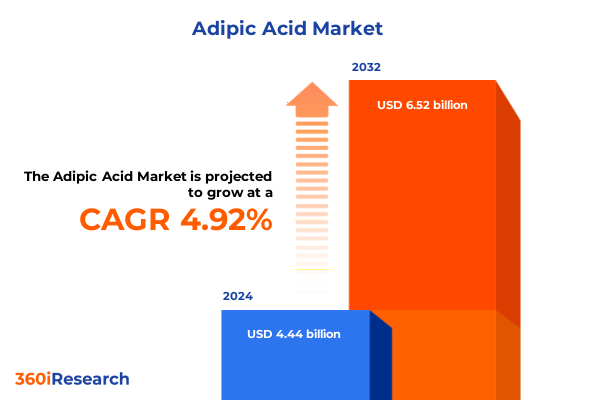

The Adipic Acid Market size was estimated at USD 4.66 billion in 2025 and expected to reach USD 4.89 billion in 2026, at a CAGR of 4.92% to reach USD 6.52 billion by 2032.

Exploring the Pivotal Role of Adipic Acid in Modern Industry and Diverse Applications Spanning Polymers, Coatings, and Specialized Chemical Sectors

Adipic acid, known chemically as hexanedioic acid, stands as a cornerstone compound within the global chemical industry, serving multiple critical functions across polymers and specialized sectors. As a white crystalline dicarboxylic acid, it is produced at volumes approaching 2.5 billion kilograms annually, predominantly through nitric acid oxidation of cyclohexanol–cyclohexanone mixtures to generate a monomer essential for nylon 6,6 production. Beyond its primary use in nylon manufacturing, adipic acid fulfills key roles as a monomer for polyurethane, as well as a feedstock for plasticizers in PVC and other polymer systems.

The versatile chemistry of adipic acid underpins its widespread adoption in various applications, from adhesives and sealants to food and beverage acidulants. Its esters and salts, commonly referred to as adipates, enhance plastic flexibility and act as acidity regulators, demonstrating the compound’s breadth of functional utility. The molecular structure affords strong hydrogen bonding capabilities, which translate into desirable mechanical and thermal properties when incorporated into polymer matrices. Consequently, adipic acid’s unique balance of performance characteristics and cost-efficiency cements its status as an indispensable building block for industries ranging from automotive to personal care.

Unveiling Transformative Shifts Reshaping Adipic Acid Production, Supply Chains, and Sustainability Innovations Across Global Chemical Markets

The adipic acid landscape is undergoing a profound transformation driven by sustainability imperatives, technological innovation, and shifting supply chain dynamics. In recent years, major producers have prioritized decarbonization initiatives, exemplified by Invista’s installation of advanced N₂O abatement systems at its Victoria, Texas facility and Ascend Performance Materials achieving a 98% reduction in greenhouse gas emissions through process modernization. These efforts reflect an industry-wide commitment to mitigate the environmental footprint of adipic acid production by targeting nitrous oxide emissions, a potent greenhouse gas generated during the nitric acid oxidation of KA oil.

Concurrently, the pursuit of bio-based adipic acid alternatives is gaining traction, with leading participants securing ISCC PLUS certifications to produce adipic acid via renewable feedstocks and fermentation pathways. Such initiatives not only respond to regulatory pressures under frameworks like the European Green Deal but also cater to brand owners demanding circularity in nylon and polyurethane products. Moreover, the integration of digital supply chain solutions is enhancing responsiveness to raw material volatility and logistical disruptions. Blockchain-enabled traceability and predictive analytics now inform procurement strategies, enabling stakeholders to anticipate feedstock shortages, optimize inventory buffers, and maintain continuity of supply in the face of global disruptions experienced during the COVID-19 pandemic, which caused a 5.4% decline in global adipic acid output in 2020 before rebounding sharply in 2021.

These converging shifts-greening the production footprint, diversifying raw material sources, and leveraging digital tools-are collectively reshaping competitive dynamics and unlocking new market opportunities for adipic acid producers willing to invest in next-generation technologies and sustainable business models.

