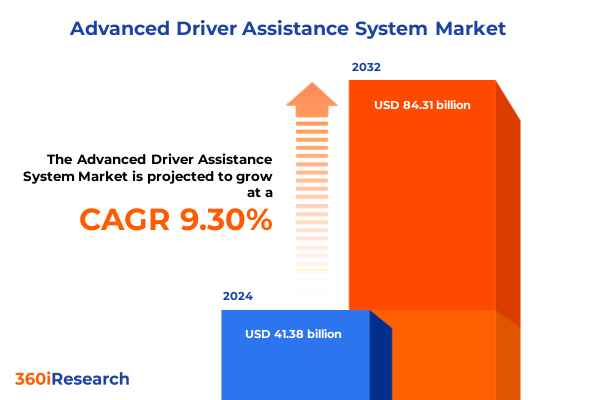

The Advanced Driver Assistance System Market size was estimated at USD 44.88 billion in 2025 and expected to reach USD 48.68 billion in 2026, at a CAGR of 9.42% to reach USD 84.31 billion by 2032.

Positioning Advanced Driver Assistance Systems as Foundational Elements of Vehicle Safety Connectivity and Trust in the Rapidly Evolving Automotive Ecosystem

Advanced driver assistance systems have swiftly transitioned from futuristic concepts to indispensable components of today’s automotive environment, reshaping how vehicles perceive, interpret, and respond to their surroundings. In an era defined by rising safety expectations, regulatory evolution, and an unrelenting demand for connectivity, these systems are forging a new paradigm in vehicle performance and occupant protection. The convergence of high-precision sensors, robust computing platforms, and real-time data processing capabilities underpins a spectrum of features designed to mitigate collision risks, enhance driver comfort, and pave the way toward fully autonomous mobility.

At the heart of this transformation lies a complex ecosystem of hardware and software working in concert to deliver situational awareness that far exceeds human sensory limitations. Cameras, LiDAR, radar, and ultrasonic devices contribute unique and complementary streams of information, while advanced algorithms fuse and interpret these inputs to generate actionable insights. As vehicles evolve into intelligent platforms, this synergy of technologies is powering innovations ranging from adaptive cruise control to sophisticated lane-keeping interventions, all while catalyzing a shift in the relationship between drivers and their automobiles.

Moreover, the proliferation of connectivity solutions and edge computing architectures is bolstering the responsiveness and reliability of advanced driver assistance features. Data exchange within and between vehicles, alongside integration with broader intelligent transportation infrastructures, is unlocking levels of coordination and predictive control previously unattainable. In turn, this interconnected environment is enabling not only incremental safety improvements but also the foundational building blocks for the next generation of shared, electrified, and automated mobility services.

Unveiling the Technological and Regulatory Milestones Propelling Advanced Driver Assistance Systems into a New Era of Automotive Intelligence

The landscape of advanced driver assistance systems is being reshaped by a confluence of technological breakthroughs and evolving regulatory frameworks that collectively signal a profound transformation in automotive intelligence. On the technological frontier, the maturation of semiconductor miniaturization and the widespread integration of high-performance computing chips have facilitated more sophisticated real-time processing, enabling features that were once relegated to research laboratories to enter mainstream production vehicles. Simultaneously, advances in machine learning and sensor fusion techniques have elevated object recognition accuracy and predictive capabilities, bridging critical gaps in situational awareness under diverse operating conditions.

In parallel, policymakers and standardization bodies around the world are enacting regulations that underscore vehicle safety and mandate the adoption of specific assistance functions. Safety requirements for automatic emergency braking and lane departure prevention are increasingly becoming prerequisites for new vehicle certifications, driving OEMs and suppliers to accelerate deployment timelines and prioritize system robustness. At the same time, industry consortia are coalescing around common performance benchmarks and interoperability standards, facilitating smoother integration of components sourced from diverse technology providers.

Consumer preferences are also exerting significant influence on the trajectory of advanced driver assistance innovations. A growing propensity for premium safety features among mainstream buyers, combined with heightened awareness of emerging autonomous applications, is prompting automakers to offer enhanced driver assistance packages even in mid-tier models. This democratization of advanced safety technology is further fueled by aftersales channels that retrofit existing vehicle fleets, deepening market penetration and intensifying competition across both original equipment manufacturers and aftermarket specialists.

