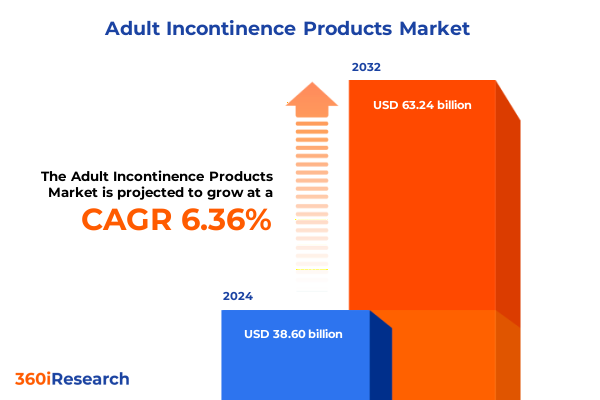

The Adult Incontinence Products Market size was estimated at USD 40.86 billion in 2025 and expected to reach USD 43.26 billion in 2026, at a CAGR of 6.43% to reach USD 63.24 billion by 2032.

An In-Depth Exploration of Adult Incontinence Solutions Setting the Stage for Strategic Decision-Making in a Rapidly Evolving Healthcare Environment

The adult incontinence market stands at a pivotal juncture, driven by shifting demographics, evolving consumer expectations, and rapid innovation in product design. As life expectancy continues to rise globally, the proportion of individuals experiencing incontinence has grown, placing heightened focus on the development of discreet, comfortable, and highly effective solutions. In this environment, manufacturers and stakeholders must align strategies with the nuanced needs of an aging population while balancing considerations of sustainability, regulatory compliance, and cost efficiency. With pressure mounting on healthcare systems to manage long-term care expenses, there is an increasing imperative for products that not only enhance quality of life but also reduce the burden on formal care networks. Against this backdrop, this executive summary explores the critical dynamics shaping the adult incontinence segment, offering a comprehensive overview that informs decision-making and strategic planning.

Beyond demographic trends, the market has witnessed a surge in consumer empowerment and information accessibility. Users are more informed than ever, leveraging digital platforms to compare product features, read user reviews, and access telehealth consultations. This transformation demands that suppliers elevate their engagement strategies, harnessing data analytics to personalize offerings and foster brand loyalty. At the same time, advancements in materials science are unlocking new opportunities for ultra-thin, highly absorbent cores, breathable fabrics, and form-fitting designs that reduce skin irritation. As stakeholders navigate this confluence of demographic shifts, technological progress, and heightened consumer expectations, establishing a clear strategic vision is paramount. This introduction sets the stage for in-depth analysis of the trends, challenges, and opportunities that will define the industry’s trajectory through and beyond 2025.

Exploring the Transformative Demographic Technological and Consumer-Driven Shifts Reshaping the Adult Incontinence Market Dynamics and Innovation Trajectory

The adult incontinence sector is undergoing transformative shifts driven by converging demographic, technological, and consumer behavior trends. On the demographic front, aging populations in North America, Europe, and parts of Asia-Pacific have spurred demand for more specialized incontinence solutions. This aging wave is complemented by rising chronic health conditions, leading to a broader base of potential consumers. Moreover, urbanization and changing lifestyles are reshaping perceptions around product usage and discreetness, with a clear preference for low-profile designs that integrate seamlessly into daily routines.

Technological innovation is another catalyst for change. Manufacturers are investing in advanced materials that improve absorbency while minimizing bulk, and integrating odor control mechanisms to enhance user confidence. Simultaneously, digital transformation has elevated the role of data-driven insights, with wearables and smart textiles poised to deliver real-time feedback on hydration levels and skin health. Furthermore, the integration of telemedicine services is enabling remote consultations and product recommendations, thereby bridging the gap between clinical expertise and consumer self-care practices. As a result, companies that leverage cross-disciplinary collaboration between materials scientists, data analysts, and healthcare professionals will capture disproportionate value.

Consumer-driven sustainability considerations are also reshaping the landscape. A growing cohort of environmentally conscious purchasers is demanding reusable and biodegradable product alternatives, prompting suppliers to reevaluate their supply chains and manufacturing processes. In this vein, partnerships with recycling initiatives and investment in renewable raw materials have become hallmarks of forward-thinking organizations. Moreover, e-commerce platforms and direct-to-consumer channels have democratized access to novel products, enabling smaller innovators to compete with established brands. Collectively, these shifts underscore the necessity for agility, collaboration, and a relentless focus on consumer-centric innovation.

