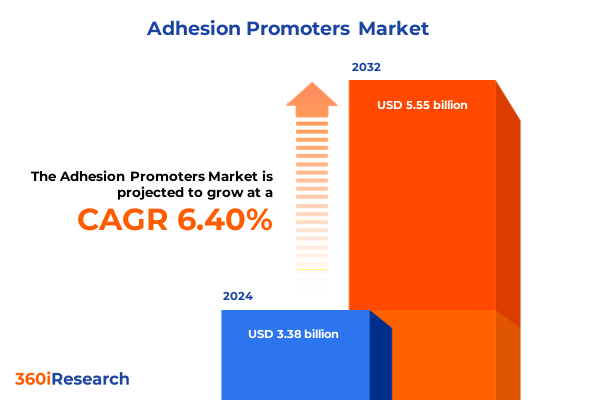

The Adhesion Promoters Market size was estimated at USD 3.59 billion in 2025 and expected to reach USD 3.84 billion in 2026, at a CAGR of 6.41% to reach USD 5.55 billion by 2032.

Establishing the Critical Role of Advanced Adhesion Promoters in Elevating Performance and Durability Across Diverse Industrial Applications

Adhesion promoters have become indispensable components in advanced materials design, delivering critical enhancements in surface bonding across a spectrum of industrial applications. In recent years, the rapid evolution of lightweight composites and the demand for durable coatings have placed greater emphasis on molecular interface optimization. Consequently, decision makers are increasingly focused on how these compounds can be engineered to bridge dissimilar substrates and ensure long-term structural integrity. This introduction explores the significance of adhesion promoters and sets the stage for a deeper examination of their transformative impact.

Within the coatings sector, achieving uniform film formation and chemical resistance relies heavily on the appropriate selection of adhesion promoter chemistries. Meanwhile, composite manufacturers are exploring novel coupling mechanisms to improve fiber-matrix interactions, enhancing both mechanical strength and environmental stability. Plastics processors seek solutions that integrate seamlessly into extrusion and molding processes. Similarly, sealant and adhesive formulators leverage these surface modifiers to deliver superior bond strength under varied service conditions. Throughout this report, we will unpack the interplay between these application-driven requirements and the advanced chemistries that make robust adhesion achievable.

Unveiling Pivotal Technological Innovations and Regulatory Dynamics Redefining the Adhesion Promoters Landscape

The adhesion promoters market is experiencing a period of unparalleled transformation shaped by groundbreaking technological developments and evolving regulatory mandates. On the technological front, innovations in silane and phosphate chemistries have unlocked new pathways for customizing interfacial compatibility, enabling formulators to address increasingly stringent performance criteria. Furthermore, the rise of UV-curable systems has driven demand for additives that promote rapid crosslinking without compromising adhesion on low-energy surfaces.

Regulatory shifts have paralleled these technological advances. Tighter environmental regulations in major manufacturing hubs have accelerated the phase-out of solvent-based systems, prompting a migration toward waterborne and powder-based formulations. As a result, producers are investing heavily in research to engineer low-VOC adhesion promoters while maintaining performance benchmarks. Moreover, geopolitical developments and trade policies have introduced fresh considerations around raw material sourcing and supply chain resilience. Taken together, these transformative shifts are compelling industry participants to adapt their R&D and production strategies to remain competitive in a dynamically changing marketplace.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Sourcing Strategies and Supply Chain Realignments

In 2025, the United States implemented a series of tariff adjustments designed to bolster domestic manufacturing while responding to global trade pressures. These measures have imposed higher duties on select tie-layer resins, specialty coupling agents, and precursor chemicals imported from key production regions. As a result, formulators and processors have encountered increased input costs, which have triggered reassessments of supplier partnerships and material specifications.

Consequently, several end users have shifted toward domestic suppliers with integrated upstream capabilities to mitigate tariff-induced price volatility. Simultaneously, some global producers have responded by establishing local production facilities in the United States to circumvent trade barriers. This realignment has not only reshaped procurement strategies but has also accelerated collaborative innovation between raw material manufacturers and formulators. By nurturing closer integration across the value chain, stakeholders are working to offset tariff pressures through process optimization, value engineering, and the introduction of higher-performance grades that justify premium pricing.

