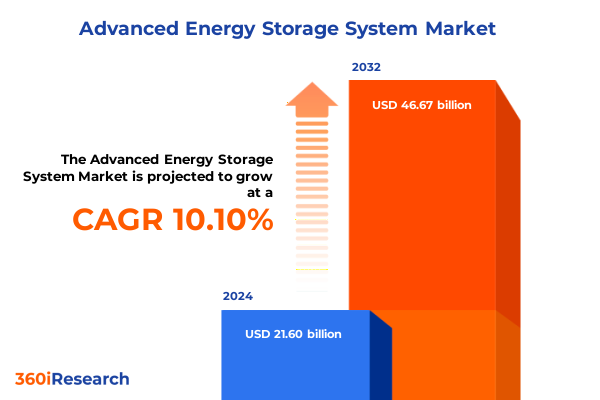

The Advanced Energy Storage System Market size was estimated at USD 23.81 billion in 2025 and expected to reach USD 26.03 billion in 2026, at a CAGR of 10.09% to reach USD 46.67 billion by 2032.

Unlocking the Power of Advanced Energy Storage Systems to Navigate the Evolving Global Energy Landscape with Resilience, Reliability, and Innovation

Advanced energy storage systems are integral to the transition to a decarbonized power sector. The growing share of variable renewable energy sources such as wind and solar has underscored the need for robust storage solutions capable of balancing supply and demand while maintaining grid reliability. At the Energy Storage Summit, experts noted that rapidly deployed battery capacity is outpacing new fossil fuel plants, underscoring a quiet revolution in energy storage technology.

In the United States alone, the installed battery storage capacity leapt by 66% in 2024, with 8.7 gigawatts of new installations bolstering grid flexibility and renewable integration. Developers have scheduled over 18 gigawatts of additional battery capacity for deployment in 2025, driven by a combination of favorable policy incentives, growing investor interest, and urgent grid modernization requirements. The intensifying pace of deployment speaks to the vital role that energy storage plays in mitigating intermittent generation and bolstering system resilience.

Looking forward, advanced energy storage systems are poised to serve as the cornerstone of a modern, decarbonized energy infrastructure. Breakthroughs in chemistry, electronics, and system controls continue to push performance boundaries, while the emergence of long-duration storage technologies promises to unlock new applications and market opportunities. As we delve into the details of recent transformative shifts, trade policy impacts, and strategic segmentation insights, it is clear that energy storage will remain at the forefront of the global energy transition.

Charting the Major Disruptive Trends and Policy Developments Reshaping the Advanced Energy Storage Sector in the Face of Global Decarbonization Efforts

Over the past two years, a confluence of technology breakthroughs, regulatory reforms, and evolving business models has reshaped the energy storage landscape. The dominance of lithium iron phosphate batteries in stationary applications, driven by their enhanced safety profile, longer cycle life, and cost advantages, has catalyzed wide-scale adoption for both grid-scale and behind-the-meter projects. Concurrently, sodium-ion and other emerging chemistries have garnered attention as potential alternatives offering diversified material supply chains and cost competitiveness.

On the policy front, Europe’s renewables expansion has spurred a fivefold rise in battery capacity projections by 2030, while Asia-Pacific governments experiment with innovative legal frameworks to finance cross-border renewable projects that integrate storage. In the United States, shifting trade tensions and tariff announcements have introduced new complexities for project developers sourcing components from international suppliers. These policy dynamics underscore the intricate balance between domestic industrial strategy and the need for rapid deployment of storage infrastructure.

Moreover, digitalization and advanced analytics are driving smarter energy management, enabling systems to optimize charge and discharge cycles, participate in grid ancillary services, and integrate with emerging applications such as virtual power plants. As stakeholders navigate this era of transformative change, strategic foresight and agile operational models have become essential for capturing value across the full spectrum of energy storage markets.

