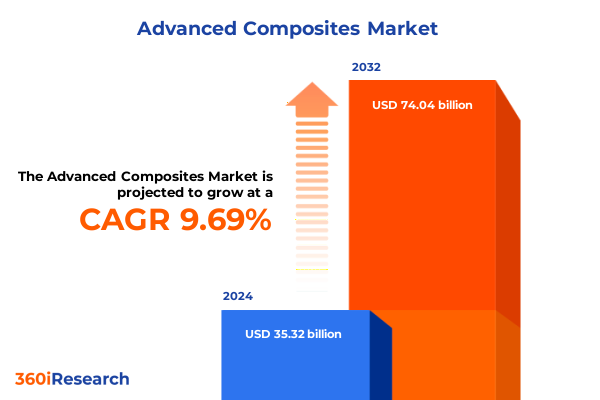

The Advanced Composites Market size was estimated at USD 38.45 billion in 2025 and expected to reach USD 41.86 billion in 2026, at a CAGR of 9.81% to reach USD 74.04 billion by 2032.

Setting the Stage for Advanced Composites Innovations That Drive Unprecedented Performance Gains and Sustainability in Modern Industrial Applications

Advanced composite materials are experiencing an unprecedented convergence of performance requirements and sustainability mandates, compelling industry stakeholders to reevaluate conventional approaches. In today’s competitive environment, the ability to engineer materials that balance weight, strength, durability, and environmental stewardship has never been more critical. From the aerospace hangar to the automotive assembly line, composites are reshaping design paradigms by offering enhanced mechanical properties combined with lifecycle advantages over traditional metals and polymers.

As broader industrial ecosystems embrace electrification, autonomous operations, and renewable energy integration, composites have become foundational to next-generation architectures. Carbon fiber in its high modulus, intermediate modulus, standard modulus, or ultra high modulus grades is delivering tailored stiffness-to-weight ratios for structural airframes, wind turbine blades, and premium automotive body panels, while aramid and glass fibers are providing cost-effective options for interior components and building materials. Alongside fibers, thermoplastic matrices such as PEEK, polyamide, polyetherimide, and PPS are enabling faster cycle times and recyclability, whereas thermoset systems including epoxy, phenolic, polyester, and vinyl ester continue to excel in high-temperature and chemically aggressive environments.

Furthermore, the evolution of manufacturing techniques-from cold and hot compression molding to advanced resin transfer molding variations like HP-RTM and vacuum-assisted VARTM-has unlocked precision and throughput improvements. As this report’s introduction highlights, companies that integrate these material and process innovations are not only meeting rigorous sector-specific demands but are also paving the way for cost efficiencies and reduced environmental footprints. Through this lens, industry leaders can better position their portfolios for sustained competitiveness in an increasingly complex global supply chain.

Uncovering the Revolutionary Technological Advancements and Strategic Partnerships Reshaping the Trajectory of Advanced Composite Materials Globally

Over the past decade, technological breakthroughs have accelerated the transformation of advanced composites, shifting the industry’s trajectory from incremental gains to exponential innovation. Developments in nanotechnology, for instance, have enabled the reinforcement of fiber-matrix interfaces at the molecular level, resulting in composites that boast superior impact resistance and fatigue life. Concurrently, artificial intelligence and digital twin simulations are empowering engineers to predict in-service performance with remarkable precision, effectively reducing prototyping cycles and time to market.

Strategic collaboration between suppliers and original equipment manufacturers has also emerged as a linchpin for innovation. Joint ventures and co-development agreements are facilitating the co-creation of composites with bespoke properties, whether for ultra-lightweight automotive panels capable of withstanding crash loads or for aerostructures that endure extreme thermal gradients. These partnerships are increasingly supported by shared investments in pilot lines and test facilities, setting the stage for scalable commercialization.

In addition, regulatory shifts toward circular economy principles are further reshaping materials development. Recyclable thermoplastic systems are gaining traction in wind energy and transportation sectors, where end-of-life recovery is becoming a contractual requirement. Simultaneously, bio-based resins and emerging solvent-free processing techniques are reducing the carbon footprint of composite manufacturing. Taken together, these seminal shifts underscore a landscape in which agility, cross-industry synergies, and sustainability are the currency of competitive advantage.

