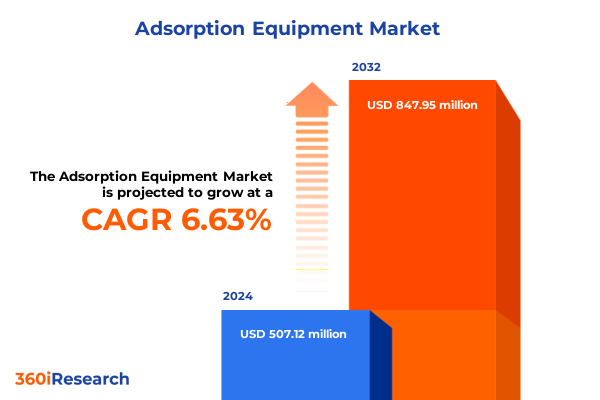

The Adsorption Equipment Market size was estimated at USD 538.18 million in 2025 and expected to reach USD 571.40 million in 2026, at a CAGR of 6.71% to reach USD 847.95 million by 2032.

Unveiling the Critical Role of Adsorption Equipment in Addressing Global Purification and Separation Challenges Across Industries

The adsorption equipment sector is emerging as a cornerstone solution for diverse separation and purification challenges that span industrial, environmental, and healthcare applications. Today’s heightened focus on sustainability and resource efficiency has propelled adsorption technologies to the forefront of engineering innovation. As global regulators tighten emissions standards and end users demand more cost-effective purification processes, adsorption equipment suppliers find themselves uniquely positioned to deliver high-performance, modular systems that address evolving market needs.

In recent years, adsorption equipment has transcended traditional boundaries to support critical operations such as air purification in manufacturing facilities, gas separation for hydrogen recovery, and stringent water treatment requirements. With each application presenting distinct technical demands, equipment designers harness material science advances and process engineering to optimize system performance, cycle times, and energy consumption. This dynamic interplay between application requirements and technological adaptation underscores the importance of an integrated view of the market landscape.

By examining the latest developments across sectors ranging from food and beverage processing to medical gas purification, stakeholders can gain clarity on how adsorption equipment is driving process intensification and circular economy objectives. Emerging adsorbent materials, advanced process controls, and increasing automation are combining to create next-generation solutions that balance operational resilience with environmental stewardship. In this context, an in-depth analysis of current trends and strategic imperatives is essential for decision-makers seeking to capitalize on opportunities within the adsorption equipment domain.

Examining How Technological Innovation and Sustainability Drivers Are Reshaping the Adsorption Equipment Landscape at an Unprecedented Pace

Rapid technological innovation and shifting sustainability priorities are catalyzing transformative shifts in the adsorption equipment landscape. Electric swing adsorption platforms are integrating intelligent sensors and advanced control algorithms that enable real-time process optimization, while novel adsorbent materials such as metal-organic frameworks are unlocking unprecedented selectivity and capacity for target contaminants. Moreover, stakeholders are increasingly aligning their development roadmaps with global decarbonization goals, which is accelerating the deployment of adsorption systems for carbon dioxide removal in industrial settings.

At the same time, pressure swing adsorption processes are benefiting from design refinements that reduce cycle times and enhance throughput. The convergence of digitalization and sustainability imperatives is giving rise to hybrid configurations that can switch between pressure and vacuum swing modalities based on dynamic feed compositions. Consequently, end users are gaining access to more flexible solutions capable of handling fluctuating process conditions without compromising purity or yield.

Furthermore, the growing adoption of temperature swing adsorption in specialty gas markets reflects a demand for ultra-high purity streams in semiconductor manufacturing and pharmaceutical production. These high-temperature systems leverage energy integration techniques to recover heat and minimize fuel consumption, aligning with broader energy efficiency mandates. Taken together, these technological advancements are redefining the benchmarks for performance and cost-effectiveness in adsorption equipment, delivering unparalleled operational advantages to forward-looking organizations.

