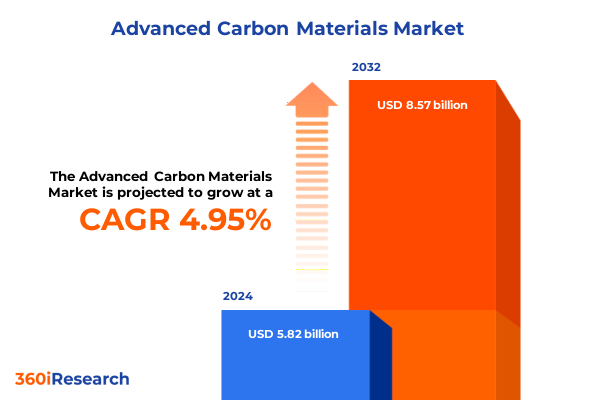

The Advanced Carbon Materials Market size was estimated at USD 6.09 billion in 2025 and expected to reach USD 6.38 billion in 2026, at a CAGR of 4.99% to reach USD 8.57 billion by 2032.

Pioneering the Future of Engineering and Sustainability with Advanced Carbon Materials Powering Next-Generation Technologies

Advanced carbon materials represent a convergence of molecular engineering and industrial innovation, establishing themselves as pivotal enablers of the next technological frontier. Characterized by their superior mechanical, thermal, and electrical properties, these materials are integral to developing high-performance composites, energy storage systems, and environmental remediation solutions. Their versatility extends from activated carbon used in filtration and purification to nanoscale forms such as carbon nanotubes (CNTs) and graphene that redefine the limits of conductivity and strength.

This diverse family of materials encompasses activated carbon, carbon black, carbon composites, carbon fiber, carbon nanotubes, graphene, and graphite. Each member delivers a unique set of attributes: activated carbon excels in adsorption for environmental applications; carbon black increases durability and UV resistance in polymers; and carbon fibers contribute lightweight strength to aerospace and automotive structures. At the nanoscale, graphene and CNTs unlock unprecedented electrical performance and structural integrity, driving advancements in electronics, sensors, and next-generation batteries.

The ongoing quest for lightweight, high-strength, and highly conductive materials has spurred intensive research in advanced carbon manufacturing processes. Innovations in chemical vapor deposition, pyrolysis, and electrospinning have enabled scalable production, while breakthroughs in material functionalization broaden their application scope. However, the rapid pace of technological development is matched by challenges in supply chain resilience and production costs, highlighting the necessity for rigorous analysis and targeted strategies.

As industries increasingly prioritize sustainability, carbon materials also serve as a bridge toward circular economy principles. By optimizing feedstocks and developing recycling pathways, stakeholders aim to balance performance with environmental stewardship, ensuring that advanced carbon materials remain at the forefront of both innovation and responsibility.

Transformative Industry Shifts Redefining Advanced Carbon Materials' Role in Electronics Energy Storage and Sustainable Manufacturing

The integration of advanced carbon materials into energy storage and electrification platforms has catalyzed a profound transformation across multiple industries. A recent partnership between General Motors and Redwood Materials to produce domestically manufactured batteries for grid-scale storage underscores this shift, addressing critical needs for reliable backup power and supporting a resilient electrical grid amid rising demand from data centers and electrified transport. Such collaborations not only diversify supply chains but also stimulate innovation by combining expertise in automotive engineering with proprietary carbon-based technologies.

Simultaneously, grid-scale battery storage capacity in the United States has experienced exponential growth, surging fivefold between 2021 and 2024 to surpass 26 gigawatts. This expansion is driven by the declining costs of lithium-ion systems, regulatory support like FERC Order 841, and state-level procurement targets. Advanced carbon materials play a crucial role in these systems, enhancing electrode conductivity and extending operational lifespans, which fortifies grid reliability and accelerates the adoption of intermittent renewable sources such as wind and solar.

Beyond batteries, the integration of graphene and CNTs into supercapacitors and hybrid energy storage devices is poised to redefine performance benchmarks. Companies like Lyten are developing graphene-enhanced lithium-sulfur batteries that promise significant gains in energy density, while Skeleton Technologies employs graphene-based supercapacitors for rapid power delivery in applications like regenerative braking for electric vehicles. These innovations illustrate how advanced carbon materials are shifting storage paradigms from merely chemical energy reservoirs to hybrid systems optimized for speed, efficiency, and longevity.