Assessing the Far-Reaching Consequences of Recent United States Tariffs on Advanced Driver Assistance System Components and Supply Chains

The implementation of new tariff measures in 2025 has introduced a complex layer of challenges for the advanced driver assistance system supply chain, compelling stakeholders to reexamine sourcing strategies and cost structures. These tariffs, which target critical sensor components and semiconductor chips, have placed upward pressure on the cost of cameras, LiDAR modules, and radar circuits. Consequently, vehicle manufacturers are confronting tighter margins and evaluating the feasibility of passing incremental expenses to end customers or absorbing them through operational efficiencies.

As a direct consequence, many suppliers have initiated diversification strategies that include nearshoring certain production lines and forging partnerships with regional foundries to mitigate the impact of import duties. This strategic pivot is reshaping traditional vendor ecosystems, giving rise to more geographically distributed manufacturing footprints and prompting negotiations with customs authorities for preferential treatment under specific trade agreements. In turn, these adaptations are influencing the pace at which new assistance features can be introduced to global markets, as lead times for component delivery are recalibrated in response to shifting logistical pathways.

Beyond direct cost implications, the tariff environment has accelerated conversations about technology standardization and interoperability, as OEMs seek to harmonize component specifications across multiple regions in order to capitalize on economies of scale. This trend is fostering a more collaborative approach between suppliers and vehicle manufacturers, whereby shared technical platforms and modular software architectures become integral to buffering against future trade policy volatility. Ultimately, the tariff-driven realignment is serving as a catalyst for supply chain resilience, encouraging stakeholders to adopt agile models that can adapt swiftly to evolving economic landscapes.

Delving into Component-Level Autonomy Application Vehicle Type and Distribution Channel Segmentation Uncovering Critical Patterns in ADAS Adoption

The advanced driver assistance market unveils critical dynamics when examined through the lens of component, autonomy level, application, vehicle type, and distribution channel segmentation, each offering a distinct vantage point on adoption patterns and innovation priorities. At the component level, camera solutions-including mono, stereo, and surround-view configurations-continue to lead initial deployments, owing to their cost efficiency and mature image-processing capabilities. Meanwhile, mechanical and solid-state LiDAR units are gaining traction in higher-end models for their capacity to generate precise depth maps, and radar systems-whether long-range, medium-range, or short-range-provide reliable performance under adverse weather conditions.

When considering autonomy tiers, assistance solutions corresponding to the early levels of partial automation remain prevalent, with Level 1 and Level 2 functionalities forming the backbone of today’s offerings. However, as data processing power escalates and sensor fusion techniques evolve, Level 3 automated maneuvers are transitioning from pilot programs to limited series production, setting the stage for eventual Level 4 and Level 5 advancements. This progression underscores a clear direction toward progressively sophisticated driver support mechanisms.

Across application domains, adaptive cruise control and automatic emergency braking continue to anchor most systems, with blind spot detection, forward collision warning, lane departure warning, lane-keeping assist, and parking assist modules complementing the portfolio. Each of these use cases illustrates the critical interplay between sensor precision and algorithmic refinement, as manufacturers strive to balance regulatory compliance, user convenience, and safety performance.

The choice between outfitting commercial platforms-whether heavy or light duty-and consumer passenger vehicles reveals contrasting priorities, with commercial buyers emphasizing reliability and total cost of ownership, while passenger segments seek a blend of advanced functionalities and user experience. Meanwhile, distribution via original equipment channels remains the primary pathway for integration of factory-fitted systems, even as aftermarket specialists continue to expand retrofit offerings, catering to a bespoke segment of cost-sensitive consumers.

This comprehensive research report categorizes the Advanced Driver Assistance System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- System Type

- Level Of Autonomy

- Vehicle Type

- Application

- Sales Channel

Exploring Distinct Market Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Regions Shaping ADAS Development Pathways

A regional perspective illuminates how varied regulatory climates, infrastructure maturity, and consumer attitudes are shaping the evolution of advanced driver assistance technologies across the Americas, Europe Middle East Africa, and Asia Pacific. In North and South America, stringent safety mandates and robust automotive manufacturing clusters have accelerated the integration of core assistance features, positioning this region as a testing ground for incremental innovations and flexible supply arrangements. Government incentives aimed at reducing accident rates are further amplifying interest among manufacturers to expand advanced safety portfolios.