Analyzing the Collective Impact of United States Tariff Measures Announced in 2025 on Equipment Costs Supply Chains and Market Dynamics

The United States government’s 2025 tariff measures have exerted a cumulative impact on the adsorption equipment industry by elevating the cost structure of imported components and materials. These measures, which include targeted duties on foreign-manufactured adsorbent beds and specialized valves, have prompted OEMs to reassess global supply chains. As a result, many equipment manufacturers have accelerated efforts to localize critical inputs or secure alternative sourcing arrangements to mitigate duty expenses.

Consequently, capital expenditures on adsorption units have experienced upward pressure, particularly for systems relying heavily on advanced adsorbents such as silica gel and zeolites imported from Asia. This shift has triggered a reconfiguration of vendor partnerships, with end users increasingly seeking integrated procurement models that bundle equipment, adsorbents, and lifecycle services under a single domestic agreement. By doing so, organizations can insulate themselves against volatility associated with tariff adjustments and maintain project timelines without incurring prohibitive cost overruns.

Moreover, the tariffs have driven a new wave of innovation in adsorbent manufacturing, as domestic producers expand capacity to address rising demand. Investments in high-throughput extrusion lines and modular fabrication cells are intended to shorten lead times for critical components. In parallel, process engineering teams are evaluating mixed-matrix adsorbent formulations that combine locally sourced activated carbon with smaller fractions of imported metal-organic frameworks, thereby diffusing the financial impact of duties. These strategic adaptations highlight the industry’s resilience in the face of evolving trade policies and underscore the imperative for proactive supply chain management.

Delving into Core Market Segments by Application Adsorbent Type Technology Process and End-User Industry to Uncover Niche Opportunities

A comprehensive segmentation analysis reveals distinct opportunities and challenges across applications, adsorbent types, technologies, processes, and end-user industries. Based on application, the market is studied across air purification, which spans industrial and residential settings; food and beverage operations requiring stringent contaminant removal; gas separation processes focused on carbon dioxide removal, hydrogen recovery, nitrogen generation, and oxygen generation; medical gas purification to support healthcare standards; and water treatment for drinking water, industrial effluent, and wastewater management. Each segment exhibits unique performance criteria that shape equipment design and service models.

Turning to adsorbent type, systems built on activated carbon remain widespread due to their versatility and cost competitiveness, while high-value solutions leveraging metal-organic frameworks offer tailored selectivity for emerging contaminants. Similarly, silica gel and zeolites continue to deliver reliable performance in moisture removal and hydrocarbon separation, respectively. The choice of adsorbent underpins capital intensity and operational complexity, driving vendors to co-develop proprietary formulations with material science partners.

In terms of technology, electric swing adsorption is gaining traction for its fine-tuned control and energy recovery capabilities, whereas pressure swing adsorption maintains its leadership in bulk gas separation. Temperature swing adsorption is carving out a niche in ultra-high purity applications, and vacuum swing adsorption is demonstrating advantages in low-pressure hydrogen recovery scenarios. From a process standpoint, gas-phase adsorption processes dominate in petrochemical and industrial gas contexts, while liquid-phase adsorption installations are critical for water and wastewater treatment protocols.

Finally, based on end-user industry, chemical and petrochemical companies leverage adsorption equipment to refine feeds and capture byproducts, electronics manufacturers demand precision purification for semiconductors, and oil and gas operators use separation units to enhance product recovery. The food and beverage sector applies adsorption systems to ensure taste and safety standards, pharmaceutical producers rely on high-purity gas streams, and water treatment entities integrate adsorption in filtration trains to meet regulatory targets. Appreciating the interplay of these segmentations is vital for crafting targeted growth strategies and aligning product roadmaps with customer requirements.

