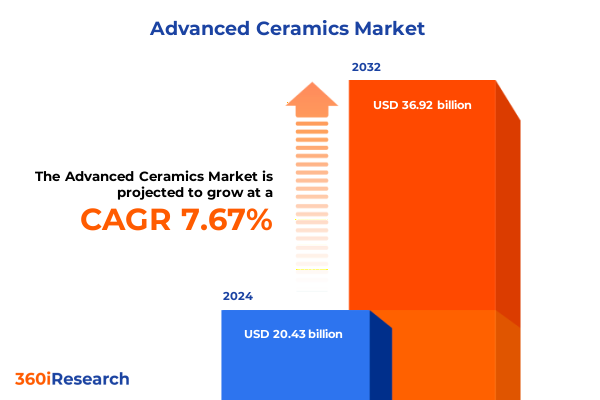

The Advanced Ceramics Market size was estimated at USD 21.89 billion in 2025 and expected to reach USD 23.50 billion in 2026, at a CAGR of 7.74% to reach USD 36.92 billion by 2032.

Explore emerging advanced ceramic materials and innovations revolutionizing performance standards across industries with exceptional durability and precision

In an era defined by relentless innovation and exacting performance standards, advanced ceramics have emerged as a cornerstone technology across a multitude of sectors. With intrinsic hardness, high temperature stability, and chemical inertness, these engineered materials enable breakthroughs in applications ranging from aerospace thermal barriers to semiconductor wafer processing. The accelerating pace of electrification, coupled with the demand for lightweight, wear-resistant components, has propelled these materials from niche laboratories to strategic boardroom discussions.

Against this backdrop, the convergence of digital manufacturing techniques and sustainability imperatives has intensified industry focus on next-generation formulations. Pioneering research continues to push the envelope on non-oxide chemistries such as silicon carbide and silicon nitride, while innovations in oxide systems expand capabilities in alumina, titania, and zirconia. As decision makers seek to optimize performance while mitigating total lifecycle costs, the advanced ceramics landscape has become a battleground for technological differentiation.

This executive summary lays the foundation for understanding the transformative shifts poised to redefine advanced ceramics markets. By examining the pivotal drivers, regulatory catalysts, and evolving competitive dynamics, readers will gain a clear view of where opportunities lie and which strategies will be essential for sustained leadership. Transitioning from introduction to deeper analysis, the following sections unpack the seismic changes across supply chains, tariff regimes, and segmentation frameworks that will shape future trajectories.

Uncover how digitalization, additive manufacturing techniques, and sustainability are reshaping the advanced ceramics landscape for performance and resilience

The advanced ceramics industry is undergoing a profound metamorphosis, driven by the intersection of digital transformation and environmental stewardship. Additive manufacturing techniques, once confined to prototyping, now produce complex ceramic geometries with tailored porosity and gradient structures, enabling components that were previously impossible to fabricate. Concurrently, process digitization-through real-time analytics and predictive modeling-has enhanced yield rates and reduced time to market, fundamentally altering production paradigms.

Moreover, sustainability considerations have spurred a shift toward low-carbon precursors and closed-loop recycling protocols. Manufacturers are integrating life-cycle assessments into material selection, fostering partnerships with energy providers to adopt renewable electricity for kiln operations. These changes are not incremental; they represent a wholesale reimagining of traditional supply chains, from precursor synthesis to powder handling and final sintering.

As industry players synchronize digital expertise with green manufacturing mandates, the competitive landscape is recalibrating. Agile startups leverage cloud-based process controls to outpace legacy incumbents, while established conglomerates invest in modular kilns and energy-efficient furnaces to maintain scale. Looking ahead, this ongoing convergence of technology and ethics will define the next frontier in advanced ceramics, creating new value chains and reshaping global collaboration models.

Examine the cumulative repercussions of recent United States tariff policies on advanced ceramics pricing shifts and domestic production resilience

In 2025, the United States implemented additional tariffs targeting key ceramic precursors and finished components, building upon earlier trade actions aimed at critical raw materials. These measures have introduced pronounced cost increases for imported powders such as silicon carbide feedstock, prompting downstream producers to re-evaluate supplier arrangements. Domestic pricing has experienced upward pressure, particularly in high-purity oxide and non-oxide segments, as manufacturers absorb or pass through these levies.

Simultaneously, supply chain resilience has come to the forefront of corporate risk strategies. Many end users have accelerated nearshoring efforts, expanding capacity at local sintering facilities and qualifying secondary sources in Mexico and Canada to mitigate border delays. While these adjustments have alleviated some procurement vulnerabilities, they have also strained logistics networks and elevated inventory carrying costs.

Notwithstanding these challenges, the tariff regime has stimulated renewed investment in domestic production capabilities. Capital flows toward capacity expansions in regionally distributed kiln sites and vertical integration into precursor synthesis are reshaping competitive dynamics. As a result, companies that combine price discipline with flexible manufacturing footprints stand to emerge stronger in the evolving landscape of US-driven ceramic trade policies.