In Europe, technology deployment is influenced by comprehensive regulations that prescribe performance thresholds for emergency braking and lane-keeping interventions. The melding of these policies with rising consumer awareness of environmental and safety credentials has prompted automakers to integrate holistic assistance suites even in compact models, reflecting an emphasis on both efficiency and occupant protection. Meanwhile, regulatory frameworks in the Middle East and Africa are emerging, with select nations piloting smart infrastructure initiatives that align with advanced driver assistance services, signaling early growth opportunities.

Across Asia Pacific, varied market stratifications-from mature Japanese and Korean ecosystems to rapidly expanding Chinese and Southeast Asian landscapes-demonstrate a dual focus on domestic innovation and international collaboration. Local suppliers are leveraging government support for electric and autonomous vehicles to introduce novel sensor platforms at competitive price points, while global semiconductor leaders continue to establish fabrication facilities in the region, bolstering component availability. This diverse tapestry of demand drivers underscores the importance of regional customization in product design, certification, and aftersales support.

This comprehensive research report examines key regions that drive the evolution of the Advanced Driver Assistance System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Collaborations Driving the Evolution of Advanced Driver Assistance Systems on a Global Scale

The advancement of driver assistance solutions is underpinned by a constellation of technology champions and strategic alliances that are collectively advancing system performance and ecosystem readiness. Leading automotive component manufacturers are partnering with innovative semiconductor designers to co-develop specialized processing units optimized for sensor fusion and neural network inference. Through these alliances, dedicated compute modules are being embedded directly within camera and radar housings, reducing latency and power consumption while enhancing overall system reliability.

Simultaneously, software firms specializing in computer vision and machine learning are forging collaborations with traditional tier-one suppliers to integrate sophisticated perception algorithms into production vehicles. These collaborations often encompass joint development centers and shared simulation environments, enabling rapid iteration and validation of automated driving functions under virtual conditions. As a result, the time from concept to deployment is contracting, and OEMs are able to differentiate their offerings through unique user interfaces and performance calibrations.

Complementing these developments, a number of startups are attracting significant investment to refine solid-state LiDAR architectures and next-generation radar transceiver designs. Their agility is facilitating faster prototyping cycles and proof-of-concept demonstrations, which are subsequently scaled through licensing agreements or mergers with established suppliers. This dynamic of disruptive entrants catalyzing innovation, alongside incumbent strengths in manufacturing scale, is creating a balanced competitive landscape that rewards both technological ingenuity and production excellence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Driver Assistance System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adasky Ltd.

- Aisin Corporation

- Analog Devices, Inc.

- Aptiv PLC

- Arm Limited

- Autoliv Inc.

- Bayerische Motoren Werke AG

- BorgWarner Inc.

- Capgemini SE

- Continental AG

- Denso Corporation

- Ford Motor Company

- Harman International by Samsung Electronics Co., Ltd.

- HERE Global B.V.

- Hitachi, Ltd.

- Hyundai Motor Company

- Infineon Technologies AG

- Magna International Inc.

- Mercedes-Benz Group AG

- Mitsubishi Electric Corporation

- Mobileye by Intel Corporation

- NEC Corporation

- NVIDIA Corporation

- Qualcomm Incorporated

- Robert Bosch GmbH

- Stellantis NV

- Texas Instruments Incorporated

- TomTom International BV

- Valeo SA

- ZF Friedrichshafen AG

Empowering Industry Leaders with Purposeful Strategies to Accelerate Adoption Integration and Competitive Advantage in Advanced Driver Assistance Systems

In light of evolving competitive, regulatory, and technological forces, industry leaders must pursue targeted strategies to secure a sustainable position in the advanced driver assistance sector. First, investing in sensor fusion research and establishing modular software architectures can enhance adaptability and expedite feature rollouts across diverse vehicle platforms. By adopting open platform frameworks and participating in cross-industry standardization bodies, organizations can minimize integration complexities and build trust with global OEMs.

Second, fortifying supply chain resilience is essential to navigate tariff fluctuations and potential component shortages. Cultivating multi-regional partnerships with foundries and distribution networks, coupled with strategic inventory buffers, will empower manufacturers to respond swiftly to policy shifts and demand surges. Concurrently, transparent communication with suppliers and proactive risk assessments will be instrumental in maintaining uninterrupted production lines.