This comprehensive research report categorizes the Adsorption Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Adsorbent Type

- Technology

- Process

- Application

- End-User Industry

Exploring Regional Dynamics in the Americas Europe Middle East Africa and Asia-Pacific to Understand Growth Patterns and Strategic Priorities

Regional dynamics in the Americas reflect a strong emphasis on North American energy transitions and water infrastructure upgrades. Investment in modular adsorption units for hydrogen recovery and carbon dioxide capture is accelerating, driven by federal incentives and state-level decarbonization mandates. Latin American markets, while still developing, are witnessing pilot installations in food processing and potable water treatment as governments prioritize sanitation and agricultural productivity.

Europe, the Middle East, and Africa (EMEA) present a mosaic of regulatory landscapes. Western Europe continues to lead in stringent air emissions control, adopting adsorption-based systems for industrial flue gas treatment and biogas upgrading. Meanwhile, the Middle East is deploying large-scale adsorption units for natural gas processing and water desalination, taking advantage of robust petrochemical infrastructure. In Africa, end-user industries are focused on water treatment solutions that address urbanization-driven demand, with adsorption units being paired with membrane technologies for advanced effluent polishing.

In the Asia-Pacific region, rapid industrialization and population growth translate into strong requirements for air and water purification. China and India are at the vanguard, scaling up adsorption equipment capacity to support chemical refining, steel manufacturing, and municipal water projects. Southeast Asian nations are increasingly incorporating adsorption into gas separation ventures, particularly for hydrogen recovery and nitrogen generation to support manufacturing hubs. These regional insights underscore the need for adaptable equipment platforms that cater to diverse regulatory standards and feedstock profiles across multiple geographies.

This comprehensive research report examines key regions that drive the evolution of the Adsorption Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Global and Regional Players Driving Innovation Partnerships and Competitive Strategies in the Adsorption Equipment Sector

Key players in the adsorption equipment arena are pursuing a combination of organic development and strategic partnerships to strengthen their market positions. Established global conglomerates are leveraging extensive R&D budgets to enhance material performance, integrating proprietary adsorbent formulations within their modular system designs. At the same time, regional specialists are carving out niches by offering turnkey solutions and localized service networks that reduce lead times and increase uptime for end users.

Collaborations between equipment manufacturers and material science innovators have become central to product roadmaps, as firms co-invest in pilot plants and demonstration projects. These alliances are enabling faster commercialization of metal-organic frameworks and tailored silica gel grades, thereby expanding the addressable applications for advanced adsorption technologies. Additionally, equipment suppliers are forming joint ventures with service providers to offer full-life-cycle support, encompassing installation, commissioning, and predictive maintenance programs backed by digital monitoring tools.

Mid-sized players are differentiating through customized engineering capabilities, addressing specific challenges such as trace contaminant removal in pharmaceutical gas streams or odor control in wastewater facilities. These companies are also focusing on aftermarket services, including rapid change-out adsorbent replacement and periodic performance testing, which foster long-term customer relationships. The combined effect of these competitive strategies is a market environment characterized by collaboration, specialization, and continuous innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adsorption Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- Cabot Corporation

- DuPont de Nemours, Inc.

- Evoqua Water Technologies Corp

- Ingevity Corporation

- Kuraray Co., Ltd.

- Mitsubishi Gas Chemical Company, Inc.

- Newterra Corporation

- Nichem Co.

- Oxbow Activated Carbon LLC

- Ravi Industries

- RCM Technologies

- Suez S.A

- Taikisha Ltd.

- Veolia Environnement S.A

- Xylem Inc.

Presenting Strategic Directions for Industry Leaders to Optimize Operations Boost Resilience and Drive Value from Adsorption Equipment Investments

Industry leaders can capitalize on the current market momentum by adopting targeted strategic initiatives that enhance operational agility and future-proof investments. First, embedding digital twins and process analytics into adsorption systems enables real-time performance benchmarking, which drives predictive maintenance and reduces unplanned downtime. This approach not only improves equipment reliability but also extends adsorbent life cycles through optimized regeneration cycles.

