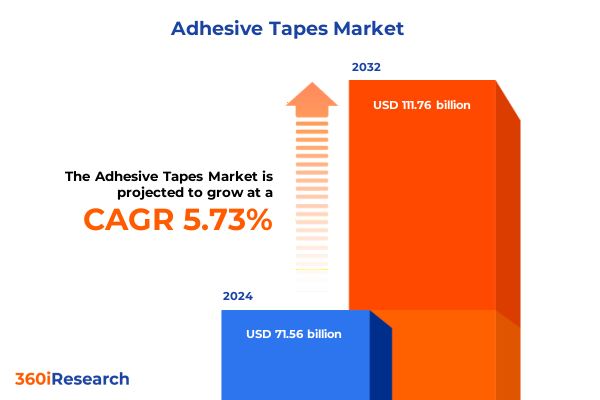

The Adhesive Tapes Market size was estimated at USD 75.41 billion in 2025 and expected to reach USD 79.55 billion in 2026, at a CAGR of 5.77% to reach USD 111.76 billion by 2032.

Unveiling the Nuanced Landscape of Adhesive Tapes with Historical Context and Core Definitions Setting the Stage for Strategic Insights

The realm of adhesive tapes has evolved far beyond simple household staples, emerging as a critical enabler of innovation across multiple sectors. From fastening components in aerospace assemblies to sealing packaging lines in high-speed logistics centers, these versatile products now underpin critical operations in nearly every manufacturing and service industry. In light of increasing demands for performance, reliability, and sustainability, a nuanced grasp of adhesive tapes’ composition, functionality, and market dynamics has never been more vital.

Historically, pressure sensitive adhesives first gained prominence in the early twentieth century, paving the way for a myriad of tape varieties. In subsequent decades, breakthroughs in polymer science introduced acrylic, rubber, and silicone formulations that catered to specialized requirements for temperature resistance, chemical stability, and bonding strength. These developments laid the groundwork for modern adhesive solutions, which now integrate functional additives and nanotechnology to further enhance performance in extreme environments.

Today’s landscape is characterized by an intricate interplay between advanced resin chemistries and innovative backing materials, each selected to optimize specific attributes such as flexibility, conformability, and UV resistance. Combined with evolving application methods-ranging from preformed sheets to automated roll-to-roll systems-industry participants are challenged to balance cost, quality, and regulatory compliance. The growing emphasis on circular economy principles adds another layer of complexity, as stakeholders seek recyclable substrates and low-emission adhesive formulations.

This executive summary provides a structured overview designed to equip decision-makers with essential insights. Subsequent sections will examine transformative shifts reshaping production, analyze the cumulative impact of new United States tariff measures in 2025, distill key segmentation and regional nuances, highlight leading players and recommend strategic actions, and conclude with a succinct synthesis and an invitation to access the full report.

Mapping the Transformative Shifts Redefining Adhesive Tape Manufacturing Technology Adoption and Emerging Applications Transforming Market Dynamics

Manufacturing technologies and market requirements have converged to produce a series of transformative shifts in the adhesive tape sector that defy traditional paradigms. Automation of coating and converting processes has accelerated throughput and consistency, enabling high-volume production of ultra-thin tapes with sub-50 micron adhesive layers. Concurrently, digital twin models and process analytics are facilitating real-time quality control, driving down waste and enabling just-in-time inventory strategies that align with lean manufacturing principles.

Parallel to these manufacturing innovations, the advent of bio-based and low-VOC adhesive chemistries is redefining performance benchmarks. Leading formulators have introduced hybrid polymer systems that blend renewable raw materials with advanced additives to achieve pressure-sensitive properties comparable to petroleum-derived counterparts. This shift not only addresses regulatory pressures but also resonates with end users in packaging, healthcare, and consumer electronics who are increasingly prioritizing environmental credentials in their supply chains.

The integration of functional coatings and smart materials represents another major evolution. Tapes equipped with conductive or thermal interface layers are being deployed in electric vehicle battery assemblies and high-frequency communication modules, while moisture-activated backings are gaining traction for fast, reliable sealing in pharmaceutical packaging. These specialized formats extend applications beyond traditional bonding and sealing, positioning adhesive tapes as integral components in next-generation electronic and medical devices.

Taken together, these trends underscore a broad transformation driven by the confluence of advanced manufacturing, sustainable chemistry, and application-specific innovation. Stakeholders across the value chain must adapt to this new reality by investing in technology adoption, forging cross-disciplinary partnerships, and maintaining agility in both product development and market deployment.