Analyzing the Combined Consequences of 2025 United States Tariff Adjustments on Supply Chain Sourcing Material Costs and Pricing Strategies

In 2025, adjustments to United States tariffs have exerted significant repercussions across the adult incontinence supply chain, affecting raw material sourcing, finished goods imports, and pricing frameworks. Historically reliant on specialized superabsorbent polymers and nonwoven fabrics sourced from Asia and Europe, manufacturers have encountered heightened import duties that have eroded traditional cost structures. Consequently, procurement teams have accelerated diversification efforts, engaging alternative suppliers in nearshore locations and exploring emerging markets with favorable trade agreements. This strategic pivot underscores the intricate relationship between trade policy and operational resilience in a highly specialized manufacturing ecosystem.

Amid these dynamics, manufacturers have been compelled to reassess pricing and product design. With elevated duties inflating component costs, product development teams are optimizing material blends to maintain performance standards while controlling expenses. Innovative formulations with locally sourced cellulose fibers and bio-based superabsorbents are gaining traction, enabling cost-competitive alternatives without sacrificing absorbency or comfort. At the same time, forward integration strategies-such as in-house polymer compounding and vertical partnerships with raw material producers-are being deployed to mitigate tariff exposure and enhance supply chain visibility. This recalibration of sourcing models is fostering a new paradigm of localized manufacturing clusters that balance efficiency with geopolitical adaptability.

The cumulative impact extends to distribution and retail strategies as well. Elevated landed costs have prompted channel partners to renegotiate margin structures, leading some to incentivize higher-value product tiers or subscription-based delivery models that smooth revenue streams and improve inventory management. Furthermore, collaborative initiatives between manufacturers and logistics providers are reducing transit times and warehousing expenses, offsetting some of the tariff-induced cost inflation. As stakeholders look beyond temporary relief measures, the emphasis has shifted toward building a resilient, tariff-agnostic framework that can endure future policy fluctuations while maintaining consistent product availability and affordability for the end user.

Unraveling Core Segmentation Insights Across Product Forms and Distribution Channels to Illuminate Consumer Preferences and Market Access Pathways

The adult incontinence market exhibits a multifaceted structure when examined through the lens of product form and distribution channel segmentation. In the realm of product form, consumer demand is met through specialized configurations designed to address varying levels of urinary and fecal incontinence. Diapers and briefs remain the core category, bifurcated into pull-on designs that mimic traditional underwear and tab-fastened solutions that provide adjustable fit and ease of changing. Alongside these, pads and liners offer a lower-profile option, with disposable variants appealing to those seeking convenience and reusables attracting a segment mindful of environmental impact. Protective underwear, an intersectional category combining absorbent cores with briefs-like comfort, is further diversified by belted and pull-on styles, while underpads deliver targeted protection for bedding and seating surfaces in both disposable and washable formats. This nuanced segmentation underscores the importance of product differentiation and targeted innovation across user demographics and care settings.

Distribution channels add a complementary dimension, shaping market access and consumer engagement strategies. Offline pathways remain vital, with retail pharmacies and supermarket or hypermarket chains serving as the primary touchpoints for in-store purchases, often leveraging point-of-sale promotions and pharmacists’ recommendations. Conversely, the proliferation of e-commerce and online pharmacy platforms has unlocked new avenues for discreet purchasing and subscription models, enhancing convenience and personalization. Each channel exhibits distinct consumer behaviors: offline shoppers may prioritize immediate availability and in-person guidance, while online buyers value home delivery, privacy, and access to broader assortments. Recognizing these channel-specific dynamics, leading suppliers are refining go-to-market approaches, integrating omnichannel frameworks that unify inventory management, digital marketing, and customer service to deliver seamless experiences regardless of the point of purchase.