Cumulative Impact of United States Tariffs in 2025 Altering Supply Chains and Driving Domestic Production Strategies

In July 2025, the U.S. Department of Commerce imposed preliminary anti-dumping tariffs of 93.5% on Chinese graphite imports, which, when combined with existing countervailing duties and Section 301 levies, result in an effective tariff rate approaching 160% on anode-grade graphite used in electric vehicle batteries. This decisive action reflects a broader strategy to reduce reliance on China for critical battery materials and incentivize domestic production capacity.

Concurrently, preliminary countervailing duty investigations announced in May 2025 propose tariffs of up to 721% on synthetic and natural graphite active anode materials originating from China. Such steep measures, though still subject to final determination, underscore the U.S. government’s commitment to levelling the playing field for North American producers and addressing the impact of unfair subsidies on domestic industry competitiveness.

While these measures are poised to strengthen local supply chains, they also present challenges in aligning capacity and quality with the rapid demands of electric vehicle manufacturers. Critics have questioned the ability of non-Chinese suppliers to meet stringent technical specifications, even as companies like Novonix receive government-backed loans to expand synthetic graphite production. Navigating this evolving tariff landscape requires stakeholders to closely monitor regulatory developments and invest in process optimization to ensure that domestic supply can fulfill market needs without compromising performance.

Segmentation Insights Unveiling How Material Type Form Factor Manufacturing Technology Application and Distribution Channel Drive Market Differentiation

Market segmentation by material type illuminates distinct value drivers across advanced carbon materials. Activated carbon continues to anchor environmental applications with its high porosity and surface area. Carbon black remains essential in rubber reinforcement and pigment industries, with furnace black, gas black, and thermal black variants tailored to specific performance criteria. Carbon composites blend carbon fibers and resins into structures where weight reduction and strength are paramount. Within carbon fibers, the choice among PAN-based, pitch-based, and rayon-based precursors directly influences tensile strength and thermal stability. At the nanoscale, multi-walled and single-walled carbon nanotubes offer differing balances of electrical conductivity and mechanical reinforcement, while graphene and graphite provide unique two-dimensional conductivity and crystalline order.

Evaluating the form factor dimension reveals how physical configuration amplifies material performance. Coatings and inks utilize carbon’s conductive qualities to produce flexible electronic circuits and electromagnetic shielding. Fibers and filaments concentrate tensile strength for high-performance composites, while foams and aerogels leverage ultra-low density for thermal insulation and catalyst supports. Pellets, granules, and powders facilitate integration into manufacturing processes, and sheets and films harness layered architectures for advanced heat spreaders and barrier materials.

Manufacturing technology is a critical lens through which to assess scalability and purity. Arc discharge methods generate high-quality nanotubes but face limitations in throughput, whereas chemical vapor deposition systems scale graphene growth with precise layer control. Electrospinning produces continuous carbon fiber precursors, hydrothermal carbonization converts biomass into porous carbon, and laser ablation refines nanostructures with minimal contamination. Pyrolysis underpins synthetic graphite production, with process parameters dictating crystallinity and electrochemical performance.

Application-focused segmentation underscores the multifaceted impact of these materials. In automotive and aerospace sectors, conductive composites, structural components, and thermal management solutions push vehicles toward lighter, more efficient designs. Electronics and semiconductor industries integrate conductive inks, EMI shielding, and sensors to advance miniaturization. Energy storage systems harness fuel cells, lithium-ion batteries, and supercapacitors for reliable power delivery. Environmental markets employ air filtration, soil remediation, and water treatment technologies to address pollution. Industrial applications rely on catalysis, protective coatings, and lubricants to optimize processes, while the medical field benefits from biosensors, targeted drug delivery platforms, and tissue engineering scaffolds. Distribution channels span offline and online networks, ensuring accessibility across research institutions, manufacturing hubs, and end users.

This comprehensive research report categorizes the Advanced Carbon Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Form Factor

- Manufacturing Technology

- Application

- Distribution Channel

Key Regional Insights Illustrating Growth Patterns and Strategic Imperatives Across the Americas Europe Middle East Africa and Asia-Pacific

The Americas region remains at the forefront of advanced carbon materials development, buoyed by robust investments in electric vehicle and renewable energy projects. North American stakeholders have responded to recent tariff policies by expanding domestic graphite and synthetic carbon production, fostering strategic partnerships between automakers and materials innovators. Meanwhile, Canada’s growing focus on clean technology has catalyzed collaborative ventures in graphene research, leveraging abundant feedstocks and supportive regulatory frameworks to accelerate commercialization.