Assessing How Recent United States Trade Tariffs Are Reshaping Costs Supply Chains and Strategic Investments Across the Battery Storage Ecosystem

United States trade measures instituted in 2025 have markedly altered the cost structure for battery storage projects. A complex overlay of Section 301 tariffs on Chinese imports, anti-dumping and countervailing duties on cathode and anode materials, and Section 232 levies on steel and aluminum have combined to push component costs sharply higher. According to industry analysis, these trade barriers may drive average prices of battery energy storage systems imported from China up by as much as 35% in 2025 alone.

Major suppliers have already begun adjusting their strategies in response to these headwinds. For instance, leading battery manufacturers are accelerating domestic production and repurposing electric vehicle cell lines to serve stationary storage markets. A South Korean producer operating in the United States reported plans to expand local lithium iron phosphate battery production from 17 gigawatt hours to over 30 gigawatt hours by 2026 to offset slowing EV demand and mitigate tariff exposure.

For project developers and asset owners, the cumulative impact of tariffs has introduced heightened uncertainty and cost volatility. Procurement timelines have been compressed as buyers seek to preempt further tariff escalations, while some utilities and independent power producers reevaluate project feasibility and financing assumptions. These dynamics have underscored the importance of diversified sourcing strategies and the acceleration of domestic manufacturing capacity to ensure a resilient supply chain for critical storage components.

Uncovering Critical Segmentation Insights from Technology to End User that Define the Dynamic Landscape of the Energy Storage Market

In assessing market dynamics through the lens of technology segmentation, the advanced energy storage sector spans a diverse array of chemistries and system architectures. Flow batteries leveraging vanadium redox and zinc bromine chemistries have found niche applications where long cycle life and deep discharge capabilities are crucial, while traditional lead acid systems, both flooded and sealed variants, continue to serve low-cost, short-duration needs. The lithium ion segment remains the technology cornerstone, with lithium cobalt oxide, lithium iron phosphate, and nickel manganese cobalt formulations each optimized for specialized performance profiles. Complementing these mainstream options, sodium sulfur batteries offer high-temperature solutions for grid-scale storage scenarios.

Similarly, when viewed by application, storage systems are increasingly deployed alongside electric vehicle charging infrastructure, providing load shifting and demand charge management benefits, while their role in grid services including frequency regulation, contingency reserves, and voltage support has expanded substantially. Integration with renewable energy assets is driving hybrid project development, and storage-enabled microgrids are emerging as resilient power solutions in remote and critical facilities. Peak shaving applications further illustrate the capacity of storage to reduce operational costs for commercial and industrial energy consumers.

From an installation perspective, behind-the-meter systems have gained traction among residential and commercial users seeking to optimize self-consumption and energy management, even as front-of-the-meter utility-scale deployments remain the primary growth driver for grid-connected projects. End-user segmentation reveals a balanced mix between commercial and industrial deployments, residential installations, and large-scale utility applications. Finally, the landscape of storage duration segmentation is bifurcated between short-duration solutions optimized for intraday cycling and emerging long-duration technologies designed to shift energy across multi-day or seasonal intervals, meeting the needs of diverse stakeholders across the energy ecosystem.

This comprehensive research report categorizes the Advanced Energy Storage System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Installation Type

- Storage Duration

- Application

- End User

Exploring Regional Dynamics and Market Drivers Across Americas Europe Middle East Africa and Asia-Pacific in the Energy Storage Ecosystem

When examining regional market developments, the Americas have demonstrated robust momentum in both behind-the-meter and front-of-the-meter storage segments. The United States is on track to add more than 20% additional capacity compared to the prior year, with procurement surges spurred by tariff pre-eligibility and emerging state-level incentives. Chile has emerged as a notable growth market thanks to its lithium extraction activities driving energy-intensive processing loads, while Canada’s provincial tenders could deliver several gigawatts of new battery deployments within the next twelve months.

