partnerships, and adaptive manufacturing frameworks will be best positioned to thrive. By synthesizing the critical insights presented here-spanning segmentation, regional dynamics, and competitive positioning-decision-makers can confidently navigate the complexities of the adhesion barrier market. Ultimately, the trajectory of this sector is defined by its capacity to deliver tangible improvements in patient outcomes and to align with evolving health-economic imperatives.

Empowering Decision Makers to Access Comprehensive Adhesion Barrier Market Research and Engage with Ketan Rohom to Secure Customized Strategic Guidance

Secure access to the most definitive market research on adhesion barrier technologies by reaching out directly to Ketan Rohom, Associate Director of Sales and Marketing. His expertise in translating granular data into actionable intelligence ensures that your organization will be equipped with tailored strategies to capture emerging opportunities and navigate industry challenges with confidence. Engaging with Ketan now allows for customized briefings, prioritized delivery schedules, and specialized insights aligned to your unique objectives.

Don’t let critical opportunities slip away as the adhesion barrier market evolves. Partner with Ketan Rohom to acquire an in-depth report that illuminates the competitive landscape, regulatory implications, and technological breakthroughs driving tomorrow’s surgical outcomes. Accelerate your decision-making process and position your team for success by initiating a conversation today-your comprehensive guide to the adhesive barrier sector awaits.

- How big is the Adhesion Barrier Market?

- What is the Adhesion Barrier Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?