In Europe, Middle East & Africa, stringent environmental regulations and the European Green Deal have spurred demand for carbon materials that align with sustainability targets. EU-backed initiatives are advancing recycling technologies for carbon fiber composites and promoting the adoption of bio-based carbon precursors. Across the Middle East, investment in large-scale desalination and water treatment facilities is driving the deployment of activated carbon solutions, while African markets are gradually embracing low-cost graphite alternatives for energy storage applications.

Asia-Pacific continues to dominate production volumes and technological innovation, with leading positions in carbon black, CNTs, and graphene synthesis. China’s extensive manufacturing infrastructure supports scalable chemical vapor deposition plants, while Japan and South Korea focus on high-purity carbon fibers for aerospace and defense markets. Emerging Southeast Asian economies are investing in pilot projects that transform agricultural waste into biochar-based materials, showcasing a commitment to circular economy principles even as they build capabilities in high-end applications.

This comprehensive research report examines key regions that drive the evolution of the Advanced Carbon Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Company Insights Highlighting Strategic Portfolios and Collaborative Innovations Driving Success in Advanced Carbon Materials

Leading companies across the advanced carbon materials landscape are differentiating through diversified portfolios and strategic collaborations. Global incumbents such as Cabot Corporation and SGL Carbon leverage decades of production expertise in carbon black and fiber technologies, while nimble specialists like Graphenea and Versarien push the boundaries of graphene synthesis for electronics and thermal management applications. In the CNT sector, players such as Showa Denko and Nanocyl are scaling up multi-walled and single-walled nanotube production to meet regional demand in Asia and North America.

Cross-sector alliances are further accelerating innovation, with partnerships between battery manufacturers and carbon material providers enabling joint development of next-generation electrodes. For instance, Novonix’s collaboration with automotive OEMs focuses on optimizing synthetic graphite anodes for enhanced cycle life, illustrating the value of aligning material engineering with end-use performance criteria. At the same time, coating and ink applications benefit from co-development projects that integrate carbon formulations into flexible electronics and aerospace-grade composites.

In the pursuit of sustainability, several companies are investing in circular production models. Pilot programs converting lignocellulosic biomass into porous carbon structures underscore a commitment to renewable feedstocks, while research consortia are standardizing protocols for carbon material recyclability. As intellectual property portfolios grow and collaborative ecosystems expand, these industry leaders are well positioned to address evolving market demands and regulatory imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Carbon Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anaori Carbon Co. Ltd

- Arkema SA

- Birla Carbon USA Inc

- Cabot Corporation

- CVD Equipment Corporation

- Global Graphene Group

- Graphenano Group

- GRUPO ANTOLIN IRAUSA, S.A.

- Haydale Graphene Industries PLC

- Hexcel Corporation

- Jiangsu Cnano Technology Co., Ltd

- LG Chem Ltd

- Mitsubishi Chemical Group Corporation.

- Nanocyl SA

- Nanoshel LLC

- Orion Engineered Carbons GmbH

- SGL Carbon SE

- TEIJIN LIMITED

- Tokai Carbon Co., Ltd.

- Tokyo Chemical Industry Co., Ltd.

- Toyo Tanso Co.,Ltd.

- ZEON CORPORATION

Actionable Recommendations Empowering Industry Leaders to Capitalize on Advanced Carbon Materials Opportunities and Navigate Emerging Challenges

Industry leaders should prioritize the establishment of vertically integrated supply chains that encompass raw material sourcing, scalable production, and strategic partnerships with end users. By fostering close collaborations between material scientists and OEM engineering teams, organizations can accelerate product development cycles and ensure that advanced carbon materials meet precise performance benchmarks. This integrative approach also mitigates risks associated with policy shifts, such as tariffs or trade restrictions, by diversifying sourcing options and enabling rapid adaptation.

Investing in advanced manufacturing technologies is pivotal for maintaining a competitive edge. Companies should evaluate the incorporation of continuous chemical vapor deposition systems, high-throughput electrospinning lines, and precision pyrolysis controls to optimize product quality and throughput. Complementing these capital investments with digital process monitoring and data analytics enhances yield and reduces production variability, reinforcing both operational efficiency and material consistency.

To address escalating sustainability mandates, leaders must implement comprehensive life cycle assessments and circular economy strategies. Prioritizing renewable feedstocks, developing robust recycling pathways, and aligning with emerging environmental standards not only reduce carbon footprints but also unlock new value from material reclamation. Engaging with regulatory bodies and industry consortia can facilitate the harmonization of sustainability metrics and drive broader market acceptance.