Assessing the Cumulative Impact of Recent United States Tariffs Enacted in 2025 on Raw Material Sourcing Production Costs and Competitive Landscape

In 2025, the United States implemented a series of tariff measures impacting key raw materials and finished adhesive tape imports, catalyzing a shift in sourcing, pricing, and competitive positioning across the industry. Tariffs on acrylic and rubber resins, aluminum foil backings, and specialized polymer films imposed additional cost burdens on importers, prompting many converters to reassess their global supply chains. These measures were introduced amid broader trade policy recalibrations aimed at bolstering domestic manufacturing resilience and addressing perceived supply chain vulnerabilities.

As a direct consequence of these duties, several tape producers accelerated onshore production initiatives, collaborating with local resin manufacturers to develop substitute formulations and co-locate adhesive compounding facilities. While this localization strategy mitigated exposure to import levies, it simultaneously required significant capital investment and time to qualify new material sources. Smaller businesses and niche producers faced heightened strain, as limited scale inhibited rapid conversion to domestic suppliers, and fluctuating raw material availability led to sporadic production bottlenecks.

On the demand side, the pass-through of higher input costs has been uneven across end markets. Price-sensitive packaging and consumer goods applications experienced tighter margin pressures, whereas high-specification sectors such as aerospace and healthcare were better able to accommodate incremental cost increases. Combined with strategic stockpiling prior to tariff enactment, the market saw a transient lull in order volumes followed by a rebound driven by contract renegotiations and longer-term sourcing agreements.

Overall, these 2025 tariff actions have resulted in a more fragmented supply landscape, incentivized vertical integration and domestic capacity building, and prompted end users to diversify procurement strategies. As the dust settles, the industry continues to monitor policy developments closely, balancing cost containment with the need for supply chain security and material innovation.

Exploring Key Segmentation Insights Based on Resin Type Feature Backing Material Thickness Bonding Form End Use and Distribution Channel Dynamics

A deep dive into segmentation reveals the multifaceted nature of adhesive tape demand and underscores how resin chemistry, tape functionality, and end-use requirements intersect to drive product innovation. When resin type is considered, acrylic formulations dominate applications requiring UV stability and long-term adhesion, while rubber adhesives are favored in general-purpose and consumer segments for cost-effectiveness, and silicone variants are indispensable in extreme temperature or chemical exposure scenarios.

Feature differentiation further refines market opportunities: heat-sensitive tapes offer rapid bonding upon temperature activation for electronics assemblies, pressure-sensitive formats deliver immediate tack for packaging and labeling, and water-activated styles continue to secure envelope and carton sealing in high-speed courier operations. Meanwhile, the choice of backing material-from cloth and foam to metal foils, paper substrates, and plastic films-influences conformability, dielectric properties, and mechanical strength, enabling customization for sectors as diverse as construction and transportation.

Thickness considerations, categorized by below 50 microns, the range of 50–100 microns, and above 100 microns, are directly correlated with application performance requirements. Ultra-thin tapes facilitate precise bonding in miniature electronics, mid-range thicknesses balance strength and flexibility in automotive trim, and thicker variants provide cushioning or vibration dampening in heavy machinery. Bonding type also plays a pivotal role: double-sided tapes excel in mounting and lamination tasks, while single-sided options remain the go-to choice for splicing, masking, and basic sealing operations.

Form factor-whether roll, dispenser, or sheet-impacts handling efficiency and process integration, with rolls leading logistics and packaging lines, dispensers enhancing precision in industrial assembly, and pre-cut sheets streamlining manual application in healthcare or retail display contexts. End-use segmentation spans aerospace through transportation, yet packaging, electronics, and automotive maintain a commanding presence. Distribution is likewise bifurcated, as traditional offline sales channels continue to serve industrial buyers, while online platforms expand access for smaller purchasers and facilitate rapid direct-to-end-user fulfillment.

This comprehensive research report categorizes the Adhesive Tapes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Feature

- Backing Material

- Thickness

- Bonding Type

- Form

- End Use

- Distribution Channel

Deriving Key Regional Insights into the Americas Europe Middle East Africa and Asia Pacific Markets Highlighting Growth Drivers Challenges and Opportunities

Regional market trajectories reveal distinctive growth drivers and competitive dynamics in the Americas, EMEA, and Asia-Pacific. In the Americas, a mature industrial base underpins steady demand, with packaging and transportation applications anchored by robust e-commerce growth and reshoring initiatives that emphasize local content. Sustainability mandates at both federal and state levels have accelerated the adoption of recyclable backings and low-emission adhesives, prompting converters and end users to collaborate on closed-loop recycling programs.

In Europe, Middle East, and Africa, stringent regulatory frameworks-such as REACH restrictions and carbon reporting requirements-shape product development and procurement. European converters are piloting bio-based resin technologies and biodegradable films to align with circular economy targets, while Middle Eastern infrastructure projects drive demand for heavy-duty sealing tapes in construction and oil-and-gas applications. African markets, though incremental in scale, present opportunities tied to rising manufacturing activity and expanding logistics networks.