Uncovering Critical Segmentation Insights that Illuminate Application Needs and Chemical Mechanism Opportunities

A nuanced view of market segmentation highlights critical sources of opportunity and risk across different application areas and chemical types. When examining applications, coatings demand remains predominant, driven by liquid, powder, and UV-curable systems seeking enhanced substrate wetting and film longevity. In composites, adhesion promoters tailored for carbon, glass, and natural fibers underpin next-generation lightweight structures, while plastics require compatibility with polyethylene, polypropylene, and PVC to ensure consistent processing. Additionally, the sealants and adhesives segment leverages acrylic, epoxy, polyurethane, and silicone-based chemistries to address diverse bonding challenges in assembly and repair contexts.

Turning to chemical types, the distinct reactivity profiles of phosphates, silanes, titanates, and zirconates guide formulators toward solutions that balance cure kinetics, thermal stability, and corrosion resistance. Meanwhile, end users in aerospace, automotive, construction, and electronics employ specific promoter variants to meet sector-specific performance regimes, from commercial aircraft and electric vehicles to infrastructure coatings and medical device assemblies. By further considering form factors-ranging from gel to liquid, powder, and solid-and functional roles as coupling agents, primers, or surface modifiers, stakeholders can fine-tune their selection to optimize both manufacturing efficiency and end-use reliability.

This comprehensive research report categorizes the Adhesion Promoters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Type

- End Use Industry

- Form

- Function

Revealing Distinct Regional Demand Drivers and Regulatory Forces Shaping Adhesion Promoter Adoption Globally

Regional market dynamics reveal contrasting patterns of demand, regulatory drivers, and innovation capacity across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, sustained growth in the automotive and aerospace sectors has underpinned robust demand for tailored adhesion solutions, particularly within electric vehicle battery enclosures and lightweight airframe composites. North American formulators are leveraging localized feedstock availability to accelerate new product introductions that comply with stringent environmental regulations.

In Europe, Middle East and Africa, regulatory harmonization under REACH and regional sustainability initiatives have propelled the adoption of eco-friendly adhesion promoters. Manufacturers are prioritizing low-VOC, bio-based chemistries to meet aggressive carbon reduction targets, while the region’s well-established chemical clusters continue to drive collaborative R&D. Conversely, in the Asia Pacific, rapid expansion in construction and electronics manufacturing is fueling volume growth. Local producers are scaling capacity to supply cost-competitive solutions, and strategic partnerships with global chemical innovators are facilitating technology transfer and performance upgrades.

This comprehensive research report examines key regions that drive the evolution of the Adhesion Promoters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling How Market Leaders Leverage Innovation, Partnerships, and Strategic Investments to Strengthen Competitive Advantage

Leading participants in the adhesion promoters market are differentiating themselves through integrated portfolio strategies, strategic alliances, and investments in high-value applications. Some companies have intensified R&D efforts to develop proprietary coupling agents that enhance polymer-fiber bonding in advanced composites, while others have forged partnerships with coating formulators to deliver turnkey solutions for next-generation protective finishes. Recent patent filings reflect a focus on multifunctional silane hybrids and modified phosphate esters that address corrosion and UV stability in one package.

Moreover, market leaders are expanding their footprint through targeted capacity additions, particularly in regions with favorable trade agreements and low-cost feedstocks. Strategic acquisitions of specialty surfactant and monomer producers have bolstered supply chain resilience and created synergies in formulation science. Through these combined approaches, top-tier companies are securing long-term relationships with OEMs and tier-one suppliers, positioning themselves at the nexus of innovation, quality, and sustainability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adhesion Promoters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Akzo Nobel N.V.

- Altana AG

- Arkema S.A.

- Ashland Global Holdings Inc.

- BASF SE

- Borica Co. Ltd

- Clariant AG

- DIC Corporation

- DuPont de Nemours Inc.

- Dymax Corporation

- Eastman Chemical Company

- EMS-CHEMIE Holding AG

- Evonik Industries AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc.