Analyzing the Far-Reaching Consequences of 2025 United States Tariff Policies on Supply Chains Pricing Dynamics and Strategic Sourcing in Advanced Composites

The introduction of new United States tariffs in 2025 has reverberated across the advanced composites ecosystem, prompting companies to reassess supply chains and sourcing strategies. Increased duties on imported carbon and glass fibers have led to steeper material costs, directly affecting OEM production budgets and pushing procurement teams to explore alternative fiber origins or to negotiate long-term agreements to buffer price volatility. Equally, tariffs on imported matrix polymers have elevated end-product pricing, creating tension between maintaining margin targets and upholding customer value propositions.

As a result, many manufacturers have accelerated initiatives to regionalize supply chains, bringing fiber and resin production closer to end-use facilities. This nearshoring trend not only mitigates tariff exposure but also reduces lead times and transportation overheads, ultimately reinforcing just-in-time manufacturing capabilities. However, regional capacity constraints and the high capital intensity of specialized production lines mean that this strategic pivot often involves multi-year planning and collaborative investments with local suppliers.

Moreover, the tariff-driven cost inflation has spurred innovation in material efficiency, with design and engineering teams increasingly embracing topology optimization and multi-axial fiber orientation techniques to extract performance with less material usage. In parallel, some players have expanded their use of domestically produced glass fiber and aramid fiber systems as a countermeasure, diversifying feedstock sources to maintain production continuity. Together, these adaptive measures underscore the industry’s resilience, revealing a strategic balance between cost management, supply chain agility, and advanced design methodologies.

Delivering In-Depth Perspectives on Fiber Types Matrix Variations Manufacturing Processes Applications and Product Configurations Driving Market Differentiation

Advanced composites demand precision in both material selection and process execution, with fiber types playing a pivotal role. Aramid fibers continue to be favored for impact resistance in safety-critical components while glass fibers maintain a strong foothold in cost-sensitive segments. Carbon fiber, in its spectrum from standard to ultra high modulus grades, is driving performance innovations in structural airframes, wind turbine blades, and premium automotive panels. Matrix systems equally shape outcome profiles; thermoplastic matrices such as PEEK enable rapid cycle times and recyclability, whereas thermosets like epoxy deliver exceptional thermal stability and adhesion.

Manufacturing processes add another layer of differentiation, with compression molding-whether cold or hot-providing high-volume repeatability and tight tolerances. Resin transfer molding variations like HP-RTM cater to complex geometries with minimal waste, and vacuum-assisted infusion techniques bolster part consistency for large-scale wind energy components. Manual layup and automated spray-up methods still find relevance in bespoke applications and low-volume specialty parts, emphasizing cost control and flexibility.

Applications further underscore diverging market dynamics. Aerospace and defense sectors demand rigorous certification and lifecycle traceability for engine components, interiors, and structural airframes, whereas automotive and transportation players prioritize cycle time reductions for body panels, interior modules, and crash-resistant structural elements. In construction, composites are innovating building facades, flooring solutions, and roofing applications with weather-resistant and corrosion-proof characteristics. Lastly, wind energy continues to push blade lengths and tower heights, reinforcing the need for advanced composites in high-stiffness, fatigue-resistant structures.

Product types from pipes and tanks to sheets and plates, and from profiles to rods and tubes each carry specific engineering and regulatory considerations. Non-pressure and pressure vessel configurations are critical for chemical processing and water treatment utilities, while composite laminates and FRP sheets are redefining architectural aesthetics and infrastructure longevity. Circular and square tubes are likewise innovating lightweight support structures in both industrial and consumer contexts.