In Europe Middle East & Africa, front-of-the-meter projects in Italy, Germany, and Spain are catalyzing a five-fold projected increase in regional battery capacity by 2030, fueled by stringent renewable integration targets and market structures that reward ancillary services market participation. Meanwhile, in the Middle East, ambitious green hydrogen and multi-utility developments in Saudi Arabia, the United Arab Emirates, and Oman are embedding tens of gigawatt hours of storage within large-scale microgrid complexes to support decarbonization and grid stability. Intense regional competition has driven rapid cost declines and spurred new procurement models, including flexibility-as-a-service contracts.

The Asia-Pacific region remains the manufacturing epicenter for cells and modules while concurrently adopting advanced storage solutions at accelerating rates. Legal and financial innovations are streamlining cross-border power projects across Southeast Asia, and firm commissions in Australia and Japan underscore the burgeoning demand for utility-scale and behind-the-meter systems. Major suppliers have secured well over two gigawatt hours of new capacity under execution in markets such as South Asia and Southeast Asia, reflecting a made-to-order approach that aligns project financing with regional policy priorities and investment frameworks.

This comprehensive research report examines key regions that drive the evolution of the Advanced Energy Storage System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Positioning and Competitive Advantages of Leading Global Energy Storage System Providers Driving Industry Innovation

Leading companies in the energy storage system market are executing varied strategies to capture market share and differentiate their offerings. Sungrow has recently overtaken its peers to become the top global AC-side integrator, driven by strong deployments in the Americas and Middle East markets, and has consistently outperformed competitors for three consecutive quarters. Tesla continues to leverage its Megapack technology, securing significant projects across North America and Europe, while BYD’s Blade Battery and vertically integrated manufacturing approach have propelled it into the global top three integrator rankings.

Meanwhile, Chinese cell manufacturers, led by CATL, maintain a dominant share of global ESS capacity due to their cost-efficient LFP production and scale advantages. South Korean players such as LG Energy Solution and Samsung SDI are actively expanding their domestic production footprint in the United States, turning EV battery assembly lines toward stationary storage applications to mitigate tariff impacts and leverage local incentives. A European renewable producer has also established a leading position by integrating large-scale storage assets with its wind and solar portfolios, achieving over 2.3 gigawatts of battery capacity under operation or development across five continents.

New entrants and joint ventures are further reshaping the competitive landscape, with technology start-ups advancing long-duration chemistries and traditional utility companies partnering with storage integrators to deliver end-to-end solutions. As competition intensifies, the ability to offer full-system services, including warranties, operations and maintenance, and digital performance management, has become a key differentiator among the leading energy storage system providers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced Energy Storage System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BYD Company Ltd.

- CALB Group Co., Ltd.

- Contemporary Amperex Technology Co., Limited

- Eaton Corporation plc

- Energy Storage Systems Inc.

- Energy Vault Holdings Inc.

- Enphase Energy Inc.

- Envision Energy

- Exide Technologies

- Fluence Energy

- General Electric Company

- Gotion High-Tech Co., Ltd.

- Hitachi Ltd.

- Johnson Controls International plc

- LG Energy Solution Ltd.

- NextEra Energy Resources

- Panasonic Corporation

- Powin LLC

- S4 Energy

- Samsung SDI Co., Ltd.

- Siemens Energy AG

- Sumitomo Electric Industries Ltd.

- SVOLT Energy Technology Co., Ltd.

- Tesla

- Toshiba Corporation

Strategic Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Challenges in Advanced Energy Storage

Industry leaders must prioritize diversified supply chains to insulate project economics from escalating trade tensions and material shortages. Engaging in strategic partnerships with domestic cell producers and repurposing existing EV battery manufacturing assets for stationary storage can reduce tariff exposure and enhance supply chain resilience. At the same time, pursuing targeted investments in long-duration storage technologies and emerging chemistries such as sodium-ion can broaden technology portfolios and address evolving grid needs.

Furthermore, collaboration between utilities, regulators, and original equipment manufacturers is essential to unlock new procurement models that reward flexibility and resilience, including capacity contracts, availability-based payments, and virtual power plant aggregation. By leveraging advanced analytics and digital controls, project developers and asset owners can optimize performance, monetize ancillary services, and extend asset life cycles. Proactive engagement in policy advocacy to secure transitional incentives and streamline permitting processes will also be critical in maintaining project viability amid dynamic regulatory environments.