This comprehensive research report categorizes the Adult Incontinence Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Usage

- Distribution Channel

- End User

- Material

Delineating Distinct Regional Characteristics within the Americas EMEA and Asia-Pacific Markets Influencing Incontinence Product Adoption and Channel Performance

Regional dynamics play a pivotal role in shaping the adult incontinence landscape, beginning with the Americas, where a maturity in product adoption has fostered a competitive environment marked by innovation and premiumization. Healthcare providers and insurers in North America are increasingly advocating for value-based solutions that align product performance with cost containment objectives. Consequently, product portfolios emphasize clinical efficacy, skin health benefits, and discrete form factors, with a growing focus on integrated care programs that bundle product supply with nursing support and telehealth follow-up.

In Europe, Middle East & Africa, the scene is more heterogeneous but equally dynamic. Western Europe parallels North America in its embrace of advanced materials and digital services, while emerging markets within Eastern Europe and the Middle East are encountering rapid growth driven by expanding healthcare infrastructure and rising consumer awareness. Regulatory frameworks in the European Union continue to shape product standards, particularly regarding biocompatibility and environmental sustainability, prompting suppliers to adhere to stringent packaging and disposal regulations. In Africa, fragmented distribution networks and variable cold chain logistics have driven innovators to develop low-cost, low-dependency formats and partner with local distributors to enhance rural outreach.

The Asia-Pacific region represents a blend of high-growth potential and diverse market maturity. Japan’s advanced elderly care facilities have spurred premium product uptake, supported by government subsidies for long-term care. Simultaneously, large populations in China and India are increasingly recognizing the importance of incontinence management, leading to rapid expansion of both organized retail chains and online marketplaces. Across Asia-Pacific, cultural perceptions of incontinence remain nuanced, requiring marketing approaches that balance dignity, privacy, and social acceptance. Consequently, localized product adaptations-such as size ranges, graphic designs, and fragrance options-play a critical role in driving consumer adoption and loyalty.

This comprehensive research report examines key regions that drive the evolution of the Adult Incontinence Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements Partnerships and Innovations by Leading Manufacturers Shaping Competitive Dynamics in the Incontinence Product Industry

Key industry participants have been actively forging alliances, launching differentiated products, and investing in sustainable innovations to capture market leadership. A leading global hygiene company has prioritized next-generation superabsorbent technologies that reduce product thickness while enhancing fluid retention, leveraging partnerships with chemical firms to co-develop bio-based alternatives. Another top-tier manufacturer has expanded its direct-to-consumer digital storefront, integrating telehealth consultations and personalized product recommendations to strengthen customer loyalty and gather actionable usage data.

Mid-sized innovators are also making strategic moves, particularly in the area of reusable and eco-friendly offerings. By collaborating with textile research institutes, they have introduced washable pads with antimicrobial coatings and modular designs that cater to varied incontinence levels. These companies are capitalizing on nimble production models and niche marketing to challenge legacy players. Meanwhile, a prominent Japanese supplier known for its adult diaper brands has diversified into adjacent categories such as smart incontinence sensors and connected care platforms, illustrating a broader vision of holistic patient management.

In parallel, private equity-backed consolidators have pursued tuck-in acquisitions of regional specialists, accelerating portfolio breadth and geographic reach. This wave of consolidation is driving standardization of quality benchmarks and fostering economies of scale, particularly in procurement and distribution logistics. As a result, the competitive environment is characterized by a dual-track landscape: large global leaders investing in cross-region synergies and digital capabilities, and agile challengers innovating around product differentiation and sustainability credentials.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adult Incontinence Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abena Holding A/S

- Attends Healthcare Products, Inc.

- B. Braun Melsungen AG

- Cardinal Health, Inc.

- Coloplast A/S

- Daio Paper Corporation

- Domtar Corporation

- Domtar Corporation

- Drylock Technologies SA

- Essity AB

- Fuburg Hygiene Products (China) Co., Ltd.

- Hengan International Group Company Limited

- Kao Corporation

- Kimberly-Clark Corporation

- Medline Industries, LP

- Medtronic PLC

- Ontex Group NV

- Paul Hartmann AG

- The Procter & Gamble Company

- TZMO S.A.

- Unicharm Corporation

Actionable Strategic Initiatives to Drive Growth Enhance Operational Resilience and Foster Sustainable Competitive Advantage in Adult Incontinence Products

Industry leaders can harness several strategic imperatives to navigate current challenges and seize emerging opportunities. First, prioritizing the development of sustainable materials-such as bio-based superabsorbents and biodegradable nonwovens-can address both regulatory pressures and shifting consumer values. By collaborating with research institutions and raw material suppliers, companies can accelerate the commercialization of greener product lines, thereby differentiating their portfolios while mitigating environmental impact.

