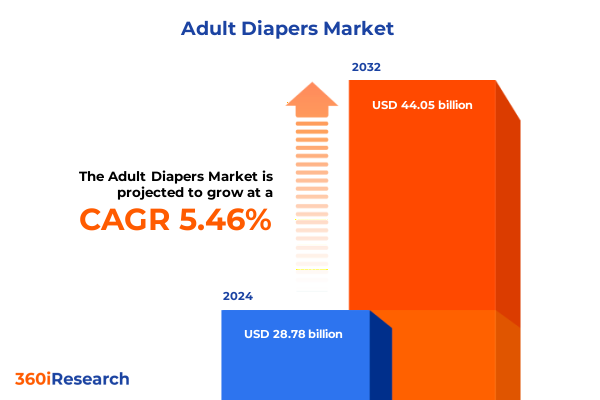

The Adult Diapers Market size was estimated at USD 30.33 billion in 2025 and expected to reach USD 31.96 billion in 2026, at a CAGR of 5.47% to reach USD 44.05 billion by 2032.

Emerging demographic trends and evolving consumer behaviors are redefining the adult diaper industry landscape with significant innovation and expanded market opportunities

Across developed and emerging economies alike, the adult diaper market finds itself at the intersection of demographic transformation and shifting consumer expectations. An aging global population combined with increased life expectancy has elevated incontinence management from a predominantly clinical concern to a mainstream consumer priority. Parallel to this, healthcare professionals and advocacy groups have amplified awareness, reducing stigma and encouraging end users and caregivers to explore a wider range of products. Consequently, manufacturers have responded with more discreet designs, advanced materials, and enhanced comfort features that resonate with modern lifestyles.

Moreover, the evolution of digital commerce has unlocked new growth channels, enabling consumers to access specialized products more conveniently than ever before. E-commerce platforms and direct-to-consumer models are rapidly gaining traction, prompting established distributors and traditional retailers to reevaluate their omnichannel strategies. As a result, distribution networks are adapting; wholesalers, pharmacies, supermarkets and online marketplaces are converging around flexible logistics and subscription-based purchasing to satisfy evolving customer demands. Against this backdrop of demographic shifts and retail transformation, the stage is set for profound innovation and strategic repositioning across the adult diaper industry.

Technological breakthroughs and shifting regulatory frameworks are driving transformative shifts in the adult diaper market dynamics and competitive choreography

Innovation continues to shape the adult diaper market in unprecedented ways. Recent advances in materials science have produced super-absorbent polymers that not only enhance fluid retention but also improve wearer comfort through improved breathability and reduced bulk. Manufacturers are experimenting with odor-neutralizing technologies and antimicrobial finishes that extend product lifespan and boost caregiver confidence. Simultaneously, regulatory bodies in key markets have introduced more stringent performance standards and labeling requirements, compelling producers to invest in rigorous testing protocols and quality assurance systems.

Shifting policy frameworks are also influencing strategic decisions. Governments are increasingly recognizing incontinence care as a vital component of public health spending, transferring reimbursement schemes and institutional procurement rules to stimulate domestic manufacturing. These regulatory incentives coincide with an accelerated digital health ecosystem, where telemedicine consultations and remote patient monitoring integrate device usage data to drive personalized care pathways. Consequently, industry players are forging partnerships with healthcare providers, technology firms and research institutions to co-develop smart textile solutions. This convergence of clinical oversight, product innovation and policy reform is reshaping competitive dynamics and creating fertile ground for new entrants and cross-sector collaborations.

Escalating tariff measures and policy adjustments have delivered a cumulative impact on supply chains and pricing dynamics in the adult diaper sector

In early 2025, a succession of tariff adjustments imposed by the United States on imported hygiene and medical products reverberated throughout the adult diaper supply chain. Raw material providers in Asia faced duties that ranged from intermediate polymer shipments to fabric laminates, effectively driving input costs upward. Domestic producers encountered a dual challenge: sourcing alternatives from higher-cost domestic mills or negotiating longer-term contracts with global suppliers at premium rates. This environment has compelled manufacturers to reassess their sourcing strategies, introducing geographic diversification and nearshoring as critical risk-mitigation measures.

Furthermore, the cumulative impact of these tariffs has extended to logistics and distribution. Increased customs duties have amplified shipping costs and port demurrage fees, subsequently affecting inventory management and lead-time forecasting. Secondary distribution networks-especially those reliant on just-in-time replenishment-have experienced margin compression as they absorb or pass through cost increases to end users. In response, many industry leaders have implemented dynamic pricing frameworks and hedging mechanisms to stabilize margins. Meanwhile, strategic stakeholders are exploring vertical integration opportunities in raw material production to shield themselves from prolonged tariff volatility and maintain supply consistency.