Gain deep insights into how segmentation across material types, product categories, end user industries and distribution channels shapes strategic priorities

A nuanced appreciation of market segmentation is essential for navigating the advanced ceramics arena. Material classification underpins value propositions, with non-oxide ceramics like silicon carbide and silicon nitride valued for their superior thermal shock resistance and fracture toughness, whereas oxide variants such as alumina, titania, and zirconia deliver cost efficiency and corrosion resistance. Product differentiation further delineates composite ceramics, which integrate multilayered or fiber-reinforced structures to meet extreme mechanical demands, from monolithic ceramics, prized for their uniform isotropic properties in applications such as wear components.

Equally significant is the distribution of applications across end user industries. Aerospace and defense harness lightweight, high-temperature ceramics for turbine components and protective coatings; the automotive sector exploits silicon nitride bearings to enhance engine efficiency; electronics and electrical leverage capacitors and insulators to support miniaturization and thermal management; energy and environment capitalize on membranes and filters; industrial manufacturing employs bearings and seals to maximize uptime; while medical and healthcare utilize dental implants and orthopedic implants where biocompatibility is paramount.

Channel strategies add another layer of complexity, with offline routes encompassing direct sales agreements for high-value, custom parts, supplemented by distributor and supplier networks for broader inventory access. Online platforms are emerging as efficient conduits for standard powders and tooling, enabling rapid ordering and competitive pricing transparency. Together, these segmentation dimensions illuminate where growth pockets exist and where strategic investments will yield the greatest returns.

This comprehensive research report categorizes the Advanced Ceramics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Type

- End User Industry

- Distribution Channel

Explore key regional dynamics driving advanced ceramics demand and innovation across the Americas, Europe Middle East Africa and Asia Pacific markets

Regional variation in advanced ceramics adoption reflects diverse industrial priorities and policy environments. In the Americas, strong ties between automotive OEMs and tier-one suppliers have fueled demand for silicon nitride engine components, while burgeoning semiconductor fabs in the United States have driven growth in high-purity alumina substrates. Cross-border trade agreements have simplified raw material flows, yet recent tariff measures have incentivized additional domestic capacity, particularly in sintering operations.

Meanwhile, Europe, the Middle East and Africa present a tapestry of regulatory drivers and innovation clusters. European decarbonization targets propel low-carbon kiln technologies and recycled ceramic powders, and defense alliances maintain steady need for advanced armor ceramics. Manufacturers in the Middle East are investing in downstream fabrication facilities to diversify petrochemical economies, and niche R&D hubs in South Africa concentrate on wear-resistant ceramics for mining equipment.

Across Asia-Pacific, the interplay of low-cost production and large-scale end user sectors cements the region as a powerhouse of volume manufacturing. Japan continues to lead in precision ceramics for electronics, South Korea expands ultrafine zirconia production for medical devices, and China scales up silicon carbide wafer slicing for the burgeoning power electronics market. Each regional ecosystem exhibits unique competitive strengths and investment imperatives, underscoring the need for tailored market entry and partnership strategies.

This comprehensive research report examines key regions that drive the evolution of the Advanced Ceramics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identify leading advanced ceramics companies driving innovation through strategic partnerships and technological breakthroughs across global markets

The advanced ceramics industry is anchored by a group of companies that have consistently demonstrated technological leadership and strategic agility. Firms such as CoorsTek and Morgan Advanced Materials have invested heavily in proprietary process controls and vertically integrated precursor production to secure cost advantages. Meanwhile, CeramTec has focused on bespoke medical ceramics, leveraging advanced surface modification techniques to meet rigorous biocompatibility standards.

Innovation partnerships between material suppliers and end users have become increasingly common. Kyocera collaborates with automotive OEMs to co-develop engine components, integrating real-time sensor feedback into manufacturing workflows. Similarly, 3M’s specialty ceramics division works with electronics manufacturers on next-generation capacitor materials, optimizing dielectric properties for high-frequency applications.

To maintain market leadership, these companies are also exploring adjacent domains. Several have formed joint ventures to commercialize wear-resistant coatings for renewable energy turbines, while others are funding start-ups focused on additive ceramic inks and digital design platforms. As competitive pressures intensify, those that balance core competencies in materials science with nimble innovation ecosystems will define the next chapter of advanced ceramics.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Ceramics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Active Enterprises

- Advanced Ceramic Technology

- Advanced Ceramics Corp.

- AGC Group

- Ants Ceramics

- Applied Ceramics Inc.

- Blasch Precision Ceramics Inc.

- Ceramitec Industries

- CeramTec GmbH

- Compagnie de Saint-Gobain S.A.

- CoorsTek Inc.

- Corning Incorporated

- Elan Technology

- Ferrotec Holdings Corporation

- IMERYS Ceramic

- Kyocera Corporation

- MARUWA Co., Ltd.