This comprehensive research report categorizes the Advanced Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fiber Type

- Matrix Type

- Product Type

- Application

Exploring Regional Demand Patterns Infrastructure Developments Regulatory Landscapes and Collaborative Ecosystems Across Americas EMEA and Asia-Pacific Markets

Regional dynamics in the advanced composites arena reveal distinct demand drivers and regulatory environments. In the Americas, investments in next-generation aerospace platforms and the automotive electrification wave have intensified demand for high-performance fibers and thermoplastic systems. Infrastructure renewal programs and energy transition policies are also catalyzing growth in wind energy and non-pressure vessel applications, prompting manufacturers to establish production hubs closer to key end users.

Meanwhile, Europe, the Middle East and Africa present a patchwork of market conditions influenced by stringent environmental regulations and ambitious renewable energy targets. The European Union’s Fit for 55 package and similar regional mandates have accelerated the adoption of recyclable thermoplastics and low-energy manufacturing processes. In the Middle East, petrochemical feedstock availability is steering composite resin producers toward value-added partnerships, enabling local downstream integration. Africa’s emerging markets, though nascent, are exploring composites for infrastructure resilience and lightweight vehicle programs.

Across the Asia-Pacific region, a diverse mix of economies is driving a two-tiered growth pattern. Established markets in Japan and South Korea continue to push ultra-high modulus carbon fiber and advanced thermoset systems for aerospace and defense. In contrast, Southeast Asian manufacturing centers are emerging as cost-competitive production sites for pultrusion, hand layup, and vacuum infusion, supporting automotive and construction projects. Government initiatives promoting indigenous capacity building and skill development are further shaping regional supply networks and innovation clusters.

This comprehensive research report examines key regions that drive the evolution of the Advanced Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves Technological Breakthroughs Partnerships and Portfolio Expansions by Leading Corporations Shaping the Advanced Composites Industry

Industry leaders are making bold strategic moves to secure their positions in the advanced composites landscape. Global fiber producers are investing in capacity expansions to address tariff-induced supply constraints, while resin manufacturers are accelerating the commercialization of bio-based and recyclable matrix chemistries. For instance, leading carbon fiber innovators are broadening their product portfolios to include intermediate and standard modulus grades, catering to mid-tier automotive programs, even as they continue to serve premium aerospace applications.

Strategic partnerships are also reshaping competitive dynamics. Collaboration between fiber suppliers and OEMs is enabling co-development of pre-impregnated systems tuned for specific manufacturing lines, exemplified by recent agreements that integrate high-pressure resin transfer molding techniques with proprietary fiber architectures. Simultaneously, several companies are forging joint ventures in emerging regions to localize production, securing raw material access and circumventing tariff barriers.

In terms of portfolio expansion, select corporations have broadened their composite offerings to include value-added services such as design consultancy and composite repair solutions. These holistic service bundles not only differentiate the supplier proposition but also embed deeper client relationships. Additionally, technology-driven entrants are disrupting traditional models by offering subscription-based composite lifecycle management platforms, integrating IoT sensors within structural components to facilitate real-time performance monitoring.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACPT Inc.

- Advanced Composites Solutions Srl

- AGY Holding Corp.

- Akzo Nobel N.V.

- ARRIS Composites, Inc.

- Avient Corporation

- BASF SE

- DuPont de Nemours, Inc.

- Evonik Industries AG

- FormosaM Co., Ltd.

- Gurit Services AG

- Hexcel Corporation

- Honeywell International Inc.

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- MITSUI CHEMICALS INDIA, PVT. LTD

- Momentive Performance Materials Inc.

- Owens Corning, Inc.

- Plasan Carbon Composites

- Rockman Advance Composites Private Limited

- SGL Carbon SE

- Solvay S.A.

- ST Advanced Composites

- Teijin Limited

- Toray Industries, Inc.

Delivering Strategic Imperatives Operational Insights and Innovation Frameworks to Propel Growth and Enhance Competitive Positioning in Advanced Composites

Industry stakeholders must prioritize flexible supply chain architectures that can pivot swiftly in response to policy changes or raw material disruptions. By diversifying feedstock origins and forging strategic alliances with regional suppliers, companies can mitigate exposure to tariff fluctuations while reducing lead time variability. Concurrently, investments in digital manufacturing tools-such as automated fiber placement and real-time quality monitoring-will be critical in driving down cycle times and ensuring consistent output as production volumes scale.