Second, diversifying the adsorbent portfolio by integrating domestically produced materials with emerging high-selectivity formulations mitigates tariff exposure while unlocking performance enhancements. Organizations should evaluate mixed-matrix adsorbent beds that balance cost efficiency with contaminant removal targets, supported by pilot-scale validation programs that de-risk scale-up.

Third, establishing strategic partnerships with local fabrication plants and third-party service providers can streamline logistics and accelerate turnaround times for spare parts and consumables. By formalizing volume-based supply agreements, companies can secure preferential pricing tiers and guarantee component availability even amid trade policy fluctuations. Lastly, investing in modular, skid-mounted adsorption units offers the flexibility to reconfigure capacity in response to changing feed compositions and emerging regulations. This modularity supports phased capital deployments and aligns capital expenditure with actual demand trajectories.

Detailing the Rigorous Multi-Source Research Framework Employed to Gather Validate and Analyze Data for Comprehensive Adsorption Equipment Market Insights

The insights presented in this report are founded on a robust research framework that integrates multiple information sources and methodologies. Secondary research encompassed a thorough review of technical journals, patent filings, and regulatory publications to map the evolution of adsorption materials and system designs. Company filings and conference proceedings provided detailed intelligence on product launches, partnership announcements, and capital investment patterns.

Primary research involved structured interviews with equipment OEM executives, key end users spanning the chemical, water treatment, and healthcare industries, and material science specialists. These discussions yielded nuanced perspectives on operational challenges, technology adoption barriers, and future development priorities. Insights from channel partners and aftermarket service providers further contextualized the competitive landscape and regional deployment nuances.

Data validation was achieved through triangulation techniques, comparing quantitative inputs on equipment costs, cycle times, and adsorbent performance across independent sources. A proprietary weighting model was applied to assess technology readiness levels and supplier capabilities, ensuring that analysis reflects both current market realities and anticipated innovation trajectories. This methodological rigor underpins the credibility and actionability of the report’s findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adsorption Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adsorption Equipment Market, by Adsorbent Type

- Adsorption Equipment Market, by Technology

- Adsorption Equipment Market, by Process

- Adsorption Equipment Market, by Application

- Adsorption Equipment Market, by End-User Industry

- Adsorption Equipment Market, by Region

- Adsorption Equipment Market, by Group

- Adsorption Equipment Market, by Country

- United States Adsorption Equipment Market

- China Adsorption Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Findings and Strategic Imperatives to Illuminate the Direction of Next-Generation Adsorption Equipment and Associated Market Opportunities

The evolving adsorption equipment market is characterized by rapid technological advancements, shifting regulatory landscapes, and dynamic end-user demands. Key findings emphasize the growing role of advanced adsorbent materials in unlocking new application frontiers, while modular system architectures are redefining cost structures and operational flexibility. The cumulative effect of recent tariff measures has underscored the importance of resilient supply chains and strategic sourcing strategies.

Strategic imperatives for stakeholders center on digital integration, supply diversification, and modular deployment models. By embedding advanced process controls, companies can achieve higher uptime and more efficient adsorbent usage. Simultaneously, regional insights reveal that local partnerships and tailored service offerings are essential to navigate diverse regulatory regimes and feedstock profiles.

Looking ahead, continued innovation in adsorbent formulations is expected to generate incremental gains in selectivity and capacity, enabling adsorption equipment to address emerging contaminants and ultra-high purity requirements. Organizations that proactively adopt these technologies, while maintaining a vigilant approach to trade policy developments, will be well-positioned to capture value in this dynamic market. Ultimately, the strategic themes outlined here offer a roadmap for next-generation adsorption equipment solutions and associated market opportunities.

Connect with Associate Director of Sales & Marketing Ketan Rohom to Access Exclusive Insights and Secure a Comprehensive Adsorption Equipment Market Report

Connect with Ketan Rohom to discuss how our tailored insights can address your organization’s strategic goals in adsorption equipment and enable informed investment decisions in this dynamic market landscape

- How big is the Adsorption Equipment Market?

- What is the Adsorption Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?