Nuanced segmentation insights reveal differentiated growth potentials across product types absorbency levels age brackets end users and distribution channels

An examination by product type reveals that belted undergarments resonate with consumers seeking adjustable support, particularly in institutional settings requiring frequent changes. Pull on solutions, characterized by their resemblance to conventional underwear, gain traction among younger adults and active seniors who value discretion and ease of use. Tape-based variants maintain a steady share where caregivers prioritize fast changes and customizable fits for patients with limited mobility.

When considering age groups, individuals between eighteen and forty often prioritize slim profiles and odor control as they manage early-stage bladder issues while maintaining active lifestyles. Those forty-one to sixty-four tend to adopt medium-absorbency products as they balance work commitments with emerging health considerations. In contrast, the sixty-five-and-above demographic heavily favors ultra-absorbency levels, emphasizing overnight protection and skin health features to support comfort and independence in daily routines.

Turning to absorbency levels more broadly, light options continue to appeal in cases of minor leakage, whereas medium and heavy products serve as the backbone of day-to-day management. Ultra-absorbent formats address more severe incontinence and are increasingly specified in long-term care facilities. Beyond individual users, institutional end users shape procurement volumes: home care demands flexibility and consumer choice, while clinics, elderly care facilities, and hospitals adhere to stringent bulk-ordering cycles and regulatory compliance. Finally, distribution channels vary by consumer preference and point of care; hospital pharmacies fulfill specialized clinical requirements, online retail caters to privacy and convenience, pharmacies and drug stores balance professional guidance with accessibility, and supermarkets and hypermarkets offer broad reach and promotional visibility.

This comprehensive research report categorizes the Adult Diapers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Age Group

- Absorbency Level

- End User

- Distribution Channel

Regional market trajectories across the Americas Europe Middle East Africa and Asia Pacific illustrate diverse growth drivers and strategic imperatives

In the Americas, North America leads with robust reimbursement frameworks, high per-capita spending, and strong retail networks that integrate online and brick-and-mortar channels. Latin American markets, while smaller, show early signs of consumer education campaigns and rising urbanization that collectively drive increasing acceptance of hygiene products beyond traditional brands.

Within Europe Middle East and Africa, Western Europe benefits from mature healthcare systems and well-defined regulatory oversight that incentivize premium performance products. Meanwhile, the Middle East shows promising uptake driven by public-sector tenders and private hospital expansions. Africa remains nascent, but regional partnerships and NGO-led health initiatives are stimulating foundational demand, particularly in key urban centers.

Asia Pacific exhibits the most varied trajectory. Japan and South Korea represent advanced markets with government subsidies for senior care and a deep penetration of innovative product lines. China and India are witnessing rapid demographic transitions, amplifying demand for value-oriented solutions and private label innovations. Southeast Asian countries combine rising disposable incomes with digital retail adoption, creating fertile ground for direct-to-consumer models and regional manufacturing hubs. These disparate growth drivers across Americas, Europe Middle East Africa and Asia Pacific underscore the need for region-specific strategies that align product offerings with local purchasing power, regulatory contexts and cultural preferences.

This comprehensive research report examines key regions that drive the evolution of the Adult Diapers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive benchmarks underscore the strategic maneuvers innovations and portfolio expansions shaping leading adult diaper manufacturers’ market positions

The competitive landscape features a spectrum of established global conglomerates and nimble regional specialists. Leading multinational manufacturers continue to diversify their portfolios, investing in next-generation materials and securing patents for advanced fluid management systems. They leverage deep R&D capabilities to pioneer sustainable product lines that incorporate bio-based polymers and recyclable components, targeting both consumer preferences and evolving environmental regulations.

Meanwhile, mid-sized companies and regional incumbents focus on agile innovation, leveraging local market insights to develop tailored solutions. These players often form strategic alliances with healthcare providers and logistics partners to optimize distribution networks. Recent mergers and acquisitions have bolstered their scale, enabling investments in automated manufacturing and quality inspection systems. At the same time, private-label entrants are intensifying competition by offering value-driven alternatives in supermarkets and online channels, driving category expansion and price segment cannibalization.

Collectively, market leaders are expanding their footprints through greenfield production facilities and contract manufacturing agreements. They also engage in digital transformation initiatives, deploying data analytics to forecast demand trends and personalize marketing campaigns. As competitive benchmarks evolve, success hinges on the ability to integrate product innovation, operational efficiency, and channel diversification.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adult Diapers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abena A/S

- Cardinal Health, Inc.

- Chiaus (Fujian) Industrial Development Co., Ltd.

- Domtar Corporation

- DSG International Ltd.

- Essity AB (publ)

- Fuburg Hygiene Products (China) Co., Ltd.

- Hengan InternationPaul Hartmann AG

- Hollister Incorporated

- Kao Corporation

- Kimberly-Clark Corporation

- Medline Industries, L.P.

- Nippon Paper Industries Co., Ltd.

- Nobel Hygiene Care India Private Limited

- Ontex Group NV

- Paul Hartmann AG

- The Procter & Gamble Company

- TZMO S.A.

