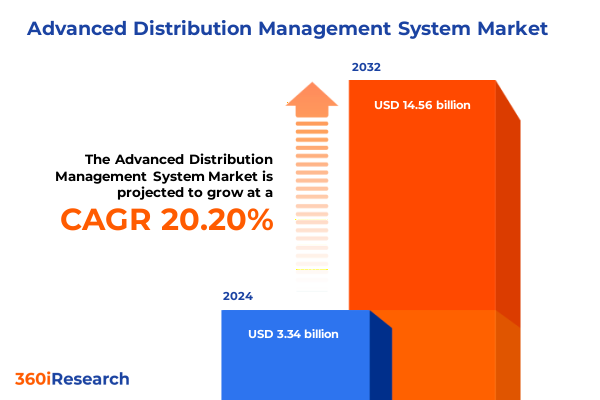

The Advanced Distribution Management System Market size was estimated at USD 4.00 billion in 2025 and expected to reach USD 4.80 billion in 2026, at a CAGR of 20.25% to reach USD 14.56 billion by 2032.

Navigating the Contemporary Energy Distribution Ecosystem with Unprecedented Complexity, Digital Integration, and Stakeholder Collaboration Across Value Chains

Modern energy distribution networks operate at the intersection of aging infrastructure, evolving consumer expectations, and rapid technological change. Advanced Distribution Management Systems (ADMS) emerge as critical enablers of real‐time monitoring, control, and analytics across the electric grid, addressing reliability, resilience, and efficiency demands. Stakeholders ranging from utilities to regulatory bodies and technology vendors converge on ADMS as the digital backbone for the next generation of smart grids.

The introduction of ADMS is driven by the need to balance growing distributed energy resources, decarbonization goals, and stringent reliability standards. By harnessing digital twin models, machine learning algorithms, and integrated operational workflows, utilities can transition from reactive fault restoration to proactive grid optimization. This shift empowers operators to anticipate disturbances, optimize feeder configurations, and manage two-way power flows without compromising service quality.

Inherent complexities arise as utilities navigate a fragmented vendor ecosystem and a patchwork of legacy systems. ADMS platforms serve to unify supervisory control, outage management, and advanced network analysis within a single operational fabric. Consequently, organizations can reduce silos, enhance situational awareness, and accelerate decision making. As the energy transition intensifies, ADMS adoption sets the stage for scalable, future-proof distribution networks capable of supporting electrification trends and distributed energy integration.

Unveiling Game-Changing Technological, Regulatory, and Operational Shifts Reshaping Energy Distribution Networks in the Digital Age

The energy distribution landscape is undergoing a confluence of transformative shifts that extend beyond technology upgrades. Regulatory frameworks now mandate greater grid resilience and renewable integration, prompting utilities to adopt more granular operational controls. In parallel, the proliferation of distributed energy resources-from rooftop solar to battery storage-has disrupted traditional one-way power flows, requiring advanced coordination mechanisms.

Technological innovation plays a pivotal role in reshaping distribution operations. Artificial intelligence and predictive analytics are being woven into core ADMS modules, enabling dynamic load balancing, voltage regulation, and outage forecasting with unprecedented accuracy. Moreover, the advent of edge computing enhances real-time responsiveness by decentralizing decision logic closer to substations and field devices.

Operational models are evolving accordingly. Cross-functional teams within utilities now collaborate around unified dashboards rather than isolated control rooms, fostering a culture of data-driven problem solving. Co-development partnerships between incumbents and startups accelerate proof-of-concept pilots, while cloud-native architectures and open standards facilitate scalable deployments. Ultimately, these shifts are redefining the roles of grid operators, technology vendors, and regulators as they navigate a more interconnected, decarbonized energy future.

Assessing the Broad-Spectrum Consequences of the 2025 United States Tariff Regime on Energy Distribution Infrastructure, Supply Chains, and Cost Structures

In 2025, new tariff measures announced by the United States government have introduced a layer of complexity for energy distribution equipment and software procurement. By increasing duties on key hardware components, such as communication units, controllers, and sensors, the regulatory adjustments have raised the total cost of ownership for utilities undertaking modernization initiatives.

As a result, procurement teams are reevaluating sourcing strategies and exploring alternative supply chains to mitigate the impact of elevated tariffs. This trend is prompting a migration toward strategic partnerships with domestic manufacturers, alongside an emphasis on repatriation of core component production. Simultaneously, software-centric solutions and SaaS-based deployment models have gained traction for their reduced hardware footprint and predictable operational expenditures.

Given the broader supply-chain implications, many utilities are accelerating digital integration to enhance inventory planning, demand forecasting, and risk management. Advanced analytics modules within ADMS platforms now incorporate tariff data into cost prediction models, enabling more precise budgeting and procurement optimization. Through proactive tariff management and supply-chain diversification, stakeholders are working to preserve modernization momentum while navigating the new regulatory environment.