Assessing the Cumulative Impact of 2025 United States Tariff Measures on Adipic Acid Imports, Supply Costs, and Trade Flows

The United States Harmonized Tariff Schedule for 2025 imposes a 6.5% general duty on imports of adipic acid (HTS 2917.12.10.00), reflecting a moderate barrier that applies uniformly to most trading partners. However, imports originating from China are subject to an additional 25% Section 301 tariff, resulting in an effective duty rate of 31.5% for Chinese-origin adipic acid products. This cumulative tariff burden significantly alters cost equations for U.S. converters relying on Chinese feedstock and reinforces the strategic importance of diversifying supply sources into tariff-free or preferential zones.

Since March 12, 2025, when Presidential Proclamation adjustments increased Section 301 duties under IEEPA authority, market participants have faced elevated landed costs that erode margin tolerances for downstream nylon and polyurethane manufacturers. In response, U.S. purchasers have accelerated sourcing from NAFTA/USMCA partners and GSP beneficiaries, enabling tariff-free imports from Canada, Mexico, and select developing economies to counterbalance the impact of higher duties on other origins. Consequently, these trade policy measures have catalyzed regional supply realignment, encouraging nearshoring of key adipic acid manufacturing assets and fostering deeper integration between U.S. converters and North American feedstock producers.

Deriving Multifaceted Strategic Insights from Application, End Use Industry, Grade, Production Process, and Distribution Channel Perspectives

A nuanced understanding of adipic acid demand emerges when dissecting key segmentation categories that define end-market applications and strategic imperatives. Within the realm of application, adhesives and sealants leverage adipic acid-derived oligomers for enhanced bonding strength, while coatings formulations benefit from its rigidity and chemical resistance. In the food and beverage sector, adipic acid serves as an acidulant and leavening agent, whereas lubricants exploit its diacid functionality to improve thermal stability. The nylon segment-comprising engineering plastics and fiber-relies on adipic acid for polymer backbone construction, further subdivided into film and monofilament applications in engineering plastics, and industrial versus textile fibers. Meanwhile, plasticizers derived from adipates impart flexibility to PVC, and polyurethanes capitalize on diacid crosslinking to produce foams and elastomers.

Turning to end use industries, agriculture formulations incorporate adipic acid derivatives for controlled-release fertilizers, the automotive sector adopts nylon 6,6 for lightweight structural components, and construction deploys sealants and coatings for weatherproofing. Electronics manufacture capacitors and insulators with adipate plasticizers, while the footwear industry uses nylon fibers for durability and comfort. Packaging leverages flexible films with adipate plasticizers, and textiles integrate adipic acid-based fibers for performance wear.

Grade distinctions-food, industrial, and personal care-drive purity requirements and certification protocols, guiding choice of raw materials. Production process segmentation contrasts bio-based adipic acid produced via fermentation and petrochemical routes dependent on cyclohexane oxidation. Finally, distribution channels range from direct sales agreements securing long-term supply to distributors offering market agility and e-commerce platforms facilitating smaller lot purchases and rapid replenishment. This holistic segmentation framework illuminates the diverse pathways through which adipic acid permeates value chains and underscores the necessity of targeted strategies aligned with specific demand drivers.

This comprehensive research report categorizes the Adipic Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Grade

- Production Process

- Application

- End Use Industry

- Distribution Channel

Highlighting Regional Dynamics and Growth Drivers Shaping the Adipic Acid Market Across the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics play an outsized role in shaping the global adipic acid market, with distinct opportunities and challenges emerging across the Americas, Europe, Middle East & Africa (EMEA), and Asia-Pacific. In the Americas, the United States and Canada benefit from integrated supply chains under USMCA, bolstered by ample cyclohexane feedstocks and accelerated investment in decarbonization technologies. This has resulted in increased collaboration between chemical producers and automotive OEMs to develop lightweight nylon components with reduced carbon footprints. Latin America, led by Brazil, continues to expand capacity leveraging abundant petrochemical intermediates, though infrastructure constraints and energy price volatility temper growth momentum.