Moreover, design and engineering teams should accelerate the adoption of advanced simulation platforms that integrate multiphysics analysis with topology optimization. This approach enables the creation of lightweight structures with minimal material waste, ultimately enhancing both performance and sustainability profiles. Procurement organizations, in parallel, should explore long-term supply agreements that include innovation incentives, aligning supplier roadmaps with evolving material requirements.

Finally, executives should cultivate a culture of cross-functional collaboration, embedding sustainability and cost-efficiency metrics at every stage of product development. By aligning R&D, engineering, procurement and sales teams around shared performance indicators, organizations can streamline decision-making, fast-track commercialization and deliver differentiated composite solutions that resonate with end users.

Detailing Comprehensive Research Approaches Data Triangulation Expert Consultations and Analytical Tools Employed to Ensure Robust Insights Unbiased Findings

The insights presented in this report derive from a robust combination of primary and secondary research methodologies. Primary research involved in-depth interviews with industry veterans, technical experts and senior executives across fiber, resin and manufacturing supply chains to capture real-world challenges and innovation trajectories. These qualitative inputs were complemented by a proprietary database of manufacturing capacity, pilot line initiatives and patent filings to validate emerging trends.

Secondary research encompassed a comprehensive review of white papers, regulatory filings, industry standards and academic journals, ensuring that all material and process developments are contextualized within broader technological and legislative frameworks. Data triangulation techniques were applied to reconcile divergent estimates, while analytical tools such as scenario modeling and risk matrices were utilized to evaluate the impact of external variables like tariff regimes and regulatory shifts.

Collectively, this multi-faceted research approach guarantees both depth and breadth, delivering insights that are not only timely but also grounded in empirical evidence. The combination of expert consultations, quantitative analysis and qualitative validation ensures that the findings are actionable, unbiased and relevant to strategic decision-making in advanced composites.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Composites Market, by Fiber Type

- Advanced Composites Market, by Matrix Type

- Advanced Composites Market, by Product Type

- Advanced Composites Market, by Application

- Advanced Composites Market, by Region

- Advanced Composites Market, by Group

- Advanced Composites Market, by Country

- United States Advanced Composites Market

- China Advanced Composites Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Summarizing Key Findings Strategic Imperatives and Future Outlook to Provide Executives Clear Roadmap for Navigating Evolving Advanced Composites Landscape

In summary, advanced composites continue to redefine the boundaries of material performance, driven by fiber innovations, matrix evolution, and process breakthroughs. The sector’s resilience in the face of tariff-induced cost pressures underscores the strategic ingenuity of manufacturers who are regionalizing supply chains and refining design methodologies. Meanwhile, the rapid adoption of sustainable resin systems and digital simulation tools signals a new era of environmentally conscious engineering.

As companies navigate divergent regional dynamics-from Americas’ electrification and aerospace investments to EMEA’s regulatory imperatives and Asia-Pacific’s capacity-building initiatives-collaboration and agility will remain key. Leading corporations are setting the pace with portfolio expansions, joint ventures and integrated service offerings, raising the bar for market entrants. Looking ahead, stakeholders that embrace flexible manufacturing architectures, data-driven design optimization and strategic supplier partnerships will secure competitive advantage in this dynamic landscape.

Engage with Ketan Rohom Associate Director Sales and Marketing to Unlock Exclusive Insights and Secure Your Advanced Composites Market Research Report Today

To explore tailored strategies and gain a competitive edge in the rapidly evolving advanced composites market, engage directly with Ketan Rohom Associate Director Sales and Marketing. His expertise and personalized approach will guide you through the report’s comprehensive findings, ensuring you extract maximum value for your organization. Reach out today to secure an exclusive copy of the market research report, unlock detailed insights, and initiate data-driven strategies that will propel your initiatives forward in 2025 and beyond

- How big is the Advanced Composites Market?

- What is the Advanced Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?