- Jowat SE

- Momentive Performance Materials Inc.

- Nippon Paper Industries Co. Ltd.

- Nouryon

- Sika AG

- Solvay S.A.

- Wacker Chemie AG

Actionable Strategies for Industry Leaders to Align Innovation Pipelines with Emerging End-Use Trends and Supply Chain Resilience

Industry leaders seeking to capitalize on evolving market dynamics should prioritize several key actions to sharpen their competitive edge. First, they must deepen collaboration between R&D and commercial teams to align product roadmaps with emerging end-use requirements, such as electrification and lightweight structures. By integrating application testing with iterative formulation adjustments, organizations can accelerate time to market for high-performance adhesion solutions.

In tandem, companies should explore vertical integration opportunities that secure critical raw materials and minimize exposure to tariff fluctuations. Establishing or expanding domestic production sites can buffer against global trade uncertainties, while joint ventures with upstream suppliers can create co-development platforms that yield differentiated chemistries. Furthermore, embracing digital tools for process simulation and surface characterization will drive operational efficiency and reduce trial-and-error cycles. Lastly, industry stakeholders must proactively engage with regulatory agencies and standards bodies to influence policy frameworks favoring low-emission technologies.

Detailing a Comprehensive Mixed-Methods Research Approach Integrating Executive Interviews and Data Triangulation

Our research methodology combines rigorous primary and secondary research techniques to deliver an authoritative analysis of the adhesion promoters market. Initially, we conducted in-depth interviews with senior executives and technical experts across major coating, composite, plastics, and adhesive manufacturers. These discussions provided firsthand insight into formulation challenges, adoption barriers, and performance criteria that guide purchasing decisions.

Complementing primary inputs, we systematically reviewed industry publications, patent databases, and regulatory filings to capture the latest advancements in promoter chemistries and global trade policies. We then triangulated this information with proprietary datasets on regional production capacities and raw material flows. To ensure consistency, we applied standardized frameworks for segmenting the market by application, type, end-use industry, form, and function, enabling a granular assessment of unmet needs and growth vectors. Finally, all findings underwent multi-layered validation through expert panel reviews and cross-comparison with market intelligence from adjacent additive segments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adhesion Promoters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adhesion Promoters Market, by Application

- Adhesion Promoters Market, by Type

- Adhesion Promoters Market, by End Use Industry

- Adhesion Promoters Market, by Form

- Adhesion Promoters Market, by Function

- Adhesion Promoters Market, by Region

- Adhesion Promoters Market, by Group

- Adhesion Promoters Market, by Country

- United States Adhesion Promoters Market

- China Adhesion Promoters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Summarizing Core Insights on Market Dynamics, Competitive Landscapes, and Strategic Pathways for Stakeholders to Thrive

This executive summary has highlighted the strategic importance of adhesion promoters in enabling high-performance, durable bonds across a wide array of materials and applications. It has examined transformative technological breakthroughs alongside regulatory shifts, analyzed the impact of recent U.S. tariffs on sourcing strategies, and distilled key segmentation and regional insights. Additionally, the overview of competitive dynamics and actionable recommendations provides a clear pathway for organizations to strengthen their market positioning.

By following the outlined strategies and leveraging the detailed methodology, decision makers can confidently navigate the evolving landscape. The full market research report offers an even deeper dive into each of these areas, equipping stakeholders with the actionable intelligence needed to drive innovation, optimize supply chains, and achieve sustainable growth in the adhesion promoters sector.

Engage with Our Associate Director to Acquire the Definitive Adhesion Promoters Market Report and Drive Your Strategic Initiatives

To secure a comprehensive understanding of the adhesion promoters landscape and position your organization for success, reach out to Ketan Rohom, Associate Director, Sales & Marketing. By procuring the full market research report, you gain exclusive access to in-depth analyses, detailed segmentation insights, and strategic recommendations tailored to your needs. Don’t miss the opportunity to leverage this definitive guide and drive your initiatives forward with confidence and clarity. Contact Ketan today to discuss how this report can empower your team and unlock new growth opportunities.

- How big is the Adhesion Promoters Market?

- What is the Adhesion Promoters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?