Meanwhile, EMEA represents a mature marketplace with high regulatory scrutiny under the European Green Deal. Producers in Germany and Belgium are pioneering bio-based adipic acid production and circular economy initiatives to comply with stringent emissions targets. Investments in advanced oxidation and catalytic abatement technologies in France and the United Kingdom are further reducing nitrous oxide releases, positioning the region at the forefront of sustainable adipic acid manufacturing.

Asia-Pacific remains the dominant force in both consumption and capacity additions. China commands a majority share of new global capacity, driven by sustained demand for nylon 6,6 in textile and automotive sectors. South Korea and Japan are pivoting toward bio-based alternatives and strategic alliances to insulate producers from feedstock price swings. Southeast Asia’s emerging economies are rapidly scaling production, supported by preferential trade agreements and burgeoning electronics and packaging industries, underscoring the region’s critical importance to future market expansion.

This comprehensive research report examines key regions that drive the evolution of the Adipic Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Initiatives and Competitive Positioning of Leading Global Adipic Acid Producers Driving Market Evolution

The competitive landscape of the adipic acid market is characterized by a mix of legacy chemical giants and innovative challengers advancing sustainable production methods. BASF SE leverages its global footprint to pilot bio-based research platforms and scale green chemistry processes, while Ascend Performance Materials stands out for vertical integration and leading-edge N₂O abatement technologies that yield near-zero emissions. INVISTA, with key sites in Victoria, Texas and Kingston, Ontario, has achieved ISCC PLUS certification, enabling production of circular and renewable feedstock-derived adipic acid streams to meet corporate sustainability mandates.

European producers such as RadiciGroup and Lanxess AG are focusing on high-purity grades for automotive and specialty polymer applications, balancing capacity optimization with targeted investments in catalytic conversion technologies. Asahi Kasei and Solvay are collaborating on microwave-based recycling technologies and electrocatalytic oxidation processes to commercialize non-nitric acid pathways, underscoring a strategic pivot toward advanced manufacturing routes. Meanwhile, regional players like Shandong Haili and Liaoyang Tianhua Chemical Co. are capitalizing on low-cost production environments in China, intensifying price competition and capacity expansion.

Emerging bio-based developers and fermentation toll processors are forging alliances with established producers to commercialize next-generation adipic acid, strategically positioning themselves to capture premium markets that prioritize traceability and circularity over price. This evolving competitive mosaic demands agile strategic positioning, continuous R&D investment, and proactive engagement with regulatory frameworks to secure long-term market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adipic Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Corporation

- Ascend Performance Materials Holdings Inc.

- BASF SE

- Central Drug House (P) Ltd.

- Domo Chemicals GmbH

- Evonik Industries AG

- Huafon Group

- Koch, Inc.

- Lanxess AG

- LG Corporation

- Liaoyang Tianhua Chemical Co.,Ltd.

- Merck KGaA

- Mitsubishi Chemical Corporation

- Pon Pure Chemicals Group

- Radici Partecipazioni SpA

- Shanghai Guanru Chemical Co., Ltd

- Shenma Industrial Co. Ltd

- Solvay S.A.

- Spectrum Chemical Mfg. Corp.

- Sumitomo Chemical Co., Ltd

- Tangshan Zhonghao Chemical Co. Ltd

- Tokyo Chemical Industry Co., Ltd.

- Toray Industries, Inc.

- Vizag Chemical International

- Zhengzhou Meiya Chemical Products Co.,Ltd

Actionable Strategic Recommendations to Enhance Competitiveness and Sustainability for Adipic Acid Industry Leaders in a Changing Regulatory and Market Environment

To maintain competitive advantage and unlock new growth avenues, industry leaders should prioritize the implementation of advanced emission control systems, particularly in regions subject to strict environmental regulations. Adopting catalytic N₂O abatement technologies can not only mitigate greenhouse gas liabilities but also serve as a key differentiator in tender processes for automotive and electronics OEMs demanding low-carbon feedstocks. Integrating predictive analytics and digital twins within production planning will enhance operational resilience, enabling swift response to feedstock price volatility and logistical disruptions.