Asia-Pacific stands out for its rapid expansion, fueled by large-scale electronics manufacturing hubs in China, South Korea, and Taiwan, alongside growing automotive production in India and Southeast Asia. Investments in high-precision converting lines have elevated capacity for thin-gauge tapes and specialty formats, while government incentives for export-oriented industries bolster competitiveness. Yet raw material price volatility and capacity constraints prompt regional players to form strategic alliances and co-development partnerships to secure feedstock and optimize production footprints.

Across all regions, digital commerce platforms are emerging as critical enablers of market access, allowing suppliers to offer custom tape configurations with rapid lead times. As environmental and technological pressures converge, regional stakeholders are increasingly prioritizing cross-border collaboration and standardized quality benchmarks to support global supply chain integration.

This comprehensive research report examines key regions that drive the evolution of the Adhesive Tapes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players Shaping the Adhesive Tape Market through Innovation Strategic Partnerships and Diversified Product Portfolios Driving Competitive Advantage

Leading industry participants are leveraging a combination of organic innovation, strategic acquisitions, and technology partnerships to fortify their market positions and broaden application portfolios. Global adhesive manufacturers have invested in advanced R&D facilities, focusing on next-generation chemistries that deliver enhanced bonding in extreme environments and lower lifecycle environmental impact. These investments have yielded proprietary polymer blends and nanocomposite adhesive systems that enable differentiated product offerings for high-value segments.

Strategic alliances between tape producers and raw material suppliers are streamlining innovation cycles by facilitating early access to novel monomers, plasticizers, and backing substrates. This upstream collaboration accelerates formulation testing and scale-up, empowering converters to bring targeted solutions to market more rapidly. Meanwhile, forward integration through selective mergers has allowed tier-one players to enhance control over critical supply inputs and distribution networks, thereby improving margin capture and customer service responsiveness.

Digital transformation remains a core focus, with leading companies deploying industry 4.0 platforms in their converting plants to harness predictive maintenance, traceability, and energy management capabilities. These smart manufacturing systems not only optimize operational efficiency but also generate data insights that inform future product development and sustainability initiatives. Concurrently, augmented reality tools are being introduced in sales and technical support functions to provide clients with real-time installation guidance and troubleshooting.

Collectively, these moves underscore a commitment to end-to-end value creation, as major firms seek to differentiate through both product performance and service excellence. By cultivating a balanced portfolio of commodity and specialty tape lines, these organizations are well-positioned to serve evolving customer needs and navigate shifting economic and regulatory headwinds.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adhesive Tapes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3F GmbH

- 3M Company

- Adhesives Research, Inc.

- Adirondack Specialty Adhesives

- Advance Tapes International Ltd

- American Biltrite Inc.

- Avery Dennison Corporation

- Berry Global Inc.

- Champion Tape

- Coating & Converting Technologies, Inc.

- Compagnie de Saint-Gobain S.A.

- Convertex Ltd.

- Coroplast Fritz Müller GmbH & Co. KG

- DermaMed Coatings Company, LLC

- Flowstrip Limited

- Intertape Polymer Group, Inc.

- kingnodetech

- Lintec Corporation

- Lohmann GmbH & Co.KG

- Nichiban Co. Ltd.

- ORAFOL Europe GmbH

- Ppi Adhesive Products (C.E) S.R.O.

- Rogers Corporation

- Shurtape Technologies LLC

- Tesa SE

- Windmill Tapes and Labels Ltd

Formulating Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends Enhance Operational Excellence and Navigate Regulatory and Trade Complexities

Industry leaders must act decisively to harness emerging opportunities and mitigate risks in the evolving adhesive tape landscape. Priority one is to invest in sustainable materials development, channeling R&D resources toward bio-based resin alternatives and recyclable substrates, thereby preempting future regulatory constraints and aligning with end-user ESG commitments. By forging collaborative research partnerships with academic institutions and raw material innovators, companies can accelerate breakthroughs and share the burden of development costs.

Simultaneously, diversifying raw material sourcing strategies is essential to reduce exposure to geopolitical volatility and tariff disruptions. Building a balanced supplier portfolio that spans domestic producers and low-cost regional suppliers will enhance supply chain resilience. Companies should also explore vertical integration for critical feedstocks or explore joint ventures to secure prioritized access to emerging bio-based monomers.

On the operational front, digital transformation initiatives should extend beyond pilot projects to plant-wide deployment of predictive analytics, process automation, and digital workflow platforms. These technologies will drive down manufacturing waste, optimize energy usage, and enable agile production scheduling that can respond to sudden changes in customer demand or input costs. Training and upskilling of the workforce to manage these digital tools will be a key determinant of implementation success.