Deriving Actionable Insights from Multi-Dimensional Segmentation of Components, Applications, Deployment Models, and End Users in Distribution Management Systems

The contemporary ADMS landscape is characterized by a multi-dimensional segmentation approach that informs strategic investments and product development. From a component perspective, the hardware domain encapsulates critical elements such as communication equipment, grid controllers, and intelligent sensors. These physical assets serve as the sensory nervous system of the grid, enabling real-time data acquisition and automated controls. Complementing the hardware layer, services encompass domain expertise in consulting, system integration, and ongoing maintenance and support. Through tailored advisory engagements and rigorous integration processes, service providers ensure that ADMS platforms align with unique grid topologies, regulatory mandates, and operational practices. In tandem, software solutions deliver specialized modules including distribution management, load forecasting, outage management, and Volt/VAr control-each designed to optimize specific facets of distribution operations.

Application-level segmentation further refines the value proposition. Core functions such as distribution management and peak load modulation coexist with more nuanced capabilities like outage management, which includes fault location, isolation and service restoration analytics, and ticketing workflows. Volt/VAr control also distinguishes itself through advanced techniques, leveraging devices like STATCOM, static VAR compensators, and synchronous condensers to maintain voltage stability and power factor correction.

Deployment mode plays a decisive role in shaping operational agility and total cost of ownership. Cloud deployments-whether on private or public infrastructure-offer rapid scalability and remote accessibility, while on-premise installations deliver tighter data sovereignty and latency guarantees. Hybrid configurations blend the best of both, with hosted hybrid and orchestrated hybrid options tailoring resilience and flexibility to each utility’s risk profile.

Finally, end-user segmentation underscores the broad reach of ADMS platforms across industries. Within the chemical sector, incumbents range from basic manufacturing to specialty derivatives, each demanding precise process control and grid reliability. The oil and gas vertical spans downstream refining, midstream transport, and upstream extraction, necessitating resilient distribution networks under dynamic load conditions. Meanwhile, the utility segment-with cooperative, investor-owned, and publicly owned models-drives the largest implementation volume, guided by divergent regulatory frameworks, governance structures, and capital allocation strategies.

This comprehensive research report categorizes the Advanced Distribution Management System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Deployment Mode

- End User

Comparative Analysis of Regional Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific Energy Distribution Markets Revealing Growth Drivers and Challenges

Geography profoundly influences both the adoption pace and feature prioritization within the ADMS market. In the Americas, utilities are concentrating on grid hardening to withstand severe weather events, while simultaneously rolling out advanced analytics for real-time visibility. The region’s deregulated and vertically integrated markets are spurring innovation in outage prediction and demand response coordination, particularly among large investor-owned utilities seeking operational differentiation.

Across Europe, the Middle East, and Africa, regulatory mandates for carbon neutrality and energy security are chief drivers. Mature European markets emphasize renewable integration and cross-border interconnections, necessitating sophisticated Volt/VAr control and DER orchestration. In the Middle East, large-scale developments and new city projects demand turnkey ADMS solutions that can be delivered at pace. Within Africa, electrification initiatives prioritize scalable, modular deployments that can address emerging network challenges while navigating variable grid robustness.

In the Asia-Pacific realm, rapid urbanization and industrial growth have intensified distribution constraints and load variability. Leading economies are investing heavily in digital substations, microgrid pilots, and AI-driven load forecasting. Meanwhile, island nations and remote regions are embracing hybrid ADMS architectures to optimize microgrid-based electrification and bolster energy resilience. Across all regions, ecosystem partnerships and local-content requirements shape procurement decisions, highlighting the importance of regional support networks and supply-chain agility.

This comprehensive research report examines key regions that drive the evolution of the Advanced Distribution Management System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players’ Strategic Positioning and Innovation Strategies Driving the Global Advanced Distribution Management System Market Evolution

Market leaders continue to invest in platform integration, user experience enhancements, and cloud-enabled analytics to differentiate their offerings. Siemens’ Spectrum Power ADMS emphasizes modular scalability and seamless integration with its SCADA and network management suites, enabling utilities to modernize incrementally. Schneider Electric’s EcoStruxure ADMS prioritizes interoperability and open-architecture designs, allowing end users to incorporate best-in-class analytics and DER management tools without disruptive replacements. General Electric’s GridOS seeks to unify transmission, distribution, and market operations through a single coherence layer, leveraging AI-driven insights and automated process orchestration.

Meanwhile, Hitachi Energy extends its Network Manager platform to encompass cybersecurity-hardened microgrid edge controllers, addressing the security imperatives of critical infrastructure. Aspen Technology’s recent acquisition of a grid-analytics specialist has fortified its ADMS roadmap with advanced asset health monitoring and prognostics. OSI’s Ventyx Unity unifies DMS and outage management within a cloud-native environment, delivering rapid deployment cycles and subscription-based pricing models. Survalent’s investments in user-centric design and low-code configurability are gaining traction among utilities seeking faster time to value. Collectively, these players are reinforcing their market positions through strategic partnerships, continuous product innovation, and expanded professional services portfolios.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Distribution Management System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Control Systems, Inc.