Securing diversified supply portfolios by establishing strategic partnerships with bio-based adipic acid providers can insulate manufacturers from petrochemical feedstock fluctuations and emerging tariff regimes. Collaboration with technology partners for scale-up of electrocatalytic oxidation and fermentation processes will accelerate pathway de-risking and cost parity achievement. Moreover, positioning adipic acid offerings within a broader sustainability narrative-supported by robust life cycle assessments and transparent traceability-will resonate with brand owners and NGOs emphasizing circularity and ethical sourcing.

Finally, proactive engagement in policy dialogues and trade negotiations will afford industry stakeholders greater clarity on impending tariff adjustments and regulatory shifts. Shaping standards for bio-based content thresholds and GHG accounting methodologies can yield first-mover advantages, helping companies secure market share in regions adopting aggressive decarbonization mandates.

Outlining the Robust Research Methodology Used to Gather, Validate, and Analyze Critical Data for the Adipic Acid Market Study

This report synthesizes primary and secondary research to ensure a comprehensive and unbiased perspective on the adipic acid market. Primary research involved structured interviews with C-suite executives, production engineers, procurement managers, and industry experts across leading producer sites in North America, Europe, and Asia-Pacific. These engagements provided insights into technology investments, supply chain strategies, and regulatory impacts.

Secondary research encompassed an extensive review of public domain information, including company financial disclosures, patent filings, regulatory filings, and trade data sourced from the Harmonized Tariff Schedule, World Trade Organization, International Trade Centre, and national customs databases. Data triangulation techniques were employed to cross-verify import and export volumes, capacity utilization rates, and technological adoption curves. All sources were critically evaluated for credibility and relevance, with adjustments made to reconcile discrepancies in regional reporting standards.

Quantitative modeling leveraged historical production and trade flow data to map growth trajectories and scenario-based sensitivity analyses under varying tariff and feedstock price conditions. Qualitative assessments incorporated expert opinions and policy analyses to contextualize technological and regulatory developments. This multi-pronged methodology ensures robust, actionable insights for stakeholders navigating the complex adipic acid landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adipic Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adipic Acid Market, by Grade

- Adipic Acid Market, by Production Process

- Adipic Acid Market, by Application

- Adipic Acid Market, by End Use Industry

- Adipic Acid Market, by Distribution Channel

- Adipic Acid Market, by Region

- Adipic Acid Market, by Group

- Adipic Acid Market, by Country

- United States Adipic Acid Market

- China Adipic Acid Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings and Strategic Imperatives for Stakeholders Navigating the Evolving Adipic Acid Landscape

In summary, adipic acid remains a foundational monomer within the polymer and specialty chemicals sector, evolving rapidly in response to sustainability demands, trade policy shifts, and technological breakthroughs. The industry’s transition toward bio-based and decarbonized production pathways, coupled with targeted tariff realignments, is reshaping competitive dynamics and supply chain configurations globally.

Segmentation insights reveal that application-specific performance requirements, end-use industry demands, grade distinctions, production process routes, and distribution channels collectively inform strategic positioning. Regional analysis underscores the significance of geographic trade agreements and investment in green technology hubs, while competitive benchmarking highlights the critical role of emissions abatement and circularity credentials.

As the adipic acid market continues to advance, stakeholders equipped with nuanced market intelligence, agile supply chain architectures, and proactive regulatory engagement will be best positioned to capitalize on emerging opportunities and mitigate evolving risks within this dynamic landscape.

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to Secure Your Comprehensive Adipic Acid Market Research Report and Gain Actionable Insights

Ready to elevate your strategic decision-making with in-depth, tailored market insights, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, for personalized guidance and to secure your copy of the definitive Adipic Acid Market Research Report today.

- How big is the Adipic Acid Market?

- What is the Adipic Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?