- Unicharm Corporation

- Vinda International Holdings Limited

Actionable recommendations outline strategic initiatives for industry leaders to capitalize on emerging consumer trends technological advances and policy environments

Industry leaders should prioritize the development of sustainable materials, investing in next-generation polymers and closed-loop recycling systems to meet rising environmental standards and differentiate their brands. Concurrently, expanding omnichannel distribution models-including subscription services and telemedicine integration-will enhance customer loyalty and capture recurring revenue.

Diversifying the supplier base across multiple geographies will buffer the effects of future tariff fluctuations and logistic disruptions. Establishing strategic partnerships with regional mills and fabric innovators can secure preferential access to critical inputs while accelerating product development cycles. In addition, companies should cultivate relationships with healthcare networks and long-term care institutions, co-creating specialized programs that integrate training, product trials, and digital monitoring tools.

Finally, embracing advanced analytics will enable precise segmentation targeting and dynamic pricing mechanisms. By leveraging consumer usage data and predictive models, organizations can tailor product assortments to demographic cohorts and usage patterns. These actionable measures will position businesses to capitalize on demographic shifts, evolving policy landscapes, and emerging technological opportunities.

Rigorous research methodology outlines the analytical framework primary secondary data sources and validation processes underpinning this comprehensive executive summary

The foundation of this executive summary rests on a multifaceted research framework. Initial secondary research involved reviewing peer-reviewed journals, industry publications, regulatory filings, and trade association reports to map the competitive and policy landscapes. These insights informed the development of customized questionnaires for primary interviews with key stakeholders, including manufacturers, raw material suppliers, healthcare practitioners, and distribution partners.

Subsequent primary data collection comprised structured interviews and online surveys with decision-makers across developed and emerging markets. Expert workshops validated emerging themes and triangulated data points, ensuring accuracy and relevance. The analytical process integrated cross-validation techniques, where quantitative findings were checked against qualitative inputs to eliminate bias and confirm consistency.

Finally, an in-depth competitive analysis assessed product portfolios, innovation pipelines, and strategic initiatives of leading players. The research adhered to rigorous quality controls throughout, including editorial reviews and methodological audits, culminating in a robust and transparent assessment of the adult diaper market ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adult Diapers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adult Diapers Market, by Product Type

- Adult Diapers Market, by Age Group

- Adult Diapers Market, by Absorbency Level

- Adult Diapers Market, by End User

- Adult Diapers Market, by Distribution Channel

- Adult Diapers Market, by Region

- Adult Diapers Market, by Group

- Adult Diapers Market, by Country

- United States Adult Diapers Market

- China Adult Diapers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Conclusive reflections synthesize critical insights on demographics innovation tariffs segmentation regional dynamics and competitive landscapes shaping future growth

The adult diaper market is at a pivotal juncture shaped by demographic imperatives, material innovation, trade policy dynamics, and nuanced segmentation opportunities. Aging populations and reduced stigma have elevated consumer expectations, compelling manufacturers to deliver discreet, high-performance products through diverse channels. Technological breakthroughs in absorbent materials and smart textile integrations signal a new era of product differentiation, while regulatory incentives and tariff pressures continue to redefine sourcing strategies and cost structures.

Segmentation insights emphasize the importance of customized solutions across product types, age cohorts, absorbency levels, end-user environments, and distribution channels, highlighting the necessity of precision targeting. Regional variations across the Americas, Europe Middle East Africa and Asia Pacific further underscore the importance of localized approaches that reflect regulatory frameworks and cultural preferences. Against this backdrop, competitive intensity remains high as global leaders and regional specialists vie for market share through sustainability initiatives, digital transformations and strategic alliances.

In conclusion, the intersection of macroeconomic trends, policy developments and consumer-centric innovation presents both challenges and opportunities. Market participants that adopt resilient supply chains, prioritize sustainable product development and leverage data-driven insights will be well-positioned to capture growth and maintain competitive advantage in the evolving adult diaper sector.

Engage directly with our Associate Director of Sales & Marketing to unlock tailored insights and leverage the full potential of our adult diaper market research report

For organizations seeking to deepen their strategic understanding and gain unparalleled visibility into consumer behavior competitive dynamics and regulatory influences within the adult diaper market, a direct conversation with Ketan Rohom offers a decisive next step. As Associate Director of Sales & Marketing, he brings a wealth of insights and context that complement the comprehensive findings included in our full report. Engaging with Ketan will enable you to explore bespoke data scenarios, clarify specific queries, and tailor the research to support your unique corporate objectives.

By reaching out to Ketan Rohom, you can arrange a detailed briefing that delves into advanced segmentation analyses, sensitivity assessments under various tariff conditions, and regional opportunity matrices. This personalized interaction ensures that the insights you obtain are aligned with your strategic priorities and operational timelines. Initiate contact today to secure early access to executive summaries, thematic deep dives, and interactive dashboards that drive informed decision-making and competitive advantage. Let Ketan guide you through the practical applications of our research and support your organization’s growth ambitions in an increasingly dynamic adult diaper market.

- How big is the Adult Diapers Market?

- What is the Adult Diapers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?