Third, deepening engagement with regulatory stakeholders and infrastructure developers can yield long-term advantages, as jurisdictions increasingly pilot smart road initiatives and connected vehicle ecosystems. By contributing to standards development and collaborating on pilot projects, companies can ensure alignment of technology roadmaps with emerging legislative requirements, thereby avoiding costly redesigns.

Finally, prioritizing user-centric design and comprehensive aftersales support will differentiate offerings in a crowded market. Implementing feedback loops via usage telematics and over-the-air update capabilities will not only improve system performance but also cultivate consumer confidence, driving both safety outcomes and brand loyalty.

Illustrating Rigorous Multidisciplinary Research Approaches Comprehensive Data Collection and Analytical Techniques Underpinning ADAS Market Insights

This research leverages a robust methodology grounded in both primary and secondary data collection, designed to deliver a nuanced understanding of advanced driver assistance system trajectories. Primary insights were gathered through in-depth interviews and workshops with automotive OEM executives, tier-one suppliers, technology providers, and regulatory experts. These engagements provided direct visibility into strategic roadmaps, technology validation processes, and go-to-market considerations.

Secondary research encompassed a comprehensive review of industry publications, academic journals, patent filings, technical white papers, and applicable regulatory mandates. Emphasis was placed on synthesizing diverse perspectives on sensor innovations, software developments, and policy evolutions to ensure balanced coverage of market drivers and barriers. Proprietary databases and historical case studies supplied additional context regarding adoption curves and investment patterns.

Analytically, the report employed a combination of qualitative frameworks and data triangulation techniques to validate findings and mitigate bias. Scenario planning exercises were conducted to explore potential trajectories under varying regulatory, economic, and technological conditions, while comparative analyses highlighted best practices across regions and application domains. Throughout the process, rigorous cross-verification and peer review protocols were implemented to uphold the highest standards of research integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Driver Assistance System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Driver Assistance System Market, by Component

- Advanced Driver Assistance System Market, by System Type

- Advanced Driver Assistance System Market, by Level Of Autonomy

- Advanced Driver Assistance System Market, by Vehicle Type

- Advanced Driver Assistance System Market, by Application

- Advanced Driver Assistance System Market, by Sales Channel

- Advanced Driver Assistance System Market, by Region

- Advanced Driver Assistance System Market, by Group

- Advanced Driver Assistance System Market, by Country

- United States Advanced Driver Assistance System Market

- China Advanced Driver Assistance System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Observations and Strategic Imperatives to Navigate the Next Phase of Advanced Driver Assistance System Advancements

Drawing together key observations from technological breakthroughs, regulatory imperatives, tariff-driven supply chain adjustments, segmentation subtleties, and regional disparities, the landscape of advanced driver assistance systems emerges as both dynamic and demanding. Continued innovation in sensor fusion, machine learning, and connectivity is expected to unlock higher levels of automation, while evolving safety mandates will propel broader adoption across new vehicle segments. At the same time, geopolitical factors and trade policies underscore the necessity of agile manufacturing and sourcing strategies.

As stakeholders navigate this intricate nexus of influences, success will hinge on collaborative ecosystems that unite traditional automotive suppliers, semiconductor specialists, software developers, and regulatory authorities. By embracing standardized platforms, fostering cross-industry partnerships, and maintaining a relentless focus on end-user experience, organizations can convert complexity into competitive advantage. Ultimately, the maturation of advanced driver assistance technologies will chart the path toward safer, more efficient, and increasingly autonomous mobility solutions.

Unlock Comprehensive Advanced Driver Assistance Systems Market Intelligence by Connecting with Ketan Rohom to Secure Your Exclusive Research Report Today

To explore the full breadth of insights and strategic intelligence woven throughout this report and to empower your organization with actionable guidance, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By partnering with Ketan, you will gain personalized support in securing your exclusive comprehensive market research package, ensuring direct access to in-depth analyses, proprietary data, and forward-looking recommendations tailored to your organizational priorities. Engage today to unlock the complete narrative of advanced driver assistance systems and to position your team at the forefront of innovation in this rapidly evolving domain

- How big is the Advanced Driver Assistance System Market?

- What is the Advanced Driver Assistance System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?