Finally, a proactive regulatory engagement strategy will support favorable market conditions. By participating in standards committees and sustainability coalitions, companies can influence policy development and anticipate compliance requirements. A focused commercial strategy that leverages advanced visualization tools and e-commerce capabilities will further differentiate offerings, enabling streamlined configuration and faster delivery to end users.

Outlining the Rigorous Research Methodology Employed to Ensure Data Integrity Comprehensive Analysis and Robust Insights into the Adhesive Tape Market

This analysis is grounded in a rigorous research methodology that integrates primary and secondary data sources to ensure comprehensiveness and validity. Primary research included in-depth interviews with a cross-section of industry stakeholders, encompassing executives at coating and converting facilities, raw material suppliers, distribution channel partners, and select end users in key application segments. These conversations provided firsthand perspectives on market dynamics, technology adoption, and regulatory pressures.

Secondary research entailed a systematic review of publicly available industry publications, patent filings, trade association reports, and technical journals focused on polymer chemistry and tape converting technologies. In addition, data from customs and trade authorities were analyzed to capture recent shifts in import-export volumes and tariff structures. This triangulation of multiple data streams reinforced the credibility of key findings and enabled cross-verification of critical insights.

Quantitative analysis incorporated historical trend evaluation and cross-segment comparisons, while qualitative inputs were codified to identify recurring themes and emerging priorities. All data underwent a multi-tier validation process involving consistency checks, anomaly detection, and peer reviews by subject matter experts. This approach ensured that conclusions drawn reflect both macroeconomic drivers and micro-level operational realities.

By adhering to these methodological best practices, the report delivers robust, actionable insights on adhesive tape market dynamics. Stakeholders can rely on the integrity and depth of the analysis to inform strategic decisions, investment prioritization, and technology road-mapping.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adhesive Tapes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adhesive Tapes Market, by Resin Type

- Adhesive Tapes Market, by Feature

- Adhesive Tapes Market, by Backing Material

- Adhesive Tapes Market, by Thickness

- Adhesive Tapes Market, by Bonding Type

- Adhesive Tapes Market, by Form

- Adhesive Tapes Market, by End Use

- Adhesive Tapes Market, by Distribution Channel

- Adhesive Tapes Market, by Region

- Adhesive Tapes Market, by Group

- Adhesive Tapes Market, by Country

- United States Adhesive Tapes Market

- China Adhesive Tapes Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1431 ]

Synthesizing Critical Findings and Strategic Implications to Provide a Cohesive Conclusion on the Future Trajectory of the Adhesive Tape Industry

The confluence of advanced manufacturing techniques, sustainable adhesive chemistries, and tailored application innovations is reshaping the adhesive tape industry at an unprecedented pace. Automation and digitalization have improved production efficiency, while bio-based and low-emission formulations are setting new environmental performance standards. These shifts demand that market participants remain agile and forward-looking, balancing investments in technology with proactive supply chain management.

Tariff measures introduced in 2025 have accelerated localization efforts and prompted firms to diversify sourcing strategies, underscoring the importance of supply chain resilience. Segmentation analysis highlights the critical interplay of resin type, tape features, backing materials, and form factors, each influencing the suitability for specific end uses. Regional insights reveal unique regulatory and economic drivers in the Americas, EMEA, and Asia-Pacific, emphasizing that a one-size-fits-all approach is no longer tenable.

Leading companies have responded through targeted R&D, strategic alliances, and digital transformation initiatives, reinforcing their competitive positions and broadening their product portfolios. Yet the path forward requires continued vigilance across multiple dimensions: material innovation, operational excellence, regulatory engagement, and customer-centric service models. By integrating these strategic imperatives, industry leaders can navigate complexity, capture emerging opportunities, and drive sustainable growth.

This conclusion underscores that success in the adhesive tape market hinges on a holistic understanding of technological trends, policy shifts, segmentation nuances, and regional dynamics. Decision-makers who apply the insights and recommendations presented herein will be well equipped to chart a course toward enhanced competitiveness and long-term value creation.

Engage Directly with Ketan Rohom Associate Director of Sales & Marketing to Secure Exclusive Market Intelligence and Unlock Strategic Advantage Today

For a comprehensive understanding of market opportunities and to secure your competitive edge, reach out directly to Ketan Rohom, the Associate Director of Sales & Marketing. His expertise and personalized guidance will ensure you obtain tailored insights and actionable data aligned with your strategic priorities. Unlock the full depth of this market research report and empower your decision-making by contacting him today to arrange a detailed consultation and purchasing process

- How big is the Adhesive Tapes Market?

- What is the Adhesive Tapes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?