Finally, incorporating comprehensive risk management frameworks that address cybersecurity, environmental compliance, and financial hedging will ensure that energy storage deployments deliver reliable returns while supporting grid stability and decarbonization objectives. By adopting these actionable recommendations, industry stakeholders can capitalize on emerging market opportunities and cement a leadership position in the accelerating global energy storage sector.

Detailing the Rigorous Research Methodology Combining Primary Interviews Secondary Data and Analytical Frameworks Underpinning This Energy Storage Study

To develop this executive summary, a rigorous research process was implemented combining both primary and secondary sources. Primary research included in-depth interviews with industry executives, project developers, and technology experts to gather firsthand insights on emerging trends, deployment challenges, and policy drivers across major markets. Secondary research encompassed analysis of company reports, regulatory publications, trade association data, and authoritative news outlets to validate market developments and tariff impacts.

Quantitative data was triangulated by cross-referencing shipment rankings, regional installation statistics, and public financial disclosures from leading manufacturers and integrators. Segmentation analyses were performed across technology, application, installation type, end user, and storage duration to ensure comprehensive coverage of market dynamics. Additionally, a dedicated expert panel reviewed preliminary findings to ensure methodological rigor, identify potential data gaps, and refine strategic recommendations.

Finally, advanced analytical frameworks, including SWOT analyses, supply chain risk assessments, and policy scenario modelling, were employed to synthesize insights and forecast potential market trajectories. This multi-layered methodology ensures that the conclusions and recommendations presented herein are grounded in robust evidence and reflective of the rapidly evolving global energy storage landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced Energy Storage System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced Energy Storage System Market, by Technology

- Advanced Energy Storage System Market, by Installation Type

- Advanced Energy Storage System Market, by Storage Duration

- Advanced Energy Storage System Market, by Application

- Advanced Energy Storage System Market, by End User

- Advanced Energy Storage System Market, by Region

- Advanced Energy Storage System Market, by Group

- Advanced Energy Storage System Market, by Country

- United States Advanced Energy Storage System Market

- China Advanced Energy Storage System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Drawing Conclusions on the Future Outlook of Advanced Energy Storage Systems and the Imperatives for Sustainable Growth Resilient Infrastructure and Policy Alignment

As the global energy transition accelerates, advanced energy storage systems have emerged as indispensable enablers for decarbonization, grid reliability, and energy access. The convergence of technology innovation, policy evolution, and shifting market paradigms has created both opportunities and challenges for stakeholders across the value chain. From the proliferation of lithium iron phosphate chemistries to the complex interplay of trade tariffs and supply chain strategies, the energy storage ecosystem is undergoing transformative change.

Looking ahead, successful market participants will be those that navigate policy uncertainty, invest decisively in manufacturing scalability, and differentiate through full-system offerings that encompass digital solution, operations excellence, and longevity guarantees. Regional market dynamics will continue to shape deployment priorities, whether driven by renewables integration in Europe, green hydrogen synergies in the Middle East, or resilient microgrid use cases in Asia-Pacific. By aligning strategic initiatives with emergent market needs and policy imperatives, the industry can unlock the full potential of energy storage as the backbone of a sustainable, reliable, and affordable energy future.

Contact Associate Director Ketan Rohom Today to Secure Your Comprehensive Advanced Energy Storage Systems Market Research Report and Gain Strategic Insights

For more detailed analysis, custom data requests, or strategic consultation, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. His team can provide tailored insights, client-specific modelling scenarios, and executive briefings to help you capitalize on the rapidly evolving advanced energy storage systems market. Secure your comprehensive market research report today to gain the competitive intelligence and actionable recommendations necessary to drive your organization’s growth in this dynamic sector.

- How big is the Advanced Energy Storage System Market?

- What is the Advanced Energy Storage System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?