- Alstom S.A.

- Aspen Technology, Inc.

- Capgemini SE

- Cisco Systems, Inc.

- Eaton Corporation plc

- ETAP

- Fluentgrid Limited

- General Electric Company

- Hitachi Energy Ltd

- IBM Corporation

- Indra Sistemas, S.A.

- Itron, Inc.

- Landis+Gyr Group AG

- Microsoft Corporation

- Open Systems International, Inc.

- Oracle Corporation

- S&C Electric Company

- Schneider Electric SE

- Siemens AG

- Survalent Technology Corporation

Implementing Open-Platform Ecosystems, Scalable AI Capabilities, and Zero-Trust Security Frameworks to Foster Sustainable Growth and Grid Resilience

Industry leaders can capitalize on emerging opportunities by aligning their roadmaps with three strategic imperatives. First, embracing open-platform ecosystems and API-driven integrations will accelerate the addition of specialized analytics, DERMS, and cybersecurity modules, enabling utilities to evolve their ADMS implementations organically. By fostering developer communities and partner networks, vendors can create a richer marketplace of value-added services and extensions.

Second, scaling artificial intelligence and machine learning across operational workflows-from dynamic load forecasting to outage restoration planning-will unlock new levels of grid performance. Organizations should invest in training data pipelines, edge inferencing capabilities, and continuous model governance to ensure that predictive insights translate into reliable field actions. Collaborative pilots with utilities and academic partners can validate novel algorithms and expedite real-world adoption.

Finally, strengthening cybersecurity resilience across the distribution network remains paramount. As distribution assets become increasingly software-defined, vendors and end users must adopt zero-trust architectures, anomaly detection frameworks, and advanced threat intelligence sharing. Leveraging security-by-design principles throughout the product lifecycle will mitigate risks associated with remote operations and cloud integrations. By prioritizing these initiatives, industry participants can sharpen their competitive edge while safeguarding critical infrastructure.

Leveraging Mixed-Method Research Techniques Including Expert Interviews, Data Triangulation, and Peer Validation to Ensure Reliable Insights

This report synthesizes insights from a rigorous mixed-method research approach. Primary data collection entailed in-depth interviews with senior grid operators, IT managers, and technology providers, supplemented by expert panel discussions and targeted executive surveys. Secondary research encompassed analysis of industry publications, regulatory filings, vendor white papers, and technology roadmaps, ensuring a holistic understanding of market dynamics.

Data triangulation was performed by cross-referencing qualitative inputs with documented case studies, procurement announcements, and standards development to validate emerging trends. The segmentation framework was refined through iterative workshops with domain specialists, aligning component, application, deployment, and end-user categories with real-world deployment scenarios. To ensure methodological robustness, findings were subjected to peer reviews by independent subject-matter experts and scenario-testing against external benchmarks. This multi-layered approach guarantees that the report’s insights are both current and actionable for decision makers navigating the ADMS landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Distribution Management System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Distribution Management System Market, by Component

- Advanced Distribution Management System Market, by Application

- Advanced Distribution Management System Market, by Deployment Mode

- Advanced Distribution Management System Market, by End User

- Advanced Distribution Management System Market, by Region

- Advanced Distribution Management System Market, by Group

- Advanced Distribution Management System Market, by Country

- United States Advanced Distribution Management System Market

- China Advanced Distribution Management System Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2385 ]

Concluding Perspectives on the Role of Advanced Distribution Management Systems in Driving Smarter, Resilient, and Decarbonized Energy Networks

As the global energy landscape shifts toward decarbonization, decentralization, and digitalization, Advanced Distribution Management Systems stand at the forefront of grid modernization efforts. By uniting hardware, services, and software into cohesive operational platforms, ADMS technologies empower utilities to enhance reliability, optimize asset utilization, and integrate distributed resources at scale.

Looking ahead, the convergence of cloud computing, AI‐driven analytics, and open architectures will continue to shape the evolution of distribution management. Stakeholders who navigate regulatory complexities, tariff fluctuations, and regional diversity with agility will be best positioned to capture strategic value. Ultimately, the journey toward smarter, more resilient grids depends on informed decision making, strategic partnerships, and a relentless focus on operational excellence.

Engage Directly with the Associate Director to Customize Your Acquisition of the Comprehensive ADMS Market Research Report

To explore this comprehensive analysis further and secure your organization’s strategic advantage, connect with Ketan Rohom, Associate Director of Sales & Marketing, to obtain the full Advanced Distribution Management System market research report. Ketan offers tailored insights, flexible pricing options, and guidance on how to leverage the findings to optimize your distribution operations. Reach out today to unlock the in-depth data, actionable recommendations, and expert perspectives that will drive your decision-making on digital transformation and infrastructure modernization. Don’t miss the opportunity to empower your teams with the intelligence needed to navigate the evolving energy distribution landscape with confidence.

- How big is the Advanced Distribution Management System Market?

- What is the Advanced Distribution Management System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?