Second, strengthening supply chain resilience through diversification and nearshoring initiatives can help buffer against geopolitical volatility and tariff fluctuations. Establishing regional manufacturing hubs close to key consumer markets not only reduces logistic complexities but also enables quicker response to local demand changes and regulatory requirements. Moreover, forward-thinking organizations should deploy advanced analytics tools to forecast demand patterns, optimize inventory levels, and detect potential disruptions before they materialize.

Third, embracing digital engagement models that blend e-commerce, telehealth, and personalized subscription services can deepen consumer relationships and generate recurring revenue streams. By leveraging data analytics and machine learning, suppliers can offer tailored product bundles, predictive reorder reminders, and virtual care solutions that extend beyond one-time transactions. Finally, driving value-based partnerships with healthcare providers, insurers, and caregiving organizations can unlock collaborative care pathways, integrating product supply with clinical support and outcome tracking to demonstrate holistic benefits across patient populations.

Detailing a Comprehensive Research Framework Integrating Quantitative Data Collection Qualitative Expert Insights and Rigorous Validation Protocols

The analysis presented in this report is founded on a robust research methodology that combines both quantitative and qualitative approaches. Initial data collection involved a thorough review of publicly available documents, industry reports, and regulatory filings to establish foundational context. This was complemented by primary interviews with senior executives, product developers, and procurement leaders across the hygiene and healthcare sectors to capture firsthand insights into strategy, innovation pipelines, and operational challenges.

Quantitative analyses were performed using a structured survey framework distributed to a cross-section of end users, healthcare professionals, and distribution partners in key geographies. Responses were statistically validated to ensure representation across demographic cohorts, product types, and channel preferences. In parallel, qualitative research included structured focus groups and expert panels, providing depth on consumer behavior, unmet needs, and emerging trends. All findings underwent rigorous triangulation, cross-referencing primary and secondary sources to verify consistency and accuracy, while maintaining confidentiality and compliance with ethical research standards.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adult Incontinence Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adult Incontinence Products Market, by Product Form

- Adult Incontinence Products Market, by Usage

- Adult Incontinence Products Market, by Distribution Channel

- Adult Incontinence Products Market, by End User

- Adult Incontinence Products Market, by Material

- Adult Incontinence Products Market, by Region

- Adult Incontinence Products Market, by Group

- Adult Incontinence Products Market, by Country

- United States Adult Incontinence Products Market

- China Adult Incontinence Products Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Strategic Imperatives to Equip Stakeholders for Informed Decision-Making in the Adult Incontinence Landscape

In summary, the adult incontinence market is navigating a complex interplay of demographic growth, technological innovation, and policy-driven supply chain adjustments. Stakeholders must balance cost pressures with the imperative to deliver discreet, high-performance products that align with evolving consumer values. Segmentation insights reveal the importance of tailored solutions across diverse product forms and channels, while regional analysis underscores the need for localized strategies. Competitive dynamics are shaped by both global leaders scaling digital capabilities and agile challengers pursuing sustainability-driven differentiation. By adopting the actionable recommendations outlined herein-spanning materials innovation, supply chain resilience, and customer-centric engagement-industry participants can position themselves for sustained advantage. As the market continues to evolve, agility and strategic foresight will be critical in unlocking new growth trajectories and delivering meaningful value to end users.

Engage with Ketan Rohom to Secure Exclusive Access to the Comprehensive Adult Incontinence Market Research Report and Empower Your Strategic Vision

For industry professionals ready to translate insights into action and gain a competitive edge in the adult incontinence arena, this research delivers the critical intelligence to drive strategic growth. To obtain the full-depth report with comprehensive data, proprietary analysis, and tailored recommendations, contact Ketan Rohom, Associate Director of Sales & Marketing. Unlock the strategic roadmap designed to inform product innovation, supply chain optimization, and market positioning initiatives, and embark on a data-driven journey to elevate your organization’s performance in this evolving landscape

- How big is the Adult Incontinence Products Market?

- What is the Adult Incontinence Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?