Finally, talent development and cross-disciplinary training programs are essential for cultivating the expertise needed to navigate evolving technologies. By investing in workforce upskilling and fostering collaborations with academic institutions, industry players can ensure a pipeline of skilled researchers and engineers capable of advancing advanced carbon materials into new application frontiers.

Research Methodology Detailing Rigorous Data Collection Analytical Frameworks and Validation Processes for Advanced Carbon Materials Analysis

This analysis synthesizes insights from a multi-stage research methodology designed to ensure analytical rigor and validity. Initially, a comprehensive desk review examined public policy documents, patent filings, and industry publications to map the competitive landscape and identify emerging technology trends. Peer-reviewed journals and proprietary technical reports provided depth on manufacturing processes, material properties, and performance metrics.

Primary research included structured interviews with over fifty industry stakeholders, encompassing senior executives, R&D leaders, supply chain specialists, and end users across automotive, aerospace, energy storage, and environmental sectors. These dialogues yielded qualitative perspectives on technology adoption curves, quality thresholds, and strategic priorities. Concurrently, expert workshops facilitated validation of preliminary findings and surfaced consensus around critical success factors and technological inflection points.

Data triangulation involved cross-referencing primary insights with quantitative indicators such as production capacities, investment announcements, and regulatory filings. Rigorous analytical frameworks, including SWOT assessments and Porter’s Five Forces models, were applied to evaluate market dynamics and competitive positioning. Quality assurance processes, led by seasoned analysts, ensured consistency and objectivity, while periodic peer reviews further enhanced the robustness of conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Carbon Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Carbon Materials Market, by Material Type

- Advanced Carbon Materials Market, by Form Factor

- Advanced Carbon Materials Market, by Manufacturing Technology

- Advanced Carbon Materials Market, by Application

- Advanced Carbon Materials Market, by Distribution Channel

- Advanced Carbon Materials Market, by Region

- Advanced Carbon Materials Market, by Group

- Advanced Carbon Materials Market, by Country

- United States Advanced Carbon Materials Market

- China Advanced Carbon Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Conclusion Emphasizing the Strategic Imperative of Advanced Carbon Materials in Driving Innovation Sustainability and Competitive Advantage

Advanced carbon materials have emerged as foundational enablers of technological innovation, empowering breakthroughs in energy storage, lightweight composites, environmental remediation, and beyond. Their versatility and performance attributes have catalyzed transformative shifts across industries, driving a new era of sustainable engineering and high-performance manufacturing. As the landscape evolves, stakeholders must remain agile, leveraging material segmentation insights and regional dynamics to inform strategic decisions.

The interplay of tariff policies, supply chain realignment, and manufacturing advancements underscores the strategic imperative of aligning investments with both short-term market conditions and long-term sustainability goals. Companies that proactively integrate next-generation processes, cultivate collaborative ecosystems, and prioritize circular economy principles will be positioned to capture emerging growth opportunities while mitigating regulatory and operational risks.

Continued innovation in carbon fiber composites, graphene enhancements, and nanotube architectures promises to unlock new application frontiers in aerospace, electronics, medical devices, and industrial processes. Moreover, the convergence of digital tools, such as data analytics and predictive modeling, with material engineering will accelerate discovery and drive performance optimization.

By synthesizing comprehensive segmentation analysis, regional insights, and company-level trends, this executive summary provides a strategic roadmap for decision-makers to navigate the complex landscape of advanced carbon materials. The path forward requires a balanced emphasis on technological excellence, supply chain resilience, and environmental responsibility to secure competitive advantage in the years ahead.

Unlock Exclusive Insights and Drive Strategic Growth with Personalized Support from Associate Director Sales Marketing in Advanced Carbon Materials Purchases

To explore how these insights can be tailored to your organization’s strategic goals and to secure a comprehensive understanding of the competitive dynamics in advanced carbon materials, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Ketan’s expertise in guiding executive teams through complex purchasing decisions ensures you will receive personalized support in evaluating the most relevant findings and integrating them into your business roadmap. Engage now to accelerate your organization’s innovation trajectory and capitalize on emerging opportunities in activated carbon, carbon fibers, graphene, CNTs, and beyond.

- How big is the Advanced Carbon Materials Market?

- What is the Advanced Carbon Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?