- Materion Corporation

- McDanel Advanced Ceramic Technologies LLC

- Morgan Advanced Materials plc

- Rauschert GmbH

- Resonac Holdings Corporation

- Wonik QnC Corporation

Explore actionable strategies that industry leaders can implement to capitalize on emerging advanced ceramics trends and navigate evolving market challenges

Industry leaders must adopt a forward-looking posture to harness the full potential of advanced ceramics. First, organizations should prioritize the integration of additive manufacturing capabilities, establishing pilot lines that leverage real-time quality analytics to accelerate product validation cycles. By aligning digital twins with physical processes, manufacturers can reduce time to market and enhance customization for demanding applications.

Second, firms should deepen engagement with emerging regional hubs by forming strategic alliances that mitigate tariff exposure and capitalize on local incentives. Co-investment in modular kiln facilities and shared R&D centers can unlock economies of scale while anchoring supply chains in growth markets. At the same time, enabling direct sales channels for high-value components and refining online platforms for standard products will optimize customer reach.

Lastly, companies should embed sustainability metrics into their product roadmaps, incorporating recycled feedstocks and renewable energy procurement into core operations. Transparent reporting on carbon intensity and circular material flows will not only meet regulatory expectations but also resonate with environmentally conscious end users. By executing these strategies in concert, industry leaders can fortify resilience, accelerate innovation, and secure lasting competitive advantage.

Gain transparency into the research methodology behind this advanced ceramics study, covering data collection, validation processes and analytical frameworks

This study employs a rigorous, multi-step methodology to ensure analytical integrity and actionable insights. Primary data was sourced from in-depth interviews with C-level executives and technical directors across materials suppliers, OEMs, and end users, ensuring a balanced perspective on market drivers. These qualitative inputs were complemented by extensive secondary research, including technical journals, regulatory filings, and customs databases, to validate regional trade patterns and tariff evolutions.

Quantitative analyses drew upon a curated dataset of plant capacities, production yields, and consumption trends, with outlier reconciliation to account for anomalies in raw material availability. Data collection efforts were underpinned by standardized questionnaires and digitized reporting templates, which facilitated consistent validation of key parameters across geographies. Where discrepancies emerged, reconciliation workshops were conducted with industry experts to refine assumptions and align on consensus figures.

Analytical frameworks integrated Porter’s Five Forces to evaluate competitive intensity, alongside a value chain decomposition that highlights margin bottlenecks in precursor synthesis, shaping, and sintering. Scenario planning exercises further tested the impact of tariff escalations, supply disruptions, and technology adoptions under alternative regulatory regimes. This comprehensive approach ensures the robustness and reliability of the findings presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Ceramics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Ceramics Market, by Material Type

- Advanced Ceramics Market, by Product Type

- Advanced Ceramics Market, by End User Industry

- Advanced Ceramics Market, by Distribution Channel

- Advanced Ceramics Market, by Region

- Advanced Ceramics Market, by Group

- Advanced Ceramics Market, by Country

- United States Advanced Ceramics Market

- China Advanced Ceramics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesize the critical insights and overarching trends in advanced ceramics to inform strategic planning and accelerate innovation across applications

By synthesizing core insights and observing market trajectories, it becomes clear that advanced ceramics will play an increasingly strategic role across high-performance applications. Innovations in non-oxide chemistries and additive manufacturing are unlocking new design freedoms, while sustainability imperatives and evolving tariff landscapes introduce both challenges and opportunities for supply chain resilience.

Decision makers must balance the imperative to invest in next-generation materials and digitalized production with the need to navigate shifting trade policies and regional regulatory ambitions. Organizations that proactively establish modular capacity near end-use markets will mitigate exposure to future tariff actions, whereas those that integrate recycled feedstocks stand to differentiate on environmental and cost dimensions.

Ultimately, the interplay of technological breakthroughs and strategic alliances will determine market leadership. By focusing on segment-specific use cases-from silicon nitride engine components to zirconia medical implants-and leveraging targeted channel strategies, companies can align resources for maximum impact. This holistic understanding of advanced ceramics dynamics provides the foundation for informed strategic planning and long-term growth.

Connect directly with Ketan Rohom Associate Director Sales and Marketing to secure your advanced ceramics market report and unlock strategic insights

To take your organization’s advanced ceramics initiatives to the next level, reach out directly to Ketan Rohom Associate Director Sales and Marketing. By connecting with him, you gain immediate access to the latest research methodologies, proprietary industry intelligence, and nuanced supply chain analyses that can sharpen your competitive edge. Whether you seek to deepen your understanding of evolving tariff impacts, emerging material innovations, or regional growth hotspots, Ketan can guide you through the report’s most actionable findings.

Engaging with Ketan also ensures a tailored experience: he can help you identify which segments-whether it’s high-purity silicon nitride in automotive bearings or zirconia dental implants in medical devices-are most critical to your strategic priorities. He will facilitate a seamless purchase process, grant you privileged insights into upcoming market shifts, and support your team in translating data into decisive actions. Don’t let opportunity slip by: secure your advanced ceramics market report today and unlock the strategic insights needed to drive transformative growth.

- How big is the Advanced Ceramics Market?

- What is the Advanced Ceramics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?